Torsten Asmus

Emerging market (EM) debt investors face headwinds in the last quarter of the year, thanks to monetary tightening, geopolitical tensions, energy crises, and economic weakness in China. But despite the uncertainty, we have a constructive medium-term view.

Resilient Fundamentals

In the near term, EM debt fundamentals remain supportive despite less favorable fiscal and debt dynamics being driven by softer economic conditions. Bright spots include:

- High commodity prices in most EMs should support external accounts.

- Because EM central banks preemptively hiked interest rates, real rates in EMs are now significantly higher than they are in advanced economies, supporting local currencies.

- In its latest world economic outlook, the International Monetary Fund (IMF) projected that economic growth in EMs would be 3.7% in 2023. This is the same level as 2022, but 2.6 percentage points higher than the projected growth in advanced economies. This widens the growth differential further in EMs’ favor.

While there are some pockets of fundamental weaknesses, especially among certain energy- and food-importing countries, we believe the asset class is broadly well-positioned to withstand a period of weaker global growth.

Compelling Valuations

In our opinion, EM debt valuations remain compelling on both an absolute and relative basis, with spreads remaining wider than their historical levels.

EM sovereign high yield spreads appear especially compelling, particularly relative to U.S. high yield. In the distressed credit space, we believe current prices are overestimating the probability of credit events and underestimating potential restructuring and recovery values.

Overall, we believe current valuations overcompensate investors for credit risks and volatility, and EM debt currently offers attractive value to investors with a medium- to long-term horizon and who have a willingness to tolerate a period of higher volatility.

Tough Technical Conditions

Technical conditions remain the weakest element of the investment case for EM debt. On the bright side, there is limited scope for new debt issuance, significantly reduced investor positioning, and high investor cash levels. That said, continued outflows from dedicated EM debt portfolios, high market volatility, and low liquidity offset the more positive technical indicators.

Potential Strategic Opportunities

We have not changed the strategic positioning of the portfolios materially. We continue to favor high-yield issuers over high-grade issuers, and remain strategically overweight in higher-yielding, frontier markets, where we believe the risk premia continue to overcompensate investors for credit risk and volatility.

However, we still see scope for fundamental differentiation among countries. We prefer commodity-exporting countries, especially in the energy space, but remain cautious about countries with strong trade and financial links to Russia. We also remain cautious about countries with strong dependence on food and energy imports.

We also continue to see opportunities in select distressed debt positions, where we believe bond prices do not reflect realistic assumptions for default risk and recovery values.

Lastly, we continue to prefer countries with easier access to financing, especially those that have strong relationships with multilateral and bilateral lenders.

In EM corporate credit, we believe a combination of differentiated credit fundamental drivers, favorable supply technical conditions, and attractive absolute valuations should continue to provide ample investment opportunities. But given uncertainty in the near term, we are focusing on issuers with low refinancing needs and robust balance sheets.

In Latin America, our positions are diversified across oil and gas; technology, media, and telecommunications (TMT); utilities, and financials. In Central and Eastern Europe, the Middle East, and Africa (EMEA), our positions are diversified across financials; oil and gas; metals and mining; and real estate. In Asia, our positions are diversified across oil and gas; financials; industrials; metals and mining; utilities; and real estate.

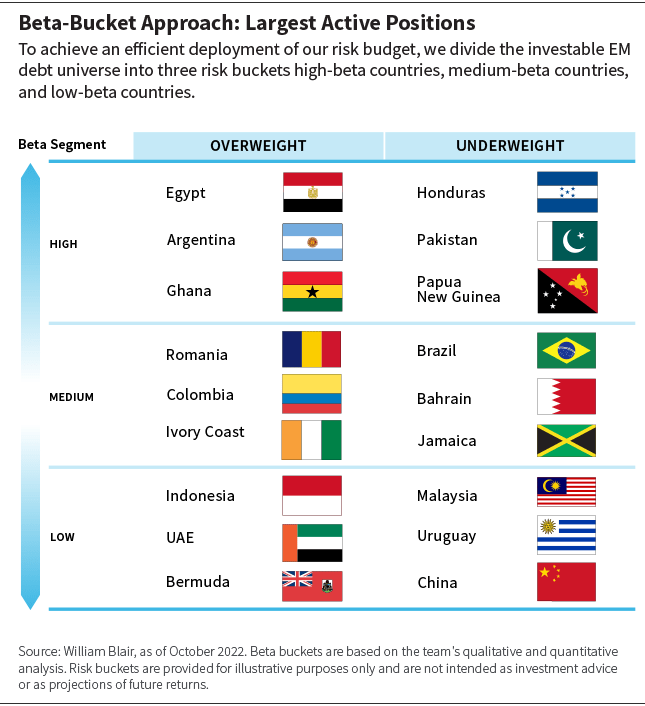

Our highest-conviction overweight and underweight positions are shown in the table below.

