Imagesbybarbara

Introduction

It’s time to talk about railroads. All eyes were on a potential December rail strike, as labor talks have been an issue for months. After Congress got involved, it looks like a worst-case has been avoided. While that’s good news for investors, there’s much more to consider. The US economy is now seeing manufacturing contraction. Historically, that has provided new buying opportunities in cyclical industries like rails. I’m hoping we get a bit more weakness as I am looking to buy more shares of Norfolk Southern Corporation (NYSE:NSC). This railroad remains a top pick due to its dividend growth characteristics and business model, allowing it to benefit from long-term secular tailwinds and high chances of a return to improved profitability in 2023.

In this article, we’ll discuss all of this and dive into longer-term tailwinds like supply chain re-shoring.

So, let’s get to it!

The Rail Strike & The Government

Class I railroads are the backbone of the United States and international economies because they connect buyers and sellers, imports, exports, and companies in every supply chain you can think of. For example, Norfolk Southern dominates the East with its peer CSX Corp. (CSX). The West is dominated by Buffett-owned BNSF and Union Pacific (UNP). Kansas City Southern is soon (expected) to be owned by Canadian Pacific (CP), which also plays a role in the United States with its peer Canadian National (CNI).

Research Gate

Disrupting these transportation flows, even for just a single day, would have major impacts on product availability in stores, energy flows, food prices, farmers’ ability to operate, construction, and a lot more things.

Estimates are that a rail strike would cost $2 billion a day and even threaten clean drinking water.

You can imagine that it’s in everyone’s best interest to avoid a strike.

Unfortunately, it took until the government got involved. In September, the Biden administration brokered a tentative labor agreement. It was signed by eight of 12 rail unions. The others did not. They represented 56% of unionized rail employees.

That agreement provides average employee compensation and benefits of more than $160,000, according to the AAR, which represents large rail employers. This means a 24% wage increase over five years from 2020 to 2024. It’s the largest raise in decades.

The issue was that unions demanded paid sick leave. To my knowledge, there is paid time off, but it cannot be used flexibly in the case of medical or family emergencies.

Not Out Of The Woods Yet

Railroads are off the hook when it comes to major labor talks. At least until 2025.

Unfortunately, other issues persist. This includes balancing the return of demand after the pandemic with available equipment and labor. During the lockdowns, railroads cut staffing and equipment to maintain high operating efficiencies. Then, demand came back roaring, making it impossible to maintain the same service standards as employees were slow to return.

The good news is that Norfolk Southern is seeing great progress when it comes to hiring.

Hiring is going according to plan. The company has 950 conductor trainees. NSC now has 7,335 qualified train and engine employees, the highest number since 2Q21. It’s also the company’s target, which it reached one month earlier than expected. It’s also up from the low of a mere 6,937 in 1Q22.

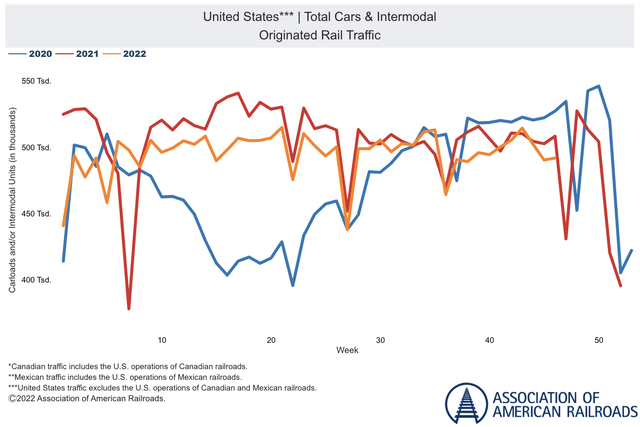

Unfortunately, as I’ve noted earlier, railroads will now have to incorporate (future) economic weakness into their models as well. In other words, lower volumes again.

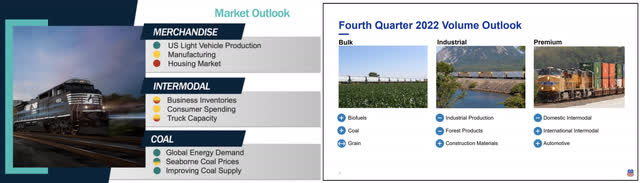

For example, both Norfolk Southern and Union Pacific (to use two prominent examples) have adjusted their full-year 2022 outlook. Intermodal and industrial shipments are not expected to be as strong anymore.

