Falcor/iStock via Getty Images

We’re nearing the start of the Q1 earnings season for the Gold Miners Index (GDX), and one of the first companies to report its preliminary results is Eldorado Gold (NYSE:EGO). Unfortunately, the company had a tough start to the year, reporting a 16% decline in gold production vs. Q1 2021 levels due to COVID-19-related headwinds. This has set the company up for a soft Q1 report at month-end, with revenue likely to come in below $190 million. So, with Eldorado’s short-term extended into this report, I don’t see any reason to chase the stock above $12.25.

Lamaque Operations (Company Technical Report)

Eldorado Gold released its preliminary Q1 results this week, reporting quarterly production of ~93,200 gold-equivalent ounces, a ~16% decline on a year-over-year basis. This was driven by COVID-19-related headwinds at the company’s operations, which led to elevated levels of absenteeism across the board. Unfortunately, this will dent Eldorado’s revenue growth on a year-over-year basis, with the higher realized gold price not nearly offsetting what should be a mid-double-digit percentage decline in gold sales. Let’s take a closer look below:

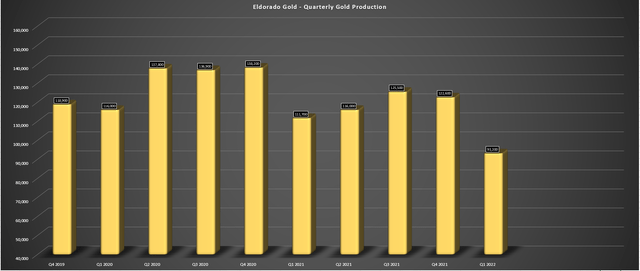

Eldorado Gold – Quarterly Gold Production (Company Filings, Author’s Chart)

As the chart above shows, Q1 was not a great quarter for Eldorado, and while the company typically sees its lowest production in Q1, this was the weakest quarter in more than two years for the company. This softness was widespread, with production at Olympias down more than 30% year-over-year, production at Efemcukuru down 10%, and production at Kisladag down 35%. The only asset with higher production was Lamaque, but the asset was coming up against very easy year-over-year comps, so it was a breeze for the asset to beat its Q1 2021 performance (~28,800 ounces).

As discussed by the company, January and February production saw much higher than anticipated absenteeism rates related to rising cases from the Omicron Variant. At Lamaque, this delayed the underground development of high-grade stopes, impacting both grades and tonnage in the quarter. At Kisladag, the asset had to deal with elevated absenteeism and a government-mandated power outage and severe weather, offsetting any early gains from the completion of its high pressure grinding rolls circuit. Finally, at Olympias, the company dealt with absenteeism and power outages related to severe weather.

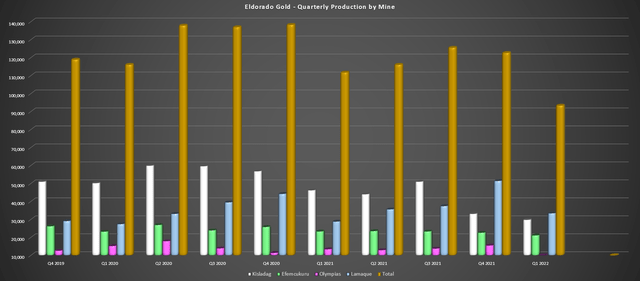

Eldorado Gold – Quarterly Production by Mine (Company Filings, Author’s Chart)

Given the severe headwinds, it’s no surprise that production was down at nearly every operation, with Kisladag logging its worst quarterly performance in years, with just ~29,800 ounces produced. The performance at Olympias was just as disappointing at ~9,000 GEOs, down from a trailing-twelve-month average quarterly production profile of ~13,900 GEOs. Finally, while grades and throughput were in line with expectations at its Turkish Efemcukuru Mine despite COVID-19 related absenteeism, production was down year-over-year as well.

