koyu

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

GARP, 2023 Edition – Growth At Reasonable Profitability

Growth stocks inspire all manner of emotion, which is silly really. You just have to play the hand you are dealt. If the market is paying you to buy castles built on sand, as long as you sell them soon enough, who’s to argue? And if the market is paying you to own companies that extract value from oil sands, well, own those instead.

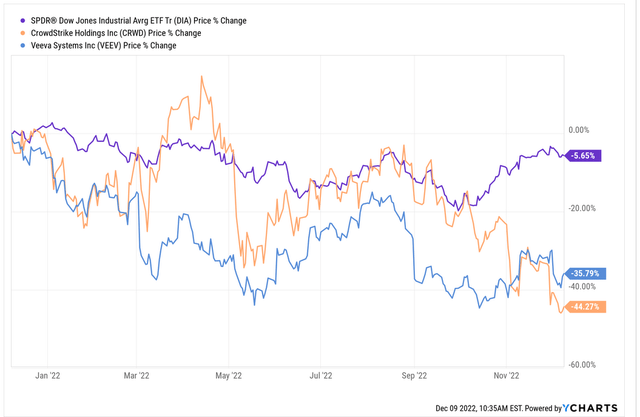

2022 has been brutal for even the best growth names – and by ‘best’ we mean stocks like CrowdStrike (CRWD) or Veeva Systems (VEEV) which enjoy sustained high rates of revenue growth, are mightily cashflow positive, have fortress-like balance sheets, and a year or more worth of revenue already signed up and in the order book. Despite which if you compare them to the Dow – the average company of which is a lot less impressive on fundamentals – here’s how 2022 has treated the best.

VEEV vs CRWD vs DIA (YCharts.com)

Yes folks, unbeknownst to many, the Dow is now just a few points below its all-time high. Its yikes-cat spike up and out of the October lows has been remarkable. We asked in June – can Papa Dow save you from the coming recession?

Cestrian Dow Analysis, June 2022 (Seeking Alpha)

And it seems the answer was a resounding yes. Up 14% on a total return (including dividends) basis since then, close to twice what the S&P would have paid you.

Rock star growth stocks however remain 30,40,50% down on the year, and again, that’s just the good ones!

The reason for this is, of course, multiple compression – the market is paying less for a dollar of revenue or a cent of earnings today than it was last year. And that’s because money is more expensive and there is less of it. Less money costing you more means don’t YOLO it all on some crazy growth name, instead, keep it close to home with Grandpa.

As inflation recedes and recessionary fears rise (no actual negative GDP growth yet that said), the likelihood that the Fed eases up on the punishment is increasing. By this, we don’t mean a sudden volte-face back to free money. But we do mean a slowing of the rate rises and a slowing of the balance sheet runoff. Together, this is likely to establish a new normal where money costs something rather than nothing, but not as much as people currently fear it will cost. And once that new normal is established, our guess is that stocks start to rise across the board once more.

The indices are all up off of the year’s lows and for now show no sign of revising them. Everyone is waiting for Apple (AAPL) to give up the ghost and take the Nasdaq with it, but that’s yet to actually happen in practice.

Will growth stocks be next to take off? And if so, which ones?

We have a systematic answer: those growth stocks that turn themselves from ‘unprofitable tech’ to ‘profitable tech’ in the eyes of the market are those which can rip up and out of the doldrums first and fastest. Our evidence for this claim is two recently-destroyed names, DocuSign (NASDAQ:DOCU) and MongoDB (NASDAQ:MDB). Both reported their Q3 earnings this week, for financial years ending 31 January 2023. Both delivered poor revenue growth, poor revenue guidance, and little growth in their deferred revenue and/or remaining performance obligation measures of the order book. In 2020 or 2021 that would be a recipe for the stock to crater, because other growth names would have been burning more brightly. In 2022 however, these stocks both moved up significantly on the earnings print; the immediate reaction was +20% (MDB) and +15% (DOCU). Why? Well, any number of reasons, of course, but the common factor between the two reports is that they signaled profitability ahead.

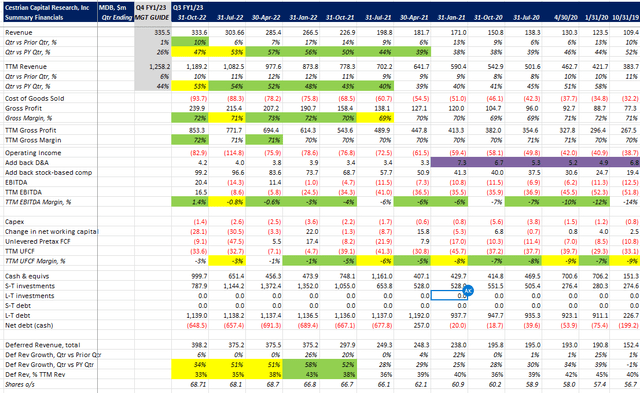

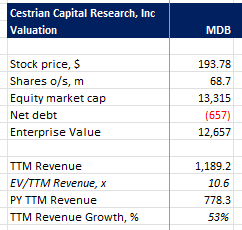

Here are MDB numbers.