Norfolk Southern, Union Pacific

Norfolk Southern hit the nail on the head as it emphasized ongoing macro challenges:

As the Fed tightens interest rates, mortgage rates have increased to levels that are cooling the housing market. This reduced demand affects several of our merchandise as well as Intermodal markets. Overall, we expect merchandise volumes to be relatively flat in the fourth quarter with some upside potential as service continues to recover.

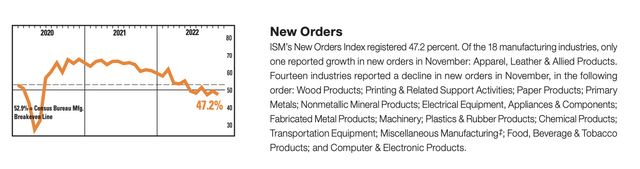

These issues are currently getting worse. For the first time since 2020, US manufacturing expectations are in contraction territory.

Bloomberg

While price expectations are also down (good news for the Fed), it was mainly caused by lower new orders. Just one manufacturing industry saw higher new orders in November, resulting in a new orders index of 47.2.

That’s bad news for railroads. Going into December 2022 volumes are now below 2021 and 2020 levels.

What does this mean for Norfolk Southern?

Norfolk Southern’s Bull Case (Dividends!)

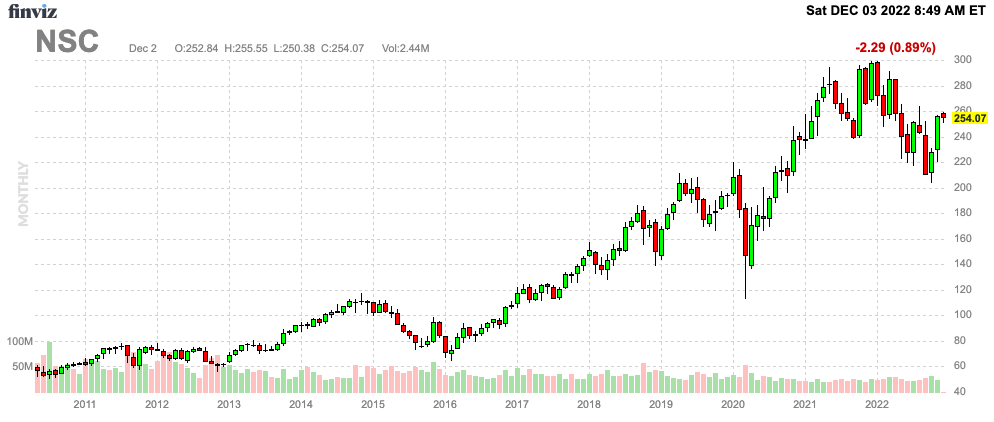

In October, I was bullish on Norfolk Southern. Since then, the stock has returned 14%. Despite all the bad news in this article, there is a good reason for that move.

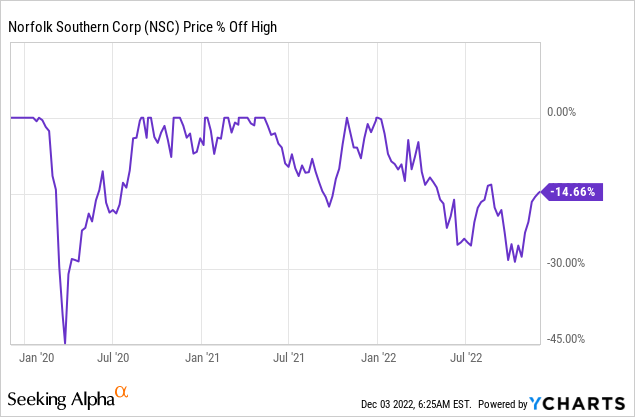

First of all, NSC shares were down almost 30% from their 52-week high. That means investors had priced in quite some weakness.

After all, the company knew it was headed into a recession with 2022 benefiting from easing congestion and operating issues.

