grandriver/E+ via Getty Images

Unfortunately, buying into a great company does not always equate to buying into a company that’s going to generate a strong return. If life were that easy, everybody could win in the stock market. One company that has strong operational performance and that will likely have a bright future ahead for it is ResMed (NYSE:RMD). Over the past several years, ResMed which focuses on providing digital health and cloud-connected medical devices associated with sleep and respiratory care, as well as SaaS (Software as a Service) functionality, has performed exceptionally well. Having said that, shares the business do look drastically overpriced at this time. This may not seem the case when looking at it relative to some similar companies. But at the end of the day, buying into the business is a truly speculative bet on whether long-term growth will be strong enough to justify current pricing.

Mixed results

Back in early March of this year, I wrote a bearish article about ResMed. In that article, I readily acknowledged that the company was a fantastic one. I lauded the company’s track record for sales, profit, and cash flow growth. I also said that, in the long run, it would likely continue to fare well for its investors. But I couldn’t get over just how pricey shares were, even though they looked fairly valued compared to similar businesses. At the end of the day, I ended up rating the business a ‘sell’, reflecting my belief that it would likely underperform the broader market for the foreseeable future. So far, the company has done just that. While the S&P 500 is down by 7.8% since the time of my article’s publication, shares of ResMed have delivered a loss of 11.4%.

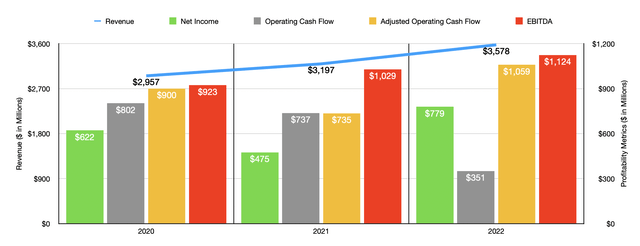

Some of this decline is certainly due to the fact that shares were expensive. But another contributor is likely related to the fact that some of its performance figures have not been particularly appealing. First, however, we should touch on sales. This was a bright spot for the company recently. For the 2022 fiscal year as a whole, revenue came in at $3.58 billion. That represents an increase of 11.9% over the $3.20 billion generated in 2021. It’s also the highest that revenue has ever been for the enterprise. The strongest growth for the company came from the Devices sales that it generated in the US, Canada, and Latin America. Sales growth here was a robust 24% year over year. And for the region as a whole, revenue growth was 15%. By comparison, revenue growth across Europe, Asia, and other select markets was a more modest 7%. The growth that the company experienced here at home came even though the company faced some pain associated with foreign currency fluctuations. In its Sleep and Respiratory Care business, for instance, international currencies hit revenue to the tune of $43 million in 2022. But this was more than offset by an increase in unit sales for its devices and masks.

This rise in revenue brought with it positive earnings results. In 2022 as a whole, net income came in at $779.4 million. That dwarfs the $474.5 million generated in 2021. And it’s also well above the $621.7 million the company reported in 2020. This is not to say that everything went well. Operating cash flow for the company did decline, dropping from $736.7 million in 2021 to $351.1 million in 2022. But if we adjust for changes in working capital, this metric would have risen from $735.3 million to $1.06 billion. Meanwhile, EBITDA for the company was also on the rise, climbing from $1.03 billion to $1.12 billion.

