Richard Drury

Author’s note: This article was released to CEF/ETF Income Laboratory members on November 14th, 2022.

The Invesco CEF Income Composite Portfolio ETF (NYSEARCA:PCEF) and the Saba Closed-End Funds ETF (BATS:CEFS) are both ETFs investing in a diversified portfolio of CEFs. Both funds invest in dozens of CEFs, provide investors with exposure to all major asset classes, and boast strong, comparable yields: PCEF yields 8.6%, CEFS yields 9.3%. Although both funds are broadly similar investments, there are several key differences between them.

PCEF is a broad-based index fund, so the fund is more diversified and less risky than CEFS. PCEF’s dividends have seen moderate growth YTD, while CEFS’s dividends have remained the same. PCEF seems like an ideal choice for more conservative / less aggressive investors, in my opinion at least.

CEFS is a narrower actively-managed fund, investing in a smaller number of (hopefully) best-performing CEFs. CEFS’s performance has been stronger in the past, owing to successful investments and trades, but that might not necessarily be the case moving forward. CEFS seems to be only appropriate for more risk-seeking investors, in my opinion at least.

In my opinion, both funds are buys. In most cases, CEFS’s proven investment strategy and strong performance track-record make it the ideal choice. Right now, the situation seems more complicated. Currently, CEFS’s largest holding consists of a short treasury position. Said position has been quite profitable in the past, but seems excessively risky right now, due to above-average interest rate volatility, and the possibility of significant treasury gains if inflation is brought back under control. Under these conditions, CEFS’s significant short treasury position seems unwise. As such, I slightly prefer PCEF over CEFS under current conditions, although both funds remain similar choices and buys.

Strategy and Holdings Comparison

Both PCEF and CEFS are ETFs investing in a diversified portfolio of CEFs. Both funds focus on bond CEFs, but include funds investing in a wide assortment of asset classes, including equities, bonds, preferred, and MLPs. PCEF is a broader index fund, while CEFS is a narrower actively-managed fund.

PCEF – Broad-Based Index Fund

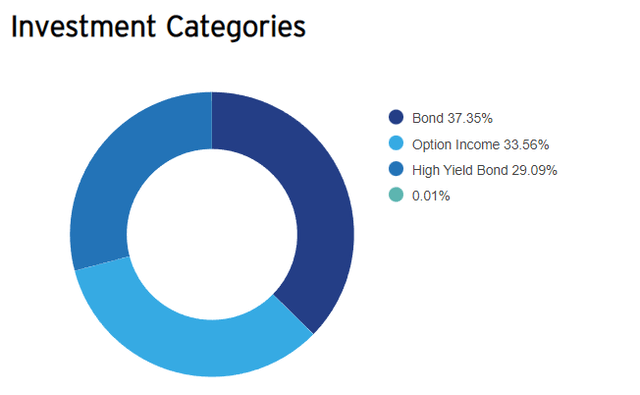

PCEF is an index fund, investing in most relevant high yield, investment-grade, and equity covered call option CEFs in the market. These three segments encompass most relevant income-producing asset classes in the market, although a couple niche securities are missing, including BDCs and mREITs. Some of PCEF’s holdings have smaller investments in these nicher asset classes, so the fund does provide some exposure to the same.

As with most index funds, there are some size, liquidity, expenses, and discount / premium screens, but these tend to be quite lax, and exclude a comparatively low number of funds. PCEF is a broad-based index fund, attempting to invest in all relevant income-producing CEFs, with few exceptions.

PCEF currently invests in 119 CEFs. Asset allocations are as follows.

CEFS – Narrower Actively-Managed Fund

CEFS is an actively-managed fund, investing in CEFs which fund management believe have the potential for outperformance. Diversification is quite strong, with CEFS investing in funds from all major asset classes, including equities, bonds, and MLPs. Security selection is based mostly based on fundamental characteristics, including discounts to NAV. CEFS is administered by Saba, an activist investor, and the fund sometimes invests in funds which are then targeted by Saba.

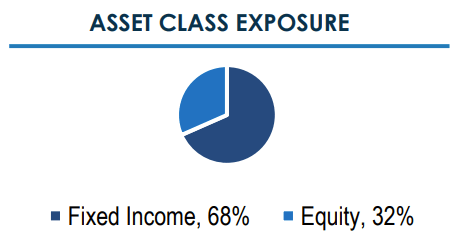

CEFS currently invests in 73 funds. Asset allocations are as follows.

