TooTH_PIK/E+ via Getty Images

Investment Thesis

I think the stock price of Ranger Oil Corporation (NASDAQ: ROCC) will appreciate based on the overall petroleum market and moves made by ROCC. There are positive developments in pricing and EPS plus consumption and production. Operational improvements, a strong balance sheet, and stock buybacks and acquisitions will help ROCC’s stock price grow. Even if ROCC’s stock price only moves from $38.50 to $40.00 by April 21st, a 44.8% potential annualized return is possible, including covered call premium and dividends.

Ranger Oil

Ranger Oil Corporation is an independent oil and gas company engaged in the onshore development and production of crude oil, natural gas liquids, and natural gas. The Company’s operations consist of drilling unconventional horizontal development wells and operating its producing wells in the Eagle Ford Shale (the Eagle Ford) in South Texas. Their landholder leases are 100% private with no federal acreage exposure. Their location gives them direct access to Gulf Coast markets and minimizes dependency on federal regulated pipelines.

They are 89.7% owned by institutions. I consider institutional investors such as hedge funds, pension funds, mutual funds, and endowments are smart money because they have more resources available for research than retail traders. They control much more buying and selling than retail investors, which determines the stock price. According to Reuters, retail investors currently account for roughly 10% of the daily trading volume on the Russell 3000.

ROCC provided preliminary third quarter results on October 19th. Their third-quarter conference call is scheduled for November 3rd. Further details on the four bullet points below from their press release are available at the company’s website. I see this as further evidence that Ranger Oil is making the right moves to cause their stock price to appreciate.

- Total sales volumes above high-end of guidance

- Drilling and completion capital expenditures within guidance

- Company adds third rig in Q4, creating significant momentum for 2023

- Approximately $70 million returned to equity holders since May, reducing share count by nearly 5%

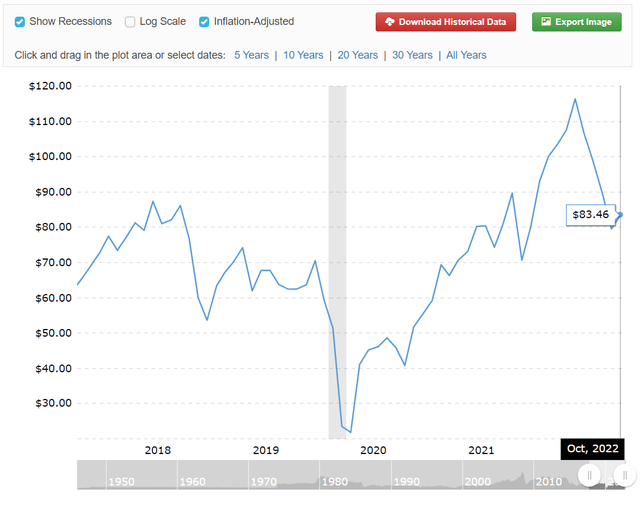

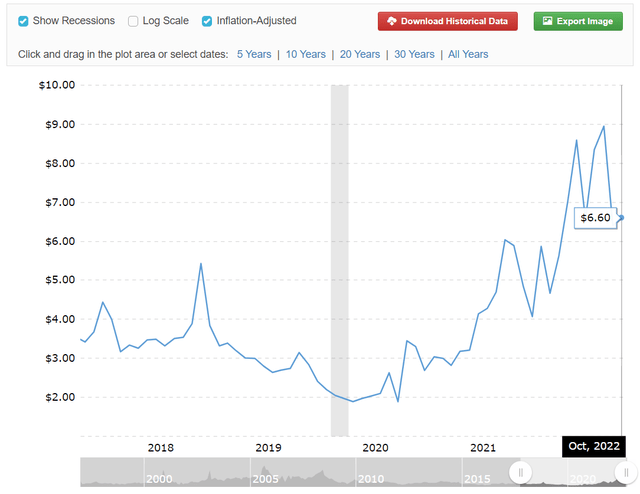

The Price of Oil and Natural Gas

The price of west Texas crude oil and natural gas are above their five-year average. This helps producers to be more profitable. I think the west Texas crude oil price averages around $85/barrel for 2023.

www.macrotrends.net/1369/crude-oil-price-history-chart www.macrotrends.net/2478/natural-gas-prices-historical-chart