Beta-Bucket Approach: Largest Active Positions (Author)

High-Beta Bucket

In the high-beta bucket, our largest overweight positions are in Egypt, Argentina, and Ghana, and our largest underweight positions are in Honduras, Pakistan, and Papua New Guinea.

Egypt (overweight): We remain overweight Egyptian credit on the belief that external financing needs will be met with support from partners in the Middle East and ultimately the IMF.

Argentina (overweight): Overall, we remain bearish about Argentine fundamentals. However, we believe sovereign bonds are priced below their eventual recovery value, providing potential value. We favor bonds on the curve with stronger indenture protections. Our overweight is concentrated in higher-quality provincial issuers. We have also purchased credit default swap (CDS) protection (net) to hedge against a default by the Argentine government.

Ghana (overweight): Ghanaian bonds are priced low relative to our assessment of their default probability and possible losses if default occurs – i.e., we believe we are being compensated for the risks.

Honduras (underweight): We decreased our position in Honduras during a period of outperformance in July. Although Honduras does have the capacity to service its debt, fundamentals have been declining. The electricity sector, in particular, has been mismanaged, creating fiscal challenges. The new government has threatened repudiation of its debt obligations, which gives us some concerns about Honduras’s willingness to pay. Given valuations and the small chance of debt repudiation, we think there is better value elsewhere.

Pakistan (underweight): Risks remain regarding repayment and ongoing political turmoil, and the aftermath of the flood crisis has made the country even more vulnerable to external shocks.

Papua New Guinea (underweight): We believe a low foreign exchange reserves base and a weak fiscal position are key reasons to avoid investing in Papua New Guinea, although the country’s debt maturity profile is well-spaced out (mostly to bilateral lenders).

Medium-Beta Bucket

In the medium-beta bucket, our largest overweight positions are in Romania, Columbia, and Ivory Coast, and our largest underweight positions are in Brazil, Bahrain, and Jamaica.

Romania (overweight): We believe euro-denominated Romanian bonds are inexpensive relative to their U.S.-dollar-denominated equivalents given that much of the heavy issuance forecast in euro-denominated debt is behind us for the year and valuations remain attractive relative to regional peers.

Colombia (overweight): We find valuations attractive. Although President Gustavo Petro’s rhetoric has turned slightly more radical, we believe strong institutional checks remain intact. Petro has a majority in Congress, but we believe the majority is thin, and not all parties in coalition with him would actually vote for more radical policies. We still believe that Petro will have to lead from the center in order to have a successful presidency.

Ivory Coast (overweight): We find valuations attractive in the country’s long-dated euro-denominated bonds and believe fundamentals remain relatively supportive.

Brazil (underweight): While currently underweight, we may pivot depending on the outlook for the second round of the country’s presidential election. We viewed investing in Brazil as an asymmetric proposition, as we thought there was a high probability of a surprise, and over the longer term, Brazil may be in a position to perform well. Despite the mediocre macro outlook, Brazil does not suffer from many of the geopolitical and global headwinds that may impact other EM countries.

Bahrain (underweight): We are underweight Bahrain, predominantly based on valuation metrics. The country continues to hold high debt levels despite high energy prices and an improved fiscal consolidation effort.

Jamaica (underweight): We reduced risk in Jamaica during the quarter as valuations became more stretched. Jamaica has continued to implement an impressive fiscal consolidation agenda, even following the pandemic. When it comes to the ratio of debt-to-gross domestic product (GDP), Jamaica has kicked the can down the road, driven by pandemic impacts. Still, fiscal discipline has resulted in continued fundamental improvement. However, we believed market expectations were too high, and high dollar prices for many Jamaican bonds led us to believe there is a more efficient allocation of capital elsewhere in the EM universe.

Low-Beta Bucket

In the low-beta bucket, our largest overweight positions are in Indonesia, United Arab Emirates (UAE), and Bermuda, and our largest underweight positions are in Malaysia, Uruguay, and China.

Indonesia (overweight): Indonesia’s improving terms of trades and structural reforms – designed to capture opportunities from green projects and supply chains – justified an overweight for a potential credit upgrade in the future.

UAE (overweight): Valuations are attractive in higher-yielding emirates such as Dubai and Sharjah.

Bermuda (overweight): We favor valuations and fundamentals over other low-beta sovereigns. Bermuda has similar valuations to Peru and Chile but a stronger fundamental trajectory, as there is less institutional uncertainty in Bermuda.

Malaysia (underweight): We find valuations unappealing, particularly in the longer-duration sovereign and quasi-sovereign bonds.

Uruguay (underweight): Fundamentals in Uruguay remain strong, but bonds have compressed materially since the pandemic, offering limited potential spread tightening. Valuations are generally unappealing, in our opinion.

China (underweight): With COVID-related restrictions remaining tight and the housing crisis far from over, we believe the Chinese economy’s growth will remain subpar despite an expected rise in infrastructure spending. This could result in outperformance of Chinese corporates over sovereign bonds, so we are overweight the former and underweight the latter.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment