zodebala/iStock Unreleased via Getty Images

Price Action Thesis

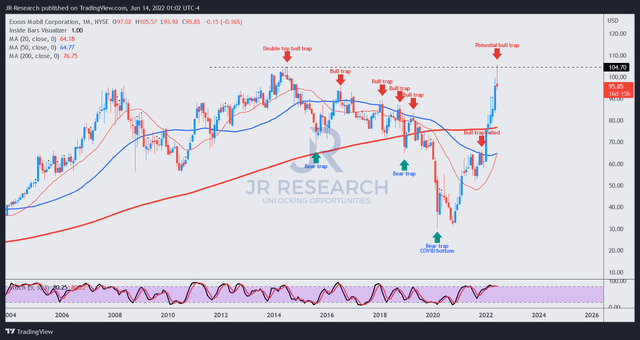

In this article, we discuss Exxon Mobil (NYSE:XOM) stock’s detailed price action analysis, helping investors visualize why we urge them to layer out and cut exposure.

The market has been digesting the gains in several oil majors over the past month, even though the WTI and Brent Crude have held steady gains. Therefore, we believe it demonstrated the forward-looking mechanism of the equity markets, which investors need to consider.

Fortunately, investors can allude to the market’s forward intentions through price action analysis, adding clarity to their investment decisions. We believe that the potential bull trap that has been brewing in June for XOM stock could help set the stage for its subsequent “fall from the sky.”

Therefore, we do not encourage new investors to add exposure at the current levels. We also exhort existing investors to consider taking profits from those gains soon.

Accordingly, we rate XOM stock as a Sell.

Menacing Bull Trap Could Be Forming in XOM Stock

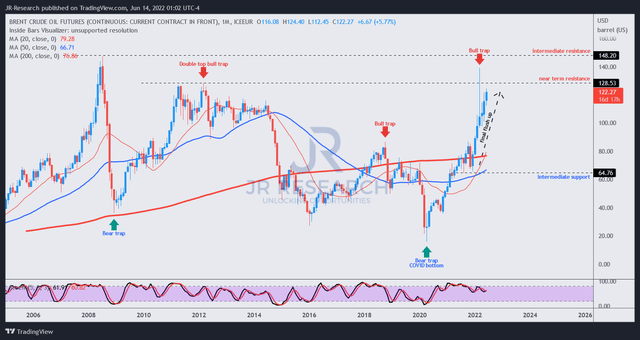

Brent crude price chart (TradingView)

As seen above, Brent crude already had a bull trap that formed in March, after the start of the Russia-Ukraine conflict, as it breached its previous 2012 all-time highs and double top bull trap. Therefore, the buying momentum failure at its critical long-term resistance was telling. Even though Brent crude has been recovering steadily since March, we believe it is likely a “final flush up” to set the stage for a steep eventual decline.

We also observed that XOM stock is in the process of forming a potential bull trap (not validated) in June. Notwithstanding, we need to wait until the end of June to confirm the validity of the potential bull trap.

Notably, it has also tested the critical resistance (and failed) formed by its previous double top bull trap, last seen in 2012. Investors should note that XOM stock does not have a discernible long-term uptrend.

Instead, it’s marked by a series of bull/bear traps. Consequently, we think layering out after bull traps are formed is an appropriate risk management strategy that investors should consider carefully. Nonetheless, we would like to caution that the bull trap has not been validated yet (until the end of June).

However, the price action structure is menacing, as it tested a previous double top resistance level. Also, the sharp momentum spikes leading to its current potential bull trap indicate the market has drawn in buyers rapidly. Therefore, we think the market is setting up for a buying momentum stall before forcing the sell-off subsequently.

Exxon Mobil’s Growth Could Slow Markedly

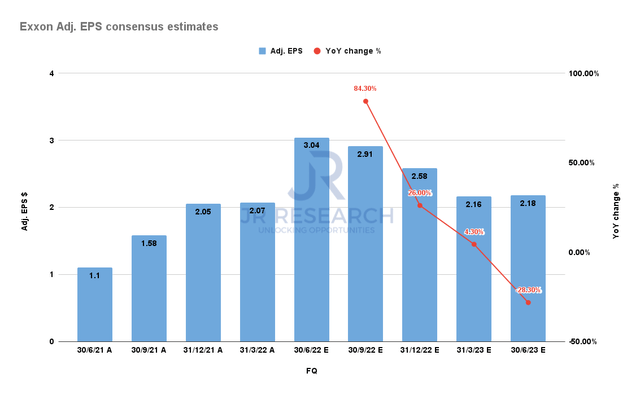

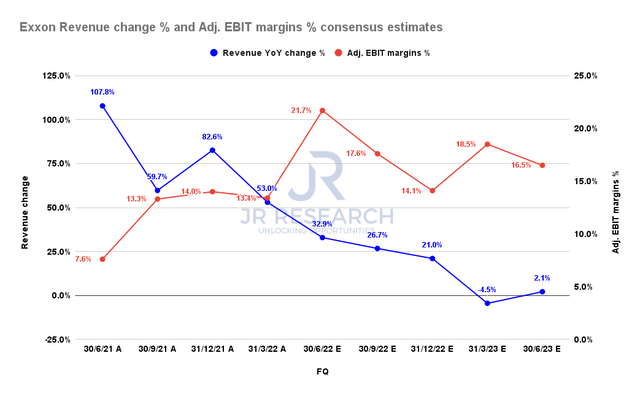

Exxon adjusted EPS consensus estimates (S&P Cap IQ) Exxon revenue change % and adjusted EBIT margins % consensus estimates (S&P Cap IQ)

As seen above, Exxon’s revenue growth is expected to moderate significantly through FY23, even though EBIT margins are expected to remain resilient.

Furthermore, Exxon’s adjusted EPS growth is estimated to decline markedly, falling into negative growth by H1’23. As a result, we think the market has been pricing in its potential weakness moving forward, even though crude has kept its steady recovery from March.

Is XOM Stock A Buy, Sell, Or Hold?

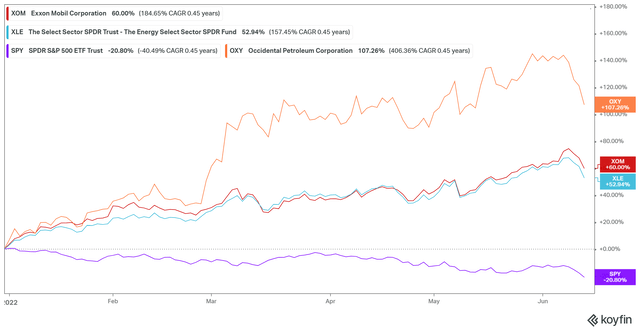

XOM YTD performance % (koyfin)

Energy investors have significantly outperformed the SPDR S&P 500 ETF (SPY) in 2022. Notably, XOM’s YTD gains of 60% are slightly ahead of the Energy Sector ETF’s (XLE) YTD gains of 52.94%.

But, we think XOM investors need to recognize the potential bull trap that could be forming in June. Therefore, investors can consider layering out and then accelerate their divestments if the bull trap is validated subsequently.

As such, we rate XOM stock as a Sell. In addition, we think the risk/reward profile for XOM stock points to the downside moving forward.

Be the first to comment