CEFS

PCEF and CEFS – Strategy Differences

PCEF and CEFS have broadly similar holdings, but the process used to pick these, their investment strategy, is very different.

PCEF is an index fund, so the fund simply tracks an index. Index rules ensure diversification, reduce turnover, and ensure long-term holding periods. Discretionary investment decisions are somewhere between extremely rare and impossible. Said process all but precludes the possibility of significant over or underperformance: PCEF will never make an aggressive trade or investment, index rules prevent it. The result is a comparatively safe, dependable fund, but one which will almost never post significant, outsized gains or outperformance.

CEFS, on the other hand, is an actively-managed fund. Any and all investment decisions are discretionary decisions taken by its management team, as are fund returns. A strong management team can result in outstanding gains and outperformance, while a weak management team can lead to losses and underperformance. The result is a more volatile fund, and one whose returns are strongly dependent on the strength and effectiveness of its management team.

From the above, it seems clear that PCEF is more appropriate for more conservative investors, wishing to minimize the possibility of losses and underperformance.

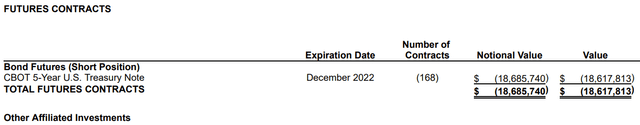

PCEF and CEFS have broadly similar holdings, with one exception. CEFS currently holds a massive short treasury position, accounting for around 20% of the value of the fund.

Said position increases fund returns when treasuries go down, and vice versa. All else equal, said position should lead to outperformance when interest rates increase, as has been the case YTD.

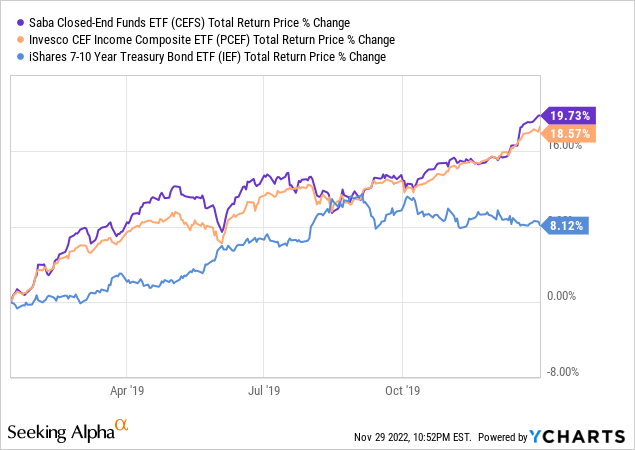

All else equal, said position should lead to underperformance when interest rates decrease. This has mostly not been the case in the past, with CEFS very slightly outperforming relative to PCEF last time rate rose, in 2019. Differences in fund strategies / specific investment decisions taken by CEFS almost certainly account for the difference.

In my opinion, CEFS’s short treasury position is a negative, at least under current market conditions. Being short treasuries exposes CEFS’s investors to the possibility of substantial losses if treasury prices were to increase, as will likely happen once inflation is brought under control. Being short treasuries have negative expected returns, as treasuries themselves have positive expected returns (from their interest or yield). Shorting treasuries should lead to losses long-term, even if that has not been the case for longer than a year.

Notwithstanding the above, PCEF and CEFS remain broadly similar funds, each investing in a diversified portfolio of CEFs.

Dividends Comparison – PCEF Winner

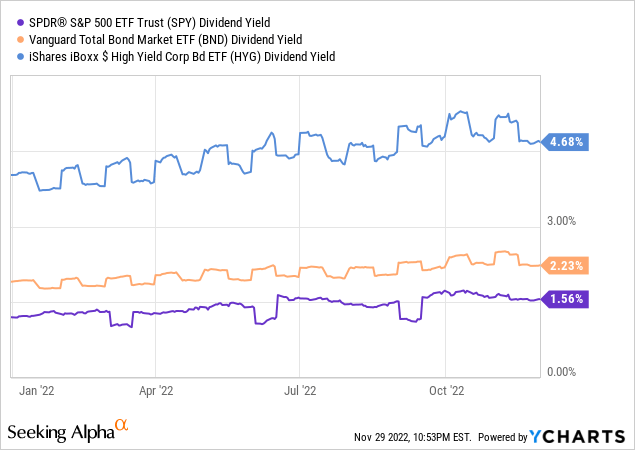

CEFs almost always sport strong distribution yields, significantly higher than most asset classes, including equities and bonds. Strong distribution yields are due to investing in securities with above-average yields, and due to return of capital distributions being common amongst CEFs.