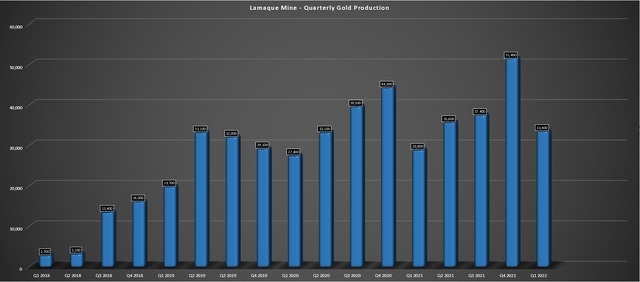

Lamaque – Quarterly Gold Production (Company Filings, Author’s Chart)

Moving to Lamaque, we can see that gold production was up year-over-year but fell sharply from the record production of ~51,400 ounces in Q4. This sequential dip is not surprising due to the difficult comps and the fact that Lamaque’s first quarter has generally been its weakest (2018, 2019, 2020, & 2021). However, while some might be disappointed, it’s important to note that the recent technical report paints a very bright future for Lamaque. Hence, there’s no reason to get hung up on the soft Q1 results.

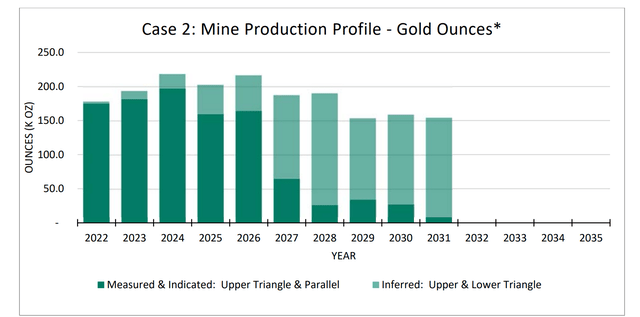

Lamaque Production Profile (Case 2) (Company Technical Report)

In fact, under the Case 2 Assumption, which includes base case projections with the addition of inferred resource material from Upper Triangle and Lower Triangle, Lamaque would produce just shy of 200,000 ounces next year and average more than 205,000 ounces in FY2024-FY2026. This would represent a ~50,000-ounce quarterly run rate, which is ~50% above the most recent quarterly figure. So, while the company has certainly limped into 2022 and has its work cut out for it, the Q1 performance is not an accurate assessment of its assets’ potential. Importantly, production normalized in March, and Lamaque should produce over 165,000 ounces this year.

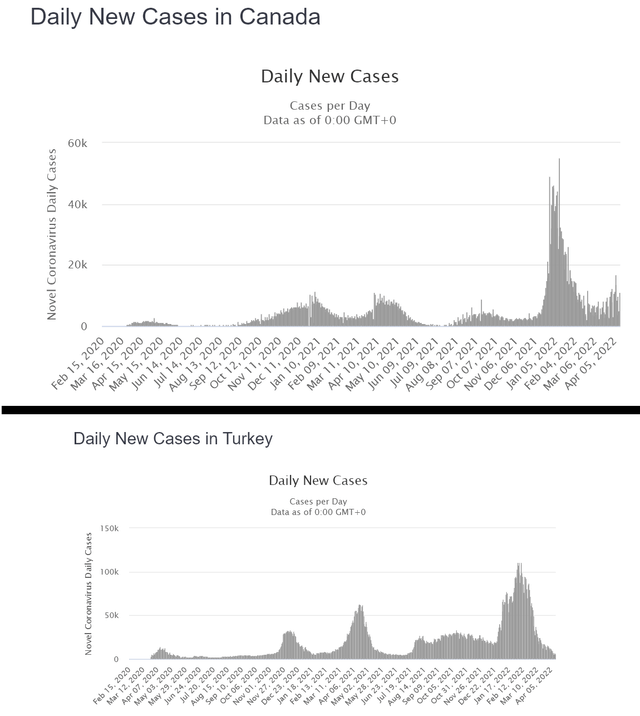

COVID-19 Cases – Turkey & Canada (Worldometers.info)

Barring additional weather headwinds, Eldorado looks to be much better positioned heading into Q2, with COVID-19 cases plunging from their February highs in both Turkey and Canada. This should help with elevated absenteeism levels witnessed in the first half of Q1 at Efemcukuru, Lamaque, and Kisladag, (the company’s three largest operations). Finally, at Olympias, while cases are still relatively high in Greece, they are down more than 50% from their peak of ~45,000 cases to just below ~20,000 cases. Therefore, this operation should have an easier Q2 ahead.