MDB Fundamentals (Company SEC Filings, YCharts.com)

As you can see, nothing remarkable about this quarter. TTM EBITDA turned positive, but since cashflow margins stayed the same, that’s a so-what.

What got the market all excited about MDB was a relatively modest hike in guidance. In the Q2 release, MDB set their FY1/2023 guide to a midpoint of $1.2bn revenue for the year; this was just upped to a midpoint of $1258/$1259 which is less than a 5% raise, but such is the misery right now that 5% mattered. And what likely mattered more was the raise from a negative GAAP EPS to a positive GAAP EPS for the full year FY/23. Thus moving MDB from unprofitable tech to profitable tech, at least as measured by EPS.

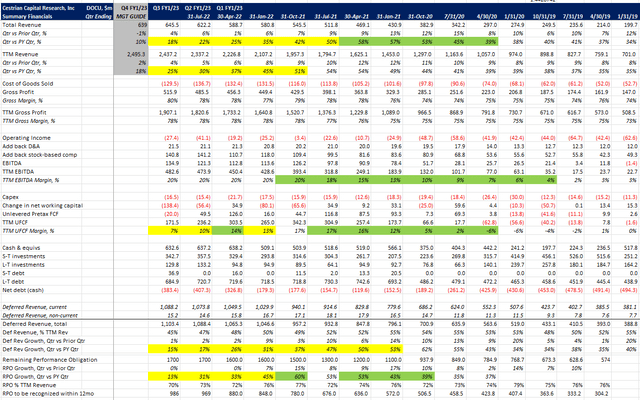

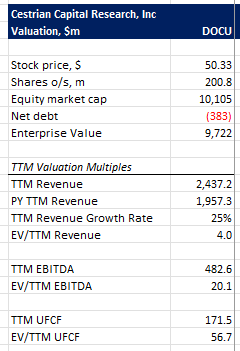

Now here’s DOCU.

DOCU Fundamentals (Company SEC filings, YCharts.com)

Note, although operating income was negative – specifically minus $27m – that is net of $28m of one-time restructuring costs. Which means that were it not for the restructuring, DOCU would have achieved its first-ever positive quarterly operating income. Which seems to have gotten a “Woot!” from shareholders.

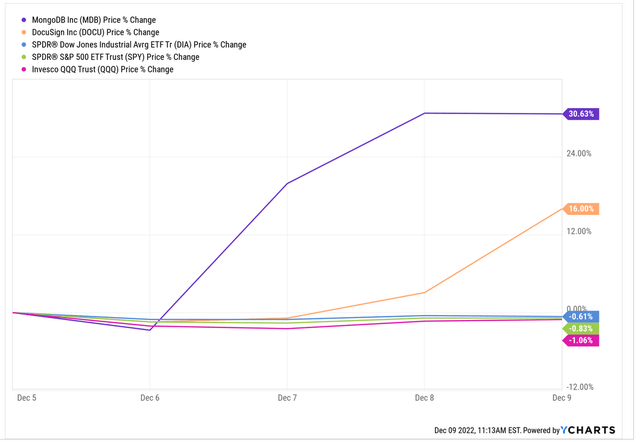

Here’s how MDB and DOCU reacted to their prints.

DOCU and MDB vs Indices this week (YCharts.com)

Sayonara, grandpa Dow! For now, at least.

Both names are valued reasonably on fundamentals, even after the pop. DOCU, at 4x TTM revenue for a likely >18% growth year in 2022, based on the management guide.

DOCU Valuation Analysis (Company SEC filings, YCharts.com, Cestrian Analysis)

And MDB at 11x TTM revenue for what should be at least a +44% growth year in 2022 (based on the management guide for Q4). More growth, bigger multiple, simple.

MDB Valuation Analysis (Company SEC filings, YCharts.com, Cestrian Analysis)

The charts of both names are a mess. The best you can say about DOCU is that its all-time lows have held as support. (Full page chart, here).

DOCU Chart (TrendSpider, Cestrian Analysis)

And if you can find any happiness in the MDB chart, it’s that it has held over the 78.6% Fibonacci retracement from the all-time highs back to a notional zero. (Yes, that is a thing). Full page chart, here.

MDB Chart (TrendSpider, Cestrian Analysis)

So if you want two fallen-angel growth stock picks for 2023, we own MDB and DOCU in staff personal accounts and believe they will move up significantly from here over the course of the coming year. More will follow. If you want to, er, ‘do your own research’ on this topic, just look for which former EPS-negative money hogs are telling the market in guidance – with some evidence – that they are going to be EPS positive in 2023. Not cashflow positive – forget that. Normally that counts more than EPS; but right now? It’s the sign that matters, not the reality. EPS is the sign. If you see an MDB type name up its guide from EPS negative to EPS positive? It’s likely a buy. And if you see a DOCU type name with a new-broom CEO taking a knife to costs with an eye to be EPS-positive? Also, likely a buy. In both examples, you still need them to grow revenue at let’s say mid-teens % year-on-year. So that’s your cut-out-and-keep guide. Mid-teens revenue growth rate, turning from EPS negative to EPS positive, Buy. See how that works out in the coming year!

Cestrian Capital Research, Inc – 9 December 2022.

Be the first to comment