Oakozhan/iStock via Getty Images

By Benjamin Schroeder, Padhraic Garvey, CFA, Antoine Bouvet

When the ECB All-Stars align, curves invert

Curve flattening remains one of the main themes. And its EUR markets actively pushing in the same direction as investors continue to ramp up their rate hike expectations.

It is not that often that one sees the ECB Council is singing in tune from the same hawkish hymn sheet. While ECB Chief Economist Lane had confirmed the central bank’s new reaction function, Vice President De Guindos yesterday signalled that there was also still a long way to go for key rates – current monetary policy was still accommodative, supporting demand and ultimately price pressures, he warned. It underscores a desire to get rates to neutral as soon as possible, with current “guess-timates” putting that target closer to 2%.

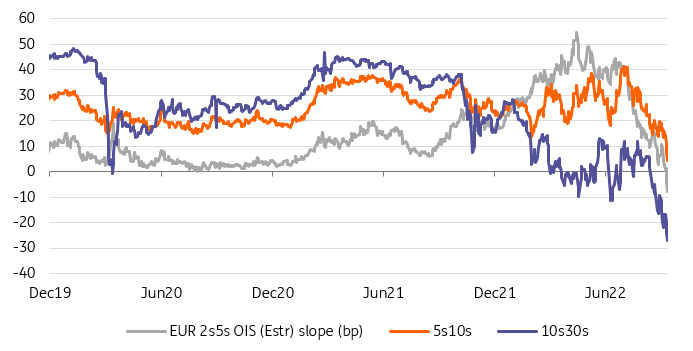

Money markets are accordingly setting their sights on at least another 125bp of tightening by year-end. A caveat, as always, the neutral rate is a fast-moving target, and amid geopolitical uncertainty and energy crunches, it can still prove fleeting. Such doubts, though, are subject area for the long end of the yield curve. So, what we are witnessing now is the inversion of curves, which we cautioned would likely follow on the heels of a 75bp ECB hike. First to invert was the 2Y-10Y OIS curve, and the swap curve standing at a meager 2.5bp looks likely to follow soon. The German curve still has more than 20bp to cover but should get there eventually.

The EUR Swap Curve Is Inverting Fast (Refinitiv, ING)

Eurozone government bond spreads prove resilient

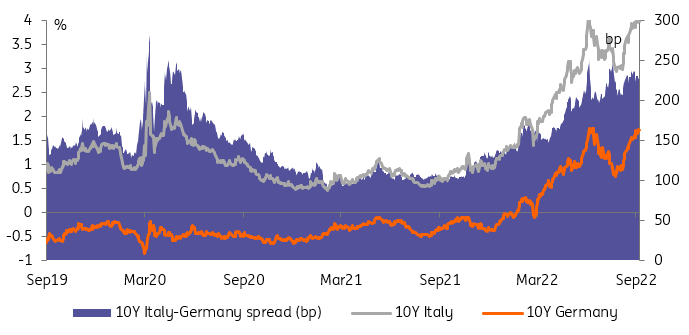

The Italian general elections next weekend are closing in and Italy’s sovereign bond spreads over Germany have proved quite resilient. Not just to the political uncertainty that comes with the likely changeover of the government to a centre-right coalition, but also in the face of the ECB’s increased tightening pace. At around 225bp the 10Y spread is below levels observed late in August and early September ahead of the 75bp ECB hike.

We will have to wait until early October for the ECB’s next set of detailed pandemic emergency purchase programme data to evaluate to what degree the ECB’s flexible PEPP reinvestments have played a role this time around, or whether it is markets coming to terms with a right-wing government, which actually might bring along something Italian politics have been lacking for a while: stability.

We Think The ECB Cares More About The Speed Than The Magnitude Of Spread Widening (Refinitiv, ING)

ECB hikes are not without costs – literally

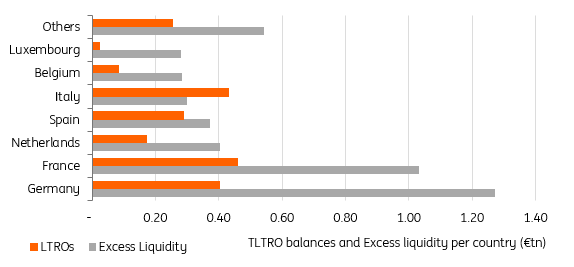

Now that the deposit facility rate is at 0.75%, this is also the rate that the ECB has pay to banks on the excess liquidity it had injected into the system – via bond purchases and via targeted longer-term liquidity operations.

As was hinted at by President Lagarde at the last press conference, the ECB could soon announce measures to address this cost issue, possibly by introducing a tiered remuneration of excess liquidity and subjecting parts of it to a zero-interest rate remuneration. The ECB would again effectively micro manage banks’ profitability, but more importantly, the choice of design can determine the impact on money market rates. We think the ECB will make sure that the deposit facility rate remains the marginal policy interest rate determining market pricing. This requires that a large enough portion remains subject to the depo rate. Lowering that portion will, of course, lower the ECB’s cost but may prove more disruptive for money markets with increasing rebalancing of the currently still unevenly distributing excess liquidity across jurisdictions.

€4.6tn Of Excess Liquidity And €2tn Of TLTRO Loans To Banks Are Becoming A Problem For ECB (ECB, ING)

FOMC next week and beyond remains key for market rates

Next week sees a crucial FOMC meeting, from which we expect a 75bp hike. What happens after that is key.

For market rates, their prognosis is tied up with the terminal Fed Funds rate, i.e., where the funds rate peaks. When it does peak, the likes of the 10yr Treasury yield will feel unshackled and can go ahead and discount future cuts, with yields capable of trading well through the funds rate. But we are not at that point just yet; we’re still in the Fed Funds up-move phase. For as long as that’s the case, long-tenor market rates will tend to be pulled higher. Should the Fed hike by 75bp in September and by another 75bp in November, that would pitch the funds rate ceiling at 4%. Against that backdrop, and given the likelihood that the funds rate pushes above 4%, the 10yr Treasury yield is likely to target the 3.75% area (versus 3.45% currently).

One clear consequence is a likely further inversion of the yield curve. The Federal Reserve will not want to see this become too pronounced, as it would open a gap between the longer-term implied subsequent rate cut discount versus the nearer-term objective to get the funds rate up. Balance sheet roll-off, which is now running at USD95bn per month, will slowly address this issue, as the bid for longer-tenor bonds is no longer being supported by Fed buying. This also helps to tighten conditions. The Fed has not had a whole lot to say about this in recent months, preferring to let the process play out quietly in the background. But in any case, it is pushing in the same direction as rate hikes, and should help to coax longer-tenor rates higher.

Today’s events and market view

In the US, money markets have made it a choice between 75bp or 100bp at next week’s Fed meeting following the CPI reading earlier this week. Current inflation certainly remain key, but so will any indications of receding price expectations. To that end, today’s University of Michigan consumer sentiment, including its surveyed 1Y and 5-10Y inflation expectations, will be scrutinized. After yesterday’s mixed retail sales data, our economist continues to favor a 75bp hike.

In Europe, ECB president Lagarde and France’s Villeroy have public appearances, and Finland’s Rehn speaks at a monetary policy conference. Eurostat will release the final inflation figure for August.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment