kelvinjay

By Antoine Bouvet, Benjamin Schroeder, Padhraic Garvey, CFA

BoE and ECB let markets fly on their own

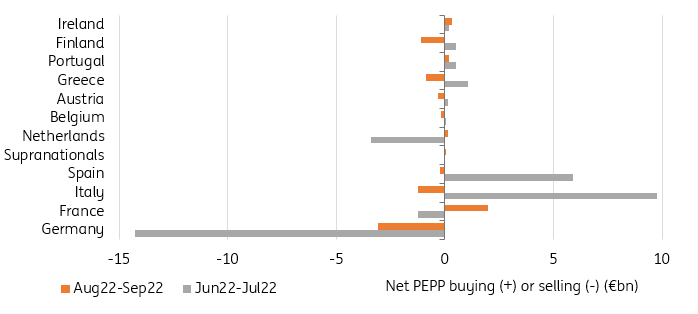

If financial stability no doubt registers on central banks’ consciousness, it is doubtful that they see policy implications. The Bank of England (BoE) balking at buying long-end gilts for the second day in a row clearly confirmed that it sees its operation as a temporary backstop, and not something that should dilute its monetary policy stance. Along the same lines, the European Central Bank’s (ECB) reluctance to support peripheral bond markets in August and September 2022 by using PEPP reinvestment flexibility sends a similar message.

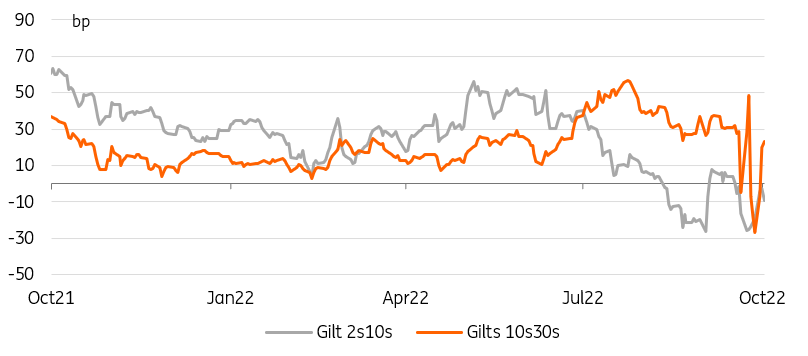

In the BoE’s case, the gilt long-end received the message loud and clear. 10s30s is racing back towards the levels prevailing before the mini budget and subsequent BoE intervention. If the shape of the curve is the best sign that markets are pricing out BoE intervention, it is the speed of the sell-off that should keep investors up at night. 30Y yields are up almost 40bp this week. Let us hope that pension funds and other structural swap receivers managed to reduce their exposure, or found funding sources for inevitable collateral calls.

The glass half-full take on European Central Bank (ECB) intervention, or lack thereof, is that spreads remained contained without its help. This is particularly notable in a context of rising core rates and rates volatility. The problem with this take is that markets are forward-looking, and that there are no ECB purchases for them to look forward to. It seems the bar for purchases is higher than previously thought and could get even higher, as hawks seem intent on pushing discussions on quantitative tightening (QT).

Gilt 10s30s is steepening back to its pre-BoE intervention level (Refinitiv, ING)

Central banks can’t afford to be complacent on financial stability

A look at wider market stress indicators in rates and credit yields a similar conclusion. For the most part, peripheral and core rates are already at crisis levels, but not yet at a breaking point. This is hardly encouraging. A bright spot so far has been short-term funding and money markets, but each time, it is clear that the ECB’s heavy hand is responsible. This is all well and good, but the expiration of TLTRO loans, tiering, and the looming QT discussion means markets cannot count on ECB support going forward.

We think it would be wrong to take comfort in still (barely) functioning markets and that central banks should pay greater attention to financial stability. Balance sheet reduction programmes are adding to financial instability and could ultimately make their fight against inflation harder, not easier, if they are forced to choose between rescuing financial institutions and cooling the economy. Despite the BoE’s intervention last week, we keep a cautious outlook on bond markets. We expect to see new highs in yields and spreads as a result of central bank intransigence.

The ECB barely intervened to support spreads in August/September 2022 (ECB, ING)

Today’s events and market view

European data releases today comprise German and UK construction PMIs and eurozone retail sales, but the minutes of September ECB meeting are likely to steal the limelight. We’re unlikely to get much discussion on QT, but we might see some on reserve tiering. Even if this isn’t the case, it is possible that officials discuss in the press the content of yesterday’s “non-policy” meeting discussions on either topics. In the minutes proper, the extent of the ECB’s inflation worries and reasons for a change in reaction function should be the main focus.

Jonathan Haskel of the BoE is on today’s list of speakers.

Bond markets have to absorb supply from Spain (7Y/8Y/10Y/30Y) and France (10Y/30Y/44Y).

Today’s US job data menu includes jobless claims and Challenger Job Cuts, but this will merely be an appetiser to tomorrow’s employment report. Charles Evans, Lisa Cook, Neel Kashkari, Christopher Waller, and Loretta Mester are all lined up to give their spin on the latest economic, and perhaps financial, developments.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment