Vladimir Vladimirov/E+ via Getty Images

Investment Thesis

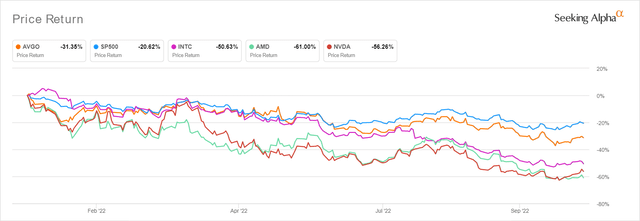

Broadcom (NASDAQ:AVGO) has been a gem during these extreme recessionary fears, since it continues to boast a 5Y Total Price Return of 114.2% and 10Y Return of 1,638.3%, despite a -31.35% retracement YTD. Nonetheless, the stock market continued to be flippant over the past few weeks, proving volatile to the slightest bit of negative news, with the S&P 500 Index already plunging below its June lows thrice. The latter is also set for another moderate retracement ahead, triggered by the underperforming FAANG earnings this week and semiconductor stocks ahead.

Combined with 85.5% of analysts projecting another 75 basis points hike in the Fed’s next meeting by 02 November and likely in December as well, we may, unfortunately, be in for more pain ahead. That is if October and November PPI/CPI/ labor market continues to report sticky inflation rates, as witnessed for September 2022. However, we reckon that most of the pessimism is already baked in, since Mr. Market is already expecting a raised terminal rate beyond 5%, with the stock market already overly battered thus far.

Therefore, investors with higher risk tolerance and long-term trajectory should definitely load up at this deep pullback, since the stock will likely rally once the Feds pivot. However, bottom-fishing investors who choose to wait for the low $400s, may just get lucky and be rewarded with stellar dividend yields of 4.51% by FY2024, against its 4Y average of 3.23% and sector median of 1.44%. May the force be with us all.

AVGO Proves Why It Deserves A Higher Valuation Ahead

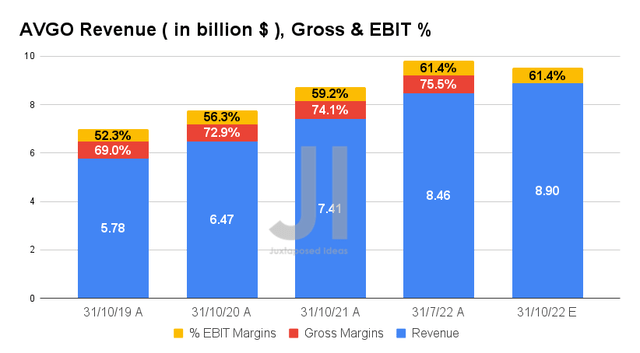

In its upcoming FQ4’22 earnings call, AVGO is expected to report revenues of $8.9B and an EBIT margin of 61.4%, representing an increase of 5.2% and inline QoQ, respectively. Otherwise, an excellent YoY growth of 20.1% and 2.2 percentage points, respectively, indicating the company’s impressive operating efficiencies thus far. In the last twelve months (LTM), the company reported $10.9B of operating expenses and $1.19B of Stock-Based Compensation, marking a tremendous moderation of -8.01% and -31.21% sequentially. Naturally, pointing to the management’s stellar leadership.

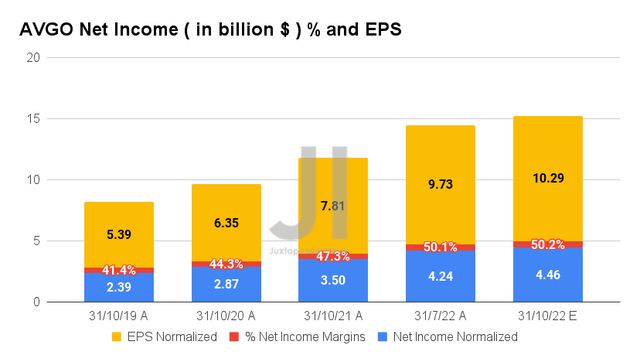

Thereby, improving AVGO’s profitability, with analysts projecting net incomes of $4.46B and net income margins of 50.2% in FQ4’22, representing an increase of 5.18% and relatively in line QoQ, respectively. Otherwise, a remarkable YoY growth of 27.42% and 2.9 percentage points, respectively, despite the tougher YoY comparison of 21.95% growth in FQ4’21. Naturally, we will see the company report superior FQ4’22 EPS of $10.29, indicating an increase of 5.75% QoQ and 31.75% YoY.

