SvetaZi/iStock via Getty Images

Investment Thesis – Speculative Wynn In The Long-Term

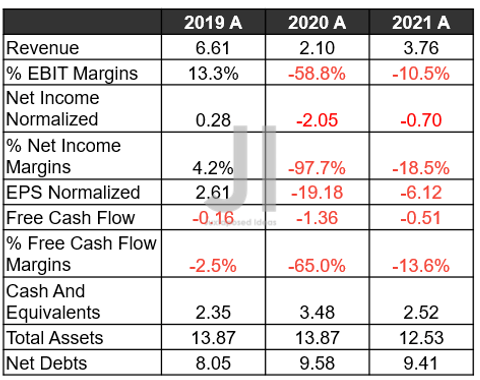

Wynn’s Financial Performance Through The Pandemic

S&P Capital IQ

Realty Income Corporation’s (NYSE:O) recent acquisition of Encore Boston Harbor and Casino from Wynn Resorts (NASDAQ:WYNN) was met with much skepticism from its investor base. This is due to the odd fit of the gaming property amongst the former’s established commercial portfolio. The latter’s financial performance was obviously decimated during the pandemic, with the company still reeling in the red thus far. By FQ3’22, WYNN reported operating incomes of -$49.99M and operating margins of -5.6%, against FQ3’19 levels of $177.84M and 10.8%. It is no wonder that the latter had to aggressively downsize its assets by approximately -24.11% since FQ3’19, while increasing its reliance on debts by 22.82% at the same time.

Then again, O had technically received an excellent -34.61% discount on the acquisition at $1.7B, given the original built cost of $2.6B in 2019. With the triple net lease agreement, the company is also absolved of any supposed maintenance or facelift usually needed every five or ten years in the hotel and casino industries. Thereby, alleviating most risks from the relatively cheap lease agreement, significantly aided by the property’s excellent $210M in annual EBITDAR profits. The transaction is also completed at a 5.9% cash cap rate, highly reasonable compared to O’s FY2021 levels of 5.5% and FQ3’22 levels of 6.1%.

Furthermore, the Fed’s rate target has been established at 2%, indicating that continuous hikes will occur until the rising inflation is successfully tamped down to Jerome Powell’s satisfaction. Combined with market analysts’ projection of a 2% rate achieved by 2025, we do not expect much lingering issues for this particular transaction, since an annual rent growth of greater than 1.75% capped at 2.5% is built into the contract between years eleven and thirty. Naturally, these are optimistic speculations, since the 30Y break-even inflation rate is currently priced at 2.4%, potentially indicating minimal protection over the next three decades, if the inflation remains elevated and the option is exercised.

On the other hand, O will be also collecting a total of $3.9B in rental over the next 30 years, assuming a fixed 1.75% rate throughout. Otherwise, $3.98B based on 2% after the fixed ten years, or $4.14B based on 2.5%. Not too bad actually, since it is part of the company’s planned acquisition volume of over $6B for FY2022, with $5.1B already reported by FQ3’22.

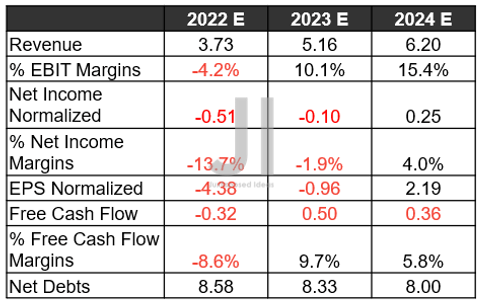

Wynn’s Projected Financial Performance

S&P Capital IQ

In addition, WYNN could achieve its prior financial health by 2024, with market analysts projecting similar or expanded margins compared to 2019 levels. Notably, its net debt levels may normalize to pre-pandemic levels, pointing to the company’s much-improved balance sheet and liquidity then. Thereby, alleviating the bankruptcy concerns voiced by O’s investors.

