Joey Ingelhart

On Monday, July 25, 2022, natural gas-focused exploration and production giant Range Resources Corporation (NYSE:RRC) announced its second quarter 2022 earnings results. A look at the headline numbers will likely please any investor as Range Resources blew away the expectations of its analysts in terms of both revenues and earnings, which had a positive effect on the stock price in after-market trading. This trend appears to be continuing as of Tuesday morning. As the price of natural gas has more than doubled over the past year, Range Resources’ financial performance was expectantly better than in the prior-year quarter. There may be some reasons to believe that this incredible performance will not be an isolated incident as the company is positioned to both grow its cash flows and strengthen its balance sheet over the coming quarters. When we consider that the stock also appears to be dramatically undervalued at the current price, we find that there is a great deal to like here and that the company is worth considering as an investment today.

As my long-time readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from Range Resources’ second quarter 2022 earnings results:

- Range Resources reported total revenues of $1.225143 billion in the second quarter of 2022. This represents an impressive 181.82% increase over the $434.722 million that the company reported in the prior year quarter.

- The company reported an operating cash flow of $324.706 million in the reporting period. This represents an 86.41% increase over the $174.188 million that the company reported in the year-ago quarter.

- Range Resources produced an average of 2.073924 billion cubic feet of natural gas equivalent per day during the most recent quarter. The company realized an average of $5.03 per thousand cubic feet of natural gas equivalent during the period.

- The company repurchased 4.5 million shares and reduced its total debt outstanding by $217 million during the current quarter.

- Range Resources reported a net income of $452.855 million in the second quarter of 2022. This compares very favorably to the $156.472 million net loss that the company reported in the second quarter of 2021.

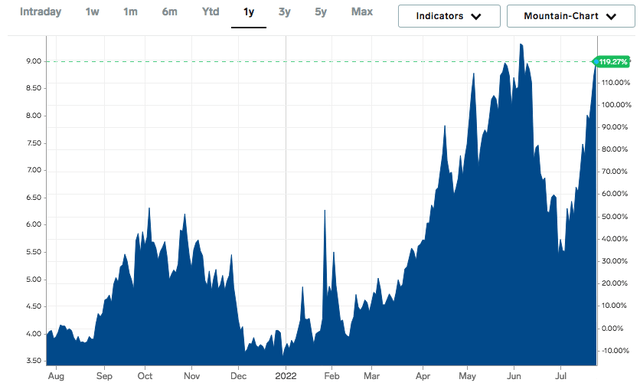

It seems essentially certain that the first thing that anyone reviewing these highlights will notice is that Range Resources saw every measure of financial performance improve considerably compared to the prior year quarter. It is unlikely that this will be a surprise to anyone reading this considering the surge in natural gas prices that we have seen over the past year. As of the time of writing, natural gas at Henry Hub has risen 119.27% over the past year:

During the second quarter, approximately 70% of Range Resources’ production was natural gas, so it is fairly easy to see how the company benefited from this. We can see this reflected in the company’s realized prices, which at an average of $5.03 per thousand cubic feet of natural gas equivalent were quite a bit higher than in the prior year quarter.

At this point, there will likely be some readers that point out that this figure was well below the average market price for natural gas during the period. This is certainly true, but it is not exactly unusual right now. As I discussed in a recent article, it is common practice for upstream producers of crude oil and natural gas to use hedges such as forwards and futures contracts to lock in a selling price for their products as a way to manage their commodity price risk. Range Resources is no exception to this as it also uses the strategy. While this works quite well to protect the company against declines in energy prices, it does not work nearly as well when energy prices increase rapidly as they did during the first half of 2022. When that happens, we get the situation that occurred here in which the company’s hedges are basically forcing it to sell its production at below market prices. We can see proof that the hedges dragged the company’s performance down by looking at the fact that it realized an average price of $7.18 per thousand cubic feet of natural gas equivalent before the hedges are considered. This was actually the highest price that the company has realized since 2008. This could ultimately boost Range Resources’ profits in future quarters if natural gas prices stay at similar levels as today. This is because some of the company’s production that is currently hedged at lower prices no longer will be and Range Resources will start to capture higher prices as the old hedges run off.

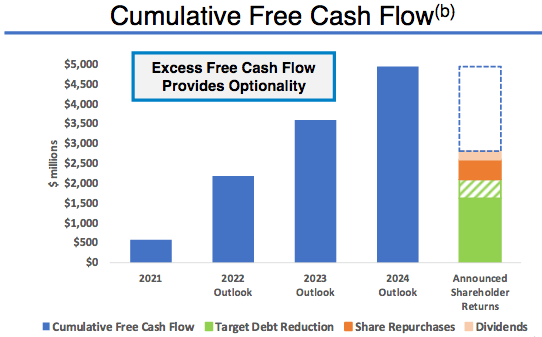

In my last article on Range Resources, I showed that natural gas prices will probably remain high for quite some time so this is a very possible scenario. The company itself is also projecting this and as we can see here, that would allow it to generate substantial free cash flow:

Range Resources

This is something that is very nice to see since free cash flow is the money that is left over from a company’s ordinary operations after it pays all its bills and makes all necessary capital expenditures. Therefore, it is the money that is available to reward the shareholders through dividends, stock buybacks, and debt reduction. Range Resources has opted to do the latter two options.

