RomoloTavani/iStock via Getty Images

Economic risks are certainly rising right now. The war in Ukraine has meaningfully impaired the global economy by disrupting global food and energy supply chains while the severity of western sanctions on Russia have included freezing the foreign reserves of the Russian central bank. As a result, Russia has responded by placing a gold price floor on its own currency and is no longer accepting Euros or Dollars as payment for its exports, instead demanding Russian Rubles or gold (GLD) as payment. If this trend spreads, it could signal the end of the U.S. Dollar’s role as the global reserve currency, which could have enormous inflationary and overall negative impacts for the U.S. economy.

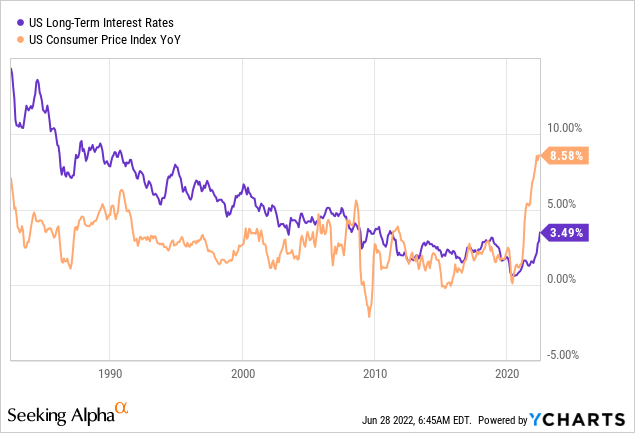

On top of that, inflation rates are already at multi-decade highs even as interest rates remain near historic lows, implying that the Federal Reserve is very likely to continue raising interest rates for the foreseeable future in attempt to rein in inflation:

However, given that GDP already shrank in Q1 and that global supply chain issues persist, it is quite possible that this will break the back of the economy and send us spiraling into recession. This is not just our opinion; it is the opinion of a large and growing number of business executives and leading economists, including the likes of Ray Dalio, Bill Gates, Elon Musk, and Larry Summers.

All of these factors have lead most Americans to believe that we are actually already in a recession. As Newsweek recently reported:

The latest IBD/TIPP Economic Optimism Index published on Friday found that 53 percent of Americans think the economy has gone into a recession, and 25 percent say they’re unsure. Only 20 percent believe the country is not in a recession.

Even amid uncertainty, concerns have dramatically risen over the last month. Back in May, less than half of Americans—48 percent—said the economy was in a downturn while 23 percent said the U.S. was not in a recession.

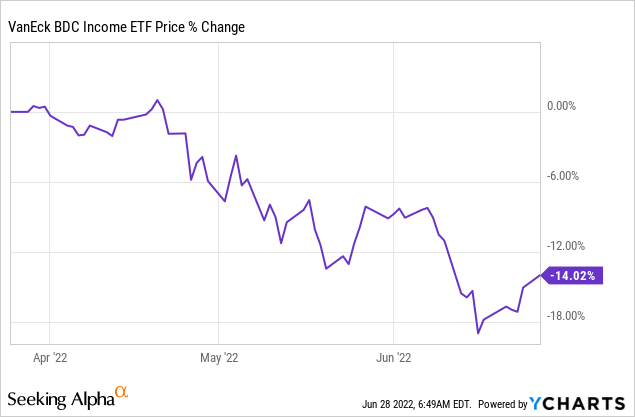

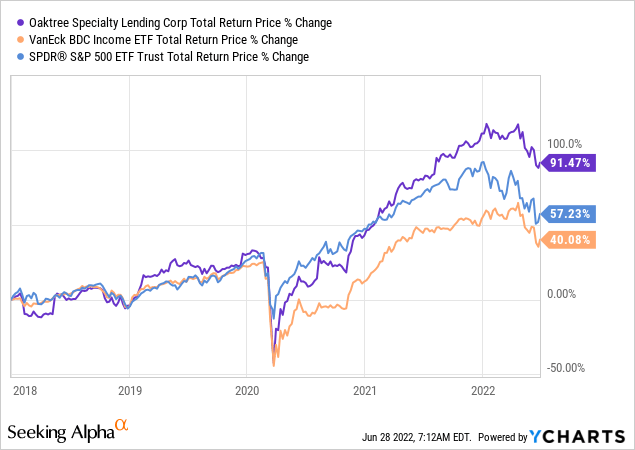

Given these factors, the stock prices of Business Development Companies (BIZD) – highly leveraged instruments with riskier counterparties – have taken a hit:

As a result, it is a time where insisting on quality in BDC investment choices is essential to ensure success regardless of the macro outcome. In this article, we discuss two of our top quality picks in the BDC space at the moment.

