Bill Oxford

By Padhraic Garvey, CFA, Regional Head of Research, Americas; Antoine Bouvet, Senior Rates Strategist; and Benjamin Schroeder, Senior Rates Strategist

The Fed has managed to telegraph a glide path ahead for rates, while also maintaining an elevated rate hike alert. The result is tighter financial conditions. Nice job! The BoE has the unenviable task of disappointing markets’ hawkish expectations. Don’t rule out a 50bp hike but a further drop in gilts depends on whether markets believe this is the right move.

Federal Reserve delivers a hawkish pivot

The Fed has caved to the “pivot camp”, through a very smart use of phraseology on the delayed effect of rate hikes and the cumulative effect of hikes already delivered. Fair enough in fact, and the messaging is clear – something different is probably coming from the December meeting. We had always thought the Fed would pivot to a 50bp hike for December. But we had expected the Fed to be a bit more coy on it. The Fed has not told us they will do 50bp with clarity, but there was enough between the lines to determine that a 50bp hike will come provided the data does not dictate that a 75bp hike is really necessary.

This can be seen as preparatory glide path that ultimately guides us to a terminal rate at 5%. If that’s the case, then 10yr has no business making a structural break below 4% this early. The model for the 10yr at this stage of the cycle remains; we still see the 10yr peaking at 25-50bp through the fed funds terminal rate, and we need to see that terminal rate level before the 10yr actually knows with conviction that it is a peak. That’s the argument for market rates to still be pressured higher, and understanding that we are still in a rate hiking process, with the terminal rate still much higher than where we are now.

The impact reaction to the Fed decision and commentary was quite different from the more considered reaction. Initially there was a rise in inflation expectations, and real rates feel, helping to put a bid into risk assets. But that reversed within the hour following the FOMC outcome. This is a decent outcome for the Fed, as they have hiked rates by the full 75bp, paved the way for smaller hikes ahead, and still managed to generate an overall tightening in financial conditions.

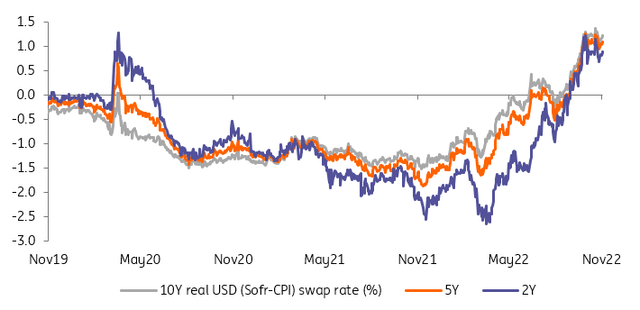

The Fed’s hawkish tone should see real rates edge higher in the near term

Refinitiv, ING

What has ultimately driven market rates up is the firm notion that Fed is not done. They are on a glide path now to get done, but the extent of that glide path remains an uncomfortable one for risk assets as it means that real market rates remain under pressure to continue testing higher.

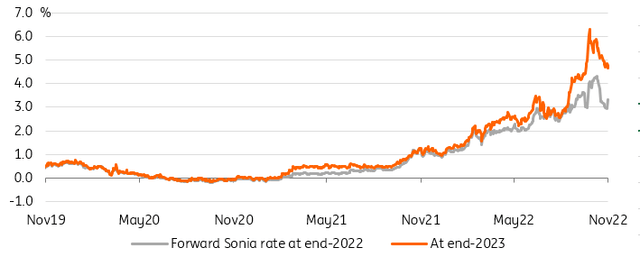

The GBP swap curve has pared down hike expectations since the ‘mini budget’ debacle

The case for a more dovish BoE

There is no easy choice for the Bank of England today. Much of the fiscal easing announced at the end of September was subsequently reversed, although we won’t know exactly how much before the November 17th budget, thus removing a key justification for the acceleration from 50bp to 75bp hikes expected by the market. Similarly, the decline in gas prices also adds to the case for a 50bp hike. The list goes on, for more details, read our economics team’s note on why they think a 50bp move is more likely.

The market disagrees. In our view, the strongest argument in favour of a 75bp hike is that the market is pricing it almost entirely (84% probability), not something the BoE can admit. In fact, the Bank is in a bind. A 75bp hike is likely to be of the dovish sort: accompanied with a warning that the amount of tightening priced by the curve would imply an even deeper recession that is currently anticipated. A 50bp hike is more appropriate in our, and we suspect the BoE’s, view but it would bring a jump in inflation expectations measured by swaps, and risk a re-steepening of the curve.

In fact, the curve has steadily been pricing out hikes since the peak in tightening expectations around one month ago. The implied peak in this cycle, around 4.70% at the time of writing, is still roughly 100bp below where we see the Bank Rate eventually land in 2023. This in turn has allowed gilts to trade below 3.50% in yields. Further repricing lower of both would make sense, but it hinges on the BoE’s willingness and ability to deliver a dovish message, not something we have been used to.

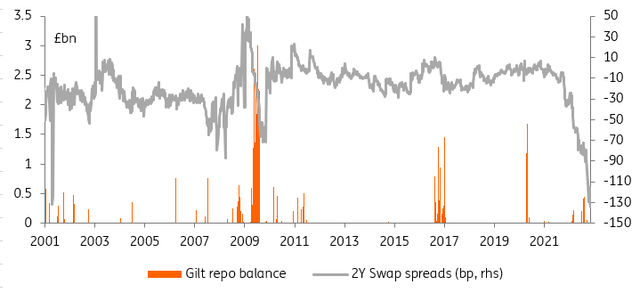

Gilt lending by the DMO has been insufficient to ensure proper transmission of BoE policy

Another topic threatening to muscle its way into today’s BoE meeting is the increasingly scarce conditions at the front-end of the gilt curve. Both in cash gilts and in repo markets, there appears to be a shortage of high quality bonds that is threatening to dampen the transmission of BoE policy into to financial markets and to the economy. This is for instance visible in repo rates dipping 42bp below the Bank Rate, and in short-dated gilt yields falling to 125bp below swap rates. This is a monetary policy problem, and a market functioning one, The BoE and Debt Management Office (DMO) have the tools to ease the pressure: they need to lend more bonds from the QE portfolio, and at a more attractive rate.

Today’s events and market view

The day will be off to a strong start with no less than Fabio Panetta, Joachim Nagel, Pablo De cos and Christine Lagarde, due to speak at various events, including the ECB’s money market conference. Gabriel Makhlouf and Mario Centeno are due to speak later in the session.

Primary markets will be no less busy thanks to bond sales from Spain (5Y/10Y/20Y and linkers) and France (10Y/15Y/30Y).

Even market participants with no interest in sterling markets have learned the hard way about how exposed they are to UK fiscal and monetary policy. The period of market stress now seems firmly behind us but there is a case to be made for keeping a close eye on today’s BoE meeting. At the headline level, the choice is between a 50bp and 75bp hike in the Bank Rate, with a majority of our peers favouring the latter. The update to the BoE’s economic forecast monetary report and governor Andrew Bailey will also play an important role in shaping future hike expectations. Catherine Mann is also due to speak later in the day.

US data consist of no less than trade balance, jobless claims, ISM and PMI services, factory and durable goods orders.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment