Dimensions/E+ via Getty Images

Introduction

According to the latest figures from the National Association of Insurance Commissioners, Cigna (NYSE:CI) is the eighth-largest health insurance company in the U.S. With a market capitalization of $88 billion, it counts more than 17 million policy holders. Provided the company’s recent performance relative to the S&P and some projections, it might appear contrarian to present this bearish outlook on the Fortune 500’s 12th-ranked company. But given my analysis of specific fundamentals, recent corporate news, and reading what is coming out of Washington, I believe pain is in store for Cigna. While there are red flags in the financials underlying my view, the crux of my position concerns the threats posed to the company by its Express Scripts subsidiary – now branded as a part of Evernorth with other CI businesses such as Accredo and MDLive – and its business practices. Let’s dive in.

Fundamental Analysis

For starters, CI is not that profitable relative to its peers. In fact, for a health insurance company, I expect better. Per the below chart for last year, we see Cigna nowhere close to the big players. But interestingly, despite $35.5 billion more revenue compared to Anthem, CI’s profit was almost 11.5% less.

Fierce Healthcare

Source: Fierce Healthcare

By further comparison, CI’s gross profit margin ((TTM)) stands at 13.1%. This is many rungs down the ladder from the sector median of 54.55%.

In terms of dividend yield, if I am paying $280 – 290 per share, I also expect more. Cigna’s current yield of 1.54% is not attractive to me. I can certainly find healthier, continual payouts for that money. Additionally, it’s far too early to decipher management’s commitment to the dividend.

Third, I read SA contributor Deep Value Ideas’ recent analysis of Cigna. The column provided worrisome insights into CI’s capital situation. This is definitely a red flag for me:

“Cigna’s return on invested capital (ROIC, based on net operating profit after taxes) and cash return on invested capital are relatively weak. Over the last five years, the company was hardly able to generate a return above its weighted-average cost of capital.”

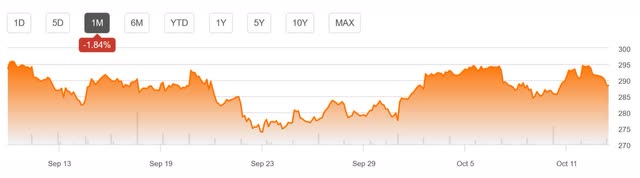

Fourth, I have also taken note of Cigna’s recent one-month performance. As the graph below shows, the stock is down 1.84%. Yet, competitor Humana is up 2.97% over the same period.

Seeking Alpha

Source: Seeking Alpha

Finally, as I dig into CI’s EBITDA growth, I am disappointed. The company’s forward growth is -76.18% compared to the health insurance sector median. Moreover, Cigna’s EBITDA growth YoY comes in at 4.17%, a noticeable departure from the industry’s median of 5.59%.

As mentioned at the start, this fundamental analysis forms the foundation of my bearish outlook. But the next points I highlight related to Express Scripts should be of primary concern for investors. They present the real danger for Cigna.

Corporate Activity and Analyst Missteps

Back in 2018, Cigna acquired Express Scripts for $54 billion. While heralded by the company at the time as a deal that would improve healthcare access and cut costs, I believe investors have yet to see tangible benefits. Of course, cost savings have not been realized either.

Now, Express Scripts is in a dispute with Kroger, the U.S.’ largest grocer. Kroger has signaled it intends to terminate its pharmacy provider agreement for its commercial customers due to Express Scripts’ unsustainable pricing model. According to Colleen Lindholz, president of Kroger Health, “We do not believe Kroger customers should have to pay higher costs to increase Express Scripts’ profits.” I agree. Other investors should take note, too, because now, by the end of the year, Express Scripts might lose millions of patients who get their prescriptions from one of Kroger’s 2,200 pharmacies.

