DjelicS/E+ via Getty Images

Main Thesis & Background

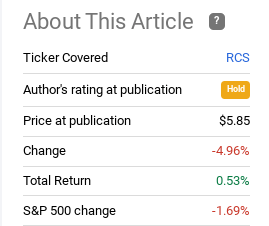

The purpose of this article is to evaluate the PIMCO Strategic Income Fund (NYSE:RCS) as an investment option at its current market price. RCS is a closed-end fund whose objective is “to generate a level of income that’s higher than that generated by high-quality, intermediate-term U.S. debt securities. Its secondary objective is capital appreciation”.

I haven’t written about RCS since March when I put a “hold” rating on the fund. In hindsight, this was a reasonable call. RCS has generated a very slight positive return, although the broader market environment has had a lot of ups and downs in the interim:

Fund Performance (Seeking Alpha)

In fairness, RCS has held up reasonably well over a five-month period. This caused me to take another look at the fund to see if I should upgrade my rating. However, after review, I am afraid the value proposition has deteriorated significantly since I last looked at it. This led me to consider a downgrade to a “sell”, but ultimately the yield is supported enough that a “hold” probably continues to be warranted. Yet, I see both positives and some major headwinds for this fund, in particular, and continue to advocate readers approach this PIMCO CEF with caution going forward.

Agency Spreads Have Widened – Potential Opportunity For RCS

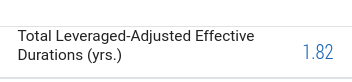

Before I get to my concerns, I want to point out a positive for the fund. One, in my view, is the widening of yield spreads in the agency MBS space. While this has pressured the values of the bonds in the short term, it has impacted the sector to greatly improving the income one could get by placing cash here. This could draw in investors going forward, a positive for the sector:

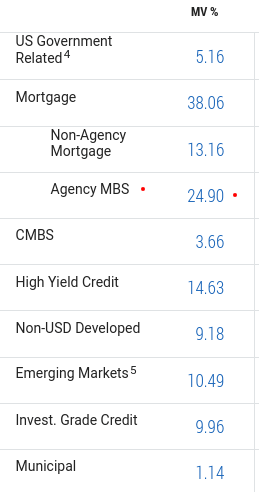

Why does this matter to RCS? The fund happens to be overweight mortgage-related holdings, with agency MBS, in particular, being the largest individual sector weighting:

RCS’ Holdings (PIMCO)

At roughly a quarter of fund assets, this is clearly an important sector. Once we consider non-agency MBS as well, we see that the bulk of the fund is exposed to the housing sector.

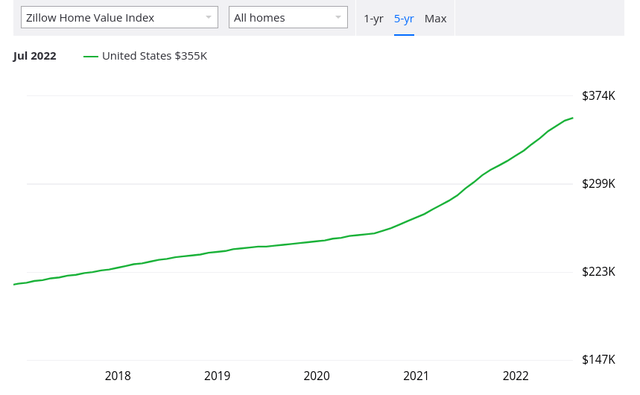

While this is an area that has been under pressure recently with some people calling the sector a “bubble” and rising interest rates pressuring new homeowners, I don’t think the backdrop is that bad. Home values are getting a bit too extreme, yes, but most homeowners are in positive equity territory on their homes. New entrants are a bit more at-risk in this environment, but the majority of homeowners have not bought their first property in the last two years, so that has to be reflected on when we consider the overall health of the sector. Generally speaking, the rise in home values is a good thing for the housing market, not a bad thing:

Average U.S. Home Price (Zillow)

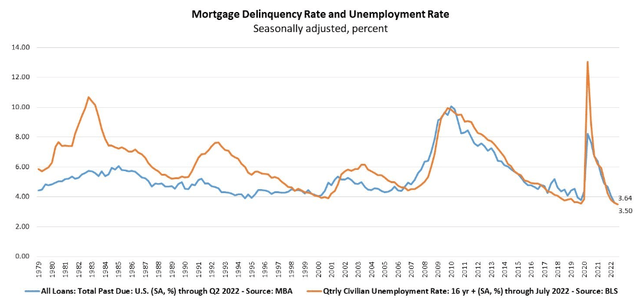

In addition, the overall health of the housing market is being aided by more than just strong demand and rising home values. The mortgage delinquency rate also sits at a healthy (historically low) level. This is a metric that is very correlated to the employment market, and the unemployment rate in the U.S. has been dropping for some time now:

Mortgage Delinquency Rates and Unemployment Rates (Bureau of Labor Statistics)

What this all adds up to is a fairly positive backdrop in my opinion. RCS is long a sector that has underlying strength, and I am not taking seriously the “bubble” chatter we are seeing today.

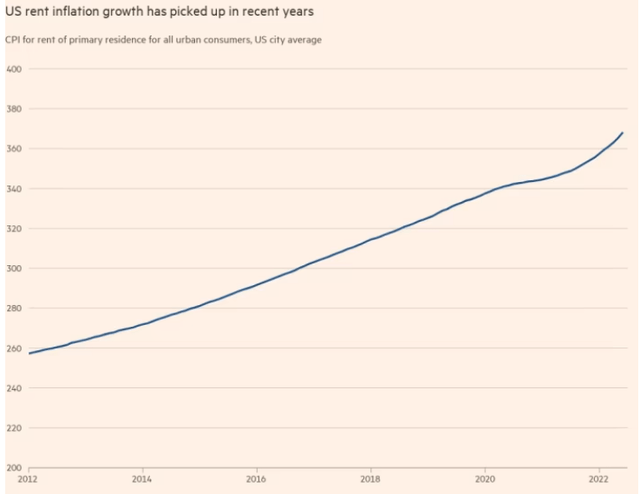

Part of this is because incomes have been rising and rents are also up. We have to consider that when an individual or family is deciding to invest in a home, they have to weigh the cost to rent against their home buying costs. As long as rents remain elevated and/or keep on rising, there is a tremendous incentive for Americans to both buy a home and stay current on their existing mortgage:

Rent Increases (USA) (USA Today)

What I am getting at here is when people refer to a “bubble” (as I have actually been seeing lately), I don’t believe they truly understand the housing backdrop. A bubble implies prices are not supported and therefore are at risk of a big drop. That is a reasonable thought to have given how home prices have soared.

But housing is a necessity, and if one doesn’t buy a single-family home, they need to look elsewhere. That “elsewhere” is primarily renting properties. For younger people that can mean moving back in with the parents, but in my view, the primary alternative to buying a home is rent. If rent prices are rising too, then demand for owning a home is supported by this metric. Simply, we have to consider alternatives before declaring a “bubble”, and given that rents and home values are rising not just in the U.S. but around the globe, we are a far cry from the “too much inventory, too little demand” bubble history of 2008-09. All this adds up to RCS’ debt being well supported from a credit perspective.

Fed Tapering Limits The Opportunity

I just spoke at length about the positive nature of RCS’ MBS holdings. This likely made the fund seem like a buy candidate – but I have a “hold” rating on the fund. So, where is the disconnect?

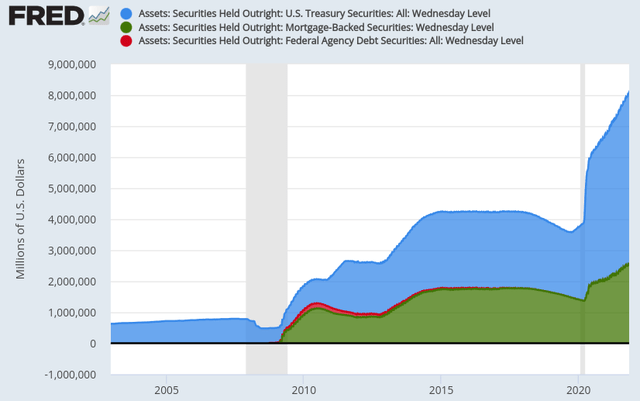

The problem is that despite the macro environment supporting home prices, and therefore lower delinquency rates for MBS, there is the Fed to consider. This is the major headwind for the agency MBS sector in particular, and is likely the key drive behind RCS’ poor performance in 2022. Aside from rising interest and inflation rates pressuring fixed-income as a whole, agency MBS and treasuries have had the headwind of Fed “tapering”. This is a roll-off, reduced purchasing, and outright selling of Fed holdings of these assets, which is pressuring the value of the underlying securities, despite the other positive attributes.

