PM Images/DigitalVision via Getty Images

Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on October 15th, 2022.

In the real estate investment trust space, there are many options that you can choose from to generate meaningful and growing income from dividends. One of the most popular ways is Realty Income (O), the monthly dividend company. Another choice that seems quite attractive with the recent market volatility is Agree Realty (ADC).

Both of these REITs operate in the retail space, where an economic slowdown would seemingly impact the tenants. However, most of the tenants in these REITs are strong financially, with large portions of them being investment-grade. The types of tenants that can withstand an economic recession. I’d even argue one’s that they are relatively more sheltered from economic slowdowns too.

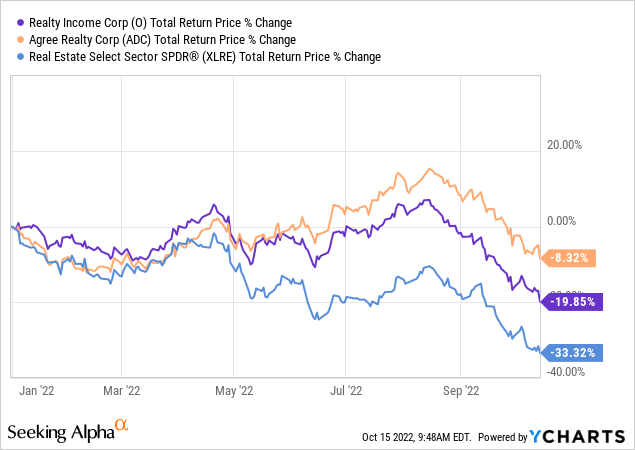

REITs have been getting slammed this year, as measured by Real Estate Select Sector SPDR (XLRE). This is despite inflation being high and generally seen as a good thing as it pushes up the valuations of properties. For what it’s worth, ADC has been holding up significantly better, and O certainly has been competitively strong, too, based on total returns YTD.

Ycharts

The downside of inflation is that inflation is too high, causing an aggressive Fed to raise interest rates. Not all REITs have particularly strong rent escalators either. They can be in the low 1 to 2% level. The other problem is that real estate prices have run up considerably and are now coming down despite inflation. They aren’t holding their value, at least not in the shorter term.

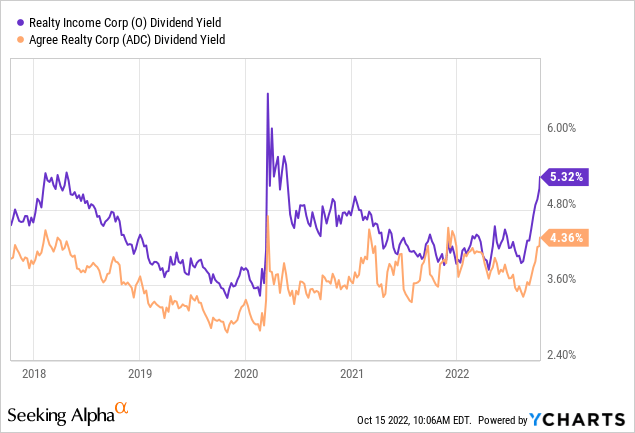

Also, just simply the fact that these are income-focused means that they are becoming less interesting. If one is only looking for a fixed income, Treasuries can now provide some competitive yields without any risk to the principal. If one doesn’t care about the prospects for potentially capital appreciation and rising income, then there are safer alternatives. The 10-Year Treasury last closed at just over 4% on October 14th.

Ycharts

Realty Income

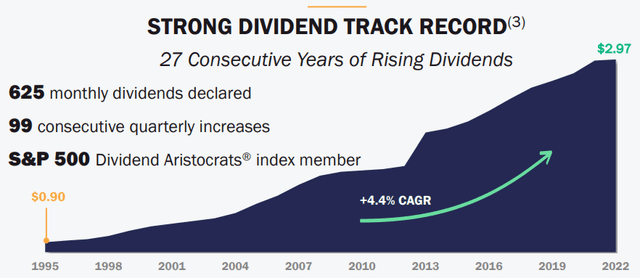

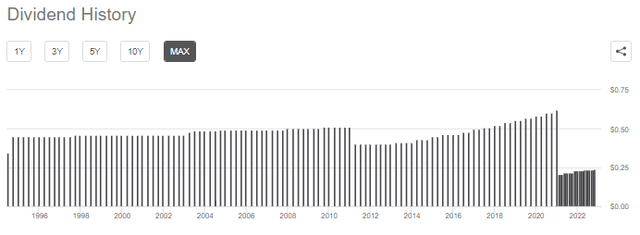

Realty Income boasts that 43% of their tenants are investment grade. O also has 53 years of operating history. So they’ve survived a recession or two. Throughout this time, they’ve continued to be able to focus on their strong balance sheet to produce a strong dividend track record. They have 27 consecutive years of rising dividends. I’d bet that next year will be almost guaranteed to make it 28 – whether we see no recession, a mild recession or even a deep recession.