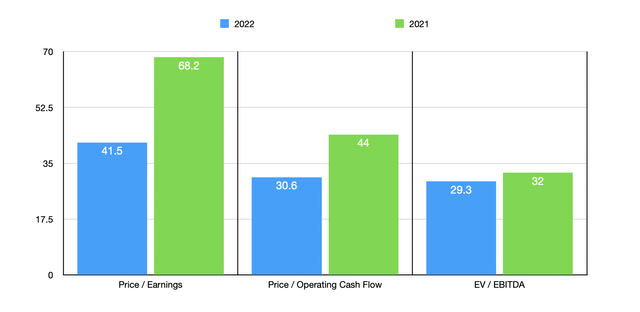

At present, we don’t really know what to expect for the 2023 fiscal year. But management did say in their annual report that current supply chain issues are expected to impact the company throughout at least part of its 2023 fiscal year. Regardless of what that will end up looking like, shares do look rather pricey if we rely on 2022’s figures. The price-to-earnings multiple of the company, for instance, comes in at 41.5. That’s down from the 68.2 reading we get using 2021’s results. The price to adjusted operating cash flow multiple stands at 30.6. If we were to use results from 2021, this multiple would be 44. Meanwhile, the EV to EBITDA multiple comes out to 29.3. Using last year’s figures, this multiple would have been 32. As part of my analysis, I did compare the company to five similar firms. On a price-to-earnings basis, the four companies with positive results traded with multiples of between 28.6 and 201.8. Our prospect was cheaper than all but one of the firms. Using the price to operating cash flow approach, the range for the five firms was between 13.5 and 55.6, while for the EV to EBITDA approach, the range was between 11.6 and 87.2. In both of these cases, three of the five companies were cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| ResMed | 41.5 | 30.6 | 29.3 |

| DexCom (DXCM) | 201.8 | 55.6 | 87.2 |

| Baxter International (BAX) | 28.6 | 15.6 | 13.6 |

| Koninklijke Philips (PHG) | N/A | 13.5 | 15.8 |

| IDEXX Laboratories (IDXX) | 45.3 | 50.4 | 31.7 |

| Zimmer Biomet Holdings (ZBH) | 77.9 | 14.9 | 11.6 |

Some might argue that there are certain catalysts that would justify this higher price. I remain unconvinced. One argument is that ResMed should continue to benefit from a product recall from rival Philips. Some estimates peg the amount of additional revenue the company can generate from this at no more than $45 million, with the company aided by tight market conditions. More recently, the company also entered into an agreement to acquire MEDIFOX DAN, an out-of-hospital software solutions company located in Germany. That particular company provides clinical, financial, and operational solutions that are deemed mission-critical for out-of-hospital care providers. Examples include care documentation, personnel planning, administration, billing, and more. These activities are similar in nature to ResMed’s US SaaS brands known as MatrixCare and Brightree.

The company is paying approximately $1 billion in cash for the enterprise. Although this is a great deal of money, it’s worth noting that the firm provides services to over 300,000 caregivers on a daily basis. And between 2019 and 2021, it generated annualized organic revenue growth of 14%, taking sales up last year to $83 million. Meanwhile, EBITDA for the business comes out to $35 million. The implied EV to EBITDA multiple paid for the enterprise comes out to 28.6. Whether or not this will end up being considered a good purchase is something only time will tell. However, I do think it was a mistake to agree to acquire it in exchange for cash. The company should have used its stock for the deal given how pricey shares are today. Instead, it’s going to have to take on debt seeing as how it has cash on hand of justice $273.7 million as of this writing. How much debt is something we will find out when the deal closes later in the 2023 fiscal year. But if the company finances all of the purchase price with debt, it would only take a 3.5% interest rate to wipe out all profitability from the transaction. Though terms were not disclosed, the company also announced, in early August of this year, the acquisition of mementor, a developer and owner of digital insomnia therapy solution somnio. But the fact that terms were not disclosed for this suggests that the transaction is fairly small.

Takeaway

Right now, I continue to believe that ResMed is a solid company with great upside potential in the long run. Having said that, shares just look very pricey at this point in time. I cannot fathom a scenario in which the stock would be even fairly valued in the near term absent a significant decline in share price. Yes, the company does have some catalysts as I mentioned previously. But these are fairly small by comparison. Because of this and in spite of the decline in price the company has already experienced since I last rated it a ‘sell’, I must stick with that bearish rating for the foreseeable future.

Be the first to comment