zeljkosantrac

This article was co-produced with Cappuccino Finance.

I already wrote about “3 REIT Stocking Stuffers Yielding 9%.” So, I apologize if this seems like I’m offering something less tempting than before.

For those who feel that way, stay tuned. I’ll be writing a “3 REIT Stocking Stuffers Yielding 10%” article sometime soon.

Because, yes, there are actually real estate investment trusts (“REITs”) out there that are yielding that much without putting everything at risk. And yes, that kind of return potential in our high-cost environment can sound like a lifesaver.

Or perhaps it just sounds like “Cha-ching!” As I wrote in the first post of this series, the title might inspire “greed, complete with Scrooge McDuck-like money signs” filling your eyes.

Though I also get it if you first felt some fear. And:

“If you’re one of my regular readers, it may very well have been a combination of the [reactions].

“On the one hand, you’ve got your natural investor instincts to make money. And real estate investment trusts… or any other kind of dividend-paying stocks – that deliver 9% yields are very attractive at first glance.

“At second glance too.

“On closer inspection though, the higher the yield, the more your alarm bells should be going off. That’s what I preach, and that’s what I put into practice.”

There are exceptions to the rule, though. And those exceptions can be beautiful, profitable, amazing assets.

However, I do completely understand if 9% yields still sound disconcerting, despite my assurances.

So, how about 8% instead?

Stay True to Your Investor Self

Here’s the thing: I don’t want you to step out of your comfort zone.

Truly. That’s not meant to be a condescending statement or any other negative or dismissive commentary on where you stand. I mean it 100%.

That’s because only you know your financial situation, not to mention the feelings you have about said status.

By that, I mean we’re all here to make money with the money we already have. We all understand (or at least my loyal readers do) that the best way to do that is to buy into quality companies at reasonable or better prices.

Most of us also recognize that short-term market volatility will happen. And that we’re better off staying strong in its face, refusing to back down and run for the hills.

Yet how often do we make a run for it anyway?

There’s a reason why they say the market runs off two emotions: fear and greed. It’s really easy to commit to a stock when everyone else loves it. But it’s also really easy to dump it when everyone else does that instead.

So, what’s your tolerance level like?

If it’s low and your personal fear factor is easily ramped up, then feel free to say no to the 9% yields I offered for your consideration, the 8%-ers I’m writing about now, and the 10%-ers I will be telling you about soon.

But if you think you’re up for buying into – and holding – stocks that are severely undervalued with very good chances of finding favor again…

I suggest you keep reading right along.

Compared to Kim Kardashian

Look, there’s a lot going on this holiday season. I know I mentioned added costs earlier, but those costs are significant. And people are cutting back.

At least some people are. Admittedly, I did just see the following headline: “Kim Kardashian Hires Pianist to Wake Up Her Kids With Christmas Songs.”

As a parent of five, my immediate reaction was… well, probably something similar to the one you just had. And at least the start of the story beneath it is every bit as ridiculous.

Sorry to share stupid celebrity gossip in a perfectly good article, but I think I want others to be as incredulous as I am.

“While we may like to think that some celebrities are just like us, The Kardashians definitely are not. The Keeping Up With the Kardashians stars live life on another level.”

You can say that again.

But I digress…

“Kim Kardashian is now selling her unique brand of home décor. The items are made of concrete. How cozy! But if you are in the market for an 8-pound garbage can, Kim’s your girl! It retails for only $129.”

Can I digress again?

No, I’d better not – if only to keep myself from using language not befitting a REIT analyst. In which case, perhaps I also shouldn’t mention that Kardashian gets $200,000 per month in child support from Kanye “Ye” West.

Per month! Some of which presumably goes toward paying Grammy-winning pianist Philip Cornish to wake her kids “while the mad morning rush is happening to calm their little souls and fill [them] with beautiful Christmas songs,” as she shared on Instagram.

Compared to that, I’d say 8%-yielding REITs are a very sound investment indeed.

Global Medical REIT Inc.

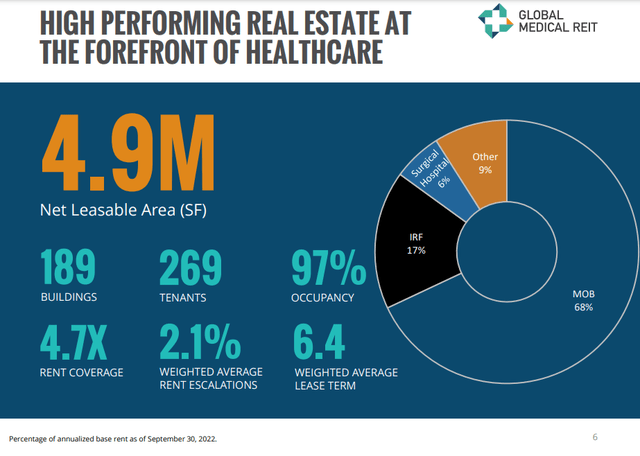

Global Medical REIT (GMRE) invests in healthcare properties that provide an attractive rate of return relative to their cost of capital and are operated by profitable physician groups, regional or national healthcare systems, or combinations thereof. They have 189 buildings (269 tenants) in their portfolio, with 4.9 M net leasable sq ft. Their properties are in high demand with a 97% occupancy rate. Global Medical REIT has been growing substantially since its IPO (56% CAGR since IPO), and I expect that growth to continue. In the third quarter, they closed 5 acquisitions for $51 M.