Our service is trending in the right direction, and we expect that to be a tailwind to volumes in the fourth quarter. Additionally, we’re optimistic that consumer spending and manufacturing activity will support volumes for the remainder of the year. Those expectations are somewhat muted in light of looming recession risks and tightening financial conditions that are pressuring economic activity, especially in interest rate-sensitive markets like housing.

While the operating ratio (total operating costs as a % of revenues) won’t likely end the year below 62%, I am confident this ratio can be lowered to 55% in the 4-6 quarters ahead. That would free up new operating income and partially offset expected top-line weakness due to the pending recession.

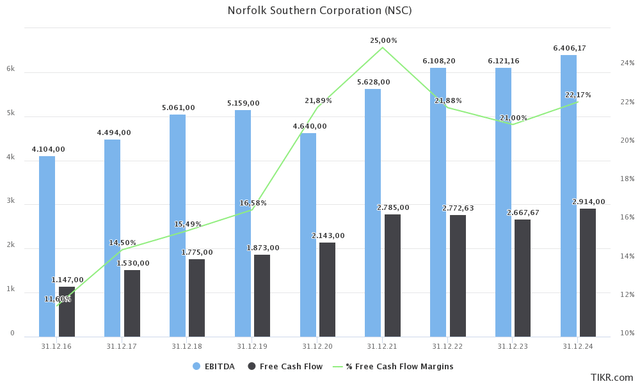

For now, it looks like NSC will be able to maintain strong free cash flow in 2023, followed by a surge to $2.9 billion in 2024. This is based on free cash flow margins of more than 20%.

In other words, NSC offers too much value for investors to ignore the stock whenever it drops more than 20%.

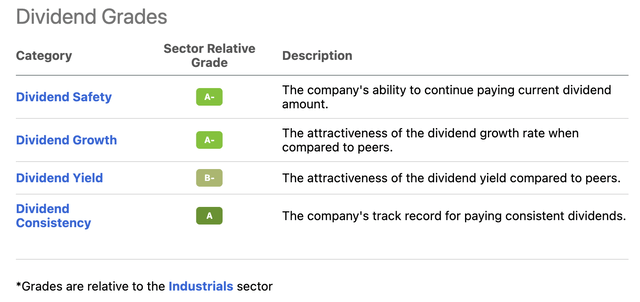

After all, these financial qualities come with a terrific Seeking Alpha dividend scorecard. NSC shows high scores on safety, growth, yield, and consistency.

Over the past ten years, the average annual dividend growth rate was 9.8%. The implied 2023 free cash flow yield is 4.6%, indicating more room to hike the dividend.

The current yield is 2.0%, based on a $1.24 per quarter per share dividend. These are the most latest hikes:

- January 2022: +13.8%

- July 2021: +10.1%

- January 2021: +5.3%

- July 2019: +9.0%

Moreover, between 2017 and 2021, NSC bought back 14.2% of its shares, which adds to long-term outperformance.

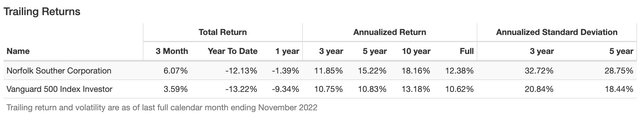

Since 1986, the company has consistently outperformed the S&P 500. This outperformance has lasted, albeit with a rather elevated standard deviation, due to the cyclical behavior of the stock and company.

These are reasons why I am consistently buying weakness, making NSC one of my largest industrial holdings.

But it’s not the only reason.

