J2R/iStock Editorial via Getty Images

BBVA (NYSE:BBVA) remains an attractive income play within the European banking sector, due to a high-dividend yield and a relatively cheap valuation considering its growth profile.

Background

As I’ve analyzed in a previous article, I’m bullish on BBVA as the bank has improved its fundamentals through the sale of its U.S operations during 2021, and now has a good capital position and better growth prospects than most European banks. Despite that, its valuation is close to the European banking sector average, which seems to be undemanding.

However, since my last article published back in February, BBVA share prices have declined by some 6.5%, which is not particularly bad considering the current bear market in global equities but has outperformed the European banking sector by a good margin (close to 11.5%) as can be seen in the next graph (BBVA white line -Stoxx Europe Banks index the orange line).

At the time, BBVA was trading at close to 0.9x book value, a multiple that was in line with the average of its European peers, while today is trading at 0.72x book value (vs. 0.71x for the sector index). This means that European banks’ valuations have de-rated in recent months, but BBVA’s superior share price performance in relative terms is justified both by a higher-dividend yield and above-average book value growth.

As BBVA will report its quarterly earnings next Thursday, I think now is a good time to revisit its investment case and analyze if BBVA is still a good income play within the European banking sector.

Business Overview

For investors who are not aware of BBVA’s business profile, I suggest a look into my previous analysis on this bank. Nevertheless, without getting into too much detail, BBVA is a Spanish bank but has operations across several markets.

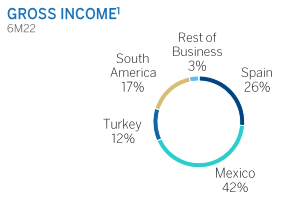

Its business profile is more biased to emerging markets rather than developed markets, especially following the sale of its U.S. operations last year. Indeed, during the first six months of 2022, more than two-thirds of its gross income (revenue) was generated in emerging markets, namely in Mexico, Turkey, and South America. Due to its geographical footprint, its closest peer is Banco Santander (SAN), which also has a diversified business profile across developed and emerging markets.

Revenue (BBVA)

Due to this unique business profile within the European banking sector, BBVA is one of the banks with better growth prospects over the long term, as banking penetration in these regions is lower than compared to developed markets and, usually, GDP growth expectations are also higher than in developed countries.

On the other hand, the bank also has a higher risk profile than most of its peers, both from a credit risk perspective, given that credit default rates for most types of credit products are higher in these regions and from political risk. This is a significant risk, especially in Turkey, which is not a stable country from a political perspective and can lead to negative investment sentiment towards the bank during periods of political unrest in the country.

Beyond macro and industry growth tailwinds, BBVA’s growth strategy is to push for digitalization in its existing markets to offer better service and cut costs. This should help the bank to have good levels of profitability over the medium to long term, given that BBVA is already one of the most efficient banks in Europe and this profile is not expected to change much in the near future.

Recent Earnings

Regarding its financial performance, since my last article, BBVA has reported its financial figures related to the first semester of 2022, reporting a positive operating momentum.

In the first half of the year, BBVA reported core revenue growth of 30% YoY, supported by higher interest rates and loan growth (+12.6% YoY), which led to an increase of 27% YoY on its operating income. Its total revenues increased to €11.5 billion, representing an increase of 12.2% YoY, as net interest income and commissions were strong, but net trading gains were flat compared to the same period of last year.

Operating expenses increased by 9.9% to €5.05 billion, a smaller growth rate than revenues, leading to a positive increase in margins during this period. This led to an improvement in its efficiency ratio, to a level of 43.9% in 6M 2022. This is a very good efficiency level in the banking sector considering, for instance, that U.S. large banks have efficiency ratios closer to 60%. Its provisions for credit risk declined due to strong credit quality across its geographies, resulting in a net income of €3 billion (+57% YoY).

Its return on equity (ROE) ratio, a key measure of profitability in the banking sector, was 12.7% in 6M 2022 (vs. 10.5% in 6M 2021). This is a level that is above the European banking sector and also higher than for its closest peer Santander (ROE of 10.7% in 6M 2022), showing that BBVA’s profitability is above-average, being a key factor to justify a potential premium valuation to its European peers.

Investors should note that BBVA is expected to announce its Q3 earnings next Thursday, which, according to analysts’ estimates, are expected to remain on a positive trend.

Indeed, its revenue is expected to be €6.13 billion (+15% YoY) in the quarter, supported by higher NII due to rising interest rates in Europe, and strong loan growth in Mexico and South America. Its net income is expected to be about €1.55 billion in the quarter, representing an increase of 11% YoY. While its financial figures are expected to remain on a positive path, investors should look into the bank’s provisioning level and its guidance for next year, with the market expecting rising loan loss provisions due to macroeconomic concerns and the prospects of a global recession in 2023. This can be very important for market sentiment towards its shares, thus even if the bank beats estimates what I truly expect to drive share price performance in the short term is the bank’s comments on asset quality over the next twelve months.

Regarding its capitalization, BBVA had a solid capital position at the end of June, a profile that is not expected to have changed much during the last quarter. Its CET1 ratio was 12.45% at the end of Q2, a level that is above its capital requirements and its target range of 11.5%-12%.

This means that BBVA should maintain its shareholder remuneration policy of distributing excess capital to shareholders instead of performing acquisitions, both through dividends and share buybacks. While nothing new is expected to be announced in the upcoming earnings release, the bank is likely to raise its dividend and announce further buybacks when it releases its 2022 annual earnings, at the beginning of 2023.

This means that its current dividend yield of about 6.75%, based on dividend distributions made during the last twelve months, is likely to increase when BBVA announces its final dividend related to 2022 earnings. Note that BBVA pays two dividends per year, one interim that was paid very recently and a final dividend, thus the next payment is only expected to be made in April 2023.

Conclusion

BBVA has maintained good operating momentum in recent quarters, reporting strong growth and sound credit quality. While there are risks from economic headwinds that its provisioning level can increase, this doesn’t seem to be a major threat for the bank’s capital return policy.

Therefore, BBVA’s high-dividend yield remains quite interesting for income investors, plus its valuation is also undemanding, making BBVA one of the most attractive plays right now within the European banking sector.

Be the first to comment