spfdigital

Investment Thesis

It is evident that the Feds are starting to see the fruits of their aggressive interest hikes, with Newmont Corporation (NYSE:NEM) already falling to $40.59, tragically nearing its 52 weeks low of $40. Despite its stellar dividend yields of 5.42% at the moment, interested investors should also note the risks of dividend cuts ahead, with gold prices already falling by -9.44%, from $1.8K per ounce during NEM’s FQ2’22 earnings call in July to $1.63K at the time of writing. Assuming that the sell-off continues through November in time for the Fed’s speculative 75 basis point hike, we may see another drastic fall in gold prices to those of $1.5Ks per ounce between CY2015 and CY2019.

Nonetheless, there is also a good chance that most of the market pessimism is already baked in, due to the Fed’s projected terminal rate of 4.6% by 2023, with January 2023 possibly moderating to a 50 basis point hike. Therefore, it would also be cautiously safe to hypothesize that the market is currently overreacting, with the global sell-off flushing out most, if not all, retail investors over the next few weeks.

NEM Remains Well Poised For Growth Through 2040s, Despite Temporary Headwinds

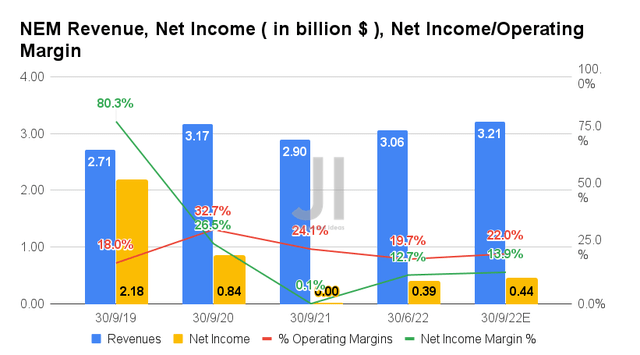

For its upcoming FQ3’22 earnings call, NEM is expected to report revenues of $3.21B and operating margins of 22%, representing a remarkable QoQ growth of 4.9% and 2.3 percentage points, respectively. Otherwise, indicating another increase of 10.38% though a minimal decline of -2.1 percentage points YoY, respectively, with the latter attributed to the persistent increase in labor, material, and energy costs thus far.

Nonetheless, NEM is expected to report improved profitability as well, with net incomes of $0.44B and net income margins of 13.9% for the next quarter. It will indicate a decent increase of 2.56% and 1.2 percentage points QoQ, respectively, otherwise, an impressive YoY growth from FQ3’21 levels of $3M net incomes and 0.1% net income margins.

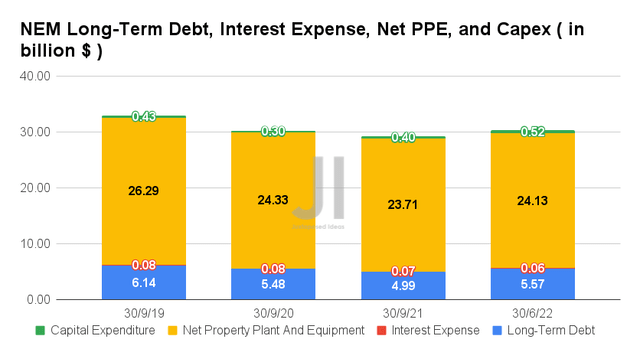

In FQ2’22, NEM also reported decent long-term debts of $5.57B, representing minimal increases of 1.64% from FQ3’21 levels, with nominal interest expenses of $57M at the same time. With no debts maturing over the next seven years, the company would be well insulated from the upcoming recession and further supply chain cost issues.

In the meantime, NEM continued to re-invest in the business, with an increased capital expenditure of $1.79B in the last twelve months (LTM), indicating impressive growth of 30.65% sequentially. The management has also guided an elevated annual capital spending of $2.5B through 2026, representing a 39.66% annualized growth from current levels.

However, investors have nothing to worry about these aggressive investments in Australia, Ghana, and Peru, since NEM has guided an ambitious annual production output of 6M ounces of gold and another 2M ounces equivalent from copper, silver, lead, and zinc. Thereby, absolutely being top and bottom lines accretive through FY2040s. Impressive indeed, boosting the stock’s long-term growth despite the temporary headwinds.