Secular Industrial Shifts

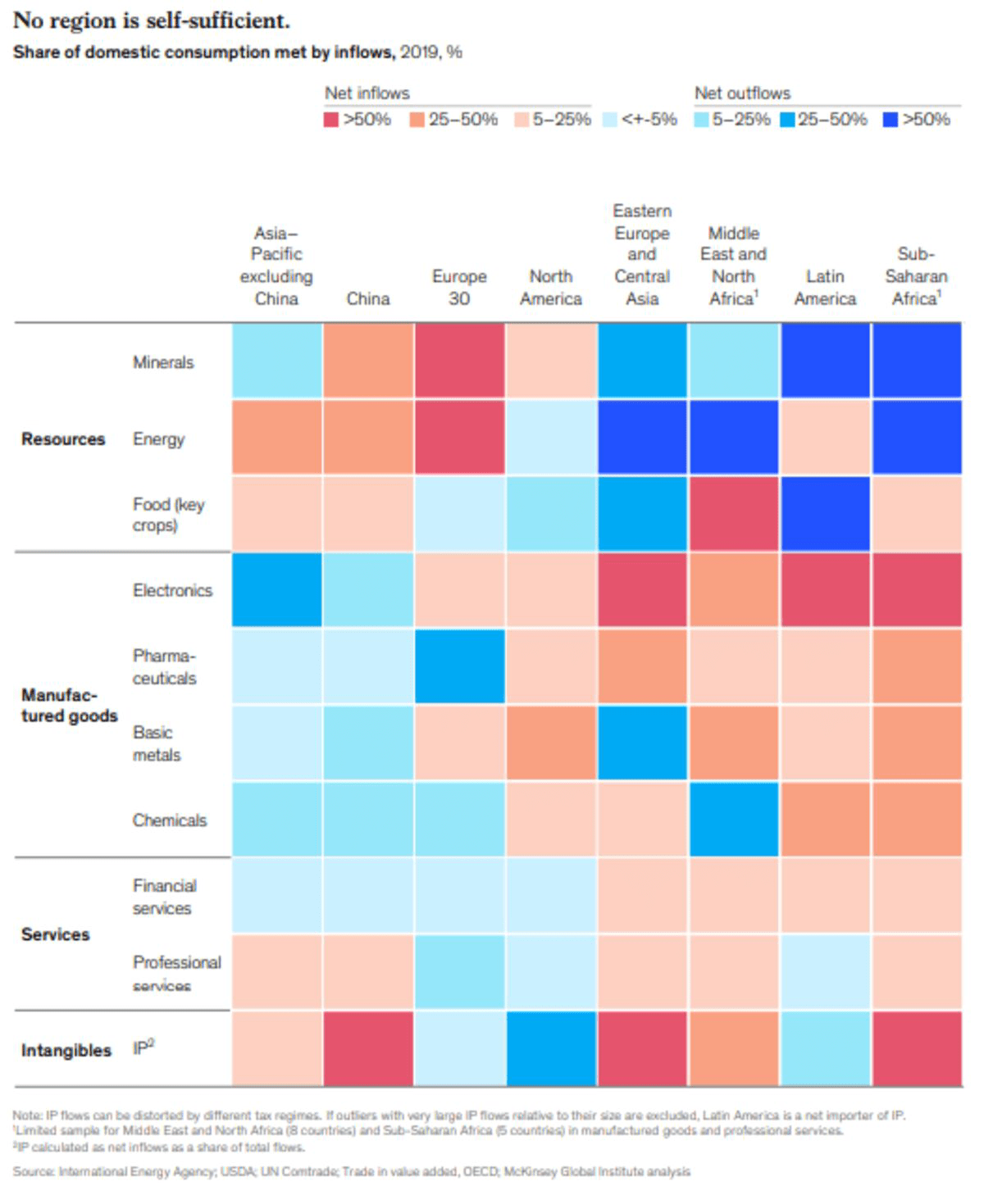

One of the things we will talk a LOT more about in the future is supply chain reconfiguration.

Whether it’s on Asharq TV where I’m a frequent guest on political and economic developments or my portfolio, I am convinced that the United States will be a long-term beneficiary of supply chain relocation.

It’s one of the reasons why I made Canadian Pacific a top holding in my portfolio – I highly recommend readers take a look at this article.

I expect that over the next 10-15 years, we’ll see a significant shift in supply chains. Manufacturing in the United States is strengthening with support from Mexico and Canada. Producers are leaving China due to geopolitical and economic risks. European producers are being pressured by high energy costs and unfavorable business developments. They move production closer to the consumer.

Don’t get me wrong, China will remain highly important as it controls commodities and commodity processing. However, the United States owns intellectual property, financial services, a huge consumer base, and the commodities to produce most products (no rare metals yet).

McKinsey & Company

According to a Bloomberg report last month:

According to a report Wednesday, Deloitte said some 62% of manufacturers it surveyed have started reshoring or near-shoring their production capacities. The survey included 305 executives at transport and manufacturing firms, mostly in the US, with annual revenue of $500 million to more than $50 billion.

