Editor’s note: Seeking Alpha is proud to welcome Syntax Indices as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

tadamichi

Introduction

Like other industries, the investment profession has its own language. Investors often use terms like “alpha”, “beta”, and “sector neutral” without questioning the way they are calculated or implemented.

In the case of “Sector Neutral”, the definitions of both words are clear in a financial context. Investopedia defines a sector as “an area of the economy in which businesses share the same or related business activity, product, or service”, and being neutral as “a position taken in a market that is neither bullish nor bearish”.

Although “sector” and “neutral” are clearly defined, when combined, their interpretation is not straightforward. In this paper, we highlight the embedded sector risks in the market cap-weighted S&P 500, and the challenges of viewing this benchmark as being sector neutral. We also share our index construction methodology to balance business risk exposure and more effectively neutralize sector risk.

Sector Neutral: A Relative or Absolute Concept?

Sector Neutral is most often applied relative to a benchmark. For example, it is common for enhanced index funds to be sector neutral, where the portfolio mirrors the sector weights of the benchmark, typically a market cap-weighted index like the S&P 500. In these types of products, an active manager focuses on their stock selection skills to add value relative to the benchmark, thereby neutralizing the impact of over- or underweighting sectors on performance.

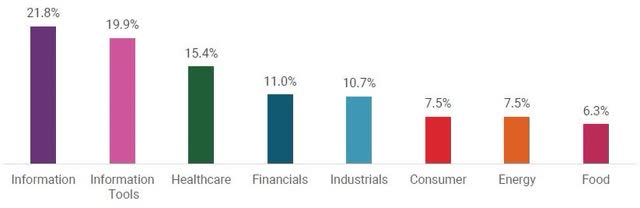

To a person outside the investment industry, this is likely not intuitive when the definition of neutral is having no view on the sector, either bullish or bearish. For example, the sector allocations of the S&P 5001 as shown in Exhibit 1 are far from balanced, with a strong bias towards the tech-driven Information and Information Tools sectors.

Exhibit 1: S&P 500 Cap Weight Index Exposure By Primary FIS Sector (S&P Dow Jones Indices, Syntax, Affinity™, Data as of 6/30/22)

The eight sectors have weights ranging from 6.3% for Food to 21.8% for Information. On an absolute basis, the sectors are clearly not neutral to each other, with the technology-based sectors Information (21.8%) and Information Tools (19.4%) having weights far in excess of the other sectors. These imbalances permeate through subsectors and industries. Exhibit 2 provides a more granular view by looking at the subsector exposures within the primary sectors for the S&P 500.

The balance of subsectors varies meaningfully. Within Information, the allocation to Internet-related companies at 9.4% is nearly three times the exposure to Media and Telecom at 3.5%. Both Software (8.6%) and Hardware(7.8%) have higher allocations than the entire Food (6.3%) and Energy (7.5%) sectors. Concentration risk clearly exists at both the primary sector and industry group levels.

Exhibit 2: S&P 500 Cap Weight Index Exposure by Industry Groups (S&P Dow Jones Indices, Syntax, Affinity, Data as of 6/30/22)

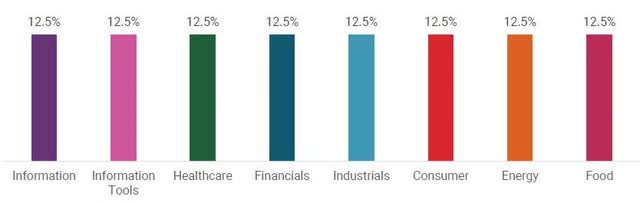

Stratified Weighting defines sector neutrality in an absolute, not relative, sense. The approach is independent of a benchmark in that each sector is assigned an equal target weight regardless of the size of its underlying companies.

For example, the Syntax Stratified LargeCap Index takes the holdings of the S&P 500 and reweights each stock to reduce individual stock concentration risk and to balance sector exposures, i.e., each of the eight primary sectors has the same 12.5% target weight.

Exhibit 3 : Syntax Stratified LargeCap Index: Target Sector Weights (Syntax, Data as of 6/30/22)

Exhibit 3 highlights the balance achieved across sectors within the Syntax LargeCap Index. To maintain this balance, each sector is rebalanced back to its target primary sector weights of 12.5% every quarter.