#1. Ares Capital Corp (NASDAQ:ARCC)

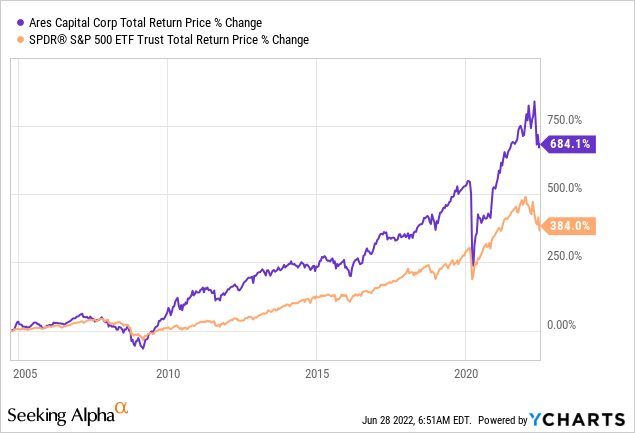

ARCC has a phenomenal track record of not only outperforming its fellow BDCs, but also of crushing the overall stock market (SPY) since inception despite going through both the Great Financial Crisis and the COVID-19 crash:

Its long-term success is no accident and largely stems from the following factors:

- Superior risk-adjusted underwriting thanks to support from its parent Ares Management Corporation (ARES), which boasts a global alternative asset investment presence, substantial knowledge, and capital, and business network scale which gives ARCC access to superior deal flow and economic insights.

- Prudent dividend payout policies which have enabled the company to maintain its dividend payout and even grow it steadily over time.

- Disciplined balance sheet management, balancing maximizing returns on equity with protecting the company against downside risk and maintaining flexibility to respond opportunistically to market dislocations.

- Strategic use of capital markets. By pursuing and maintaining an investment grade credit rating and achieving massive scale, ARCC is able to take on debt at very attractive rates. On top of that, whenever ARCC’s share price has commanded a meaningful premium to NAV and management has attractive places to invest capital, it has strategically issued equity along with cheap debt in order to grow earnings per share. Meanwhile, when ARCC’s share price has strayed too far below NAV, management has occasionally repurchased equity in order to arbitrage the discounted price of its own holdings.

ARCC continues to thrive on all four of these fronts and remains well-positioned to weather upcoming macroeconomic challenges. While a recession is never fun and make no mistake that a severe and prolonged downturn will undoubtedly hurt ARCC’s nonaccrual performance and could possibly even force them to cut their dividend, we are still bullish on the stock on a risk-adjusted long-term level.

In its most recent quarterly results, management reported NAV per share continuing to grow (0.4% sequentially and 9% year-over-year) despite paying out a very substantial dividend, the balance sheet remained a source of strength with ~$5.9 billion in total liquidity, and investment performance remained strong with a nonaccrual rate at cost of just 1.2% (compared to ARCC’s already solid 10-year average of 2.5%).

On top of that, ARCC’s CEO clearly believes that ARCC is well-positioned to benefit from a rising interest rate environment. He said on the Q1 earnings call:

As of quarter end, holding all else equal and after considering the impact of income-based fees, we calculated that a 100 basis point increase in short-term rates could increase our annual earnings by approximately $0.23 per share, a 14% increase above this quarter’s core EPS run rate.

A 200 basis point increase in short-term rates could increase our total annual earnings by approximately $0.44 per share, a 26% increase above this quarter’s core EPS run rate.

Since then, the Federal Reserve has hiked interest rates meaningfully and appears poised to continue doing so.

