phototechno

Main Street Capital Corporation (NYSE:MAIN) announced a $0.10 per share special dividend in November (to be paid in December) as well as an increase in the monthly dividend rate due to strong portfolio performance.

Main Street’s dividend was covered by net investment income in the third quarter, as expected.

Main Street, in my opinion, provides one of the most secure dividend streams in the BDC sector, and despite the stock’s higher-than-average NAV multiple (I recommended buying the dip in October), Main Street remains a compelling buy for passive income investors.

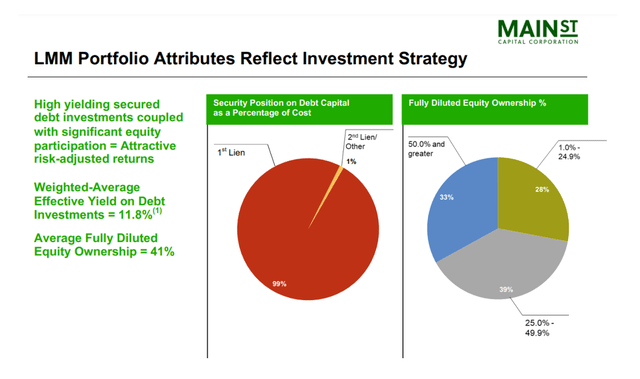

Core Business And Strong First Lien-Focus

The primary business of Main Street is to invest capital in high-yielding loans to lower-middle-market companies. As of September 30, 2022, the BDC’s 75 investments in the LMM portfolio were valued at $1.9 billion, accounting for 48% of Main Street’s total investments (in fair value terms).

The majority of Main Street’s LMM portfolio (99%) is made up of First Liens, which gives the portfolio stability as well as a low overall risk profile.

Percentage Of High Yielding Loans (Main Street Capital Corp)

The second largest block of investments occurs in Main Street’s private loan portfolio, which had 87 investments worth $1.5 billion at the end of the September quarter.

At the end of the third quarter, the total investment value represented 37% of Main Street’s total investment funds. Again, First Lien Term Debt comprised 99% of the private loan portfolio.

Loans to middle market companies came in third, with higher revenues, longer operating histories, and stronger cash flow than lower middle market companies. The middle market portfolio was worth $354.3 million and consisted of 33 investments. The investment allocation has also remained at 99% First Liens.

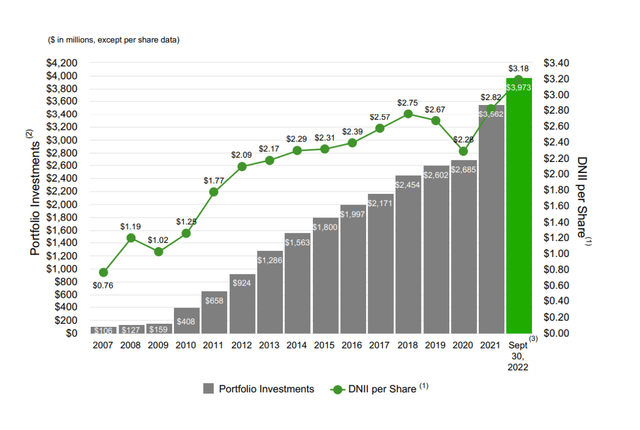

Including all of these investments, Main Street’s portfolio value reached an all-time high of $3.97 billion at the end of September, representing 11.6% YoY growth.

Main Street never achieved a higher portfolio value or, for that matter, distributable NII. The long-term trend (consistent portfolio and income growth) depicted in the chart below explains why Main Street’s stock trades at a significant net asset value premium.

Distributable NII (Main Street Capital Corp)

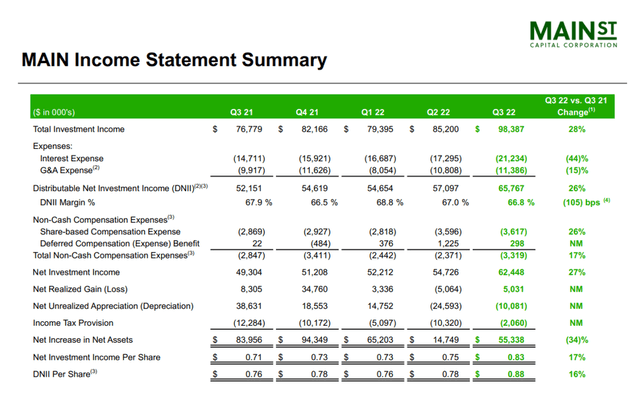

NII, Pay-Out Ratio, Dividend Growth

Main Street earned $0.83 per share in net investment income in the third quarter, a 17% increase YoY due to improved market financial conditions and recovering asset valuations. The $0.83 per share in NII easily outperformed the $0.645 per share dividend paid in the third quarter, and the dividend pay-out ratio was 77.8%.

The dividend pay-out ratio was 89.8% when the $0.10 per share special dividend was included in 3Q-22. The regular dividend payment is secure, and NII has consistently covered it over the last year.

Income Statement Summary (Main Street Capital Corp)

Because of the BDC’s high dividend coverage, the company declared a supplemental cash dividend of $0.10 per share, which will be paid to shareholders on December 28, 2022.

The ex-dividend date is December 19, 2022, and investors who purchase before this date will be eligible for the special dividend.

Main Street also increased its monthly dividend by 2.3%, from $0.22 per share to $0.225 per share. The new monthly dividend translates into an annual dividend payment of $2.70 per share and a forward dividend yield of 7.4%.

Net Asset Value Premium

Main Street has the highest net asset value in the industry due to the company’s consistent performance in the LMM market, strong portfolio performance, and dividend coverage. The premium to net asset value is currently 41%, which is nearly low given Main Street’s valuation history.

Why Main Street Could See A Lower/Higher Valuation

Because passive income investors tend to reward quality BDCs with premium multiples, Main Street’s stock price will likely continue to deviate significantly from its underlying net asset value in the long run.

That being said, Main Street may face a lower net asset value (though I believe it is unreasonable to expect MAIN to trade at a NAV discount) as a result of a recession, a deteriorating credit cycle, declining portfolio quality, and compressing debt yields.

My Conclusion

Main Street increased its monthly dividend by 2.3%, and the company also declared a special dividend of $0.10 per share in the fourth quarter.

Furthermore, Main Street’s portfolio value reached a new all-time high in 3Q-22, based on fair value. Passive income investors may want to consider paying Main Street’s net asset value premium in exchange for consistent dividend income.

Be the first to comment