That is an outstanding spread. LauriPatterson

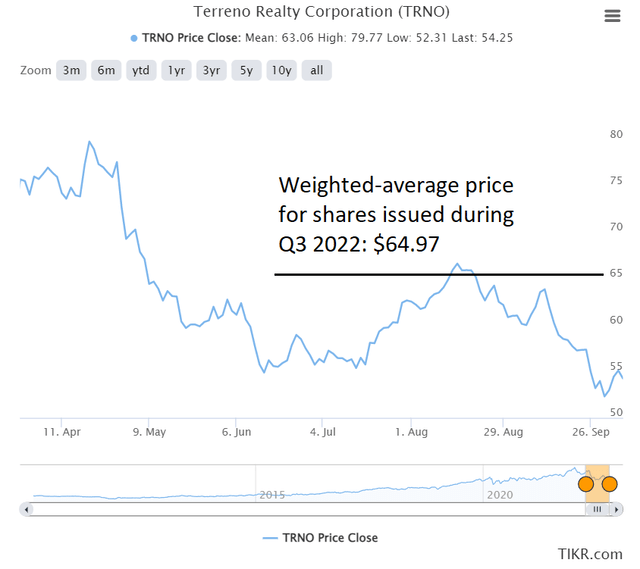

Terreno (NYSE:TRNO) validated our thesis yet again. The latest update delivered everything investors could ask for in the quarter. Monstrous cash leasing spreads, increasing occupancy, and they only issued shares far above the average price for the quarter.

There is literally nothing to dislike in this report. TRNO is succeeding in absolutely everything we want them to do. Some investors might say that we should want them to have a higher share price. That’s debatable. We waited years for an opportunity to buy industrial REITs. We’d love to see the sector stay low for at least a few more months so we can keep adding to these positions.

Our Thesis

Consider how TRNO does on the metrics we care about:

- We expect TRNO to post huge leasing spreads. They posted 65.9%.

Our standards were pretty high, but 65.9% is better than we dared to expect. That’s the cash leasing spread. It’s not the GAAP spread that averages out rental rates over the contract. GAAP leasing spreads would be much higher.

This is the tenant’s rent expiring at $10,000 (hypothetically) and being renewed at $16,590 with material annual escalators for future years.

When we say TRNO’s AFFO per share today is artificially low, that’s what we mean. Many properties are leased dramatically below market rates. As those leases end, they get renewed at market rates. That drives a massive increase in revenue. The enormous revenue increases flow through the income statement to AFFO. When shares outstanding are increased, it is to buy even more real estate. Consequently, AFFO per share increases even more. Sometimes it takes a few quarters for the benefit to show up because the new purchase may have a lease dramatically below market rates.

- We expect TRNO to post huge growth in AFFO per share.

That number isn’t available in their update. It comes out with the earnings announcement. However, those leasing spreads and occupancy metrics point to strong growth again and to massive growth for 2023.

- We expect TRNO to maintain a strong balance sheet and to be careful with the price for issuing new shares.

They’ve kept debt levels low. They rolled over some debt that was reaching maturity. The spread on their debt (compared to the risk-free rate) remains low as creditors recognize TRNO’s pristine balance sheet. Meanwhile, TRNO was also very careful with issuing new shares. Rather than growing for the sake of growth, they waited to see a share price where they could issue shares at a price high enough that buying more real estate would be accretive.

Industrial REITs

We previously mentioned the mid-quarter update from Prologis (PLD) emphasizing their strong leasing so far in Q3 2022. Now we have another update demonstrating that leasing spreads are only getting better.

We remain very bullish on industrial REITs. Based on the early data revealed by TRNO and PLD, we expect Rexford (REXR) to also post monstrous leasing spreads. The growth coming in even hotter than expected suggests that when we next review industrial REIT targets, we may need to raise them slightly again. Market prices are down? That doesn’t change the fundamentals. The fundamentals are beautiful.

Prior Coverage

I’m not reviewing all the fundamentals in this article. If you’re not familiar with TRNO yet or why our price targets represent a high multiple of AFFO, please see our prior articles:

Conclusion

While some investors refuse to buy REITs with low yields when Treasury yields are so high, we’re seeing enormous growth in cash flows. Even if it cooled off, the huge growth in leasing spreads year-to-date in 2022 would fuel significant growth in AFFO per share for 2023. That is just from having a full year at these higher rates. However, if leasing spreads remain even in this ballpark, then 2023 AFFO per share throughout the sector should soar.

Should leasing spreads remain hot? Probably for quite a while. Market rates are still increasing and the expiring leases are often pretty old. The typical length for an industrial lease is around 4 to 7 years, so expiring leases are way below market. Pretty much any industrial lease signed that long ago is way below market. They won’t be lapping the current leases for several years.

While I don’t expect 65.9% every quarter, investors should expect the spreads to remain very large. Market rental rates for industrial real estate have been growing much faster than normal and there are many leases that still need to be renewed (or replaced) at higher rates. Industrial REITs as a sector (excluding ILPT) have a high probability of posting the best AFFO per share growth rate for 2023.

As a reminder, at current market prices, TRNO is 4.75% of our portfolio. PLD is 5.57%. REXR is 2.52%. Out of our last 11 equity REIT purchases, 8 of them were industrial REITs (3 TRNO, 4 PLD, and 1 REXR).

- Ratings: Strong Buy on TRNO, PLD, and REXR

Be the first to comment