O Dividend History (Realty Income)

In September, they announced another dividend increase. This was the 117th increase. These are small increases, but they really all add up.

While they’ve historically focused almost entirely on the U.S., that’s been changing as they push into Europe over the last few years. It can help diversify their portfolio and create new avenues for growth.

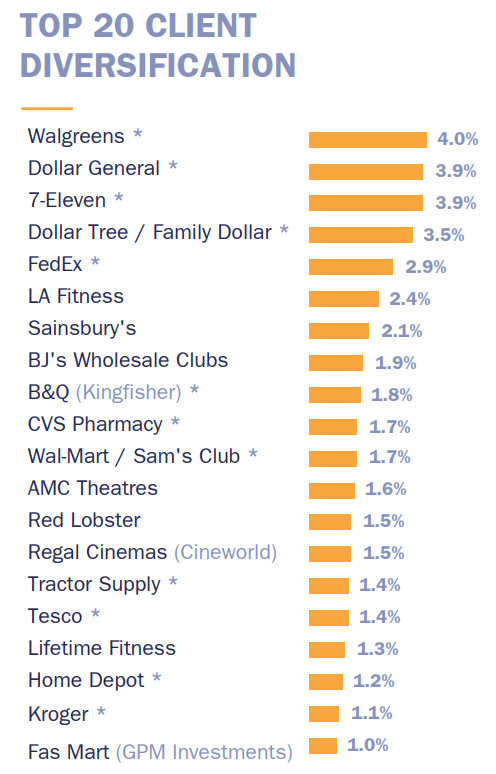

When looking at their tenants, is where we can see many operations that can work, even during an economic downturn. The gyms and theatres could be some sore spots where consumers would cut back. However, I suspect that dollar stores, pharmacies and other retailers such as Walmart (WMT) and Kroger (KR) are essential.

O Top Tenants (Realty Income)

They put the figure at “~94% of the total rent is resilient to economic downturns and/or isolated from e-commerce pressures.” That’s where theatres and restaurant chains can be isolated from e-commerce as those experiences you can’t order online. Though an understandable argument that streaming services could be seen as competition could easily be made.

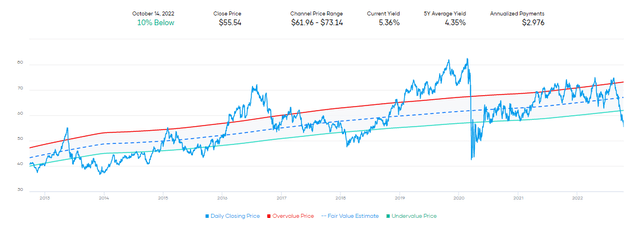

At the same time, interest rates and an overall sour market have led to shares of O collapsing. The shares are down nearly 27% from the 52-week high. In fact, O shares have just hit a new 52-week low. Looking back at its fair value estimate based on P/AFFO, we see that shares are trading quite cheaply.

O Fair Value P/AFFO Estimate (Portfolio Insight)

Certainly, the valuation should be lower due to higher interest rates and high inflation at this time. However, I believe, at this point, it is quite excessive.

Based on its average yield of the last decade, shares are undervalued on that basis too.

O Fair Value Yield Estimate (Portfolio Insight)

Agree Realty

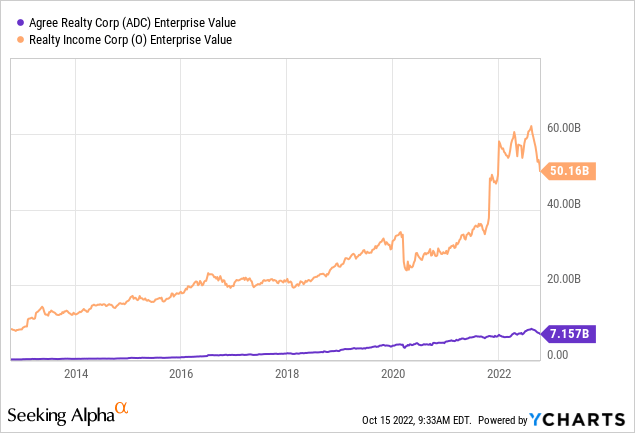

Agree Realty might be significantly smaller compared to O on an enterprise value basis. However, it, too, has a very promising future and trajectory. Part of this “promising future” is already written over the last decade. They’ve been executing and delivering to shareholders.