The balancing of exposures also applies at the industry group / subsector level, where the primary sector exposure is distributed evenly across its constituent subsectors as shown in Exhibit 4. The weight of each group is determined by the number of distinct subsectors within each sector. For example, Financials has three subsectors (Banking, Real Estate and Insurance), so the target weight to each is about 4.17% (12.5% / 3), whereas Energy has two subsectors (Oil & Gas and Utilities), so the target weight is 6.25% (12.5% / 2). Exhibit 4 highlights the balanced and robust index structure that this approach creates.

Exhibit 4: Syntax Stratified LargeCap Group Exposures (Syntax Indices. Size of section is proportional to target group weight in the Syntax Stratified LargeCap Index)

Benefits of Being Stratified (Sector Neutral)

We are believers in passive investing and the benefits of holding a basket of securities that efficiently capture the equity risk premium. By redefining sector neutral in absolute, rather than relative terms (i.e. “Stratified Weight”), one can hold a more diversified portfolio that, we believe, can capture a higher equity risk premium than cap-weighted benchmarks.

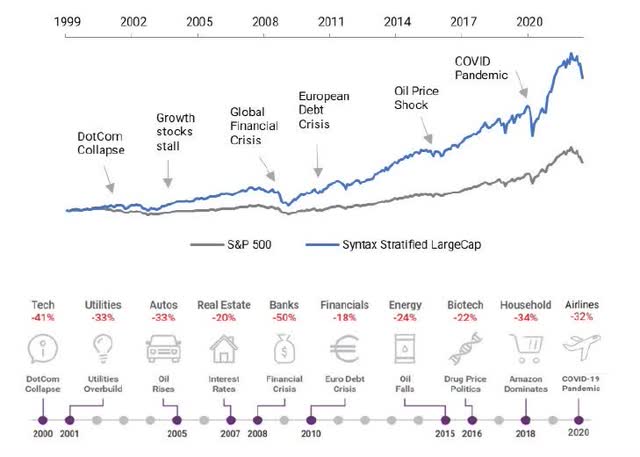

Increasing diversification has two key benefits. Firstly, the lower the correlation is between risk premia, the more investors may increase exposure to them, thereby increasing their expected return. Secondly, the more diversified the index, the less likely it is to be overexposed to a business risk which suffers a major decline following a shock. The performance of our Stratified LargeCap Index is shown in the Exhibit 5. Over the years, there have been many major market events, as shown in the lower panel.

Exhibit 5: US LargeCap Index and Business Risk Shocks (S&P Dow Jones Indices, Syntax. Total return performance does not reflect fees or implementation costs an investor can not directly invest in an index. Please see important disclaimers regarding back tested data prior to inception.)

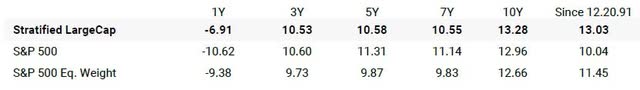

Since the start of backtested data in 12/1991, the average annualized return of the Stratified LargeCap Index was 13.0%, 300 basis points higher than that of the cap-weighted S&P 500 index and 150bps higher than the equally weighted S&P 500 index (Exhibit 6), holding the exact same set of stocks.

Exhibit 6: US LargeCap Index Performance Comparison (S&P Dow Jones Indices, Syntax. Total return performance does not reflect fees or implementation costs an investor can not directly invest in an index. Please see important disclaimers regarding back tested data prior to inception.)

Summary

We discussed how the term sector neutral is a relative term that typically means a portfolio has similar sector weights as the benchmark. However, by following a benchmark such as the S&P 500, investors are taking a view that the largest sectors will continue to outperform the smaller ones. This challenges the notion of neutrality, in our view, as it implicitly takes a bullish or bearish view on particular business risks.

Given the high degree of uncertainty regarding the current macro economic climate and the challenges of consistently and accurately predicting business risk shocks, we believe that the most prudent strategy is to neutralize as many business risks as possible. The Stratified Weight approach takes neither a bullish nor bearish view on any business risk, seeking to simultaneously balance individual stock, sector, industry group and industry risks. We believe that the increased diversification allows the Stratified Weight approach to capture higher risk premia over the longer term than a comparable cap-weighted index.

_________

1 Sector Classifications based on the Syntax Functional Information System.

Original Source: Author

Be the first to comment