Both PCEF and CEFS invest in CEFs with strong yields, and so both funds sport strong yields too. PCEF currently yields 8.6%, while CEFS currently yields 9.3%, excluding a special distribution in late 2021. Both are very good yields, and higher than that of most asset classes.

CEFS’s yield is slightly higher, a small advantage of the fund relative to PCEF.

PCEF’s yield is fully covered by underlying generation of income, as evidenced by the fund’s 8.6% SEC yield. SEC yields are a standardized measure of the actual short-term income generated by a fund’s underlying holdings. PCEF generates 8.6% in income, distributes 8.6% to shareholders as dividends, so dividends are fully covered by income. Seems simple enough.

CEFS’s yield is not covered by underlying generation of income, as the fund only sports an SEC yield of 7.6%. Best-case scenario, the short-fall is covered by capital gains, if not, return of capital distributions might be needed. From what I’ve seen, the fund has generated more than enough capital gains to fund the aforementioned shortfall in the past, but that might not necessarily be the case moving forward. ETFs that do not generate sufficient income to fund their dividends almost always cut their dividends. That seems like the most likely scenario for CEFS, although some of the fund’s positions and trades might help sustain the fund’s dividends moving forward.

In my opinion, PCEF’s stronger SEC yield is a significant advantage of the fund relative to CEFS, and much more important than the difference in dividend yields.

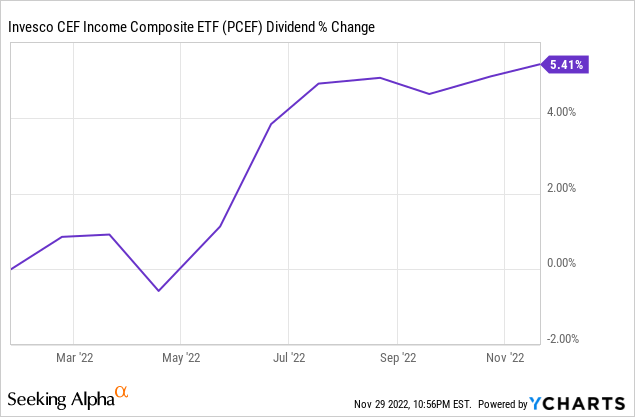

Moving forward, both funds should see rising dividends due to Federal Reserve rate hikes. I’ve covered these issues more in-depth here, but the gist of it is simple enough.

As interest rates rise, bonds are issued with higher interest rates, while older bonds maintain their original, lower, rates. As these older, lower-yielding bonds mature, they are replaced with newer, higher-yielding alternatives, leading to higher income and dividends for most bond funds.

The process tends to be pretty straightforward for bond ETFs, most of which have seen growing dividends YTD. Bond CEFs are a bit more complicated, due to differences in market structure, distribution policies, and use of leverage. Still, bond CEFs should see some dividend growth in the coming months and years. That has been the case for PCEF, as expected.

On the other hand, it has not been the case for CEFS, with the fund’s dividends remaining stable for the year. This is likely due to the fund’s relatively low generation of income / SEC yields: dividends generally won’t grow unless income is growing.

Although PCEF’s growing dividends are something of a benefit for investors, future growth is what matters, and it is not immediately clear to me that PCEF’s dividends should see faster growth than CEFS. Both funds benefit from economic trends, higher interest rates, and the underlying holdings of both should see rising dividends too. Much will depend on the specific investment decisions taken by CEFS. Growth should be strong if the fund focuses on CEFs with strong distribution yields and holds long enough to see rising dividends. Growth might stall if the fund chooses otherwise, prioritizing, say, heavily discounted CEFs instead.

Capital Gains / Losses Comparison – CEFS Winner

Both funds focus on CEFs, which are income vehicles with comparatively little in potential capital gains. Investors should expect relatively low, perhaps zero, capital gains for either fund moving forward.

