Andrew Brel/iStock via Getty Images

Introduction

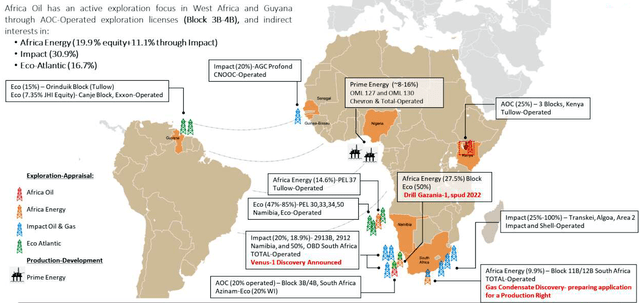

The Vancouver-based Africa Oil Corp. (OTCPK: AOIFF)(AOI: TSX) is an oil and gas exploration company producing and developing deepwater offshore Nigeria assets and development projects in Kenya and South Africa.

The company also has a portfolio of exploration assets in Guyana, Kenya, Namibia, Nigeria, South Africa, and the Senegal Guinea Bissau Joint Development Zone (“AGC”).

AOIFF: Exploration Inventory Presentation (Africa Oil)

The company holds its interests through direct ownership interests in concessions and its shareholdings in investee companies, including Prime Oil & Gas Coöperatief U.A.(“Prime”), Africa Energy Corp., Eco (Atlantic) Oil & Gas, and Impact Oil and Gas Ltd.

Africa Oil Corp. is controlled by the Lundin Group, which is excellent logistic support for such a start-up company.

It is essential to know that the Lundin Group comprises Lundin Energy, Lundin Mining, Lundin Gold, International Petroleum, Filo Mining, Josemaria Resources, NGEx Minerals, Lucara Diamond, ShaMaran Petroleum, Africa Oil, Africa Energy, and Bluestone Resources.

However, the pivot point when it comes to Africa Oil is, without a doubt, the acquisition of 50% of Prime, which I will explain below.

1 – 4Q21 and full-year results Snapshot

On March 1, 2022, Africa Oil Corp. announced its fourth-quarter and full-year 2021 financial results.

Warning: Africa Oil Corp. is not generating revenues per se. The company focuses mainly on Africa, except Guyana, South America, through its shareholdings of Eco (Atlantic) (OTCPK: ECAOF). (See map above)

The primary source of income (dividend) comes from the acquisition of a 50% interest in Petrobras Oil and Gas BV (POGBV, now known as Prime) in 2020 for a cash consideration of $520 million. Prime is involved with oil-producing assets off the coast of Nigeria, West Africa.

Since acquiring its 50% shareholding in Prime for a cash consideration of $520 million in January 2020, Africa Oil has received ten dividends from Prime for a total amount of $400 million, representing 77% of the cash consideration paid.

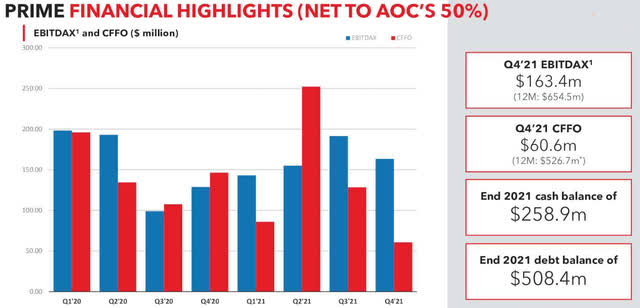

2 – Selected Prime’s fourth-quarter 2021 results net to Africa Oil’s 50% shareholding:

AOIFF: Prime Financial Highlights 4Q21 (Africa Oil)

- At the end of the fourth quarter, the cash position was $258.9 million, and the debt balance was $508.4 million.

- Prime’s fourth-quarter 2021 average daily W.I. production was 26,400 boep/d, and economic entitlement production was 28,500 boep/d (83% light and medium crude oil and 17% conventional natural gas), net to Africa Oil’s 50% shareholding in Prime.

- Prime had an EBITDA of $163.4 million (first nine-month 2021 total of $489.8 million) and cash flow from operations of $60.6 million in 4Q21.

CFO Pascal Nicodeme said in the conference call:

very strong performance from Prime, not even taking into account the security deposit that we receive in June last year, which is basically more than $150 million net to what’s shown in Prime. Prime has continued to deliver in terms of EBITDAX on a 12-month basis.

3 – Development projects.

