solarseven/iStock via Getty Images

Introduction

In July 2022, I wrote a bullish article on SA about third-party logistics provider Radiant Logistics (NYSE:RLGT) in which I said that it looked cheap as revenues and net income were growing fast thanks to acquisitions and a tight capacity thanks to global supply chain disruptions.

Radiant Logistics posted strong preliminary financial results for Q4 FY22 but it’s share price has been under pressure over the past few days as it recently revealed that it has to restate its financial results for periods in fiscal years 2021 and 2022 due to errors stemming from the timing of the recognition of the estimated accrual of in-transit revenues and related costs.

In my view, these accounting issues create a window of opportunity to open a position as the errors are unlikely to affect the FY22 EBITDA and net income of Radiant to a large extent. According to the preliminary findings, FY21 EBITDA and net income were overstated by inconsequential amounts and there is no reason to think FY22 errors will be larger. Let’s review.

Overview of the recent developments

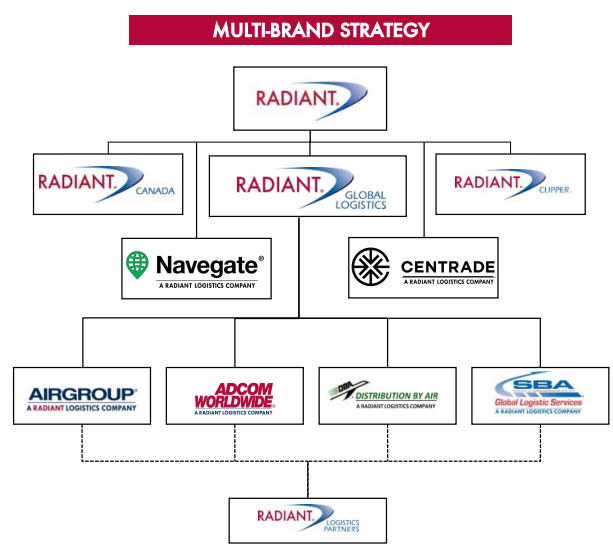

In case you haven’t read my previous article about Radiant Logistics, here’s a short description of the business. The company is focused on air and ocean freight forwarding and truckload, less-than-truckload, and intermodal freight brokerage solutions in North America and currently has over 100 operating locations and 12,000 clients. This means that Radiant Logistics buys transportation from direct carriers and resells those services to its customers and its brands include Radiant, Navegate, Centrade, Airgroup, and Adcom Worldwide among others. On October 5, Radiant Logistics announced that it bought Minneapolis-based Cascade, which has been operating under its Airgroup brand since 2007.

Radiant Logistics

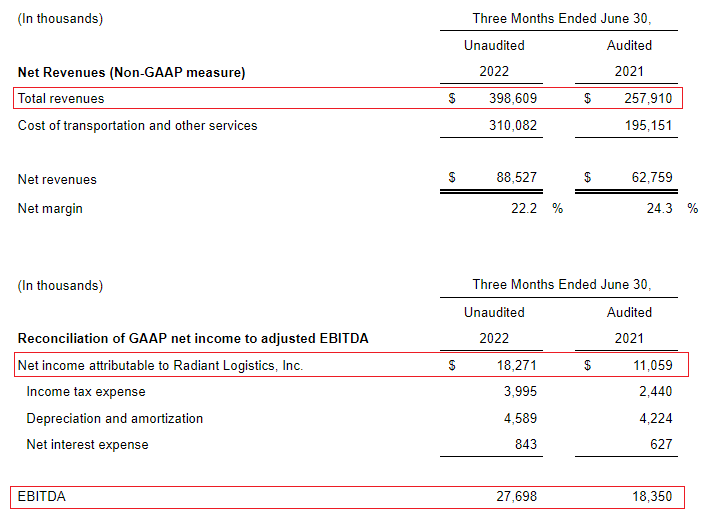

Radiant Logistics is a compounder focused on acquiring companies with complementary geographical and logistics service offerings and this strategy has helped it grow its gross revenues from $25 million in FY06 to $1.48 billion in FY22. In Q4 2022 alone, gross revenues came in at $398.6 million as they soared by 54.5% year on year thanks to the effects of the COVID-19 pandemic. Over the past two years, Radiant Logistics has seen increased demand for the delivery of essential products such as COVID test kits, personal protective equipment, food and beverages, and consumer goods. EBITDA and net income, in turn, soared by 50.9% and 65.2% to historical records of $27.7 million and $14.3 million, respectively.

Radiant Logistics

I think it’s impossible to predict how much revenues and EBITDA will decrease once the pandemic boost ends. In FY18, Radiant Logistics had gross revenues of $842 million and adjusted EBITDA of $29.2 million. However, it’s a much different company today as it has completed several acquisitions over the past few years. For example, Navegate was bought for $35 million in December 2021, and it had annual revenues of $88 million and EBITDA of $5.9 million when the deal was announced. This company contributed $38.8 million in revenues and $1.7 million in net income in Q3 FY22 alone.

In addition, comparing the financial results of Radiant Logistics to previous years is made even more challenging by the fact that the FY21 and FY22 figures are wrong. On October 4, the company revealed that it found differences between estimated purchased transportation and commission expenses and the actual revenues and expenses. The main reason for this discrepancy is errors in the underlying shipment information which was used to calculate the original estimates of the accrued amounts.

Accounting mistakes are never a good thing but, in this case, there’s a silver lining. You see, the FY21 revenues and operating expenses appear to be understated by roughly the same amount according to the preliminary findings – $14.1 million to $17.3 million and $14.7 million to $18 million, respectively. This means that the attributable net income was overstated by only $0.4 million to $0.5 million. EBITDA, in turn, was overstated by $0.5 million to $0.7 million. Due to the nature of the errors, it seems likely that FY22 EBITDA and net income were also overstated by insignificant amounts.

Overall, I remain bullish on Radiant Logistics. In my view, the COVID-related charter business won’t go away for at least another quarter, and this should help the company keep Q1 FY23 EBITDA above $20 million. If we assume that normalized EBITDA is in the region of maybe $40 million per year, then Radiant Logistics is valued at an EV/EBITDA multiple of about 8.5x as of the time of writing (based on net debt of $73 million at the end of March as we still don’t have the June figures). I think that Radiant Logistics should be valued at somewhere above 12x EV/EBITDA thanks to its history of compelling growth over the past 15 years and this would put the share price at about $8.20. In my view, the accounting errors shouldn’t affect the bull case and the decline in the market valuation over the past several days seems like a good opportunity to open a position in Radiant Logistics.

Turning our attention to the risks for the bull case, I think that there are two major ones. First, it’s possible that the extent of the accounting errors is more significant than initially thought. Second, many financial experts are forecasting a major global recession in the near future. If its magnitude is anywhere near the Great Recession, the logistics sector is likely to be affected significantly, which would put pressure on the margins of Radiant Logistics.

Investor takeaway

Radiant Logistics booked record EBITDA and net income in Q4 F22, but this was overshadowed by accounting errors. Fortunately, these errors seem to have a very small impact on EBITDA and net income, and I think that the company’s shares seem even cheaper than in July.

I think that Radiant Logistics should be trading at about $8.20 per share and I rate it as a speculative buy due to the accounting issues and global recession fears.

Be the first to comment