Khanchit Khirisutchalual/iStock via Getty Images

Thesis highlight

Remitly Global (NASDAQ:RELY) is cheap. Remitly has successfully grown their international money transfer product to cover over 1,700 corridors worldwide, allowing them to provide a wider range of financial products and services. The cross-border remittance market is expected to reach $1.25 trillion and is one of the fastest growing sectors of the financial services industry. I believe Remitly’s mobile-first approach streamlines and improves the customer service they offer, leading to high levels of customer satisfaction and loyalty.

Company overview

Remitly connects immigrants with their loved ones in over 135 countries through digital financial services. They have been able to expand their main international money transfer product to more than 1,700 corridors around the world, which gives them the ability to offer a wider range of financial products and services.

Cross-border remittances remain a large and underpenetrated market

One of the fastest growing sectors of the financial services industry is international money transfers, which includes both remittances and international banking. Global transaction fees are expected to reach an all-time high by 2030, with the cross-border remittance market alone reaching $1.25 trillion. If anything, the massive size of this industry should serve as a reminder of how important remittances are to the health of economies and social structures worldwide.

However, concerns have been raised about the conventional approach because of a lack of innovation and economic diversity. It’s safe to say that banks, traditional retailers, and informal channels have a stranglehold on these markets, and that their respective participants rely on a wide variety of legacy systems and procedures. As a result, both the quality of service provided to customers and the business’ overall operating costs rise, ultimately increasing the price paid by consumers. Most of the time, these organizations serve multicultural immigrant communities with technology that isn’t scalable, integrated, or tailored to the needs of the local market.

RELY’s S-1 claims that more than 280 million foreign-born individuals may be denied equal access to basic financial services that are essential to establishing and maintaining financial stability. To me, this is a catastrophe because, for the immigrants, sending money internationally is usually a tedious, time-consuming, and costly process. They may feel threatened because they may lose money or their personal information, or they may be unable to get an answer to a pressing service question at a crucial time. When they are provided at all, supplementary financial services like savings, credit, investments, and insurance products typically come with excessive fees and a high potential for fraud. Therefore, I think RELY has a fantastic chance to seize market share and emerge as a market leader.

RELY’s solution is simple and reliable

The prospectus claims that over 85% of customers have used Remitly on their mobile phones, making it possible to do in seconds what once took hours of waiting in line for an agent. In my opinion, RELY has been able to achieve such a high level of customer dedication by developing mobile-first products that streamline and improve the customer service they offer, all while giving their clients complete peace of mind. Because the typical immigrant is not tech savvy, this is crucial because they would abandon the app if they encountered any difficulties.

Rely, a mobile app, makes sending money abroad a breeze by streamlining the entire procedure. By linking their bank account to the app, users can send money back home in a matter of minutes, with as few as five taps required for subsequent transfers. Customers and their loved ones can check on the current standing of their financial dealings at any time. I think this mobile-first approach helps RELY build relationships with its customers that last beyond a single purchase, which ultimately leads to increased loyalty and patronage.

In addition, RELY has done a fantastic job of adapting their products for the local market. I think one of RELY’s greatest strengths is its ability to efficiently localize marketing, products, and customer support on a global scale. Their global customer support team and 14 available native languages allow for a personalized customer experience. In addition, they partner with local brands that are highly regarded and well-known among our clientele in order to distribute the money. All of these features set RELY apart from its rivals.

Global availability is a key criterion for mass adoption

Of course, being accessible everywhere in the world is crucial for successful international money transfers. In this respect, RELY excels. Money transfers can be made in over 1,700 corridors thanks to their global network of funding and disbursement partnerships. The challenge lies in actually putting it into practice. Imagine you’re a new entrant trying to imitate RELY’s success; between the various national and international licenses and permits you’ll need, getting up and running won’t happen overnight.

Customers can use their bank accounts, credit cards, or other preferred payment methods in addition to those offered by RELY thanks to the company’s partnerships with major financial institutions around the world and industry leaders in the payment processing industry. According to the prospectus, RELY’s disbursement network allows users to send money to more than 3 billion bank accounts, 600 million mobile wallets, and 300,000 cash pickup locations within minutes. In my opinion, these partnerships are important for improving the quality of service given to customers in a number of ways.

These alliances with complementary businesses help set RELY apart from the competition by proving to customers that it is a solid option. Financial institutions care about their reputations, so they don’t want to work with a new company that they don’t know much about.

Data-driven approach to ensure proper executions

RELY takes a data-driven approach to expanding their business, allocating resources, and managing daily operations. Given that they may have to process millions of data points every day, I think this is crucial. When customers initiate transfers digitally, RELY gathers and analyzes a wealth of data about those transactions to gain insight into their behavior and satisfaction. Analytics and data help them decide where to put their money in terms of product creation and promotion. In addition, RELY is able to manage pricing, treasury, risk, and customer support with the help of their data platform and unique models. As a result, RELY will be able to more accurately price their products and reduce their exposure to risk as they expand.

Valuation

Price target

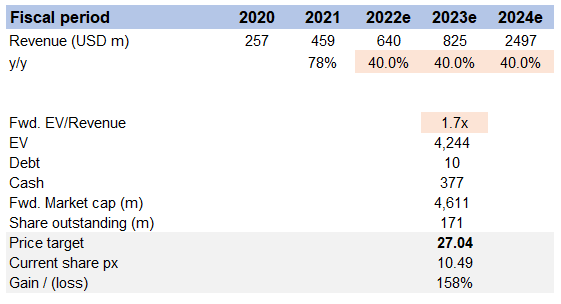

My model suggests a price target of $27.04 in FY23. This assumes that revenue will continue its high growth rate, and the forward revenue multiple will be 1.7x in FY23e.

Own estimates

For FY22e, I used FY22 guidance, and for FY23e and beyond, I believe RELY can continue to grow at historically high rates due to the big TAM. As for how much RELY is worth, it trades at 1.7x forward revenue right now, and I assumed that RELY would at least trade at the current level moving forward. That said, I do believe that once we get past this weak macro environment, RELY could see a positive re-rating of its average trade back to its average of 3x, which would mean further upside.

Risks

Competitive market

There is a wide variety of both old-fashioned and newfangled businesses competing for a piece of the remittance pie. RELY faces competition from both larger international firms like Western Union (WU) and MoneyGram as well as smaller local firms like banks and informal person-to-person money transfer service providers who may be better able to adapt their offerings, marketing strategies, and regulatory compliance to local tastes and norms.

FX exposure

RELY reports in USD, but the majority of their revenue and earnings come from emerging markets. This puts RELY in a very bad position when the USD rises, as it is currently doing.

Regulation

RELY transfers a large amount of money cross-border every day. Because of the sheer magnitude of this transmission, RELY is constantly scrutinized by regulators. If RELY is caught committing illegal acts (which may or may not be RELY’s fault), they may suffer reputational damage that is difficult to repair.

Conclusion

RELY is cheap today, in my opinion. Remitly offers a range of financial products and services, including international money transfers and other banking services. As stated above, the cross-border remittance market is expected to reach $1.25 trillion by 2030, and Remitly has positioned itself as a mobile-first solution that offers streamlined and personalized services to its customers, thereby enabling it to gain meaningful share in this space.

Be the first to comment