To understand why this is so significant, we should first consider how we got here. The Fed bought up a tremendous amount of both treasures and agency MBS during the Covid-19 pandemic, as well as other types of corporate debt. Their balance sheet ballooned, greatly distorting the market:

Fed Balance Sheet Holdings (St. Louis Federal Reserve)

It should be clear from this graphic why the reduction of the Fed’s securities purchases and the directive to let maturing securities roll off from the balance sheet are such important headwinds for this sector. The Fed undertook a massive buying spree over the past two years. While this propped up the sector, it means private demand is going to have to come through in a big way to keep these asset prices elevated. That probably isn’t going to happen to the same degree as when the Fed purchased these assets, so a decline in prices is all but certain. This has been playing out already this year and should continue going into 2023.

The reason is that the Fed has a monthly reduction cap of $95 billion. This can be broken down by $60 billion of Treasuries and $35 billion of mortgage securities that can be hold, if it wants, each month. That doesn’t mean the Fed will do so, but the size of those numbers should at least make investors in this space cautious. Given how exposed RCS is to this tapering program, which is set to kick off at “full strength” in September, I don’t see why one would want to be a buyer at this moment.

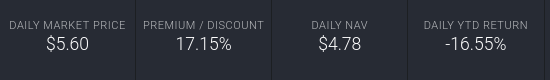

Valuation Is A Killer

My next concern is one I have for most PIMCO CEFs at this juncture. This is valuation, which is getting to the point where justifying new positions is very difficult, in my opinion. I get that some people don’t care about premiums, but the fact is that most funds don’t trade at elevated premium levels for the long term. In fairness, in the short term, valuations don’t change dramatically. So I wouldn’t “panic sell” just because RCS is too expensive at this juncture. But, by the same token, it should be a red flag for someone wanting to buy in. For perspective, consider that RCS had a premium near 8% when I covered it in March. Today, that figure rests north of 17%:

RCS Valuation (PIMCO)

This is concerning for two key reasons. One, this valuation is simply expensive, there is no getting around it. Buying into funds for 17% more than the underlying holdings are worth is not prudent investing. While I believe that to be true, others can disagree and buy in, but they should at least recognize the risk of doing so. Two, we have to consider how RCS can produce a flat return and yet almost double in terms of premium. How can this be? The answer is a sharp decline in underlying value, contributing to value erosion:

| NAV on 3/1/22 | NAV – 8/12/22 | Change |

| $5.58/share | $4.78 | (14%) |

Source: PIMCO

The conclusion I draw here is that RCS has been struggling quite a bit in 2022. While buying in on weakness can often be a good strategy, that assumes a fund/sector/stock is a better value than it was before. RCS, despite seeing a flat total return, has a much worse value because its underlying value has dropped so much. The premium is at a level that I would almost never recommend, supporting a neutral outlook on this CEF.

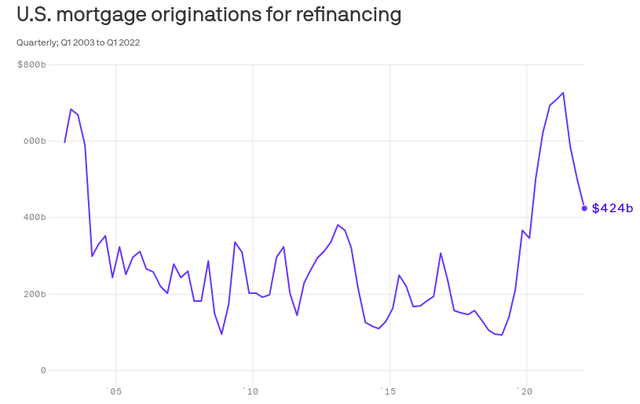

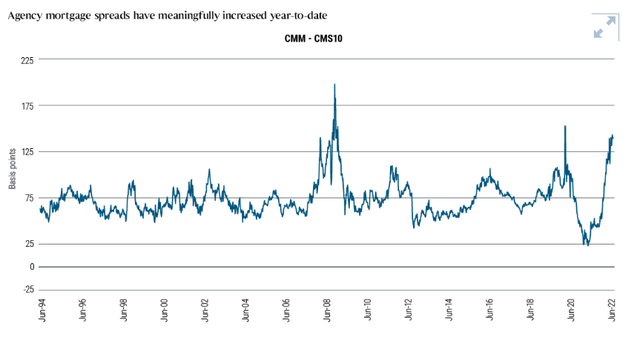

Income Metrics Very Strong – Likely From Lower Refinancing

My next point has a more positive connotation. This is also an important point because it concerns the fund’s distribution, which is probably a foremost reason on why a reader is considering RCS in the first place. Fortunately, the most recent UNII metrics are fairly strong. While the UNII balance is only slightly positive, the distribution seems well supported based on recent coverage ratios. This limits the downside potential in the short term:

This is a backdrop that is supportive of RCS’ yield, so it is understandable why this fund will still pique some interest. Importantly, these coverage ratios are likely to stay elevated in my view.

To understand why, let us consider the macro-interest rate environment. While rising rates hurt the value of fixed-income bonds and debt, it has the benefit of limiting refinancing. This improves the outlook for the income stream because it removes some pre-payment risk. Simply, a fund like RCS can see its income decline if its underlying holdings are paid off early in a declining rate environment. To replace those pre-paid securities, RCS would have to buy up a lower-yielding product at the prevailing rates – assuming they want a comparable product. In a rising rate environment, such as right now, this risk is mostly eliminated because borrowers would not refinance to get a higher rate, that doesn’t make sense.

And that is indeed what is happening. While refinancings had surged over the past two years, they have come down considerably in the mortgage space as rates have risen:

Mortgage Originations for Refinancing (New York Federal Reserve Bank)

My forward look is mortgage rates are not likely to decline much from current levels, not with more Fed rate hikes on the way. This means refinancing will continue to shrink, sustaining the current income production for RCS. In fact, it could even improve as the fund buys up new holdings, since they should offer higher yields than over the past few years. With this considered, RCS’ income stream looks safe to me.

Lower Inflation Readings Helping Fixed-Income, But Risks Remain

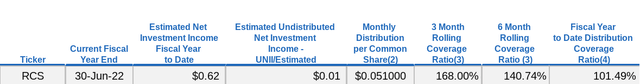

My final point touches on another macro factor. This is inflation, which has been the sore spot for fixed-income this year – whether individual bonds or funds. There has been a relief rally in the past month or so, as inflation metrics have cooled off a bit. There is some hope that inflation has “peaked”, and while we won’t know for a few months if that is the case, it has given the bulls some legs in both equity and debt markets. This is a positive development, but we should not ignore that even if inflation has “peaked” at these levels, it is still very high from a historical perspective:

What I am getting at here is that debt investors, whether in RCS or anything else, need to be mindful of the inflationary environment. There has been some positive news of late, but we need to manage expectations on what this means for debt securities. The relief rally has been nice, and income streams have gotten much more attractive over the past year. But I don’t expect it to be smooth sailing from here on out. Volatility will probably remain elevated, and the market will be closely watching CPI readings going forward. So stay balanced and cautious when buying.

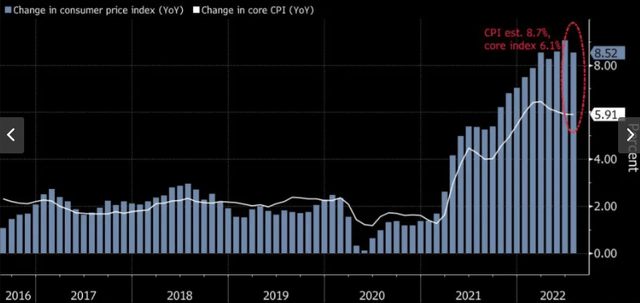

The good news is that even if inflation does stay high and the Fed continues on its rate hiking course, RCS is less exposed to this risk than many other funds. Its current duration, a measure of interest rate sensitivity, is just under 2 years. That is pretty low for a diversified fund:

RCS’ Duration Level (PIMCO)

This is another reason why I have not placed a “sell” rating on RCS. It is better equipped to handle rising rates than most funds I cover, and that is a good thing.

Bottom-line

RCS has had a tough year. While the recent rebound has been welcomed, I honestly don’t think it has much momentum left. There are positives that could send the fund higher, such as a lower-than-average duration level, strong income metrics, and rising property values. However, these are balanced out by an excessive premium to NAV, the risks of Fed tapering in the agency MBS space, and better relative values within the PIMCO CEF family. All things considered, I believe caution continues to be warranted here, and I would suggest readers approach RCS very selectively at this time.

Be the first to comment