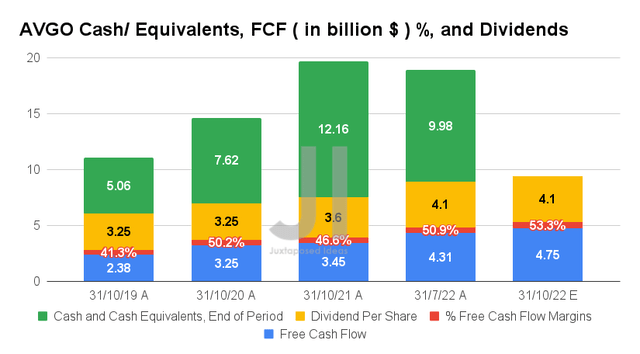

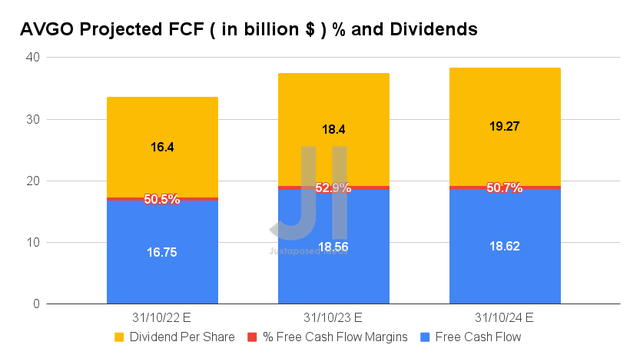

AVGO is also expected to improve its Free Cash Flow (FCF) generation by FQ4’22, with an FCF of $4.75B and an FCF margin of 53.3%. It indicates excellent QoQ growth of 10.2% and 2.4 percentage points, respectively. Otherwise, an increase of 37.68% and 6.7 percentage points YoY, respectively. Impressive, since the company has also been competently deleveraging by -12.97%, from peak long-term debt levels of $45B in FQ2’20 to $39.16B by FQ3’22. This is also on top of its $6.8B dividend payouts and $8.43B in share repurchases over the LTM, with a robust war chest of $9.98B in cash and equivalents on its balance sheet by FQ3’22.

In the meantime, consensus estimate that AVGO will similarly pay out $4.1 in dividends for the next quarter, indicating an increase of 13.88% YoY. However, we are more optimistic with a speculative $4.66 payout, assuming another 13.9% hike then. We shall see, since that would indicate an excellent 4.09% forward yield.

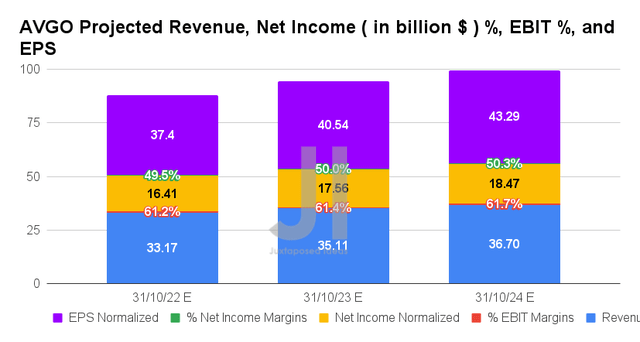

Over the next three years, AVGO is expected to report revenue and net income growth at an excellent CAGR of 10.2% and 13.7%, respectively, despite the perceived destruction of demand and impending recession. It is impressive that the company is still projected to sustain its previous hyper-pandemic growth of 10.2% and 15.3%, since these will also contribute to the continuous expansion of its profit margins.

By FY2024, AVGO is expected to report stellar EBIT and net income margins of 61.7% and 50.3%, compared to FY2021 levels of 58%/45.8% and FY2019 levels of 52.8%/41.8%, respectively. Thereby, naturally boosting its EPS at a CAGR of 15.6% through FY2024, to reach $43.29, compared to FY2021 levels of $28.01 and FY2019 levels of $21.29.

Furthermore, AVGO will also report improved FCF generation with margins of 50.7% in FY2024, compared to FY2021 levels of 48.5% and FY2019 levels of 41%. Thereby, naturally expanding its dividend payouts to $19.27 by FY2024, indicating a stellar yield of 4.23% then based on current stock prices, compared to its 4Y average of 3.23% and sector median of 1.44%.

AVGO YTD Stock Price

It is no wonder then, that the AVGO stock had only suffered minimally compared to other semiconductor companies at a -31.35% plunge YTD, compared to Advanced Micro Devices (AMD) at 61%, Nvidia (NVDA) at 56.26%, and Intel (INTC) at -50.63% at the same time. This is naturally attributed to the peak FUD levels in the stock market, instead of its fundamental performance. Drown out the noise.

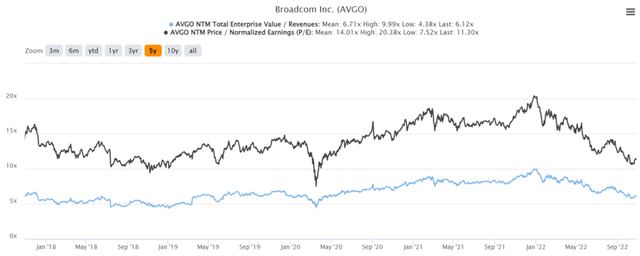

So, Is AVGO Stock A Buy, Sell, Or Hold?

AVGO 5Y EV/Revenue and P/E Valuations

AVGO is currently trading at an EV/NTM Revenue of 6.12x and NTM P/E of 11.30x, lower than its 5Y mean of 6.71x and 14.01x, respectively. Discounting the brief plunge during the start of the COVID-19 pandemic, the stock is currently trading at its lowest P/E valuation point in the past four years, indicating its notable undervaluation. The stock is also trading at $455.40, down -32.80% from its 52 weeks high of $677.76, though at a premium of 9.55% from its 52 weeks low of $415.07.

Nonetheless, consensus estimates remain bullish about AVGO’s prospects, given their price target of $668.00 and a 46.68% upside from current prices. Who wouldn’t, given its stellar profitability ahead?

Therefore, we rate AVGO stock as a Buy during this pullback, since it will naturally rally once the Fed pivots. The time may come sooner than later, since multiple market traders are already seeing early signs of a reversal in inflation rates. Thereby, potentially pointing to the stock market’s near-bottom levels here. Do not miss the boat.

Be the first to comment