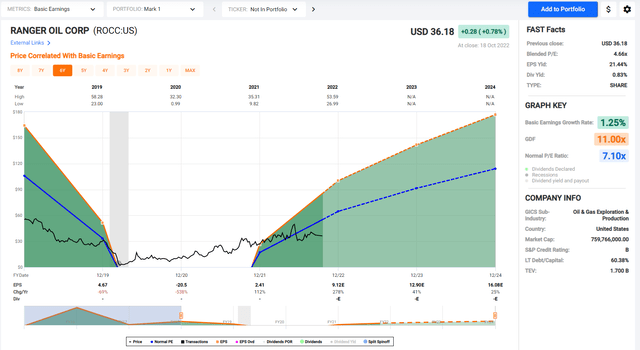

Earnings per Share for ROCC are Improving

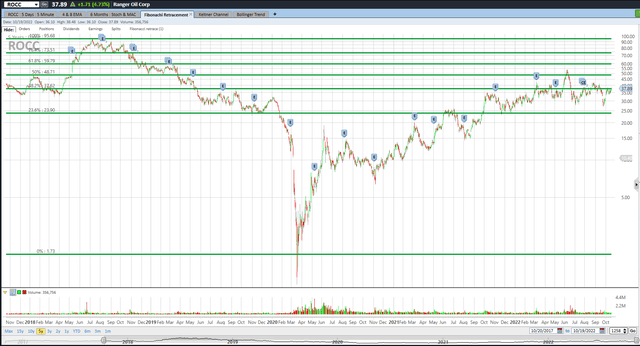

The black line shows ROCC’s stock price for the past several years. Look at the chart of numbers below the graph to see that ROCC had negative earnings per share in 2020. Earnings are expected to grow 41% from an estimated $9.12 in 2022 to $12.90 in 2023. They have a 3.1 forward P/E. ROCC’s stock price could go up significantly if the market assigns them a higher P/E ratio.

I’ve added the green Fibonacci lines using the high and low of the past five years for ROCC. It’s interesting to note how the market pauses or bounces off these Fibonacci lines. They can be one clue as to where ROCC may be going. ROCC may hit the $37.65 38.2% Fibonacci retracement level or even go lower. However, I believe that ROCC will trade above $40 by April for the reasons in this article.

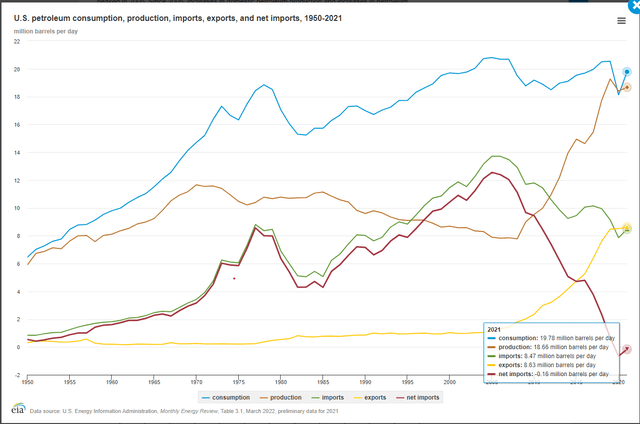

Petroleum Consumption, Production, Imports, and Exports

The U.S. produced 18.66 million barrels of oil daily and consumed 19.78 in 2021. We exported 8.63 million barrels per day and imported 8.47 making us a net exporter. In 2020 and 2021, annual total petroleum net imports were negative, the first years since at least 1949.

www.eia.gov/energyexplained/oil-and-petroleum-products/imports-and-exports.php

OPEC and its allies, including Saudi Arabia and Russia, control more than 40% of global oil production. They announced a 2 million barrels per day cut would take effect in November. The reduction is equivalent to about 2%of global oil demand. “An announced cut of any volume is unlikely to be fully implemented by all countries, as the group already lags 3 million barrels per day behind its stated production ceiling,” Rystad Energy analyst Jorge Leon said in a note.

Oil consumption is not growing like it was years ago, but it also is not showing much decline other than short term during the pandemic. Oil producers seem to be doing what they can to keep their profits high, even if it means higher oil prices.

