MCCAIG/iStock via Getty Images

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on April 10th.

Real Estate Weekly Outlook

U.S. equity markets retreated on another choppy week as record-high inflation reports and surging commodities prices kept upward pressure on interest rates while corporate earnings season kicked off with mixed results. Social media firm Twitter (TWTR) stole the headlines, however, after forcefully rejecting an “unwelcome” takeover bid from Tesla (TSLA) CEO Elon Musk, who has been critical of the firm’s censorship policies which “undermines democracy” which sets the stage for a high-profile showdown with potentially significant ramifications across finance, culture, politics, and technology.

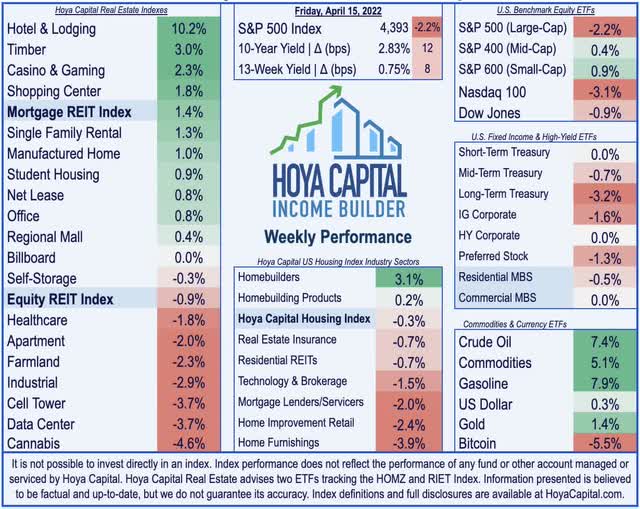

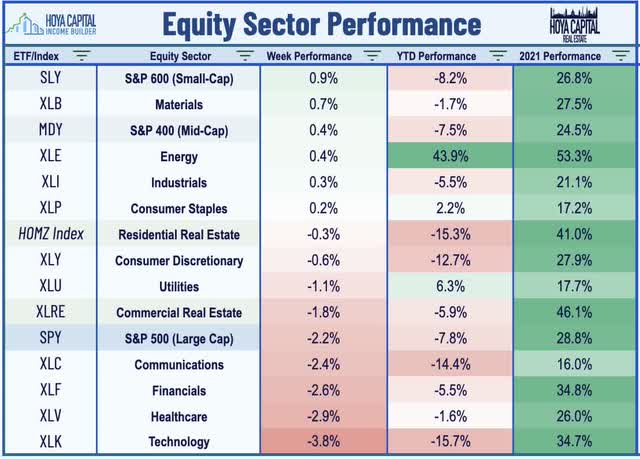

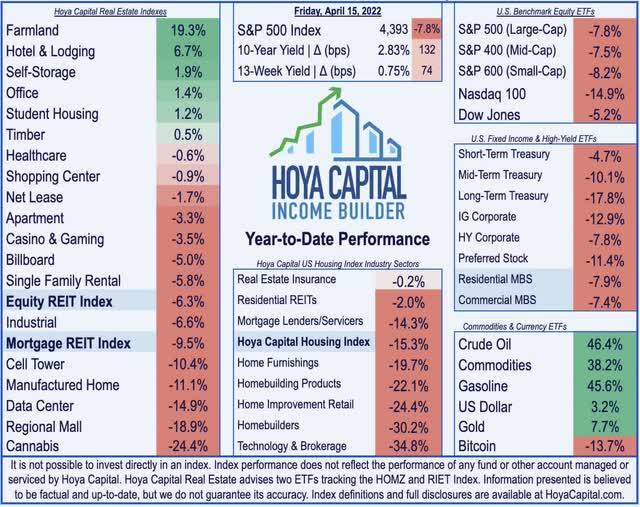

Finishing lower for a second-straight week, the S&P 500 declined 2.2% on the week while the tech-heavy Nasdaq 100 dipped more than 3%. Reversing the recent “flight to quality” trend, however, smaller market-cap tiers rebounded on the week as the Mid-Cap 400 gained 0.4% while the Small-Cap 600 advanced 0.9%. Ahead of the start of earnings season in the week ahead, real estate equities delivered mixed performance amid a growth-to-value rotation as the Equity REIT Index declined by 0.9% with 10-of-19 property sectors in positive territory while Mortgage REITs rebounded with gains of 1.4%.

