NiroDesign/iStock via Getty Images

Introduction

Rent-A-Center, Inc. (NASDAQ:RCII) rents out durable household goods to customers on a lease-to-own basis. The company supplies furniture and accessories, appliances, consumer electronics, computers, tablets and smartphones and other durable goods.

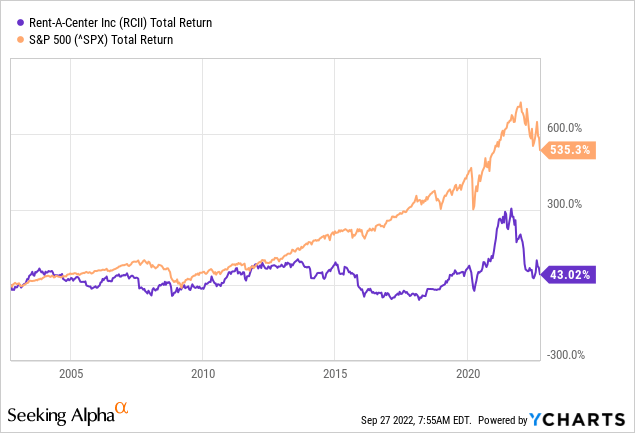

The stock made strong progress through 2014, after which it struggled to keep up with the S&P500. The dividend was reduced in 2016, and this could be the cause of the underperformance, among other things.

The valuation metrics show that the stock is valued very cheaply. But revenue and EPS declined year-over-year in the past quarter. Rent-A-Center performed strongly during the recent financial crisis. Because there are still uncertainties about the revenue and profit developments, I’m holding off on buying the shares.

Quarterly Earnings Have Been Mediocre, Outperformance In Economic Downturns

Recent quarterly figures have been mediocre, but better than analysts had expected. Revenue decreased 10% year-over-year due to lower merchandising sales and rental income compared to last year. The recently acquired Acima performed poorly, with sales declining 17% year-over-year, while the Rent-A-Center segment saw sales fall by only 3% over the same periods.

High inflation, pressure on discretionary income and the effects of lower government stimulus measures affect the company’s results. Rent-A-Center expects a 5% average revenue decline and a 24% non-GAAP EPS decline for this year. According to the SA RCII ticker page, 7 analysts expected revenue and non-GAAP EPS to rise in 2023.

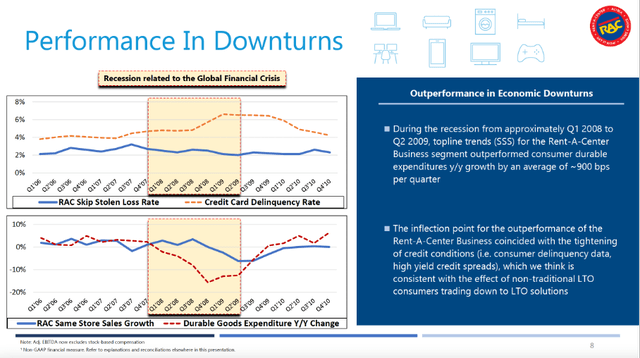

To make an analogy with the financial crisis of 2008, Rent-A-Center is now in a better position. Same Store Sales growth was -3.3% in the quarter, but Rent-A-Center experienced strong growth during the coronavirus crisis. Rent-A-Center shows in the next sheet that it continues to perform strongly in times of recession.

Performance in downturns (Rent-A-Center recent investor presentation)

This puts the stock on the edge of my hold/buy rating, but I’d rather wait until there are positive revenue and earnings developments. After the acquisition of Acima, the company has a relatively large debt compared to the previous situation, which makes the purchase decision a lot more complicated.