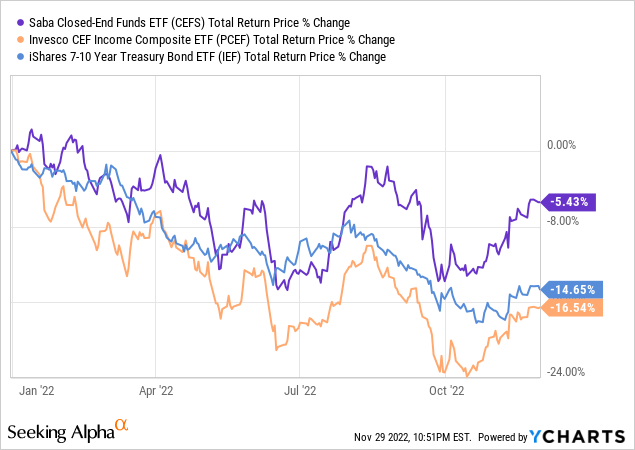

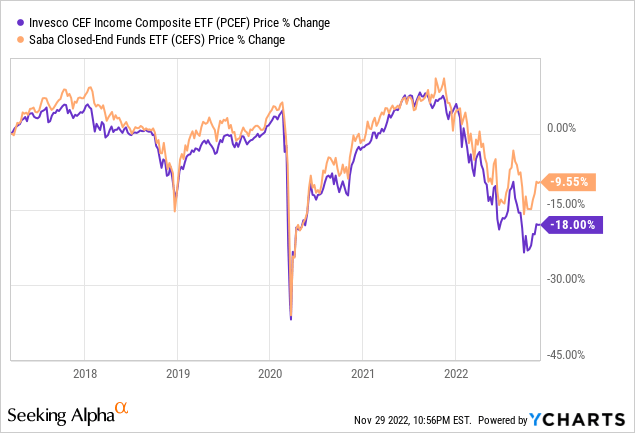

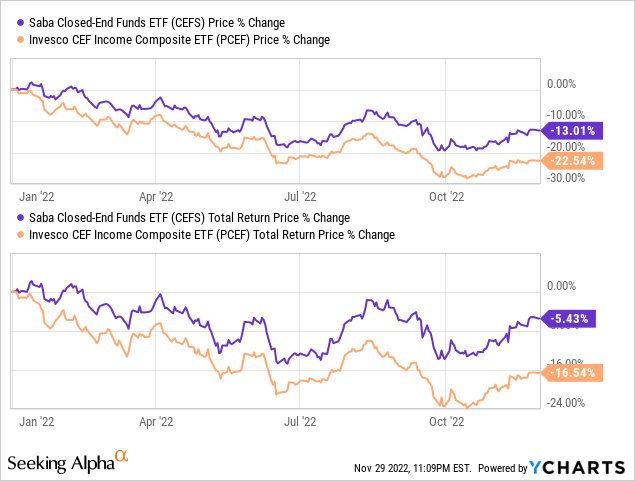

Since inception, both funds have seen moderate capital losses, somewhat underperforming relative to expectations. Losses have almost entirely occurred YTD, as rising interest rates hammer asset prices. Bonds have been hit particularly hard, as have most bond funds. Both PCEF and CEFS focus on bond CEFs, so both have seen their share prices rapidly decline all year.

On the other hand, CEFS has seen significantly lower capital losses, mostly due to the fund’s short treasury position. Although this was definitely a positive for past shareholders, I don’t think it will necessarily be a positive moving forward. Treasuries are not destined to go down forever, so don’t expect a short treasury position to be consistently profitable.

As a final point, even though both funds have seen very hefty capital losses these past few months, the future is much rosier. Remember, these losses were mostly due to higher interest rates leading to lower bond prices. Lower bond prices are something of a temporary phenomenon, as bonds must be paid back in full, at maturity, regardless of their market price. Bond funds should recover from their recent losses in the coming months and years, although a lot will depend on specific investment decisions taken by fund management teams, as well as future interest rate movements.