The historic rout across bond markets paused briefly mid-week as a cooler-than-expected CPI print and COVID concerns in China sparked a bid for bonds, but the selling resumed following a red-hot PPI report and hawkish Fed commentary late in the week. The 10-Year Treasury Yield jumped 12 basis points to 2.83% – its highest close since late 2018 – but the yield curve widened a bit with the 2-Year Treasury Yield declining 6 basis points to 2.46%. After briefly dipping to the cusp of pre-invasion levels, Crude Oil (CL1:COM) prices surged more than 7% this week to back above $106/barrel. Homebuilders caught a bid amid a historically rough start to 2022 following several reports from the MBA and Redfin showing that despite the surge in mortgage rates, housing demand remains surprisingly resilient.

Real Estate Economic Data

Below, we recap the most important macroeconomic data points over this past week affecting the residential and commercial real estate marketplace.

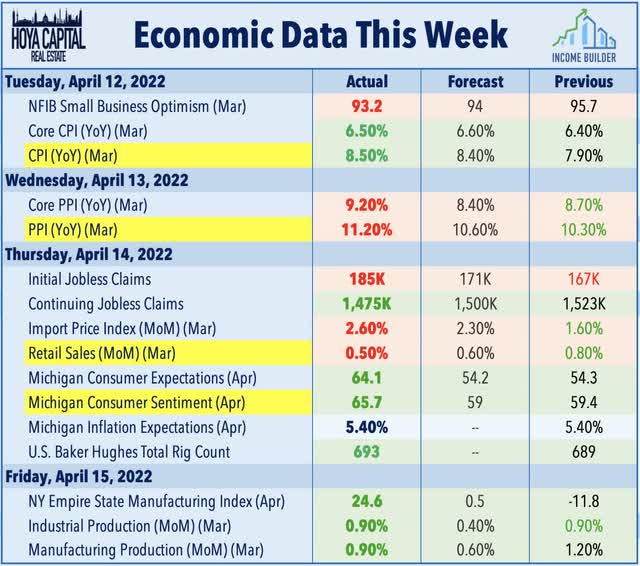

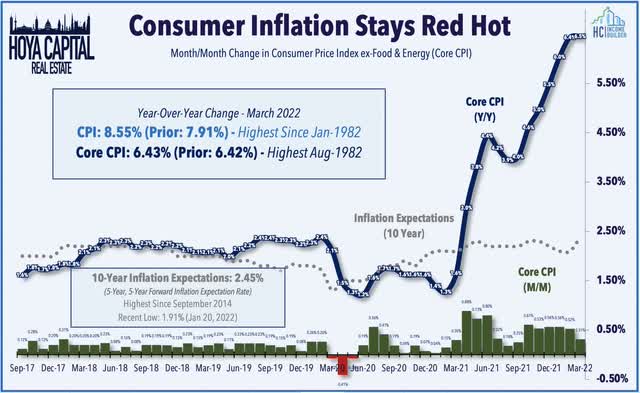

Inflation Remains Relentless: The BLS reported this week that consumer prices surged at the fastest pace in over four decades in March while Producer Prices soared at an 11.2% annual rate – the highest annual inflation rate on record. The Consumer Price Index rose 1.2% from last month – the largest month-over-month increase since Hurricane Katrina in 2005 – and rose 8.6% year-over-year, the highest annual increase since 1982. Prices for food, rent, and gasoline were once again the largest contributors to inflation as the energy index rose 32.0% over the last year, and the food index increased 8.8% percent, the largest 12-month increase since May 1982.

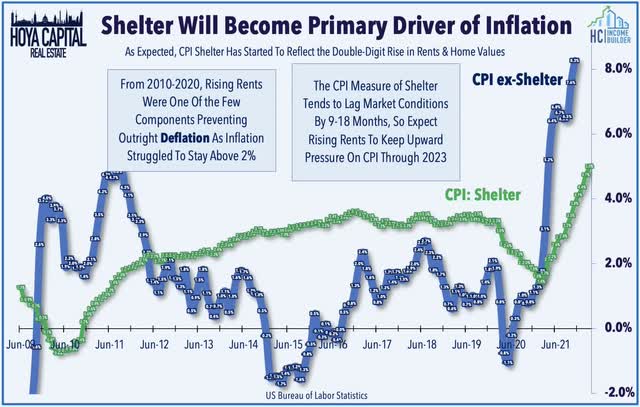

While there have been some early hints of easing inflation in energy prices and transportation, shelter costs will continue to put upward pressure on headline inflation metrics. The cost of shelter increased 0.5% in March and accounted for nearly two-thirds of the monthly increase in the Core CPI Index. Private market rent data has shown that national rent inflation has been in the 10-15% range over the past quarter while home values have risen by 15-20%. The Dallas Fed published a report highlighting the data issues at the BLS, finding a 16-month lag between the BLS inflation series and real-time market pricing of home prices and rents which will add an estimated 0.6-1.2% to the Core CPI index in 2022 and 2023.

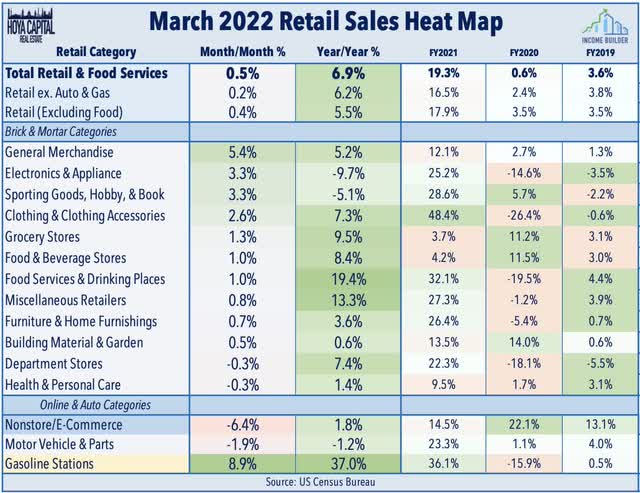

The Census Bureau reported this week that retail sales rose at a slower pace than expected in March – a potential early sign of cooling consumer spending resulting from multi-decade-high rates of inflation. Overall retail sales rose 0.5% from last month and 6.9% from last year, but increased spending at gasoline stations accounted for the bulk of the increase. Retail sales excluding gasoline actually declined by 0.3% in the month but remained higher by 4.4% from last year. Aside from gasoline stations, areas of strength in March included General Merchandise retailers and Electronics & Appliances stores while Department Stores lagged. Notably, the February data included a 6.4% dip in nonstore (e-commerce) sales which brought the year-over-year increase to just 1.8% – the slowest annual growth rate since December 2018.

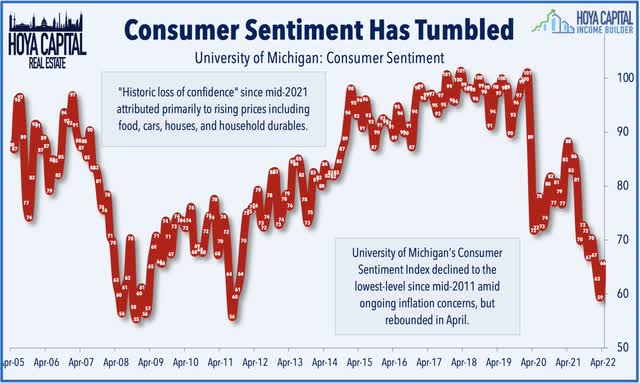

Contrasting with the relatively downbeat slate of economic data, consumer confidence unexpectedly jumped in the preliminary April report, bouncing back from its lowest level in over 10 years. The University of Michigan Consumer Sentiment Index increased to 65.7 from 59.4 last month, one of the largest single-month increases on record for the metric. Earlier in the week, the IBD/TIPP Economic Optimism Index showed a similar bounce across all of their monthly metrics with its read on consumer confidence jumping 4.5 points to 45.5, bouncing from March’s eight-year low to the highest level of 2022. Despite the rebound, however, both confidence metrics remain at levels typically observed during recessionary periods.

