krblokhin

Compared to the carnage across much of the stock market, Raytheon Technologies (NYSE:RTX) has fared relatively well with shares down just about 5% over the past year. Raytheon is a fairly unique company after the merger between legacy Raytheon and United Technologies and spin-off of Carrier (CARR) and Otis Worldwide (OTIS) as it is a company with operations relatively evenly split between defense and commercial aerospace. There are several largely pure-play defense contractors like Lockheed Martin (LMT) and L3Harris (LHX) and those primarily tied to the commercial market like Boeing (BA), but none others that are evenly balanced like RTX.

This equal balance between commercial aerospace and defense was seen as a positive differentiator for the company, but on a go-forward basis, I see it as a negative for investors because it has left the company sitting in no man’s land. I believe there are very positive fundamentals for the defense industry, but pure-play defense stocks actually screen cheaper than RTX. At the same time, investors who want to bet on an eventual recovery in commercial aerospace can find much more beaten-up stocks like Boeing. With RTX sitting between these two worlds, shares are likely set to languish, and investors should consider looking elsewhere.

To be clear, Raytheon’s businesses are not performing particularly poorly; the primary issue is valuation. In the company’s second quarter, sales were up 3% to $16.3 billion, driving a 13% increase in adjusted EPS to $1.16. As a consequence, the company bought $1 billion in stock, well on its way to its full year of plan at least $2.5 billion. The firm’s backlog now stands at $161 billion–$96 billion of which is from commercial segments and $65 billion from defense. The defense business also had a book-to-bill ratio of 1.35x, meaning it is taking in more orders than it is delivering.

This is a common theme in the defense industry, and a reason I like the sector. The more dangerous the world seems from Russia invading Ukraine to China saber-rattling over Taiwan the more the US government will be inclined to spend on defense. We are seeing this happen. The Pentagon is seeking a $31 billion budget increase for 2023 to $773 billion to insulate it from inflation and help it modernize the military. Congress though is likely to pass a defense authorization between the $840 billion proposed in the House and $857 billion in the Senate, providing the Pentagon with plenty of resources. Spending more on defense is a rare point of bipartisan and bicameral agreement.

With the Pentagon spending more, defense contractors should be able to book more future orders than they deliver this year. Indeed, a reason I view L3Harris as an attractive investment is that it too is generating a book-to-bill ratio above 1x, growing its backlog and securing a greater share of Pentagon spending. I would also note that RTX’s 1.35x ratio is not quite as impressive as it first appears because current quarter sales were negatively impacted by supply chain problems.

Even as defense spending has risen this year, missile and defense revenue is down 11% year on year to $3.6 billion and intelligence and space revenue was down 1% excluding divestitures to $3.6 billion. If sales had been flat, the book-to-bill would be 1.27x, still above 1x but not quite as strong as it first appears.

The commercial side of the business is what is driving revenue growth as commercial airplane deliveries recover and Boeing very slowly moves past its 737 MAX problems. Collins Aerospace saw revenues rise 10%, led by commercial aftermarket segments, while Pratt & Whitney engine sales rose 16%. As a consequence, even with supply chains weighing on current defense segment results, management is still guiding to about $68.25 billion in revenue and $4.70 in EPS, which will translate to $6 billion in free cash flow. It is also important to emphasize that RTX is making a significant assumption underneath this cash flow forecast. Starting in 2022, research and development spending has to be capitalized for tax purposes rather than expensed. RTX is assuming in its $6 billion guidance that this legislation is “deferred beyond 2022.”

That may or may not be right, but it is important to factor this assumption in when doing relative analysis as different companies are making different assumptions. RTX has spent $1.3 billion on R&D this year, so the annualized cash tax impact of this assumption is about $500-550 million, or 8% of free cash flow. That would reduce its free cash flow yield from 5% (20x free cash flow) to 4.6% (21.7x free cash flow). For comparison, L3Harris, which is issuing guidance assuming congress will not delay this legislation, has a 5.5% free cash (or 18x free cash flow) flow yield.

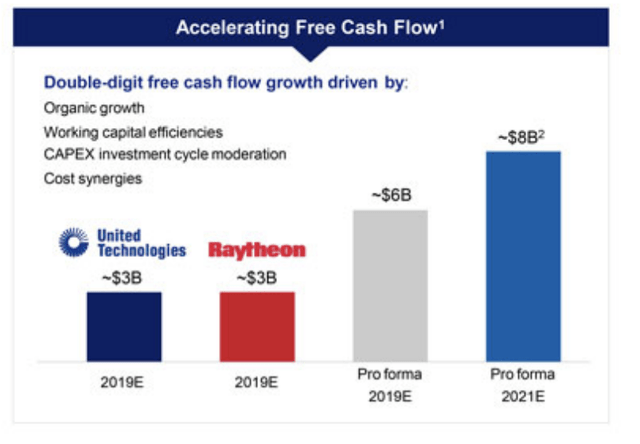

As you can see, RTX is trading at a premium valuation to a pure play defense company (a 3.7x greater multiple off of its cash flow). This comes even as the company has missed its long-term target. Now, of course when the Raytheon-UTX transaction was consummated, COVID did not exist, but it is worth bearing in mind that in 2019 management forecast $8 billion in free cash flow by 2021. Here we are in 2022, and guidance is now $6 billion. Management seems to err on the side of making aggressive forecasts, whether it be long-term cash flow or assumptions about tax legislation. Again these forecasts could prove right, but the risks appear skewed to the downside.

(Source: Raytheon)

At the mid-point of guidance, RTX is still trading at 17x earnings; that is a premium to pure play defense companies, LHX, Lockheed, and General Dynamics (GD), based on consensus estimates. These companies benefit from the Pentagon budget increases without nearly any of the uncertainties of the commercial side of the business. And for investors who want to bet on a commercial recovery, looking at firms more greatly exposed to that business, which have been more beaten up like Boeing or General Electric (GE) may have more substantial upside.

Of course any thesis, bullish or bearish, has risks of being wrong. If the overall market rallies, then RTX’s valuation would not be at as much of a premium, so shares could go higher, though I would still expect them to lag cheaper trading peers. In an environment where the Russia-Ukraine war escalates even further and US shipments of weapons increase, RTX would likely see increased orders from its missile unit, and its overall defense business may be able to grow more quickly than the Pentagon budget. In this environment where it gains market share vs other defense contractors, share could outperform even though it is not a pure play defense company. In these environments where RTX performs well, I would expect other defense contractors to perform well, though perhaps not as well, so given their lower valuations, the risk/reward profile in RTX simply does not look as compelling to me.

At 17x earnings with a lower free cash flow yield, and relatively aggressive tax assumptions that increase downside risk to that guidance, RTX is not an attractive investment. It is stuck between the safe and secular growth story of defense sector with the more speculative recovery of the commercial aerospace sector. Given that, a premium valuation is not justified.

If investors want exposure to both markets, I believe they would be best to invest in two pure play firms, or if they want exposure to just one market, to buy a company that operates primarily in that industry. Being in RTX may not satisfy either goal. And as such, I expect shares to remain stuck in the $75-83 area or 15-17x forward earnings as it slowly tries to grow into its premium valuation. The stock is likely dead money in my view, and I believe investors should allocate elsewhere.

Be the first to comment