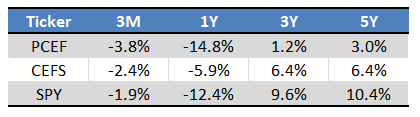

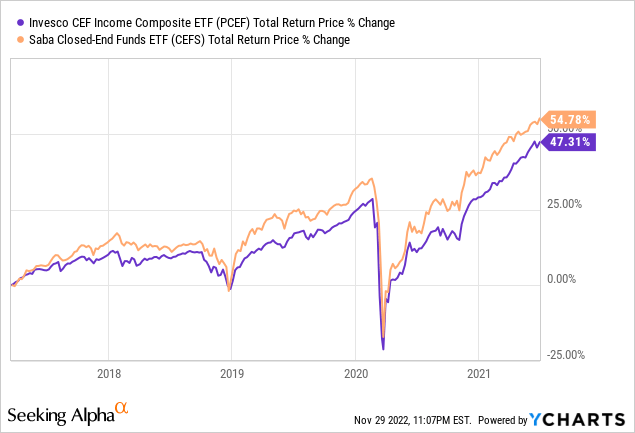

Total Returns Comparison – CEFS Clear Winner

CEFS’s performance track-record is significantly stronger than that of PCEF. CEFS has outperformed since inception, and by quite a large margin. Performance is strong for most other time periods too.

ETF.com – Chart By Author

From what I’ve seen, most of CEFS’s outperformance is quite recent, and was mostly due to its aforementioned short treasury position. Fund selection and activist campaigns have led to some gains too, including overweighting MLPs earlier in the year, and a successful activist campaign to narrow Delaware Investments National Municipal Income Fund’s (VFL) discount earlier in the year.

CEFS still outperformed in prior years / excluding recent performance, although only moderately so.

CEFS’s stronger performance track-record is a significant benefit for the fund and its shareholders, and a key advantage relative to PCEF. In my opinion, CEFS’s stronger performance track-record make it the better long-term investment, but I remain weary of the fund’s significant short treasury position.

Risk Comparison – PCEF Slight Winner

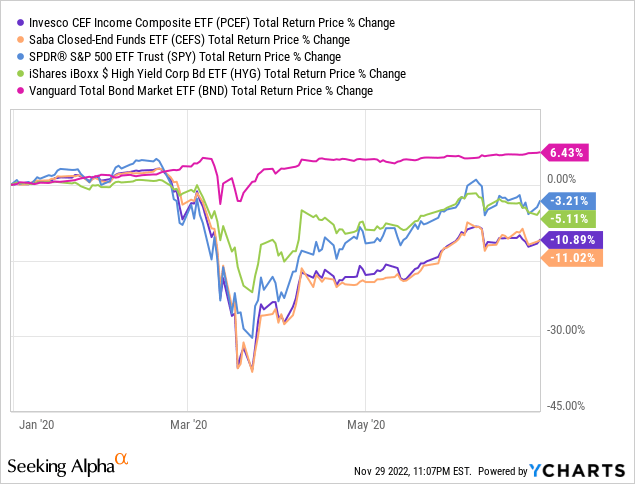

PCEF and CEFS invest in broadly similar funds, so both have broadly similar risk profiles. Risks are relatively high for both funds, due to focusing on high-yield corporate bond funds. Risks are further boosted due to investing in CEFs, which tend to see widening discounts to NAVs during downturns and bear markets. Expect significant losses during downturns and recessions, as was the case during the first half of 2020, during which the coronavirus pandemic was in full swing.

As can be seen above, both PCEF and CEFS saw significant losses in early 2020, and both moderately underperformed relative to equity and high-yield bond indexes. I’m confident that the NAV performance of their underlying holdings was much stronger, although I don’t data to this effect.

CEFS’s short treasury position is meant to reduce interest rate risk, which should lead to lower losses when interest rates rise. This has been the case YTD, as expected.

CEFS’s short treasury position does mean that the fund should see lower capital gains if rates were to decrease, and should lead to somewhat lower long-term total returns (treasuries have positive expected returns, so shorting treasuries has negative expected value).

CEFS’s overall strategy is quite a bit riskier than PCEF’s, as it is dependent on the fund’s investment management team making effective, profitable trades and activist campaigns from here on out. PCEF is a simple, broad index fund, so does not have these issues.

In my opinion, CEFS’s riskier strategy outweighs its lower interest rate risk, making it the riskier fund out of the two, an important disadvantage. Other investors might disagree, especially those most concerned about the possibility of further interest rate increases.

Conclusion

PCEF and CEFS are both ETFs investing in a diversified portfolio of CEFs. Both funds invest in dozens of CEFs, provide investors with exposure to all major asset classes, and boast strong dividend yields. CEFS’s stronger performance track-record make it the better long-term holding, but the fund’s short treasury position seems excessively risky right now. Under current conditions, would pick PCEF over CEFS, although both funds remain broadly similar investments, and buys.

Be the first to comment