Global Medical REIT is in great financial condition and has a strong balance sheet. 79% of their debt is fixed rate, and the weighted average interest rate is 3.90%. The weighted average maturity of their debt is 4.2 years. Also, they have ample liquidity available to them with $250 M of revolver capacity and $298 M of unutilized common equity ATM capacity.

Global Medical REIT’s dividend is safe at this point with 78.15% cash dividend payout ratio and 85.56% FAD payout ratio.

Their valuation metrics are favorable right now too. P/AFFO of 10.22x and P/FFO of 10.77x are significantly lower than their 5-year average and than their peers.

You can enjoy the current 8% yield while waiting for stock price to rise in the future.

Ladder Capital Corp.

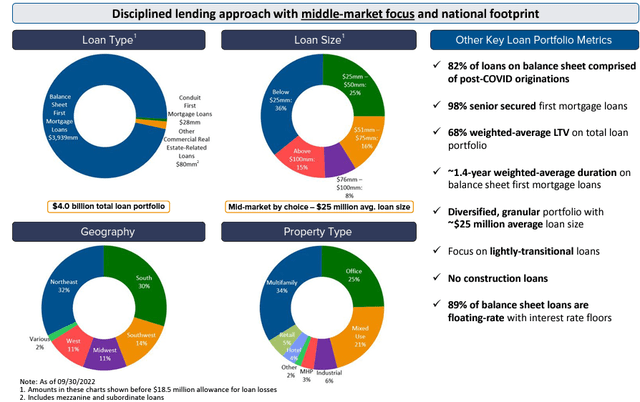

Ladder Capital (LADR) is a leader in the commercial real estate finance world. They originate and invest in a diverse portfolio of commercial real estate and real estate-related assets.

Their businesses include balance sheet lending, conduit lending, securities investment, and real estate investments. They originated loans in over 475 cities across 48 states. They have a very diversified loan portfolio by loan type, loan size, geography, and property type.

Ladder Capital has a long and strong liability structure to ensure superior access to capital. They have diversified financing sources and substantial undrawn capacity. Their debt maturity schedule for unsecured bonds, non-recourse CLO financing, unsecured syndicated revolving, and FHLB financing are well spread out over the next several years.

Since Ladder Capital has a large floating-rate balance sheet loan portfolio and predominantly fixed-rate liabilities, their earnings will be positively correlated to our rising interest rate environment.

The valuation metric (P/FFO) suggests that Ladder Capital is undervalued at this point. The P/FFO of 9.04x is about 30% lower than its 5-year average.

Given their strong liability structure and well diversified portfolio, I expect Ladder Capital to remain a solid investment in the future and reward its shareholders.

NewLake Capital Partners, Inc.

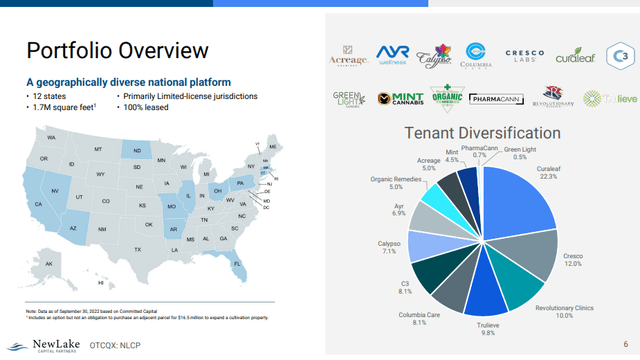

NewLake Capital (OTCQX:NLCP) is a leading provider of real estate capital to state-licensed cannabis operators through sale-leaseback transactions. They have a very diversified portfolio by geography and tenant mix. Their properties are located in 12 different states (100% leased), and leasable space is about 1.7 M square feet. Top tenants include Curaleaf, Cresco, and Revolutionary Clinics.

Their dividend has grown substantially in the past couple of years, from $0.21 per share in 2Q 2021 to $0.37 per share in 3Q 2022.

The cannabis industry is expected to grow substantially in the near future, and NewLake Capital is in a prime spot to take advantage of the trend. Currently, 82% of the U.S. population reside in medical markets, and 44% of the U.S. population reside in adult-use markets. The projected growth of Cannabis industry is 18.3% CAGR until 2026.

NewLake Capital has strong financials. They have $115 M cash against $2 M of debt. They have total shareholder equity of $427 M, and invested and committed capital of $378 M. I don’t expect them to run into any shortfalls that would stall their growth plan.

With a current dividend yield of 6.6%, a shareholder gets to enjoy a juicy dividend while he or she waits for a substantial rise of stock price in the future.

Risk

Ladder Capital and NewLake Capital are rated below investment grade by the credit agencies, which means that their cost of capital may increase substantially during a recession. The spread between the interest rate for investment grade debt and the below-investment grade tends to increase during tough times. Therefore, Ladder Capital and NewLake Capital may have a harder time accessing capital if the U.S. goes into a recession next year.

The growth of the cannabis market depends a lot on government regulation. As many of us know, government regulations can be unpredictable at times. The growth trajectory of NewLake Capital could be delayed or change substantially if the political environment changes. Therefore, investors in the cannabis space should keep tabs on the political environment.

Conclusion

December is now almost halfway over, and we are approaching the new year. There is still plenty of uncertainty in the air – inflation, interest rates, geopolitical relations, and energy price.

There are some good signs, though. The CPI number showed some signs of easing, and now it is reported that consumers are expecting inflation to go down next year. So, we might see some changes in consumer and market sentiment.

While we are waiting for all this volatility to pass, consider treating yourself to the three REITs in this article. These reliable dividends will create enough music in your portfolio, you won’t even miss the private pianist.

Be the first to comment