Phiwath Jittamas

Investment

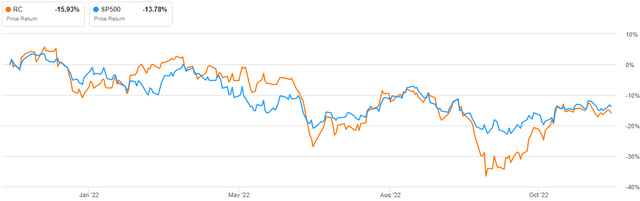

Mortgage rates have risen considerably this year and at an even faster clip in recent quarters, contributing to the turmoil in the mortgage market. Inflation, a growing credit spread, and a possible economic downturn in 2023 are additional threats to the industry. In our previous article on Ready Capital Corporation (NYSE:RC), we were skeptical about the company’s short-term success due to these headwinds.

Upon reevaluation, I am persuaded that the company’s strategic innovations put it in a solid position to meet these challenges head-on. Inflation may be showing signs of cooling, but it’s still high enough that it, along with other factors, makes this an industry with a bleak prognosis for investors. Given the current economic climate, investors can only afford to put their money into businesses that are prepared to weather the storm. Ready Capital Corporation is, in my opinion, one of the best strategically positioned companies to do just that.

I believe that RC’s success since September can be attributed to the strategic innovations it has implemented. The current share price of $12.93 is up 33% from the 52-week low of $9.69 in September. The company’s impressive recovery has brought it nearly on par with its industry, and I anticipate it will continue along this track and, in the near future, beat the market.

I expect the company’s dividend and earnings per share EPS to increase due to its promising prospects brought about by what I see as successful strategic developments. Based on this, I believe the stock is worth buying.

How Will mREITs Develop?

Constantly rising interest rate volatility, below-average market liquidity, and weak fixed-income demand have all taken a toll on the mREIT (mortgage real estate investment trust) industry. It’s instructive to consider the state of the sector in light of these ongoing economic challenges. The following are the specifics of my approach to this analysis. Data in this section was culled almost entirely from Yahoo Finance unless otherwise noted.

Residential mREITs and Housing Activity: Mortgage rates have risen considerably this year, accelerating in recent quarters, worsening the mortgage market pandemonium. The housing market has cooled, and home loan originations are expected to continue plummeting. The Mortgage Bankers Association has revised its outlook, predicting a 50% drop in mortgage originations. The 30-year fixed rate mortgage rate is expected has risen to more than 6.7% in 2022 from 3.1% in 2021. This may diminish residential mREITs’ gain on sale margin and investing activity.

Net Interest Spread & Book Value Erosion to Continue: High fixed-income market volatility, rising interest rates, and the growing gap between the 30-year Agency MBS and 10-year treasury rate are hurting Agency mortgage-backed securities prices. Thus, mREIT book values will continue to fall.

Funding costs will reprice quicker than asset yields for liability-sensitive mREITs. Therefore, its expected net interest margins and profitability are to be hampered by fund costs. This may deter mREIT investors and cause capital outflows from the industry, which might further reduce company book values. Most commercial mREITs have floating-rate liabilities, which raise interest costs when rates rise.

Temper Returns Conservatively: Financial markets are turbulent due to the Federal Reserve’s strong monetary policy tightening to moderate persistent inflation, resulting in negative fixed-income fund flows. As credit-risky assets become more stressed, mREITs should be judicious in their investments and add assets to their portfolios.

To avoid interest rate risks, many corporations have increased their hedge ratio. In uncertain times, such steps may appear smart, but they will limit mREIT growth. It’s foreseen there will be low returns as corporations emphasize risk and liquidity management over incremental returns, at least in the immediate term.

Is RC Strategically Positioned In the Dynamic and bleak Industry?