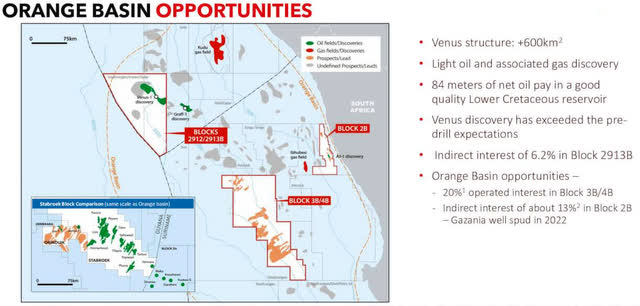

3.1 – The Orange Basin

Africa Oil is also active in Namibia (Block 2912/Block 2913B) with Namibia and South Africa (Block 2B).

On February 24, 2022, Africa Oil announced that TotalEnergies (TTE) had made a significant discovery of light oil with associated gas on the Venus prospect, located in block 2913B in the Orange Basin, offshore southern Namibia. The Venus 1-X well encountered approximately 84 meters of net oil pay in a good quality Lower Cretaceous reservoir.

AOIFF: Orange Basin Opportunity Presentation (Fun Trading)

CEO Keith Hill said in the conference call:

Perhaps the biggest announcement we did, and I think for a lot of the movement in our share price last week was – we’ve opened a new basin in the Orange Basin with the Venus discovery. Early days yet on Venus, but it looks like it could be a very major discovery that not only are we positioned well in this block, but we have other blocks in the region that could benefit from this as well.

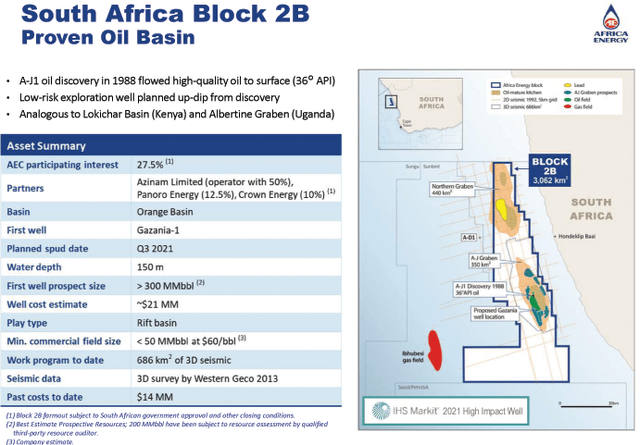

3.2 – Block 2B in South Africa.

Through its shareholdings in Africa Energy, the Company has exposure to the Gazania-1 exploration well drilled in Block 2B offshore South Africa, with a target spud date by August 2022.

Africa Energy Presentation Block 2 (Africa Energy Presentation)

The Gazania-1 exploration well could spud in August 2022.

According to Eco Atlantic – which is set to assume operatorship of block 2B – the asset partners have signed a contract with Island Drilling to deploy its Island Innovator semi-submersible for the Gazania-1 probe.

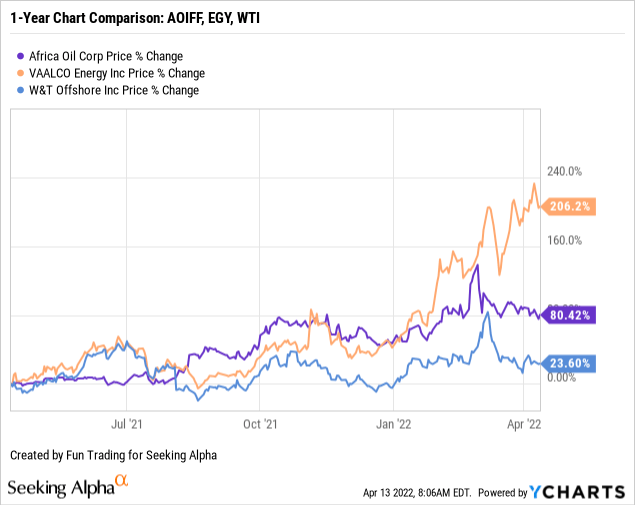

4 – AOIFF stock Performance

AOIFF is up 80% on a one-year basis. I compared the company with two other small E&P oil companies. One involved in Gabon, West Africa, called VAALCO Energy (EGY) and W&T Offshore Inc. (WTI) with assets and production in the Gulf of Mexico (offshore).

However, Africa Oil is not generating direct revenues from production and is not comparable to the other two.

5 – Investment Thesis

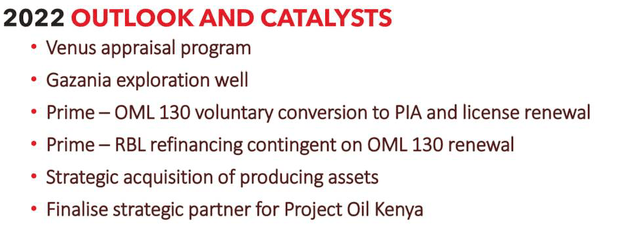

Africa Oil offers many opportunities and has become a strong potential for mid-term investment. The recent discovery in Namibia and the new Gazania-1 well in South Africa are two promising prospects. Furthermore, with the acquisition of Prime’s stake, the company is generating cash flow.

The only question that investors should evaluate is what is the best entry point for a long-term perspective?

I believe the stock is still attractive for new investors interested in such a promising start-up, and I recommend accumulating using any weakness from here.

Thus, my recommendation has not changed, and I am still advocating a dual strategy for AOIFF.

I suggest trading short-term LIFO about 65% of your total position and keeping a core long-term position for a much higher target, assuming success. The short-term trading gains could eventually be added to your core position, minimizing a severe hiccup’s risk potential.

Africa Oil Corp. – 4Q21 Balance Sheet and Trend – The Raw Numbers

| AOIFF | 4Q20 | 1Q21 | 2Q21 | 3Q21 | 4Q21 |

| Total Revenues and other in $ Billion | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Net Income in $ Billion | 79.85 | 38.92 | 38.38 | 58.51 | 54.91 |

| EBITDA $ Billion | 86.15 | 44.55 | 44.18 | 63.74 | 56.87 |

| EPS diluted in $/share | 0.17 | 0.08 | 0.08 | 0.12 | 0.11 |

| Operating cash flow in $ Million | -1.92 | -3.32 | -3.07 | -3.86 | -2.44 |

| CapEx in $ Million | 1.86 | 0.00 | 1.85 | 0.67 | 1.81 |

| Free Cash Flow In $ Million | -3.77 | -3.32 | -4.91 | -4.53 | -4.25 |

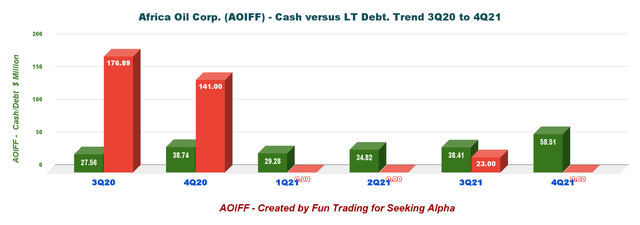

| Total Cash $ Billion | 38.74 | 29.28 | 34.82 | 38.41 | 58.51 |

| Total LT Debt in $ Billion | 141.00 | 0.00 | 0.00 | 23.00 | 0.00 |

| Shares outstanding (diluted) in Million | 471.96 | 475.01 | 476.40 | 477.80 | 477.64 |

Source: Company filing and Fun Trading analysis.

Analysis: Revenues, Free Cash Flow, Net Debt

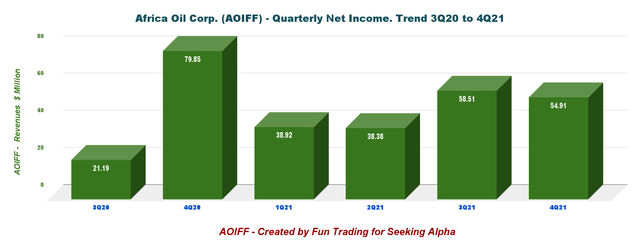

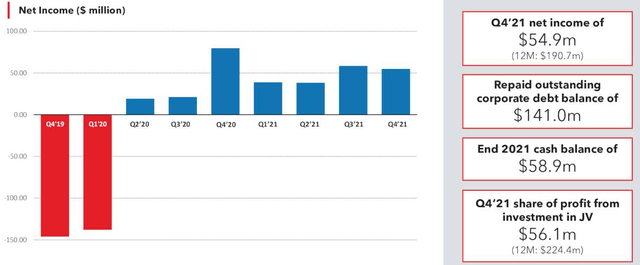

1 – Quarterly Net Income was $54.91 million for 4Q21

AOIFF: Chart Quarterly net income history (Fun Trading)

The quarterly net income was $54.91 million in 4Q21, down from $79.85 million in 4Q20.

AOIFF: 4Q21 Financial Highlight Presentation (Africa Oil)

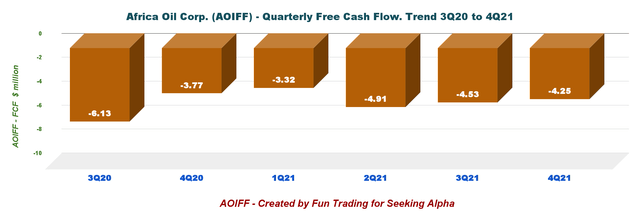

2 – Free cash flow was a loss of $4.25 million in 4Q21

AOIFF: Chart Quarterly Free cash flow history (Fun Trading)

Note: Free cash flow is the cash from operations minus CapEx.

As I said in my preceding article about Africa Oil Corp., the free cash flow is not very meaningful because the only source of income is the dividends received from its Prime ownership.

The trailing 12-month free cash flow is a loss of $17.01 million, with a loss in free cash flow for 4Q21 of $4.25 million.

3 – The company has no long-term debt at the end of December.

AOIFF: Chart Quarterly Cash versus Debt history (Fun Trading)

As of December 31, 2021, Africa Oil Corp. had total cash of $58.51 million and no long-term debt.

CFO Pascal Nicodeme said in the conference call:

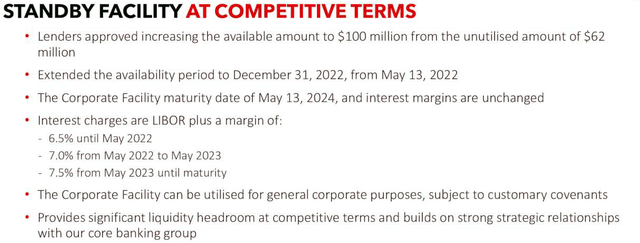

I think at that level, I think that the main achievement has been, as I mentioned, the full repayment of our debt facilities. And on top of that, we managed to increase the availability under our corporate facility up to $100 million, which is available for general corporate purposes including acquisitions.

AOIFF: Standby Facility Presentation (Africa Oil)

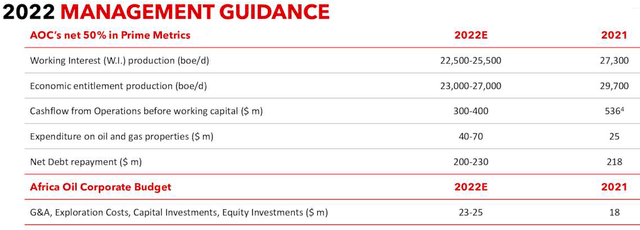

4 – 2022 Guidance and Outlook

AOIFF: Management 2022 Guidance (Africa Oil) AOIFF: 2022 Outlook Presentation (Africa Oil)

Technical analysis and commentary

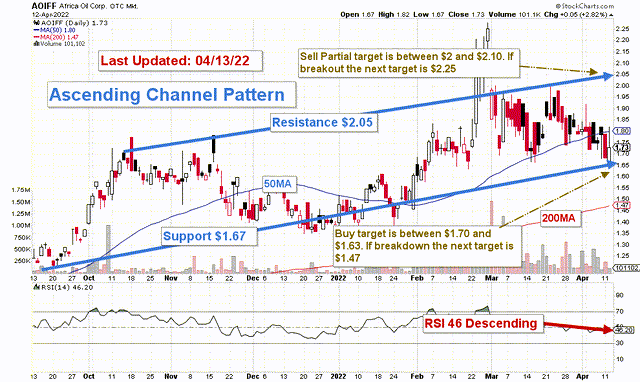

AOIFF: TA Chart short-term (Fun Trading)

AOIFF forms an ascending triangle pattern with resistance at $2.05 and support at $1.67. The trading strategy is to keep a core long-term position and trade short-term LIFO using the stock volatility and oil price cyclicity.

I recommend selling about 55%-65% of your position between $2 and $2.10. If the stock turns bullish, the following upper target is $2.25. Conversely, if the stock turns bearish later in 2Q22, AOIFF could drop below $1.47 and as low as $1.25.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Author’s note: If you find value in this article and would like to encourage such continued efforts, please click the “Like” button below as a vote of support. Thanks!

Be the first to comment