Stephen Brashear/Getty Images Entertainment

It’s an open secret: Redfin (NASDAQ:RDFN) has had a bad year, in sympathy with the rest of the real estate industry. The pandemic home-buying craze is over. People are getting called back into the office and are no longer relocating to cheaper states in search of more land. Sky-high interest rates have pinched home affordability, and general economic unease and widespread layoffs have many consumers thinking that now is not the best time to make long-term commitments.

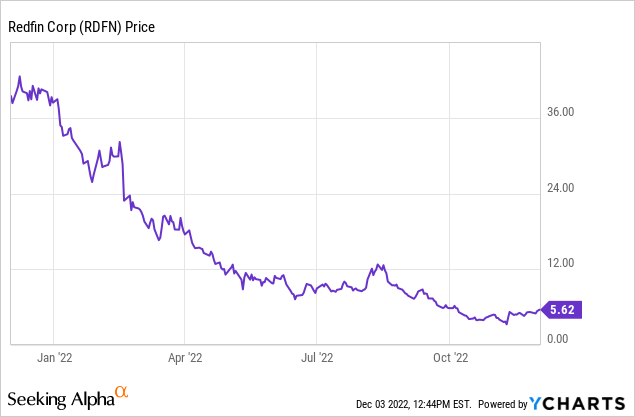

Year to date, shares of Redfin have shed more than 85% of their value, a stunning loss for a stock that was once a Wall Street darling and growth-stock champion. The company’s brokerage business is down double-digits and is expected to decelerate even further in the last quarter of the year.

I have long been a Redfin bear (though a repeat user of Redfin’s actual services) owing to its weakening fundamentals in a tightening macro environment. However, with the company’s market cap now slipping beneath $1 billion and with the actions the company is taking to mitigate losses, I now believe Redfin’s brand equity, its massive traffic base and its market share gains are worth more than the stock is currently reflecting. I’m upgrading my view on Redfin to neutral – if the stock dips below $5, or if Q4 results come in better than expectations, the stock becomes a clear buy.

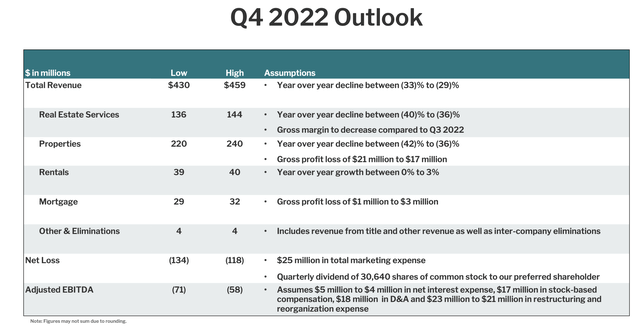

My neutral rating is anchored on the fact that there is obviously still risk in this business. Real estate trends have no real floor right now; in fact, Redfin is guiding for Q4 brokerage revenue to decline as much as -40% y/y:

Redfin outlook (Redfin Q4 earnings deck)

This being said, however, I think there are bright spots that need to be acknowledged. The bottom line here: after seeing ~$3 billion of market value wiped out in a near instant, I think Redfin is approaching a near-term bottom. When we take a step back from the short-term pessimism around the real estate industry, we still think that new tech-forward brokerages like Redfin and Compass (COMP) will continue to gain market share (Redfin, in particular, has done a great job at pushing the envelope down on brokerage fees, which is in-line with consumers’ expectations). Though the current stock trajectory would suggest otherwise, I don’t think Redfin is a company that can easily disappear overnight.

Strong consumer engagement, market share, and cost-saving efforts

Let’s now discuss all the positives that Redfin has amassed under its belt. The first and most obvious one: in spite of the fact that real estate activity is down, the number of eyeballs scouring real estate is not.

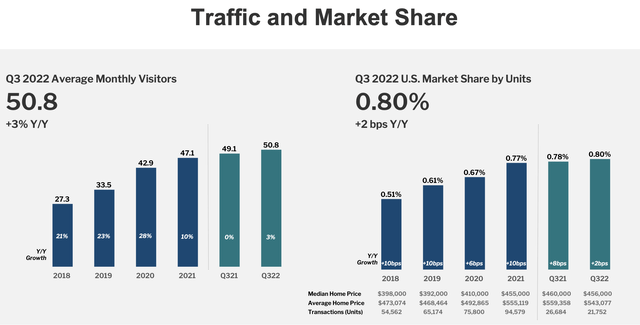

Redfin traffic and market share (Redfin Q4 earnings deck)

As shown in the chart above, Redfin saw 50.8 million monthly average visitors in Q3, which is up 3% y/y. Monthly average visitors, in fact, have seen a steady uptick throughout the past two years, and it has clipped well above the first pandemic spike in 2020.