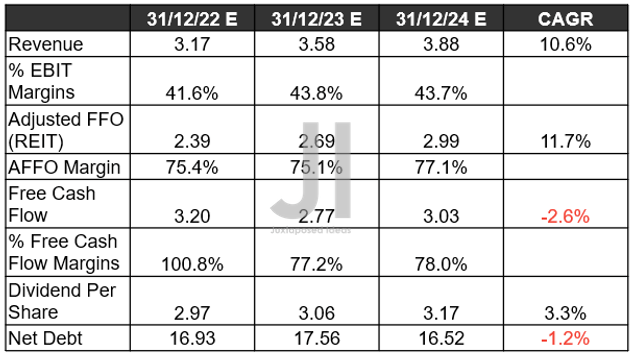

O Will Continue Expanding Its Profitability, Despite The Growing Bearish Sentiments

O Projected Revenue, EBIT %, AFFO %, FCF ( in billion $ ) %, Dividends, and Debt

S&P Capital IQ

Despite the bearish tone in the market, O continues to deliver an excellent FQ3’22 earnings call. Therefore, it is no wonder that market analysts have confidently upgraded its top-line growth through 2024 by 12.46% since our previous article in October 2022, while also expanding its AFFO margins to 77.1% at the same time. Impressive indeed, against 74.16% in 2019 and 76.95% in 2021.

Furthermore, O’s dividends payout remains safe ahead, due to the steady expansion in its cash flow margins to 78% in 2024, against -178.5% in 2019 and 66.5% in 2021. Thereby, extending the stellar 629th consecutive monthly dividends paid out by November 2022 through the uncertain macroeconomics ahead, against the sector median of 84 months. Its net debt will remain stable at these levels for the next two years as well, thereby tempering any temporary headwinds.

In the meantime, we encourage you to read our previous article, which would help you better understand its position and market opportunities.

- Realty Income: Load Up On Dips Before The Fed Pivots

- Realty Income: More Pain May Be Ahead – Recession Is A Real Concern

So, Is O Stock A Buy, Sell, Or Hold?

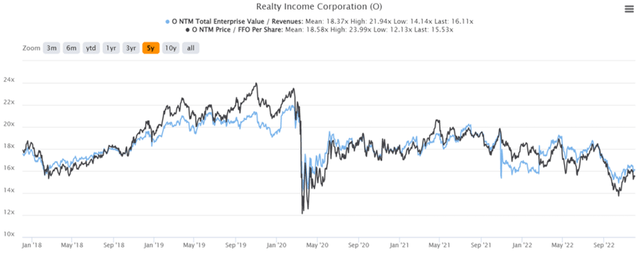

O 5Y EV/Revenue and P/E Valuations

O is currently trading at an EV/NTM Revenue of 16.11x and NTM Price/FFO per share of 15.53x, lower than its 5Y mean of 18.37x and 18.58x, respectively. Otherwise, still undervalued based on its YTD mean of 17.18x and 16.85x, respectively.

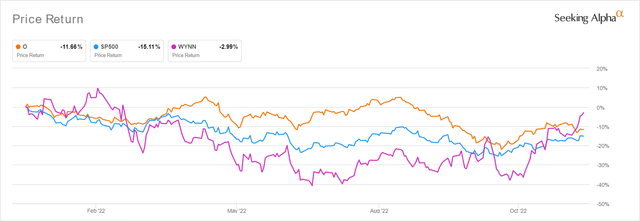

O YTD Stock Price

The O stock is also trading at $62.60, down -16.97% from its 52 weeks high of $75.40, though at a premium of 12.79% from its 52 weeks low of $55.50. It is evident that the consensus estimates are more apprehensive than expected, due to the continued downgrades from their original price target of $76.29 in September to $67.25 now, with the latter indicating a minimal 6.92% margin of safety. However, we reckon that the pessimism is overdone, since Mr. Market has also quietly upgraded the company’s top-line growth through 2024. Combined with Wynn’s return to profitability at the same time, the investment appears secure through the next thirty or sixty years, barring another catastrophic pandemic, of course.

While bottom-fishing investors may potentially wait for another mid $50s entry point, we are unsure when it will occur again, given Jerome Powell’s upbeat commentary. Naturally, it all hinges on favorable November CPI reports being released on 13 December, with 81.8% of market analysts already predicting a 50 basis points hike, potentially breaking the Feds’ previous four consecutive 75 points hikes. In the meantime, with terminal rates potentially raised to over 6%, we may see more uncertainties in the short term. Those volatile market conditions do not, however, diminish our confidence in the company’s future performance and profitability in the long run.

As a result, we continue to rate the O stock as a speculative Buy at these levels, significantly made sweeter by its 5.04% dividend yields by 2024. Naturally, portfolios should also be sized appropriately in the event of volatility.

Be the first to comment