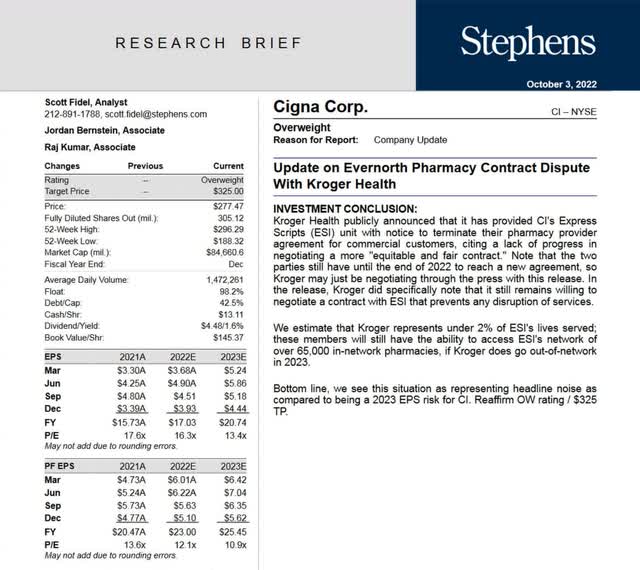

In light of this dispute, I surfaced this brief from Stephens. I disagree with its author, analyst Scott Fidel. Kroger services 35 states, and more than 11 million customers come through their stores each day. That is a big customer base to lose. I believe, moreover, that, if Kroger ultimately cancels its contract with Express Scripts, other big names will follow.

CI Research Brief, Stephens, Inc

Source: CI Research Brief, Stephens Inc.

Investigations

Having traded in highly regulated industries for more than 45 years, I have a decent sense of how Washington probes affect an industry or company. Pharmacy benefit managers are increasingly coming into the crosshairs of regulators and legislators. Rightfully so. In my research, I came across a position paper that was released last month from more than a dozen healthcare experts. It examines the murky business practices of these managers (on pages 28 – 32).

This type of sunshine does not bode well for Cigna.

First, the highest risk stems from an investigation from the Federal Trade Commission. In very unlikely fashion, this probe actually has bipartisan support. Furthermore, the Commission’s Chair, Lina Khan, has pledged to use all tools at the agency’s disposal to investigate pharmacy benefits managers like Express Scripts.

For quick insight into the problem at hand – and the corresponding risk for Cigna – I found this commentary from former ((FTC)) Policy Director David Balto noteworthy:

“The problem is that while PBMs were originally formed to act as honest brokers and pass…savings on, today, they keep a significant portion of the funds for themselves — with no legal limit. Moreover, their profits rise when drug prices are higher. So they have incentive to seek steeper, not lower, prices.”

This type of business model, in my view, will not reward investors in the short- nor long-term.

Momentum is also gathering in Congress. Per Rep. Buddy Carter, a pharmacist:

“PBMs have been allowed to rob patients blind for decades and Congress cannot afford to continue ignoring a system that is forcing our loved ones to stay sick, sacrifice their mental health, go into debt, and put their lives on hold just to convince a man behind a computer that they need the care their doctor says that they do.”

In the Senate, Sens. Chuck Grassley, Ron Wyden, and Mike Braun wrote to ((FTC)) Chair Lina Khan this past May, saying:

“PBMs are…vertically integrated with health insurers and operate their own pharmacies. Despite, or perhaps because of, this level of consolidation, PBMs operate with little transparency, making it difficult, if not impossible to understand how PBMs influence prescription drug pricing.”

Finally, the Pentagon might well be inclined to investigate Express Scripts, too. Why? Because Express Scripts is the sole pharmacy provider to TRICARE, the program that provides civilian health benefits for U.S armed forces personnel, military retirees, and their dependents. This letter from a bi-partisan group of members of both chambers of Congress should be concerning for those watching – or holding – CI shares. It seeks to gather more information on the “monitoring of TRICARE beneficiaries’ access to retail and community pharmacies.”

Conclusion

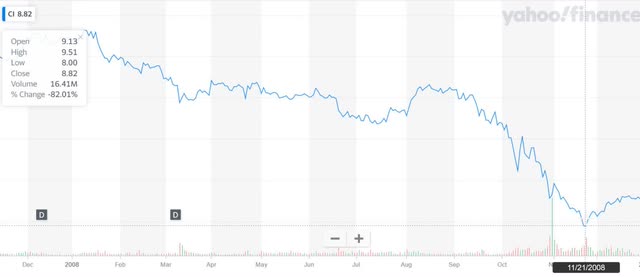

Based on my assessment today, I hope investors take a pass right now on Cigna. On a historical note, as well, investors in the health insurance sector will remember that, back in 2008, CI shares plummeted 83% from January to November. That type of volatility, as depicted below, does not sit well with me.

Yahoo! Finance

Source: Yahoo! Finance

The knives could be coming out for Express Scripts – from the halls of Congress to the Biden Administration and the military. I believe that analysts have yet to catch up with this reality. What is more, several of CI’s important fundamentals are weak heading into the uncertainty of next year. As such, CI shareholders would be the ones who pay the price.

Be the first to comment