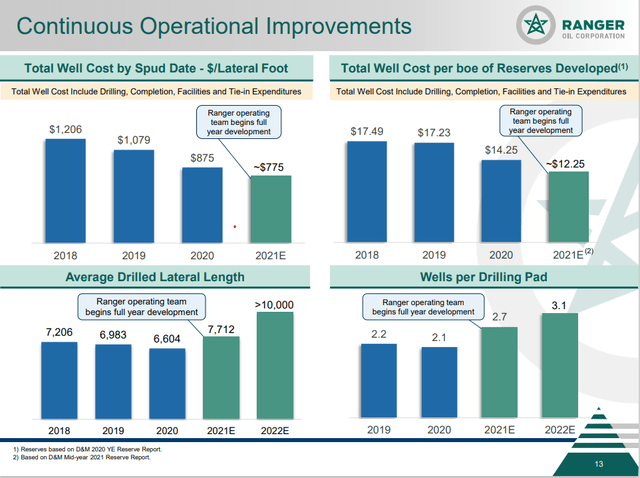

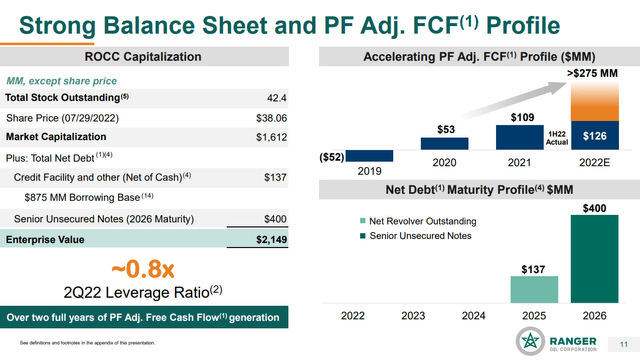

Operational Improvements and Debt Reduction

ROCC is continuing to reduce well costs. They are drilling more wells per pad with greater lateral lengths.

www.rangeroil.com/news-media/presentations

ROCC has a low net debt to forward EBITDA ratio of 0.4, with no obligation due until 2025. ROCC’s S&P credit rating is B. Free cash flow is accelerating yearly. ROCC has a 10.2% free cash flow yield per share.

www.rangeroil.com/news-media/presentations

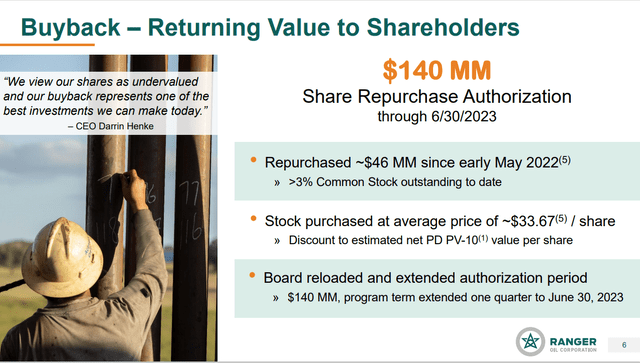

Stock Buybacks and Acquisitions

ROCC is buying back stock that returns value to shareholders. They have a 3.3% buyback yield per share.

www.rangeroil.com/news-media/presentations

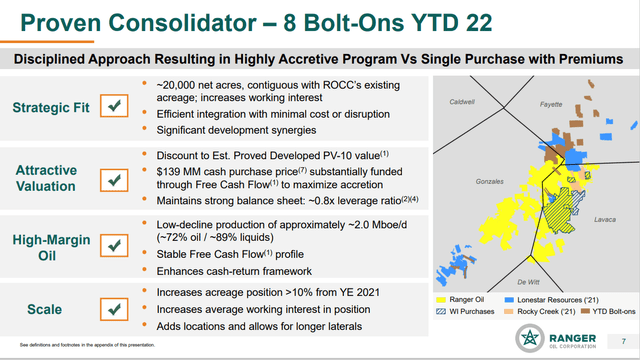

They have acquired eight smaller companies so far this year. Smaller companies can be easier to integrate. Synergies allow for cost reductions. They seem to be able to increase both the top-line revenue and bottom-line profits while keeping the balance sheet in good shape.

www.rangeroil.com/news-media/presentations

The Seeking Alpha rating summary and factor grades show strength in all areas.

| Seeking Alpha | ROCC |

| SA Authors | Buy |

| Wall Street | Strong Buy |

| Quant | Strong Buy |

| Valuation | A- |

| Growth | A- |

| Profitability | B- |

| Momentum | B- |

| Revisions | B- |

Sell Covered Calls

My answer to uncertainty is to sell covered calls on ROCC six months out. ROCC traded at $38.50 on 10/20, and April’s $40.00 covered calls were at or near $7.00. One covered call requires 100 shares of stock to be purchased. Selling April covered calls will allow the investor to collect dividends in October and January at $0.075 each. It will be called away if the stock trades above $40 on April 21st. It may even be called away sooner if the price is above $40, but that’s fine with me since I will have my capital returned sooner.

The investor can earn $700 from call premium, $15 from dividends, and $150 from stock price appreciation. This totals $865 in estimated profit on a $3,850 investment which is a 44.8% annualized return since the period is 183 days.

If the stock is below $40 on April 21st, investors will still make a profit on this trade down to the net stock price of $31.35. Selling covered calls and collecting dividends reduces your risk.

RBC Capital set its one-year price target at $52.00 on October 13th. This implies a 39% potential upside if they are correct. Seaport Global and Truist Financial have $55 and $68 price targets, respectively.

Takeaway

Operational improvements, a strong balance sheet, and stock buybacks and acquisitions will help ROCC’s stock price grow. Even if ROCC’s stock price only moves from $38.50 to $40.00 by April 21st, a 44.8% potential annualized return is possible, including covered call premiums and dividends. ROCC is a small company with $934M in sales, 136 employees and $741M in market cap, so I suggest keeping exposure to a small part of the portfolio.

Be the first to comment