Alikaj2582/iStock via Getty Images

Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on November 15th, 2022.

In investing, there are many ways to make money. One is to invest in dividend-paying stocks – even better are dividend growers. Dividend growers are generally those investments that can generate growing earnings and, therefore, higher payouts. Realty Income (NYSE:O) is one incredibly popular way to play this.

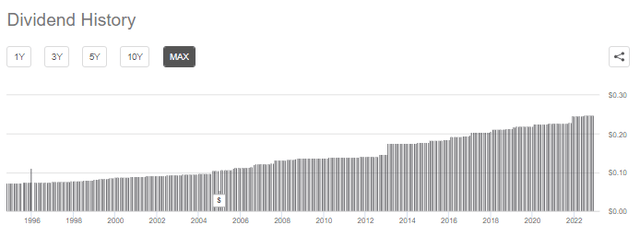

As a REIT, it is almost synonymous with income. Doubly for O as they labeled themselves “The Monthly Dividend Company.” They’ve paid out 629 consecutive monthly dividends and raised 100 consecutive quarters (25 years.)

O Dividend History (Seeking Alpha)

While that is certainly impressive, there are other ways to generate ‘income’ from holdings that you might otherwise not mind holding. That’s through writing (selling) puts on shares such as O. Today, I wanted to highlight how we’ve generated higher option premiums by selling puts in two different ways compared to just holding for the dividend. We’ve utilized shorter-term trades and a long-term trade to achieve this.

I view this as a supplement to holding shares of O as well. So definitely worth considering investing in O outright. When writing puts, you can end up going long shares. So that’s why I would reiterate that it’s generally best to employ this strategy on something worth owning. I’ll also mention that shares of O are still trading at a generally favorable valuation. Investing in shares outright can make sense.

O Fair Value Range P/AFFO (Portfolio Insight)

On the other hand, selling puts could also mean that you end up owning shares of O at a lower price. Thus, one of the other benefits of writing puts overall. It allows for some further downside protection; collecting a premium upfront also means your breakeven is lower than the strike selected.

A “buy-and-hold” strategy is essentially what I employ in my portfolio. The passiveness of investing in dividend payers and dividend growers means I can sit back and collect the income. The point of highlighting this supplemental strategy is to show how easy it can be to participate if you have some cash sitting around. As we’ll highlight in the long-term trade, more aggressive investors can even consider employing such a strategy in a margin account.

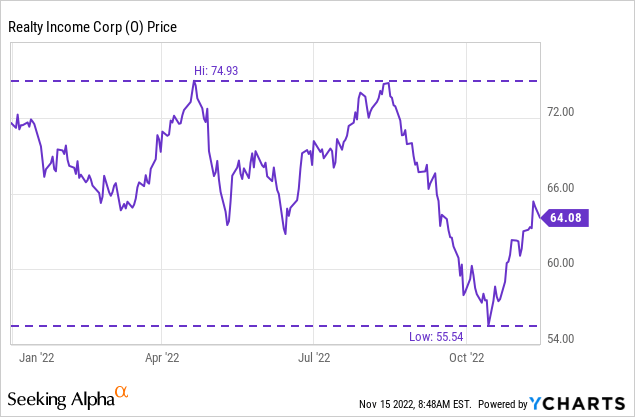

I’ll also concede that greater volatility overall in the broader market had made O shares more volatile than usual. So that is important to note. With shares of O swinging around due to interest rate pressures, that can generate a relatively higher option premium than during flatter years. Shares have swung between a high of nearly $75 and a low of nearly $55.50 for this year.

Ycharts

The Short-Term Plays

In total, 2022 has seen shares of O pay $2.7205 (or will when the December dividend is paid out.) Here’s the recap of the trades we’ve been able to pull off and close out or let expire in 2022 alone.

- November 18th, 2022, expiration at a $60 strike collected $1.80 but closed for $0.04 to net $1.76.

- July 15th, 2022, expiration at a $60 strike collected $0.78 but closed for $0.10 to net $0.68.

- May 20th, 2022, expiration at a $60 strike collected $0.25 as it expired worthless. This was a trade over only 9 days.

- March 18th, 2022, expiration at a $65 strike collected $0.90, and that trade expired worthless.

In total, that means we collected $3.59 per share or $359 per contract for the year (assuming an equal number of contracts sold for each trade.) This was for only four trades that all expired worthless or were closed early. We never took an assignment of any of the shares. That means we collected the equivalent of 1.32x the dividend. We still have a month and a half to go as well.

The highest strike price we wrote puts at was $65 – which was done earlier in the before the deeper declines had come. From start to finish, it was 36 days when we allowed the trade to expire worthless. That worked out to a potential annualized return of PAR of 14.04%.

The duration of days for each trade was different. The rather small $0.25 collected was done over the course of only 9 days. Expiring worthless meant that the PAR was 16.89%.

The last two trades that, include the latest one, saw us close the trade early as shares of O rallied higher from lows. Taking a look at the price chart, YTD shows that there were several distinct peaks and valleys to take advantage of. Closing them early freed up cash to participate in other trades potentially. When closing the trades early, we can see that the majority of the premium collected was already achieved.

By utilizing short-term trades, you have less ‘duration’ risk as you can adjust more frequently to fluctuations in the share price. Taking advantage of those pesky secondary equity offerings that are a common way for REITs to grow.

The Long-Term Play

Going about this another way is with the strategy that Stanford Chemist had highlighted for us. In this case, it is a trade that is still in play – that’s how long-term it has been!

- January 20th, 2023, expiration at a $60 strike collecting $4.50

This trade was initially shared on July 12th, 2021. That means we are looking at around an 18.5-month duration or 557 days. The PAR comes out to 4.30%, which highlights why the trade in a margin account can make sense. While margin is always a riskier bet and only for advanced investors, there are a couple of benefits here.

First of all, you don’t actually have to have the cash sitting idle for that long, yet you collect the premium upfront. Secondly, you aren’t charged any interest on the margin because, well, it’s not actually drawing on your margin balance.

This brings up the third point, you aren’t drawing on your margin, and only a portion of margin will be set aside by a broker to ‘secure’ the potential of assignment. When utilizing a trade that is over a year and a half, you have a lot of time to adjust as needed to avoid assignment or deposit the cash to back the trade.

By going longer-term, you are also collecting a sizeable portion of the premium upfront. That brings the breakeven down to $55.50, and the dividend equivalent at the time was 19.1x the monthly dividend. Since the dividend has grown, the equivalent is reduced.

In total, $4.1262 in dividends were collected – or known as the December dividend. However, we don’t know what the January dividend will be as it should be raised. The last four increases were $0.005, so we’ll presume that is the next boost as well. If that is the case, we should ultimately collect $4.3747 on the long portion of shares. Even if it is a greater boost, it likely won’t be greater than the $4.50 collected by selling the long-term puts.

Conclusion

One of the pushbacks I hear about writing puts is, “it won’t make you rich. If it did, everyone would do it.” I absolutely agree too. It won’t make anyone rich overnight. That isn’t the goal of selling options, in my opinion. If you are looking for a get-rich-quick scheme, look elsewhere.

Option writing can be a great supplement to dividend investors, whether utilizing cash-secured puts or covered calls. Even going more aggressively with writing naked in a margin account can be lucrative, but know your limits!

It can be tailored to each investor’s risk tolerance and how frequently they want to initiate trades. The higher volatility of 2022 has helped provide more opportunities, but that’s compensating for a greater likelihood of taking assignments. You might generate lower premiums in a flat year, but the likelihood of assignment would generally be reduced.

Be the first to comment