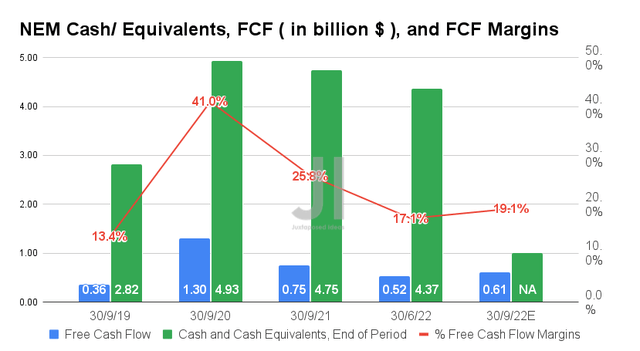

Therefore, it is no wonder that NEM is expected to report a lower Free Cash Flow (FCF) generation of $0.61B and an FCF margin of 19.1% in FQ3’22, indicating a remarkable increase of 17.3% and 2 percentage points QoQ, respectively. Otherwise, a minimal decline of -18.66% and -6.7 percentage points YoY, respectively.

However, NEM investors must still note the impressive increases of 69.44% and 5.7 percentage points against FQ3’19 levels, respectively. Thereby, ensuring the company’s liquidity and dividend safety through the economic downturn ahead, with the macroeconomic potentially recovering by H2’23, lending strength to the recovery of gold prices then.

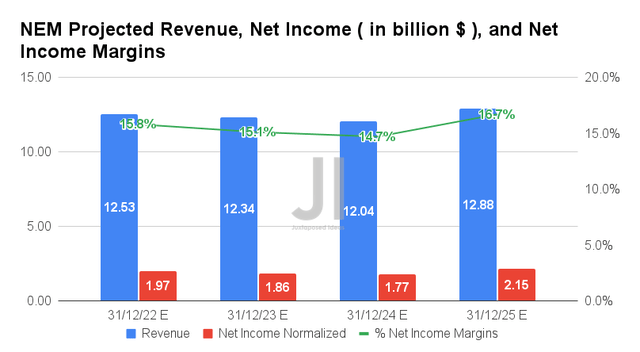

NEM is expected to report an adj. revenue and adj. net income growth at a CAGR of 4.77% and -4.31%, respectively, between FY2019 and FY2025. In the meantime, the company is expected to report a normalization in net income margins from 28.8% in FY2019, to 9.5% in FY2021, and finally to 15.7% by FY2025. On the other hand, it is evident that Mr. Market expects to see a drastic fall in gold prices from previously elevated levels to an average of $1.55K through FY2025, given the relatively in-line revenue growth.

For FY2022, NEM is expected to report revenues of $12.53B, net incomes of $1.97B, and net income margins of 15.8%, representing excellent YoY growth of 2.53%, 69.82%, and 6.3 percentage points, respectively, despite the pandemic hyper-growth. However, with its poor track record of missing estimates for the past few quarters, the upcoming FQ3’22 earnings call may disappoint Mr. Market again, putting further downward pressure on its stock performance. Combined with the highly bearish market conditions, it is apparent that the time of maximum pain is coming soon.

So, Is NEM Stock A Buy, Sell, or Hold?

NEM 5Y EV/Revenue and P/E Valuations

NEM is currently trading at an EV/NTM Revenue of 2.77x and NTM P/E of 16.86x, lower than its 5Y mean of 3.41x and 22.06x, respectively. The stock is also trading at $40.59, down -53% from its 52 weeks high of $86.37, tragically nearing its 52 weeks low of $40. Nonetheless, consensus estimates remain bullish about NEM’s prospects, given their price target of $58.40 and a 43.88% upside from current prices.

NEM 5Y Stock Price

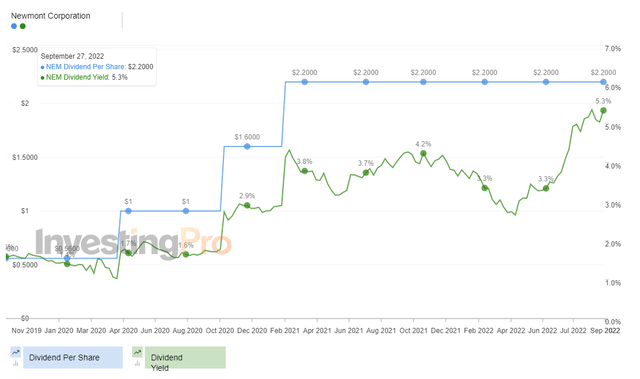

NEM 3Y Dividend Payout & Yields

With NEM drastically corrected to pre-pandemic levels, it is evident that the stock currently looks undervalued, given its handsome dividend yields of 5.42% at the moment, compared to 1.41% in FY2019. Investors would also be getting a robust deal, due to its excellent B- Dividend Safety Grade from the Seeking Alpha Quant and projected profitability through FY2025.

As a result, keen investors with a higher risk tolerance should not miss this golden opportunity and load up at the mid to high $30s range, boosting their dividend yields to a stellar 6% then. Do not miss this rare chance!

Be the first to comment