Even more importantly, management followed that statement up with the following:

We also do not expect that a projected increase in rates will result in deteriorating credit performance, particularly given our strong starting point with portfolio weighted average interest coverage of nearly 3 times. What this means is that holding all else equal, including the leverage at the borrower level, short-term base rates would need to rise above 3% before aggregate interest coverage would dip below 2 times, which is similar to the 5-year pre-pandemic weighted average of 2.3 times.

For investors looking for a proven management team that has delivered enormous returns across cycles and a business model that is poised to benefit from rising interest rates without taking on inordinate amounts of risk, it is hard to top ARCC. As an additional bonus, ARCC’s price to NAV is currently at a 4.15% discount, making it a compelling value as well.

#2. Oaktree Specialty Lending (NASDAQ:OCSL)

OCSL is another high quality BDC in large part due to the impressive credentials of its manager: Oaktree Capital (OAK), led by the legendary Howard Marks. The company has achieved an impressive track record of generating double-digit annualized returns as a lender despite operating in an environment with historically low interest rates. Its secret to success is investing successfully in high interest rate distressed debt while maintaining a maniacal focus on its motto:

If we avoid the losers, the winners will take care of themselves.

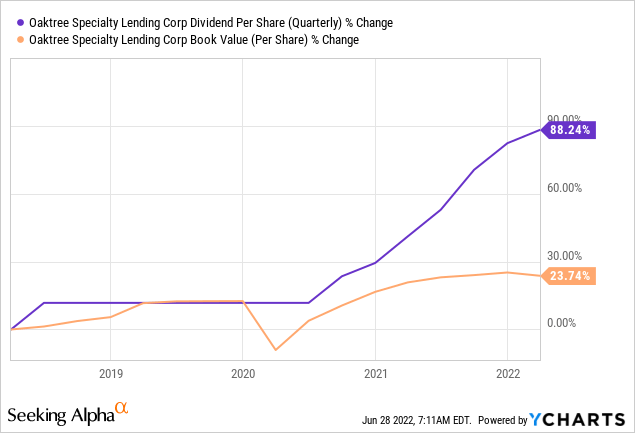

Since assuming control of the BDC in late 2017, OAK has driven substantial outperformance as well as book value per share and dividend per share growth:

As a result, it should come as little surprise that OCSL has crushed the broader BDC sector and stock market over that span:

Moving forward, we expect this outperformance to continue as OCSL’s recent quarterly results indicated that the company is well-positioned for what lies ahead. For example, it grew adjusted net investment income per share by 5.9% on a sequential basis, prompting management to hike its dividend for the 8th quarter in a row at a 3.1% pace while still maintaining 1.09x dividend coverage.

On top of that, thanks in part to support from its OAK origination platform providing it with exclusive loans, OCSL was able to originate $220 million in new investment commitments.

OCSL is also well prepared to benefit from rising interest rates as 90% of its loan portfolio has floating interest rates while the balance sheet debt consists primarily of fixed rate interest rates and the overall weighted average interest rate is just 2.5%. OCSL also has nearly $500 million in total liquidity thanks in part to issuing 2.6 million shares at a premium to NAV during the quarter, which is substantial for a BDC with a market cap of just $1.19 billion.

Now that the share price has pulled back to trade at a 10.33% discount to NAV, its decision to issue shares at a premium to NAV looks especially prudent now as management could decide to simply repurchase those shares now, thereby creating value for shareholders without having to successfully deploy any of that capital into new loans.

Last, but not least, OCSL continues to post stellar underwriting results with no loans on nonaccrual status and its investment portfolio currently consists of 86% senior secured debt and only 4% of the portfolio invested in equity. The company also has a large and growing portfolio of recession-resistant life sciences loans that it expects to help it achieve risk-adjusted outperformance through the current macroeconomic environment.

Investor Takeaway

It is a scary world out there for investors in general, and BDC investors in particular. With the inflation raging, interest rates rising, and recession risks growing by the day, the smaller-sized and higher-leveraged counterparties for most BDC investments could be at risk of defaulting on their loans from BDCs.

As a result, insisting on quality in terms of track record, balance sheet strength, and most of all loan portfolio quality is essential right now. In ARCC and OCSL, investors get proven management teams combined with investment grade balance sheets and stellar underwriting performance trading at a discount to NAV and offering sky-high dividend yields. As a result, we think both are compelling Buys at the moment.

Be the first to comment