chonticha wat/iStock via Getty Images

More than a year has passed since my first article about Aris Gold (OTCQX:ALLXF). Back then, the freshly appointed all-star management team consisting of names like Neil Woodyer, Ian Telfer, David Garofalo, or Frank Giustra was a promise of big things to come. And they really started delivering. By the end of the year, Aris started the Marmato Lower Mine construction and delivered relatively good exploration results from the Juby project. Despite all the positive developments, Aris Gold’s share price declined by more than 40% between May and January. This made shares of the company even more attractive, and I decided to pick Aris Gold as the January Idea of the Month for the subscribers of my Marketplace service “Royalty & Streaming Corner”.

Since then (January 24), Aris Gold’s shares did really well, growing by 41%. Aris outperformed the gold mining industry significantly, as, since January 24, the VanEck Vectors Gold Miners ETF (GDX) is 3% down, and the VanEck Vectors Junior Gold Miners ETF (GDXJ) declined by more than 8%. Among other things, Aris Gold benefited from the acquisition of a 20% interest (with an option to acquire further 30%) in the world-class Soto Norte gold project, which was made at very favorable terms. However, despite Aris Gold’s more than 40% growth in less than 5 months, there remains significant upside potential left.

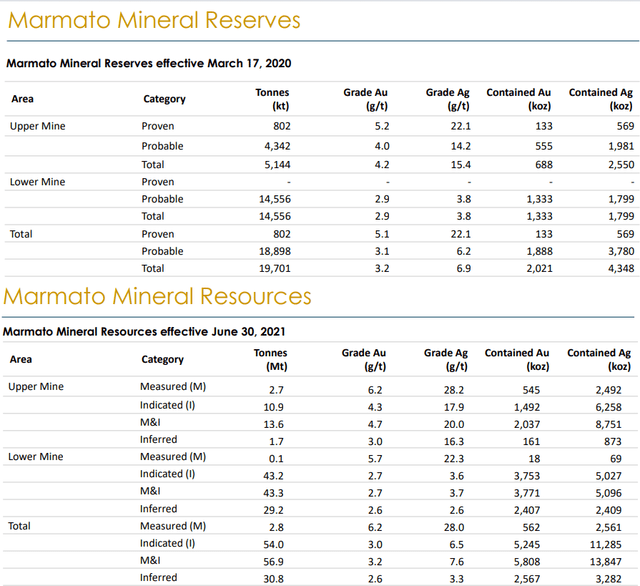

The Marmato mine

The Marmato mine is located in Colombia, approximately 80 km to the south of Medellin. The deposit can be divided into two parts, the Upper mine, and the Lower mine. The measured and indicated resources contain 5.81 million toz gold and 13.85 million toz silver, and inferred resources contain further 2.57 million toz gold and 3.28 million toz silver. Only approximately 1/4 of resources has been converted into reserves for now. Therefore, the reserves contain 2.02 million toz gold and 4.35 million toz silver. It is almost sure that the reserves will be meaningfully expanded in the future.

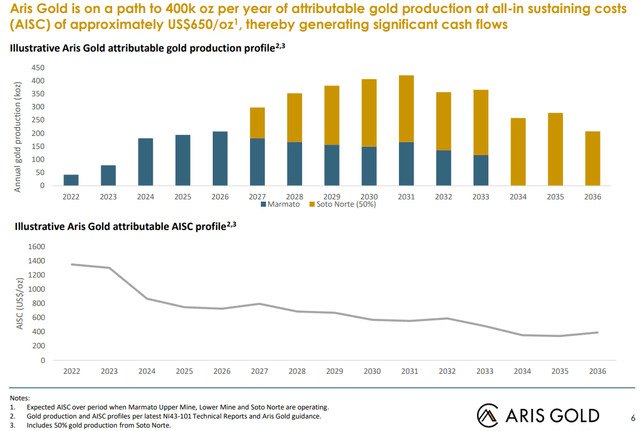

Right now, the upper part of the known deposit is being extracted. However, it is only a small-scale operation with a daily throughput of 1,200 tpd. The annual production is only around 25,000 toz gold, with an AISC of around $1,700/toz. But things should start changing as soon as this year, as the Marmato Upper mine production should nearly double. Next year, the production at the Marmato Lower mine should begin and the gold production should increase further. However, the main progress should be seen in 2024, which should be the first full year of Marmato Lower mine operations and the overall Marmato production should be around 175,000 toz gold.