In light of the foregoing examination of the market, I believe it is right to investigate the company’s strategic position to identify resilience against threats. First off, the company has a solid balance sheet. ReadyCap was a financially sound organization as of September 30th, with $1 billion in unencumbered assets, $200 million in cash on hand, and $2.4 billion in accessible warehouse space. Short-term repo of $392 million, which accounts for about 4% of total debt and is predominantly covered by floating rate, short-duration assets subject to low price volatility, is well within their 2:1 objective.

Also, the average maturity of their warehouse lines is two years, and only 16% of their debt is marked to market. Additionally, corporate debt maturities in the near future are manageable, with only 10% of the total $1.1 billion due in August 2023 and the remainder laddered after April 2025.

Secondly, the company’s credit is well positioned in my view. As a result of the shock and housing affordability, which is skewed to rent versus buy, 72% of their current CRE portfolio is invested in lower- to middle-market multifamily. The mortgage-to-rent ratio in the United States is now 159%, up from 103% over the previous decade on average. This is especially important for their affordable multifamily market, as it will help keep vacancy rates low and rents rising, even if the economy is in a downturn.

Their small business lending team expects delinquencies to rise from 1.5% to 3.5%, which they are prepared for. This segment represents 4.5% of equity; therefore, net credit loss exposure is low. In a recession, portfolio diversity sets them apart from peers. Only 9% of the total loan portfolio comprises the 10 biggest loans, and RC has no exposure to the CBD office. Its office is only 5% of its portfolio, with an average balance of $2.4 million.

The other strategic position relates to its book value. The constant book value of ReadyCap since COVID has been its defining feature. First quarter 2020 book value improved by 7% to $15.40 per share after adopting CECL. This is in stark contrast to the 15%-30% year-to-date book value reductions in the residential REIT sector and the write-downs of C-REITs with large CBD office exposure. The CEO has stated that maintaining and increasing book value is a major indicator of success for ReadyCap. In light of their strong liquidity position, they have repurchased 3.6 million shares since September 30th, adding roughly $0.16 to their per-share value.

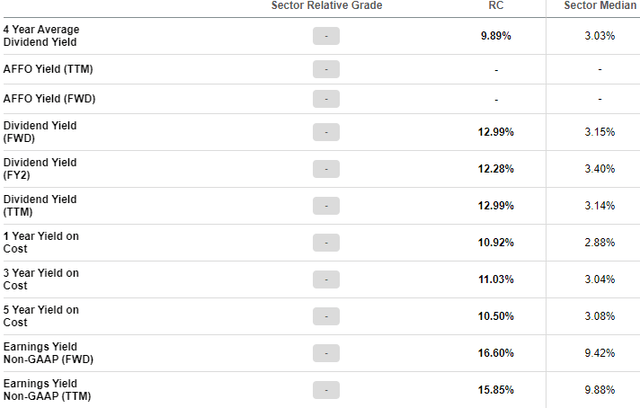

Lastly is the company’s dividend yield. As the COVID stimulus revenue from PPP begins to drop and mortgage banking slows, RC anticipates a return to normal earnings in the coming quarters. Core commercial real estate is currently in a distressed market, but these decreases will be mitigated by loan and purchase activity with an improvement in ROE of 300 to 500 basis points. Backed by its strategic position in the industry, I am confident this goal will actualize.

ReadyCap has paid and adequately covered a dividend yield on the average book value of 11.6% over the past two years, which is higher than the average of its peers. The company is the largest dividend payer relative to its competitors, and I am optimistic that its dividend volatility will soon settle and begin to grow. Its superior strategic innovation supports this.

Conclusion

Growing interest rate volatility, restricted market liquidity, and poor fixed-income demand have hurt the mREIT industry. These challenges have exacerbated the industry’s woes. Companies face an uncertain future as the industry undergoes significant shifts. So yet, only the strongest have been able to withstand the harshness of that unsettling macroeconomic environment.

My analysis of Ready Capital Corporation has led me to conclude that the firm is well-positioned to weather these storms and emerge victorious. Investors should feel encouraged that RC is taking proactive measures to deal with the growing threats they face. For that reason, I am giving Ready Capital Corporation a buy recommendation.

Be the first to comment