Dilok Klaisataporn/iStock via Getty Images

Investment Thesis

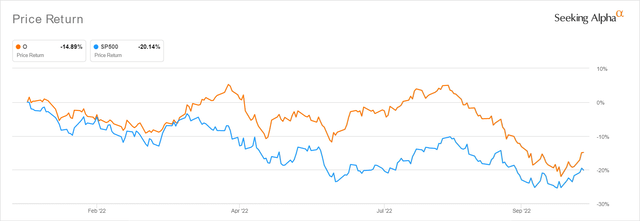

O YTD Stock Price

Since our previous Hold rating in September 2022, Realty Income Corporation (NYSE:O) had continued to retrace by -17.32% to hit rock bottom at $55.50, though it is apparent that the stock has also moderately recovered by 9.18% by now, along with the S&P 500 Index by 7.08%. This phenomenon is probably attributed to the flurry of Big Tech earnings propping the stock market temporarily. However, we are unsure how long this optimism will last, since FAANG continues to underperform against market estimates, potentially triggering more pain ahead.

The Feds are also due to meet by 02 November, with 92.3% of analysts projecting another 75 basis points hike, and similarly for the December meeting. The latter is if October and November PPI/CPI/ labor market continues to report sticky inflation rates, as witnessed for September 2022. Assuming a raised terminal rate to over 5%, beyond the original projection of 4.6%, we can be sure to see another bottom test ahead. Therefore, reversing any gains experienced over the past two weeks. Investors would be well advised to load up then, speculatively at $50s.

O Continues To Execute Brilliantly Despite Worsening Macroeconomics

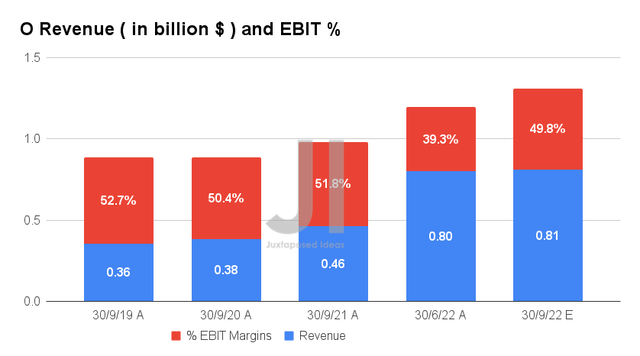

For its upcoming FQ3’22 earnings call, O is expected to report revenues of $0.81B and EBIT margins of 49.8%, indicating relatively inline though a favorable increase of 10.5 percentage points QoQ, respectively. Otherwise, exemplary YoY growth of 76.08% though a minimal moderation of -2 percentage points, respectively.

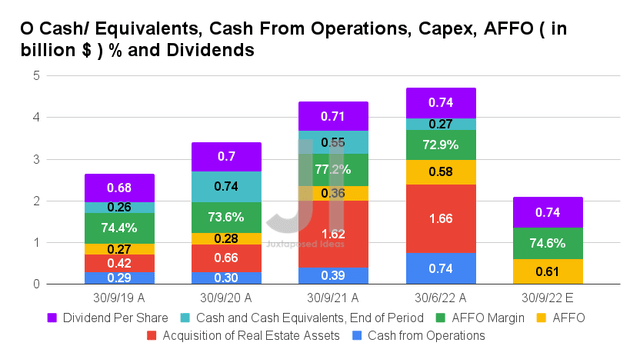

In the meantime, O is expected to report notable improvements in its profitability, with an AFFO of $0.61B and an AFFO margin of 74.6% in FQ3’22. It represented a notable increase of 5.17% and 1.7 percentage point QoQ, respectively. Otherwise, tremendous YoY growth of 69.44% though another moderation of -2.6 percentage points, respectively, after the normalization from the reopening boom.

With the recent announcement of O’s October dividend payout of $0.248, we are looking at a total FY2022 payout of $2.9685, assuming inline for the next two months. That would indicate an excellent yield of 4.88% based on current stock prices, representing notable improvements from its 4Y average of 4.18% and sector median of 4.30%.

It is also impressive that O invested $1.8B in properties in FQ3’22, indicating an increase of 8.43% QoQ and 11.11% YoY, despite the rising interest rates and worsening macroeconomics. This expansion is definitely accelerating from pre-pandemic levels of $0.42B in FQ3’19. Though the company also had to raise some equity to fund its aggressive acquisitions, most recently for $750M due October 2032, we are not concerned for now. This is because the management has always been prudent with its debt leveraging, while keeping the maturity schedules well staggered through 2047. Thereby, indicating O’s disciplined capital management indeed.