Equity REIT & Homebuilder Week In Review

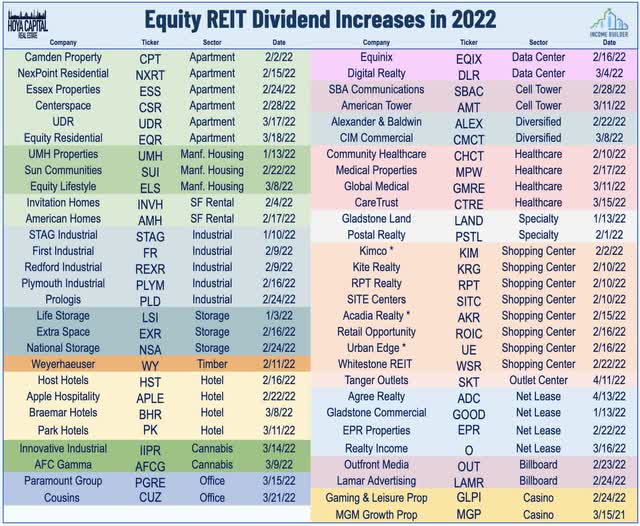

A trio of REITs hiked their dividends this past week. Tanger Factory Outlet (SKT) gained 2.2% on the week after it hiked its quarterly dividend by 9.6% to $0.20/share representing a forward yield of 4.7%. For context, in its final quarter before the pandemic, SKT paid a dividend of $0.3575. Net lease REIT Agree Realty (ADC) rallied 2.5% after it hiked its monthly dividend by 3.1% to $0.234/share. Gladstone Land (LAND) finished lower by 1% despite raising its monthly dividend by 0.2% to $0.0454/share. We’ve now seen 56 equity REITs raise their dividend this year along with 7 mortgage REITs. Three REITs have reduced their dividends – all small mortgage REITs – Orchid Island (ORC), Lument Finance (LFT), and Western Asset Mortgage (WMC).

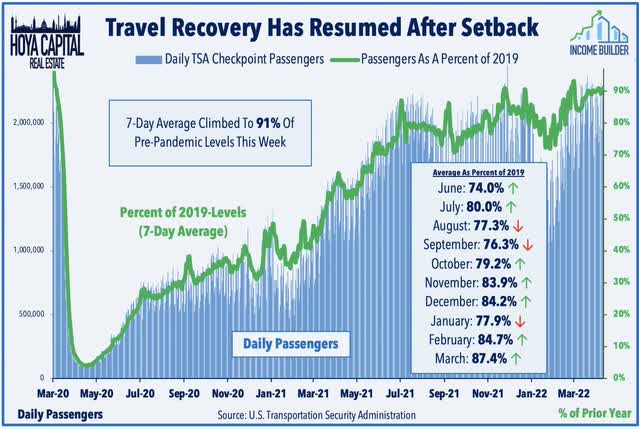

Hotels: Rallying back from sharp declines in the prior week, hotel REITs led the way with double-digit gains this past week. Park Hotels (PK) surged more than 12% on the week after reporting that its occupancy rate in March improved to 63% – up 10.1 percentage points from February – and to within 20% of its pre-pandemic level. PK expects its April occupancy to improve by another 6 percentage points to the “low 70% range” and for its Revenue Per Room to be within 7% of pre-pandemic levels – an impressive rebound considering that urban-focused hotel REITs like PK had been significantly lagging their Sunbelt-focused peers. TSA Checkpoint throughput data rebounded to 90% of pre-pandemic levels this week while STR’s weekly hotel data showed that Revenue Per Available Room (“RevPAR”) was nearly 5% above pre-pandemic levels last week.