In Q1, the Marmato mine produced 7,419 toz gold, at an AISC of $1,437/toz, and Aris has confirmed its 2022 guidance of 40,000-45,000 toz gold. The Lower mine should be able not only to push the production volumes higher but also to push the production costs lower. According to the PFS, after the Lower Zone mine is developed, Marmato should be able to produce 165,400 toz gold per year at an AISC of $880/toz on average, over the initial 13-year mine life.

The Soto Norte Project

Aris Gold paid MDC Industry Holding Company LLC, a subsidiary of the Abu Dhabi-based Mubadala Investment Company PJSC, $100 million to acquire a 20% interest in the Soto Norte project. Moreover, Aris has an option to acquire further 30% interest for $300 million.

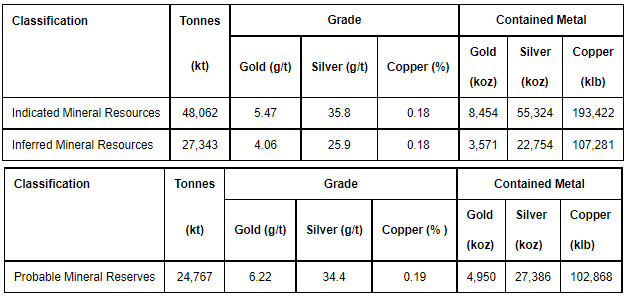

Soto Norte is a world-class project located in Colombia. It has indicated resources (including reserves) of 8.45 million toz gold, 55.3 million toz silver, and 193.4 million lb copper, and inferred resources of 3.6 million toz gold, 22.8 million toz silver, and 107.3 million lb copper. The reserves contain 4.95 million toz gold, 27.4 million toz silver, and 102.9 million lb copper. Moreover, both Aris and Mubadala believe that the property offers significant exploration potential, as the deposit is still open along strike and at depth.

Source: Aris Gold

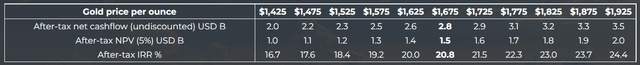

According to the feasibility study, the mine should be able to produce 450,000 toz gold per year on average over the 14-year mine life, at an AISC of only $471/toz. The initial CAPEX was projected at $1.2 billion. At a base-case gold price of $1,675/toz, the after-tax NPV(5%) equals $1.5 billion and the after-tax IRR equals 20.8%. However, as shown in the sensitivity analysis below, at the current gold price, the after-tax NPV(5%) is around $1.9 billion and the after-tax IRR is approximately 23.7%.

Soto Norte is in the permitting process right now. Aris Gold’s corporate presentation indicates that if everything goes well, it should start production in 2027.

Risks and Opportunities

Aris Gold’s current market capitalization is $212 million. The company had cash of $82.3 million and total debt of $87.5 million as of the end of Q1. To finance the acquisition, Aris expanded the Marmato precious metals stream from $110 million to $175 million and it also took a $35 million convertible loan from GCM Mining. So the pro-forma enterprise value (after the full $100 million is paid – $50 million in April, upon the transaction closing, and $50 million over the next 12 months) should be around $320 million. This is not much, given that Marmato alone should be producing around 165,000 toz gold per year at an AISC of around $900/toz, starting in 2024. This could lead to operating cash flows in the $130-140 million range at the current gold prices. And in 2027, Soto Norte should start contributing as well. For Aris, it means additional 225,000 toz gold per year (assuming the acquisition of a further 30% interest), at an AISC of around $500/toz, or cash flows close to $300 million at the current gold prices. So the overall annual cash flows could be somewhere in the $400-450 million range based on the currently known projections. It is more than double Aris Gold’s current market capitalization.

Although the Marmato mine production is projected to start declining from 2027 on (chart below), as I mentioned above, given the exploration potential and the volume of resources not included in reserves, it is very probable that its production profile and mine life will be improved. It means that there is a chance for Aris to maintain the annual production rate of around 400,000 toz gold at a relatively low AISC for a relatively long period of time.

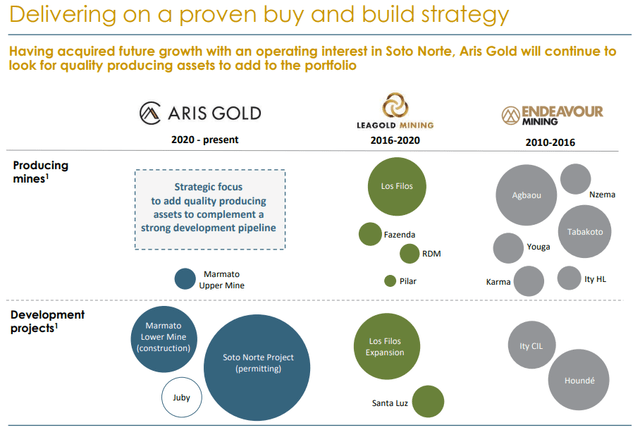

As shown in the chart above, Marmato and Soto Norte alone provide a very nice growth profile. However, the company remains growth-oriented and wants to keep on expanding. As the slide from the latest corporate presentation (picture below) indicates, even after the recent acquisition of the interest in Soto Norte, Aris Gold’s management keeps on looking for potential additions of some producing assets. The strategy of acquiring, expanding, and developing operating mines and development projects proved successful both at Endeavour and at Leagold, the previous two ventures of the management team.