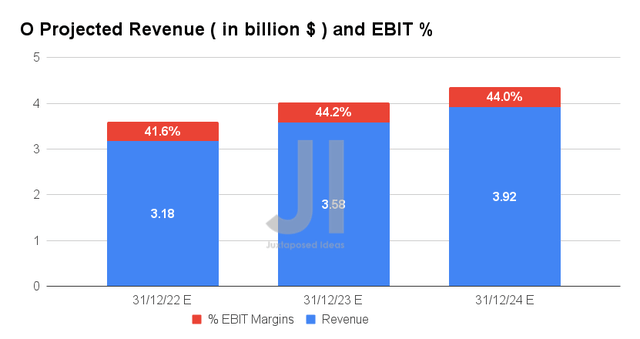

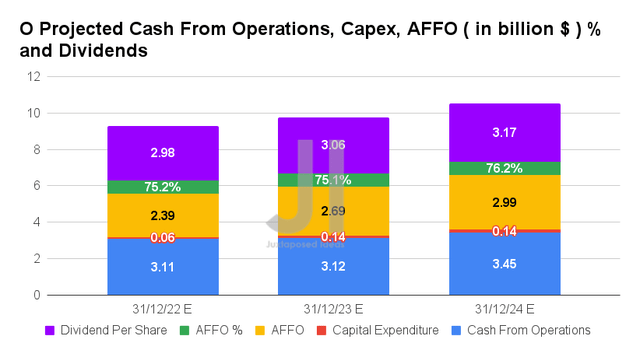

Over the next three years, O is expected to report revenue and AFFO growth at a CAGR of 26% and 19.3%, respectively. Though these numbers represent apparent top and bottom line downgrades by -3.92% and -1.63% from market analysts since our previous analysis in September 2022, we are still encouraged since it is still accelerated from pre-pandemic levels of 10.2%/12.6% and pandemic levels of 17.6%/19%, respectively.

Furthermore, market analysts are expecting notable improvements in O’s AFFO margins, from 74.17% in FY2019, to 75.95% in FY2021, and finally to 76.2% by FY2024. As its cash flow improves, we expect to see sustained growth in its dividend payouts as well, at a CAGR of 3.8% through FY2024. If investors load up at current levels, they will be enjoying an excellent dividend yield of 5.23% by FY2024. Otherwise, at 5.71% instead, for those who had strategically added at the recent bottom.

In the meantime, we encourage you to read our previous article on O, which would help you better understand its position and market opportunities.

- Realty Income: More Pain May Be Ahead – Recession Is A Real Concern

So, Is O Stock A Buy, Sell, Or Hold?

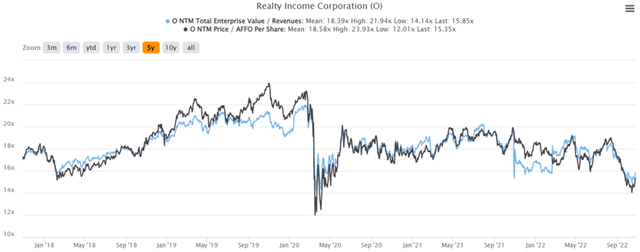

O 5Y EV/Revenue and P/E Valuations

O is currently trading at an EV/NTM Revenue of 15.85x and NTM Price/FFO Per Share 15.35x, lower than its 5Y mean of 18.39x and 18.58x, respectively. The stock is also trading at $60.60, down -19.62% from its 52 weeks high of $75.40, though at a premium of 9.18% from its 52 weeks low of $55.50. Nonetheless, consensus estimates remain bullish about O’s prospects, given their price target of $69.36 and a 14.46% upside from current prices.

Depending on its upcoming performance on 03 November, the O stock may temporarily be impacted by the volatile market conditions, as witnessed thus far since mid of August 2022. However, in view of its stellar management team, ambitious acquisitions, and well-staggered leveraging, we expect the stock to eventually recover once the Feds pivot and macroeconomics improves. This may speculatively occur by H2’23, or even earlier by its approaching November meeting, as highlighted by multiple market traders and Jeremy Siegel from the University of Pennsylvania. No one knows for sure when it will happen, but we are definitely in for some surprises ahead.

Therefore, we are revising our rating on the O stock to a cautious Buy at these levels, given the strength of its performance thus far and the massive potential through FY2024. Otherwise, bottom-fishing investors may potentially wait for $50s as the market provides more clarity by early November, though they would also miss these near-bottom levels assuming a vertical rise then. We shall see.

Be the first to comment