As stated in the highlights, Range Resources bought back 4.5 million shares as well as repaid $217 million worth of its outstanding debt during the period. Admittedly, I am not a particularly big fan of the stock buyback as I would rather see Range Resources implement some sort of fixed plus variable dividend program like Pioneer Natural Resources (PXD) is doing. Stock buybacks are generally considered to be a more tax-friendly way to return money to the shareholders than a dividend but the problem is that the stock price does not always go up in response to the buyback. A dividend, however, puts money into your pocket that can be spent to buy more of the company’s stock yourself, used to buy another stock, or spent on bills or anything else. It is still conceivable that Range Resources may implement a dividend at some point as I suggested in my last article, but the company made no mention of that in the earnings report so unfortunately income-seekers may have to keep waiting.

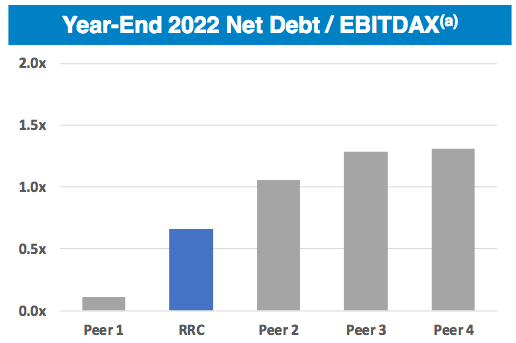

The fact that the company reduced its debt is very nice to see. This is because of the high risk that a high amount of leverage presents for a company like this. The reason for this risk is that a company must make regular payments on its debt if it is to remain solvent so any event that causes the firm’s cash flows to decline could push it into financial distress if it has too much debt. When we consider the impact that sometimes volatile commodity prices can have on Range Resources’ finances, we can see why this could be a significant risk. Thus, it is nice to see that Range Resources made some progress at addressing it during the quarter. We can see this by looking at the company’s leverage ratio, also known as the debt-to-EBITDAX ratio. This ratio essentially tells us how long it would take the company to completely pay off its debt if it were to devote its entire pre-tax cash flow to that task. At the end of the second quarter 2022, this ratio stood at 1.2x based on the company’s trailing twelve-month EBITDAX. This is a significant improvement over the 1.6x that the company had at the end of the first quarter. Range Resources still has quite a ways to go with reducing this further, however. As I have pointed out in various past articles, I like to see this ratio under 1.0x in order to minimize the position’s risk, which is in line with the best companies in the sector.

Range Resources has stated that it intends to keep working on reducing its leverage over the remainder of the year and it should be able to get its leverage down to a very attractive level by then assuming that natural gas prices remain at today’s levels:

Range Resources

There are certainly some reasons to believe that Range Resources will actually be able to accomplish this as the demand for natural gas remains strong but supplies remain tight. This is overall conducive to stable or rising natural gas prices, although we may see a temporary dip as the economy falls into a recession. The long-term fundamentals are quite strong for natural gas though and we will probably see prices remain around today’s level or increase over any sort of extended period.

It might be expected that Range Resources would increase its production in order to take advantage of the high prices and generate large profits. However, it is not actually doing this. The company reiterated its guidance of producing an average of 2.12 billion to 2.16 billion cubic feet of natural gas equivalent per day over the course of 2022. This is only slightly higher than the 2.07 billion cubic feet of natural gas equivalent that the company produced on average during the second quarter. This is surprising because higher production would give the company more products to sell and earn money from. However, there are several companies across the industry right now that have elected to simply hold production steady instead of growing it. This is mostly being done in order for the companies to hold their capital spending down and allow more of their revenues to make its way into free cash flow. The fact that they are holding production steady also prevents the market from becoming oversupplied with natural gas, which would collapse prices. This could prove to be a shrewd decision for the company and its investors, although admittedly consumers might not like the high prices.

It is always critical that we do not overpay for any asset in our portfolios. This is true even for companies like Range Resources that just reported fantastic results. The reason for this is that overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In Range Resources’ case, one metric we can use to value the company is the price-to-earnings growth ratio. This is a modified form of the familiar price-to-earnings ratio that takes a company’s earnings per share growth into account. A price-to-earnings growth ratio of less than 1.0 is a sign that the stock might be undervalued relative to its forward earnings per share growth and vice versa.

According to Zacks Investment Research, Range Resources will grow its earnings per share at a 28.40% rate over the next three to five years. This gives the stock a price-to-earnings growth ratio of 0.22 at the current price, which is a clear sign that the company is dramatically undervalued today. However, as I have pointed out in numerous previous articles, pretty much everything in the traditional energy industry is undervalued right now. Thus it may make sense to compare Range Resources to some of its peers in order to see which company offers the most attractive relative valuation. Here is a chart that does that:

| Company | PEG Ratio |

| Range Resources | 0.22 |

| EQT Corporation (EQT) | 0.25 |

| Chesapeake Energy (CHK) | 1.04 |

| Continental Resources (CLR) | 0.14 |

| Diamondback Energy (FANG) | 0.21 |

| Pioneer Natural Resources | 0.78 |

As we can see above, while Range Resources is not the absolute cheapest company in the sector, it does overall compare reasonably well to its peers. Overall, the stock does look remarkably cheap when we consider the company’s forward growth rate. When we combine this with its strengthening balance sheet and the high possibility of continued free cash flow generation, Range Resources looks like it is a buy today.

In conclusion, there was a great deal to like in Range Resources’ results. The company showed phenomenal year-over-year growth, which was generally expected due to the high price of natural gas. The long-term fundamentals for natural gas remain strong so it is likely that this will not end up being a one-off quarter, either. As Range Resources continues to generate very high free cash flow, it should be able to strengthen its balance sheet further and bring its financial strength in line with that of its best-run peers. When this is all wrapped in an affordable package, we see that there is a lot to recommend an investment in Range Resources.

Be the first to comment