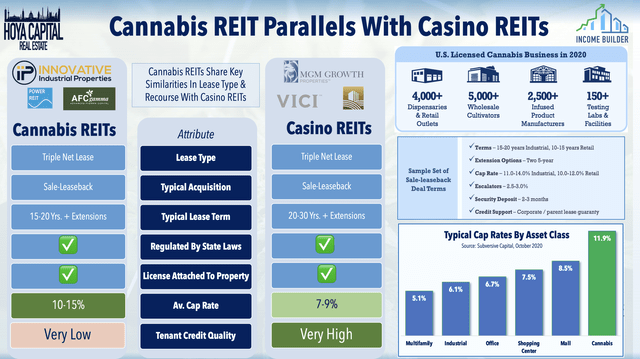

Cannabis: Innovative Industrial (IIPR) dipped 10% on the week following a report published by Blue Orca Capital, a “short activism” firm that has historically focused its activism on Asia-based technology companies. Blue Orca commented that it sees IIPR as a “marijuana bank masquerading as a REIT” – critiquing the sale-leaseback model through which IIPR provides financing to operators to build out the facility into a cultivation facility – and focused the balance of its thesis on the credit quality of IIPR’s tenants. IIPR responded to the short report with a press release noting that the report contained “numerous false and misleading” statements about IIPR. We’ve discussed in our recent reports how IIPR has delivered the best performance in the REIT sector since the start of 2017, and has historically been effective in managing tenant credit quality issues.

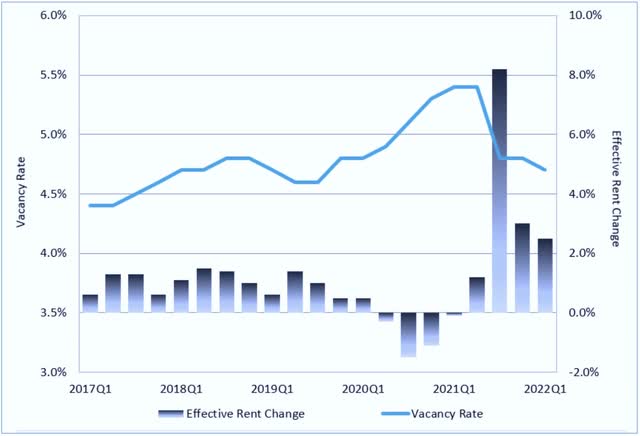

Apartment: Residential REITs were mixed this past week despite fresh data showing that rent growth remains relentless. Data provider Moody’s Analytics reported that national effective apartment rents soared 12.7% on a year-over-year (YoY) basis in Q1 2022 – a record-high – while the vacancy rate declined to 4.7%, down from 4.8% in Q4 which “signaled further strength in the sector.” The report noted that “while new construction is picking up the pace, a supply and demand imbalance remains, resulting in further market tightness and further upward pressure on rents.” Moody’s expects rents to continue to climb in the first half of 2022 before showing signs of slowing in the second half, but to remain in the 5-10% range throughout the year.

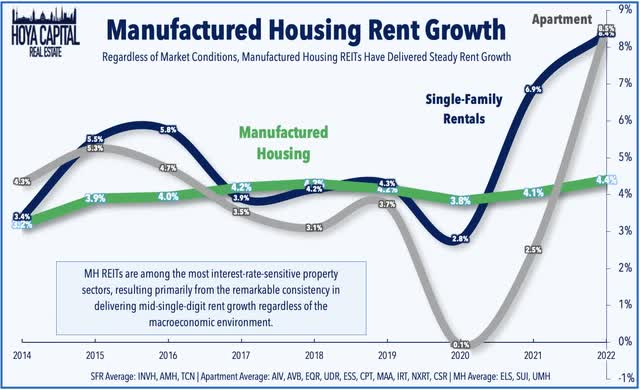

Manufactured Housing: Sticking on that theme, this past week we published Manufactured Housing REITs: Affordable Prices for Elite REITs. We discussed how MH REITs have emerged over the past decade from relative obscurity into several of the most well-run publicly-traded property owners in the world, but have uncharacteristically stumbled in early-2022. MH REITs are among the most interest-rate-sensitive property sectors, resulting primarily from the remarkable consistency in delivering mid-single-digit rent growth regardless of the macroeconomic environment. We discussed our thesis that rent growth will significantly exceed consensus estimates this year and break out of the tight historical range. As the most affordable housing option with a significant share of renters in retirement age and receiving social security income or other inflation-linked transfers, rent growth tends to track broader inflation rates – and thus Cost-of-Living Adjustments – which have been substantial over the past twelve months at 5.9% – the highest increase in about 40 years