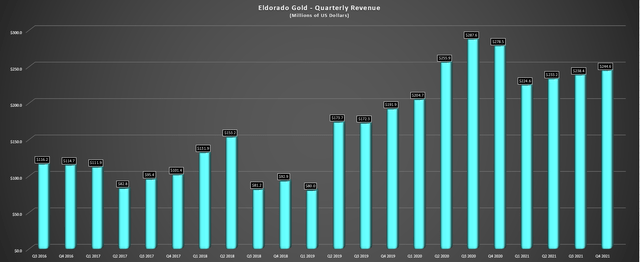

Financial Results

Looking at Eldorado’s revenue trend below, we can see that quarterly revenue rose for the third consecutive quarter in Q4, helped by a strong finish to the year and slightly higher gold prices. Previously, I had expected Eldorado to report an increase in revenue in Q1 2021, given that it was up against very easy year-over-year comps (average gold price: $1,723/oz) with a strong start to the year for gold. However, even if the company enjoyed an average realized gold price of ~$1,870/oz in Q1, this would still translate to a sharp decline in revenue year-over-year in Q1 for Eldorado.

This is because, assuming the company’s gold sales are similar to its production levels (~93,200 GEOs), sales will decline more than 15% (Q1 2021: ~113,600 ounces), more than offsetting the higher gold price. This could lead to a negative reaction on earnings, with the company likely to miss sales and earnings estimates. So, paying up for the stock here at $12.20 ahead of its earnings at month-end may backfire.

Eldorado Gold – Quarterly Revenue (Company Filings, Author’s Chart)

The good news is that Eldorado has stuck to its FY2021 guidance of ~475,000 GEOs, which would translate to flat production year-over-year. Meanwhile, the higher expected gold price should more than offset the increased costs based on its guidance mid-point. So, from a margin standpoint, Eldorado may have a soft Q1 report, but it should see margin expansion this year and higher revenue on a full-year basis. Combined with the catalyst of a potential development decision at Skouries and organic growth at other assets like Lamaque, there’s a lot to like about this story long-term.

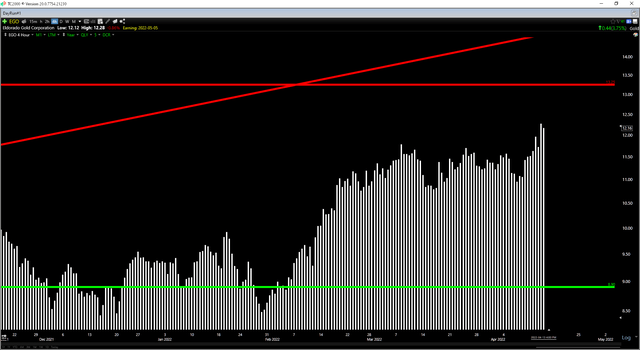

Technical Picture

As the chart above shows, Eldorado had a solid run over the past few months and is now up more than 35% from the low-risk buy point at $8.55, which I highlighted in December. However, while the stock has confirmed positive momentum, which favors sharp dips being bought, the stock is now beginning to get a little extended short term, sitting in the top one-fourth of its expected trading range. This is based on the stock having resistance at $13.25 and no strong support until $8.90.

From a current share price of $12.15, this translates to an unfavorable reward/risk ratio of 0.34 to 1.0. This is based on $1.10 in potential upside to resistance and $3.35 in potential downside to support. The less favorable ratio does not mean that the stock can’t continue to trade higher, and it’s certainly possible that we could see a push above the $13.00 level this year. However, given that I generally prefer a minimum 4 to 1 reward/risk ratio to justify entering new positions, the stock is nowhere near a low-risk buy point at current levels. Hence, I am Neutral short term.

Eldorado Operations – Gold Pour (Company Presentation)

Eldorado Gold had a tough start to the year, and while the company has not cut its guidance, we could see some relatively weak Q1 results even with the benefit of a higher gold price. So, with the stock being short-term extended heading into this report, it’s possible we could see some mean reversion. However, given that Eldorado is a solid organic growth story, with Skouries looking even better at current copper prices, I would view sharp pullbacks as buying opportunities.

Be the first to comment