Ycharts

While they cut their dividend in 2011, they’ve been raising it since. It also wasn’t a significant cut, considering the economic conditions at that time.

ADC Dividend History (Seeking Alpha)

Since they’ve only grown stronger since then, the likelihood of another cut is quite minimal, in my opinion. Analysts believe that FFO is still anticipated to grow over the next several years. That includes 2023, where FFO is estimated to come in at $4.05.

They also just raised their dividend in October. Based on their latest monthly dividend of $0.24, annualized, that works out to $2.88. With that, we see that the FFO payout comes in at around 71%. That leaves them plenty of room for dividend coverage, even if FFO declines heading into 2023 based on a recession.

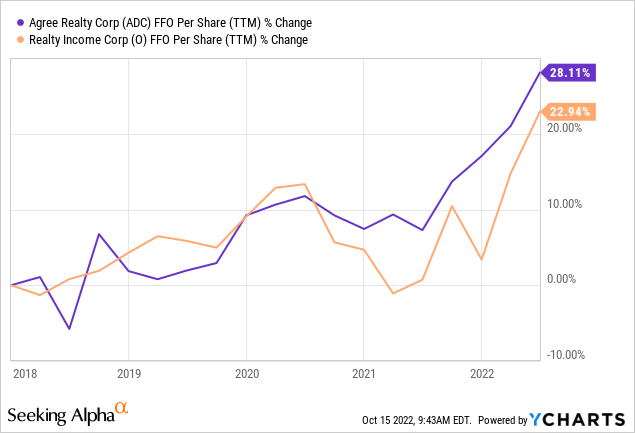

ADC has also been growing FFO faster than O in the last several years. As a smaller operation, it can be easier to grow. I would expect this to continue as we move forward.

Ycharts

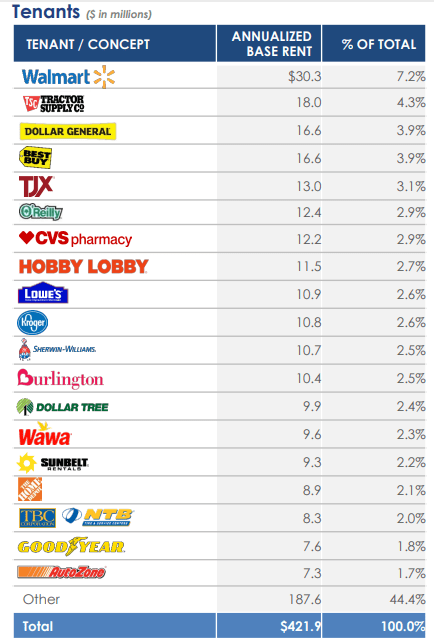

ADC also boasts that 67.5% of their tenants are investment grade. When looking at their tenants, we see a lot of similarities with O. That certainly isn’t a bad thing, either.

ADC Top Tenants (Agree Realty)

They have a fair bit of exposure to “tire and auto services.” At first blush, that could be seen as a weakness. During tough economic times, consumers might choose to forgo repairs as long as possible. Generally, that wouldn’t be advised as that often causes even more costly repairs in the long run.

That being said, it can work to the advantage of auto services in an economic downturn. With less money, people might spend less on new vehicles and keep the ones they already have on the road. At least, this was observed in 2009. History never repeats itself, but it does often rhyme.

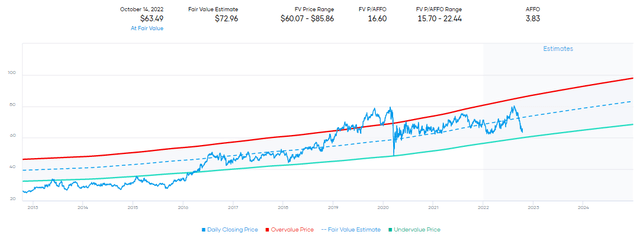

For ADC, we see a similar discount open up regarding its fair value based on P/AFFO. That being said, it is within the channel of the range of fair value.

ADC Fair Value P/AFFO Estimate (Portfolio Insight)

On that basis, it could suggest that O is a better value now. On the other hand, the growth anticipated for ADC would still be expected to be stronger. ADC had fallen around 21% from its 52-week high.

Conclusion

Both O and ADC present interesting options to invest in monthly dividend-paying REITs. Both have a strong track record; even if O’s track record is longer, it doesn’t make ADC any less impressive with the success they’ve been able to accomplish.

O-shares have come down more drastically, but ADC is also flirting near its 52-week low. The valuations of these two REITs have come down substantially lately on a P/FFO basis. The yields have also been surging higher. Though it isn’t risk-free like you could get with a Treasury, it offers tempting future appreciation and dividend growth.

Be the first to comment