gorodenkoff

In the last 8 years, Viridian Therapeutics, Inc. (NASDAQ:VRDN) changed its name twice, from Signal Genetics, to Miragen, and now to Viridian. I have been following this name for a while, and I closely followed the demise of Miragen. However, Viridian did a reverse merger with Miragen, and things have changed for the better. They are finally producing data they can be proud of. I discussed that good data in my earlier article.

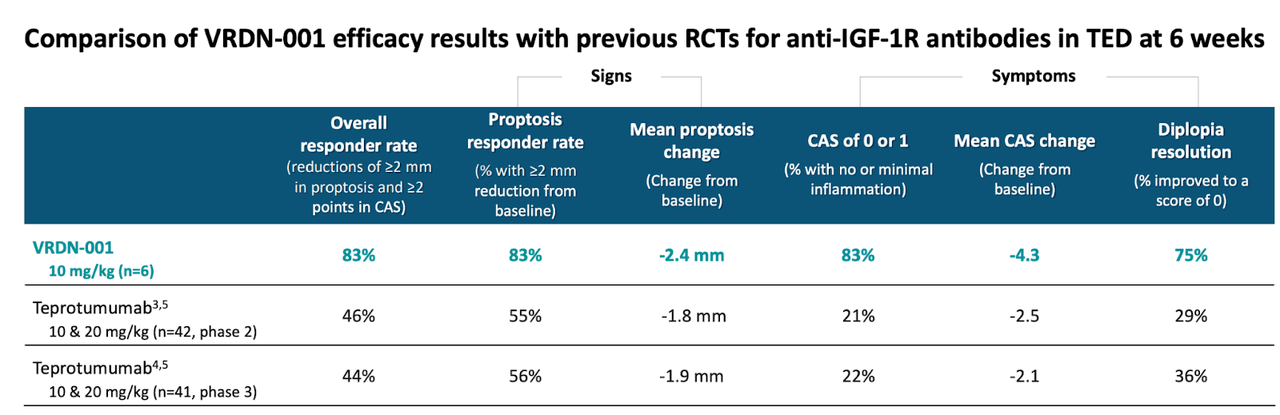

Lead candidate is VRDN-001, an IGF-1R signaling pathway blocker, which produced positive data from a phase 1/2 trial targeting Thyroid Eye Disease, or TED. Key competitor in TED is Tepezza, approved in 2020, a super expensive drug sold by Horizon Pharma (HZNP), however VRDN-001’s data is better than Tepezza’s. A six-month course for Tepezza costs anywhere between $250,000-$500,000 according to a KOL interviewed by Jefferies. If VRDN-001 can prove even non-inferiority to Tepezza, it can create a market for itself.

In the phase 1/2 trial whose 10mg/kg cohort data I described earlier, the baseline characteristics of the trial population was quite similar to Tepezza’s trial, and patients had active TED with a Clinical Activity Score or CAS ≥4 in both trials. Data for the 10mg/kg cohort was better than Tepezza’s same dosage cohort data. Overall response was almost double Tepezza’s ORR if we consider the same duration. However, Tepezza did run a longer trial, at the end of which, the data became comparable – at that time in September, I said we would not know if there was a difference until we had longer term data for VRDN-001. They had just 6 weeks of data at that time. For your reference, the full data for the 10mg/kg cohort that they presented at the ATA this year is here. Data shows:

Peers (VRDN website)

In November, the company released more data from the 20mg/kg cohort. The company said the data was excellent, but if you look at it closely, the 20mg/kg data wasn’t that good at all, and brought the average down for the entire trial. In every single measure, the 10mg cohort actually overtook the 20mg data. For example, ORR was 83% at 10 mg/kg versus 67% at 20 mg/kg, mean reduction in clinical activity score or CAS was 4.3 points at 10 mg/kg versus 3.7 points at 20 mg/kg, 83% at 10 mg/kg versus 67% at 20 mg/kg proptosis resolution, with only equivalent results in diplopia, 75% at 10 mg/kg versus 75% at 20 mg/kg. Safety data for the two cohorts have not been provided granularly, so we don’t yet know that. However, looking at this data, 20mg/kg does not look viable. That means, there isn’t actual hope for data superiority with higher doses between VRDN-001 and Tepezza. What we can hope for is superiority at equal time periods. That data isn’t in hand yet.

There’s also the fact that VRDN-001 data was from just 6 patients in each cohort. We need a larger trial. Some silver lining is that its two other molecules are improved versions of VRDN-001. Maybe that will be something; but only if VRDN-001 is successful, first. A phase 3 trial called THRIVE has been initiated.

Financials

VRDN has a market cap of $1.1bn and a cash reserve of $431mn. The stock is moderately traded, with an average trading volume of ~500k shares. Research and development expenses were $22.1 million during the third quarter of 2022, while general and administrative expenses were $8.9 million. At that rate, the company has a cash runway of over 12 quarters, or, as the company says, till 2025.

The CEO has been regularly selling shares in the open market, having sold nearly $1.6mn of shares this year alone. However, a few 10% holders made major purchases this year.

Bottom Line

VRDN looks like it is doing good science. Its currently available data is indicative of superiority compared to a blockbuster level competitor. The 20mg/kg data disappointed, however, the 10mg/kg data is still more than good enough to compare against Tepezza. Horizon, itself, is getting closer to a buyout, so that puts Viridian in an enviable position. All in all, Viridian looks like a buy – but I am more comfortable with a price below $20 if I can get it.

About the TPT service

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

Be the first to comment