To me, what this suggests is that many potential home buyers and sellers are still doing research and are waiting on the sidelines until interest rates or the economy improve.

Additional positive news: Redfin noted that its traffic from new visitors arriving via search engine is up, which will have a positive domino effect on new clients and transactions. Per CEO Glenn Kelman’s prepared remarks on the Q3 earnings call:

In October, traffic from new visitors coming to Redfin via search engine had increased, 14% year-over-year since the most reliable, earliest indicator of transaction share growth is search share growth. Our gains in search engine ranking will probably raise our fortunes more than any other development we discuss today. The improving sales execution can have a compounding effect on search share gains. Until recently, our sales force has struggled to overcome a change in customer behavior. Since the great financial crisis, homebuyers have become more casual and convenience-driven and asking for service from the array of agents they can now meet online. To yield the same number of sales, our website and mobile applications have had to generate more and more customers, both for Redfin agents and especially for partner agents, but that started to change this year.”

We note as well that in spite of the fact that Redfin’s brokerage revenue and transaction counts were down -17% y/y in Q3, the company still gained 2bps of market share y/y to 0.80%. This pain is being felt across the industry, but not disproportionately by Redfin.

The second major positive we should acknowledge is that Redfin is shrinking its workforce by just shy of 900 employees, or roughly 13% of its headcount. One of my previous criticisms of Redfin is the fact that its direct-employment method for real estate agents (whereas most traditional brokerages use a commission-based approach), which makes it less flexible in a downturn. Though unfortunate, the company’s quick decision to lay off staff will help it survive. Management now expects to hit positive adjusted EBITDA in 2023.

Another big positive: following in Zillow’s (Z) footsteps, Redfin is now also shuttering its Redfin Now proprietary home-buying business, which has been a source of revenue growth but a drag on profitability for years. Per Kelman’s remarks on the wind-down of this segment on the Q3 earnings call:

We expect to complete the liquidation of our RedfinNow inventory in the second quarter of 2023.

Starting from the end of the third quarter, this will return more than $100 million of cash to our balance sheet. Our decision to close our iBuying business is only partly due to the challenges we have had selling RedfinNow homes. Prices may stabilize in 2023, but the cost of capital, especially the capital coming from our balance sheet, is likely to remain higher for the foreseeable future. That has already lowered how much Redfin and other iBuyers can pay for homes, which in turn has discouraged redfin.com visitors from contacting us about an instant offer.”

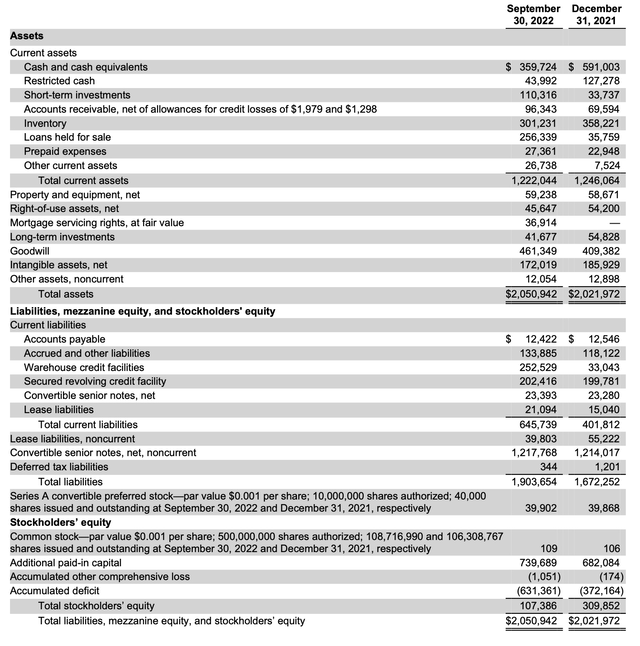

We find Redfin quite sufficiently capitalized to last through the downturn. As of the end of Q3, Redfin had $511.7 million of cash on its books, with ~$300 million in home inventory to be converted into cash by the second half of FY23. The company’s operating cash flow loss in the first nine months of FY22, meanwhile, was “only” $148.5 million.

Redfin balance sheet (Redfin Q3 earnings release)

Note that Redfin has $1.24 billion of convertible debt on its balance sheet, but the majority of the principal is due in either 2025 or 2027 per the company’s most recent 10-Q – giving it plenty of time to recover.

Key takeaways

Negative momentum has sunk many growth stocks this year below their actual worth. In the case of Redfin, I find that the company’s huge existing customer and traffic base, its branding and technology/data assets are worth far more than the stock’s existing ~$600 million market cap. It’s time to put this one on the watch list: swoop in and buy anywhere under $5.

Be the first to comment