RCII Dividends and Share Repurchases

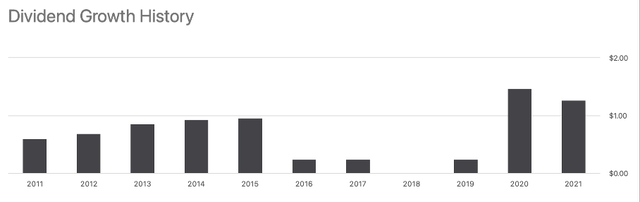

Management’s capital allocation to shareholders is characterized by a growing dividend and share repurchase program. The company pays a dividend of $1.36 per share, which represents a high dividend yield of 6.2%. But if we look at their dividend history, I see a broken dividend period. And that’s a shame, because I’d like to see at least some stability in the dividend. In the period 2016 to 2018, the share price fell sharply. From peak to trough (mid-2013 to mid-2018) the share price declined 80%. This is a lot.

Dividend growth history (SA RCII ticker page)

In 2021, operating cash flow was $392 million, capital expenditures were $63 million, and thus free cash flow was $329 million. In that year, $390 million was used for share buybacks, more than their free cash flow. This is not sustainable in the long run.

Of the $329M in free cash flow, $71 million was paid in dividends. A sustainable share repurchase program would then amount to approximately $250 million, which corresponds to a repurchase yield of 19%. I think this is on the high side, but it shows that Rent-A-Center shares has the potential to rise through share buybacks.

Rent-A-Center can better benefit from paying off their high debt, which arose after the acquisition of Acima in 2021. The net debt burden after cash is currently $1258 million, which is a lot compared to before the Acima acquisition (the debt net of cash amounted to $31 million). Management’s goal is to reduce leverage from 2.4x to 1.5x. A share repurchase program is considered on an opportunistic basis.

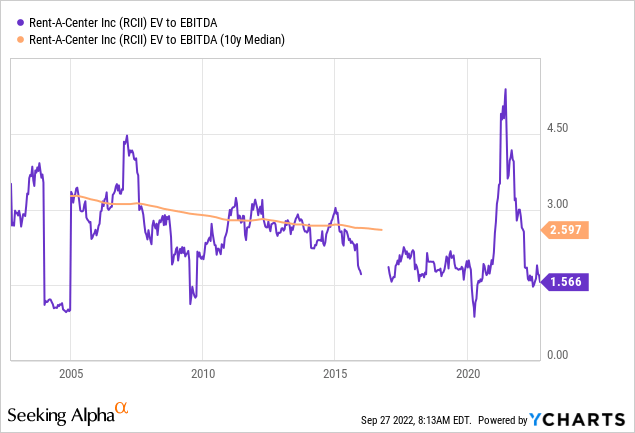

Valuation Metrics

To chart the valuation metrics, I use the EV/EBITDA ratio because it takes the debt and cash into account plus market cap and compares it to EBITDA. With the recent acquisition of Acima, the company has more debt on its balance sheet than before, making the EV/EBITDA ratio an appropriate choice. Rent-A-Center invests in various consumables and depreciates them annually, for which EBITDA is preferred.

At 1.6, the ratio is generally very low. The 10-year median could not be displayed by YChart because 2016 EBITDA was negative. In general, Rent-A-Center is attractively valued in the stock market.

Despite the low valuation, I’m holding off on buying the shares. Revenue declined and the outlook for this year is revised downward. The decline in revenue can last for several quarters in times of economic recession. And with the U.S. showing negative GDP growth for two consecutive quarters, the U.S. has entered a recession. If sales and earnings improve, I will take a position in Rent-A-Center, but it’s too early right now.

Conclusion

Rent-A-Center rents durable household goods to customers on a lease-to-own basis and has experienced strong growth in recent years. However, recent quarterly figures show declining sales and earnings per share. The recently acquired Acima in particular performed poorly.

However, I remain slightly positive because Rent-A-Center experienced unprecedentedly strong growth during and just after the corona crisis. For 2023, the company expects a decline in sales and earnings, analysts expect an increase after 2023. During the recent financial crisis of 2008, Rent-A-Center performed strongly. The stock valuation metrics show a favorable picture. As the company is now heavily indebted from the acquisition, I’m holding off buying stocks until revenue and earnings per share have increased.

Be the first to comment