An obvious risk in the current inflationary environment is a CAPEX overrun. However, the initial CAPEX for the Marmato Lower mine was estimated only at $269.4 million, and a portion of this sum has been already expended. Although some cost overruns may occur, even if they are big on a percentual basis, their absolute value should be manageable. Much more risky is the Soto Norte mine development which should cost $1.2 billion according to the original estimates, however, it is possible to reasonably expect the final price tag to be several hundred million higher. And it is probable that a portion of Aris Gold’s share on the CAPEX will be covered by equity financing. However, it is too early to estimate the extent of the future share dilution.

Moreover, Aris will need $300 million to acquire the additional 30% interest in Soto Norte. Aris must use the option prior to 42 months after closing of the acquisition of the initial 20% interest, or 10 weeks after the receipt of the Environment and Social Impact Assessment, whichever occurs sooner. The problem is that if Aris doesn’t use the option, Mubadala has the right to repurchase Aris Gold’s 20% stake for a sum equal to Aris Gold’s initial investment plus further costs expended on Soto Norte development.

Another problem is that also the production costs have to face the inflation pressures. Therefore, the Marmato and Soto Norte AISC of $880/toz and $471/toz gold are unrealistic. The actual costs will be most probably higher. However, this applies to the whole mining industry. And although Marmato and Soto Norte will have higher costs, they should maintain their status of low-cost operations when compared to their peers whose production costs will grow as well. Unfortunately, if the gold prices don’t increase as well, the actual cash flows will be negatively impacted. But given Aris Gold’s current low share price, there is significant upside left, even if the production costs increase notably.

When talking about the risks, it is important to mention also the jurisdiction risk. Although Aris, as well as the previous owner of Marmato, GCM Mining (OTCQX:TPRFF), has been operating in Colombia for years, without any major issues, the country doesn’t have a good reputation, and it weighs on Aris Gold’s share price. Not only Marmato but also Soto Norte is located in Colombia. The development of the Canadian Juby project should help a little. However, Juby is only in earlier development stages. Moreover, it probably won’t be big enough to present a true counterweight to Marmato and Soto Norte. Therefore, it would be great if the new assets potentially acquired by Aris were located in a better jurisdiction.

Conclusion

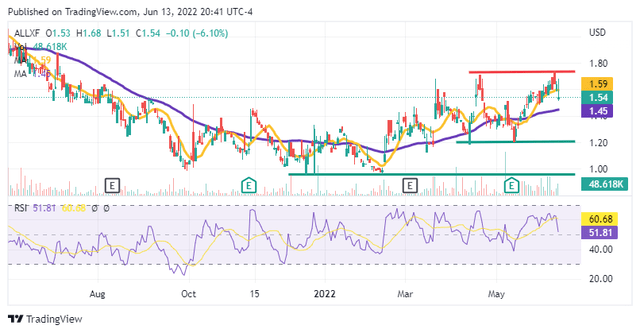

Despite the decline experienced over the recent trading days, Aris remains in an uptrend. The share price is situated above the 50-day moving average and the 10-day moving average is above the 50-day one. The RSI is around 50, far from overbought levels. The fundamentals of Aris Gold are good, but some damage may be done by the general stock and gold market sentiment in the near term. Should the negative sentiment prevail, Aris Gold’s share price may decline to the support in the $1.2 area. In the case of some major market turbulences, the next support is around $0.95. On the other hand, if the growth returns, the nearest resistance level is situated in the $1.75 area.

Aris Gold is an exciting growth-oriented company with a great time-proven management team. The recent acquisition of the stake in the Soto Norte project paved the road for Aris to become a low-cost gold producer with annual production rates of around 400,000 toz gold. Despite all of the positive developments, Aris Gold’s share price remains only around $210 million, which is very low compared to the long-term potential of the company. The Marmato mine alone should be enough for the current share price to more than double. Soto Norte provides further upside potential. However, its true extent will be known only after there is some more clarity regarding Aris Gold’s plans to finance the acquisition of the additional 30% stake and its share of CAPEX.

Be the first to comment