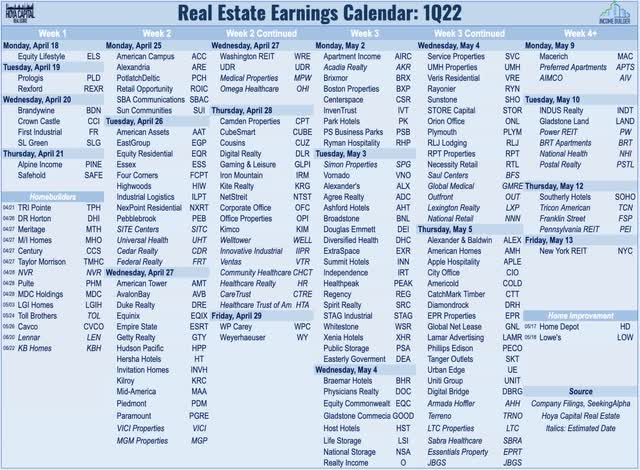

Real estate earnings season kicks off next week with reports from nine equity REITs and one homebuilder – Tri Pointe (TPH). The week kicks off with manufactured housing REIT Equity LifeStyle (ELS) on Monday, industrial REITs Prologis (PLD) and Rexford (REXR) on Tuesday, a pair of office REITs Brandywine (BDN) and SL Green (SLG), and cell tower REIT Crown Castle (CCI) on Wednesday, and net lease REITs Alpine Income (PINE) and Safehold (SAFE) on Thursday. We’ll publish our Real Estate Earnings Preview early next week that will discuss the major themes and metrics we’ll be watching across each of the real estate property sectors this earnings season. Below, we compiled the earnings calendar for equity REITs and homebuilders. (Note: Companies that have not yet confirmed an earnings date are in italics with the estimated date.)

Mortgage REIT Week in Review

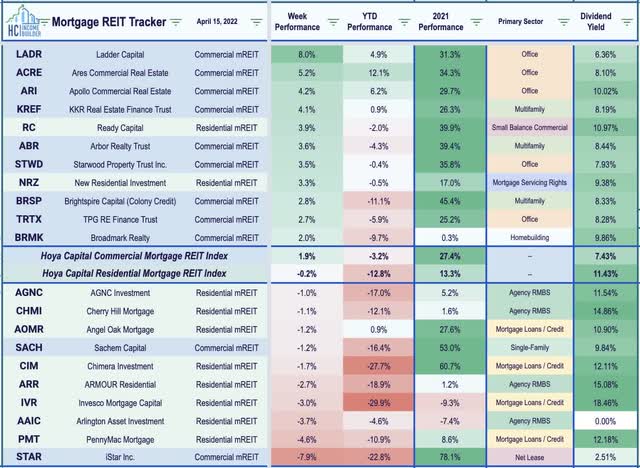

Mortgage REITs were mostly higher this past week, lifted by the steeping yield curve and stabilizing MBS prices after a month-long skid. Commercial mREITs rallied 1.9% while residential mREITs finished lower by 0.2%. Orchid Island Capital gained 0.3% on the week after reporting preliminary Q1 results that were not as bad as expected. ORC – which is among the most highly-levered mREITs – reported that its Book Value Per Share was $3.34 at the end of March – a decline of 19.5% from last quarter, not quite as bad as the 20%+ decline expected. ORC also maintained its monthly dividend at $0.45/share. A trio of other mREITs also maintained their dividends at current rates: Seven Hills Realty (SEVN), AGNC Investment (AGNC), and Dynex Capital (DX). The average residential mREIT pays a dividend yield of 11.43% while the average commercial mREIT pays a dividend yield of 7.43%.