American firms are expected to reshore almost 350,000 jobs in 2022 — an increase of 25% from 260,000 in 2021, according to figures cited in Deloitte’s ‘Future of Freight’ report. Ultimately, the shift could reduce by 20% the share of Asia-originating shipments to the US by 2025 and by 40% by 2030, it said.

What’s interesting (one of the many things) is that Norfolk Southern was prepared to benefit from these opportunities back in 2013. The company was spot on when it mentioned secular tailwinds. The only two things that changed are that it took a while for it to unfold and that the trend is much stronger than anyone could have expected:

The good news is that NS’ marketing groups are aggressively pursuing business opportunities in a range of emerging markets, most notably in the energy arena but also in the manufacturing sector. In a trend known as reshoring, companies are relocating foreign production plants or building new facilities in the U.S. as the cost of doing business abroad has reached a tipping point, particularly in China.

Moreover, Norfolk Southern covers the areas that I’m looking for to benefit most from this re-shoring trend (there are also some great states in the West). The company covers agriculture (high and lasting export demand), energy like coal and ethanol, the rust belt (steel), and some highly attractive states benefiting from the Red to Blue migration (like Georgia, the Carolinas, and Tennessee).

Norfolk Southern

So, what about the short-term risk/reward?

Valuation

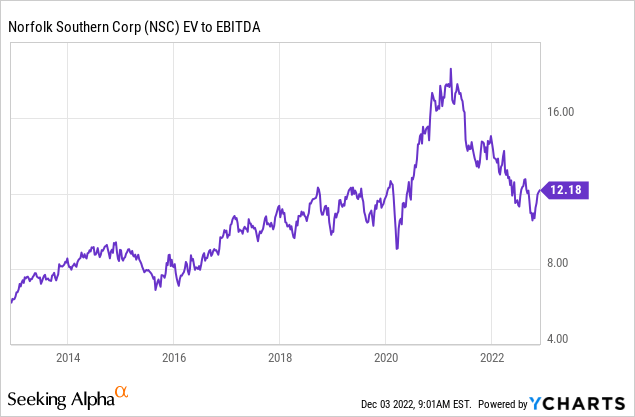

Norfolk Southern is trading at 12.1x 2023E EBITDA of $6.1 billion. This is based on its $74.0 billion enterprise value, consisting of a $58.8 billion market cap, $14.6 billion in expected 2023 net debt, and roughly $600 million in pension-related liabilities. The company’s 2023E net debt is just 2.4x EBITDA. Its balance sheet has a BBB+ rating.

This valuation is fair, but not deep value. Especially not considering that 2023 estimates are likely to come down as a result of the (pending) manufacturing recession.

I aggressively added to NSC close to its 52-week low. Since then, it has rebounded along with the market. Lower inflation numbers and a somewhat dovish Fed have provided fertile ground for a rally.

FINVIZ

I’m looking for another move below $220 before I buy more. Given macroeconomic developments, I believe we could get that opportunity (again).

Takeaway

In this article, we accomplished a number of things. First of all, we looked into the labor talk situation, which now seems to be resolved as a result of political involvement. That’s good news for railroads, who can now focus on hiring again.

Unfortunately, railroads not only need to improve post-pandemic operating efficiencies, but they also need to incorporate lower expected freight demand in the quarters ahead.

The United States economy is cooling at a rapid pace, which could cause railroads to give some poor guidance going into 2023.

However, that’s not a huge issue. I am a believer that weakness should be used to investors’ advantage. Hence, I focused this article on Norfolk Southern. The railroad looks to be on track to enhance operating efficiencies in 2023. The railroad benefits from supply chain reconfiguration, and its ability to turn high free cash flow into high dividend growth and buybacks.

I have zero doubt that NSC will maintain a long-term outperformer.

Hence, I will continue to buy. My next buying target is $220, which I believe is feasible given the broader economic trend.

On a long-term basis, I remain bullish.

Also, as I promised, we’ll discuss supply chain reconfiguration a lot in the weeks and quarters ahead. There’s a lot to unpack, including more interesting investment ideas.

(Dis)agree? Let me know in the comments!

Be the first to comment