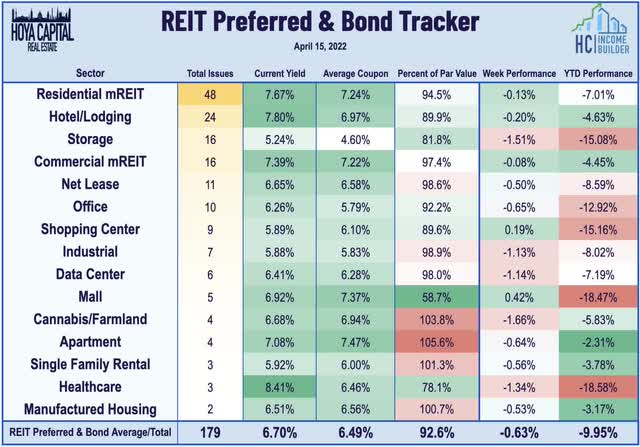

REIT Preferreds & Capital Raising

REIT Preferred stocks slipped 0.63% this week and are now off by 9.9% on the year after ending 2021 with price returns of roughly 8.0% and total returns of roughly 14%. It was a quiet week in the capital markets, but Global Net Lease (GNL) announced that it replaced its existing credit facility with a new, $1.45 billion corporate revolving credit facility that has a 4.5-year term and improved pricing that is 15 basis points lower than the facility it replaced.

2022 Performance Check-Up

Through fifteen weeks of 2022, Equity REITs are now lower by 6.3% this year on a price return basis while Mortgage REITs have slipped 9.5%. This compares with the 7.8% decline on the S&P 500 and the 7.5% decline on the S&P Mid-Cap 400. Led on the upside by the farmland, hotel, and self-storage REIT sectors, 6-of-19 REIT sectors are now in positive territory for the year. At 2.83%, the 10-Year Treasury Yield has climbed 132 basis points since the start of the year and is now closer to its post-Great Financial Crisis peak of 3.25% reached in October 2018 than its August 2020 low of 0.52%.

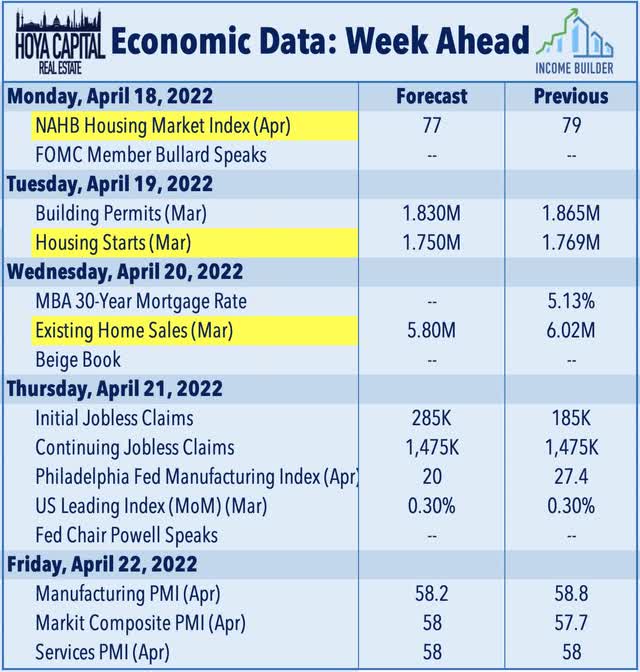

Economic Calendar In The Week Ahead

Housing data highlights this busy slate of corporate earnings reports, Fed speeches, and economic data in the week ahead which investors and the Fed will be watching carefully for indications on the impact of surging mortgage rates on housing demand. On Monday, we’ll see Homebuilder Sentiment which is expected to show a moderation to 77 which – while still historically strong – would be the lowest since last September. On Tuesday, we’ll see Housing Starts and Building Permits which are also expected to moderate from historically strong levels. Finally, on Wednesday, we’ll see Existing Home Sales data which is expected to show a more pronounced pull-back to a 5.80M annualized rate, which would be the lowest since June 2020.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Prisons, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment