alberto clemares expósito

Introduction

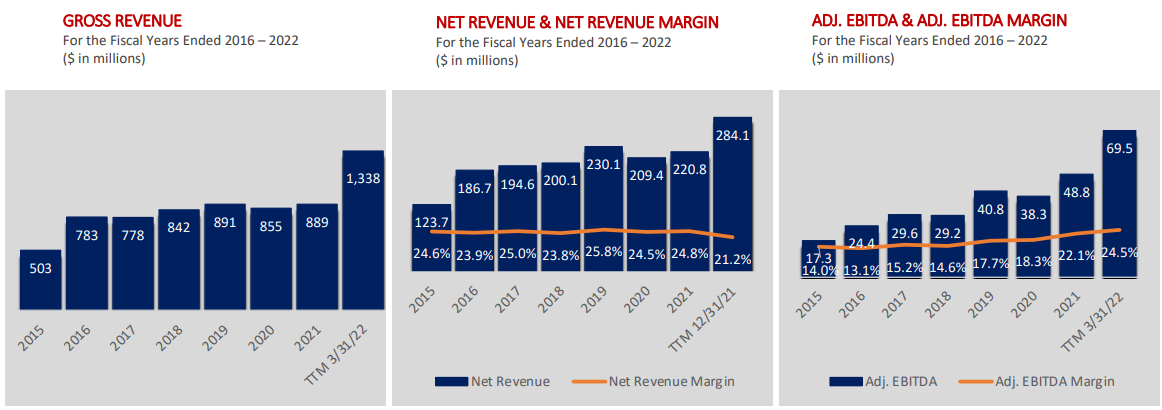

I like writing about undercovered stocks on SA and today I’m taking a look at Radiant Logistics (NYSE:RLGT). It’s a third-party logistics provider that has been showing a significant improvement in revenues and net income over the past few quarters thanks to tight capacity as a result of global supply chain disruptions. I view the company as a cheap compounder as TTM adjusted EBITDA is $69.5 million. Even if supply chain disruptions ease, Radiant Logistics looks undervalued due to its good track record of revenue and EBITDA growth through M&A. Let’s review.

Overview of the business and financials

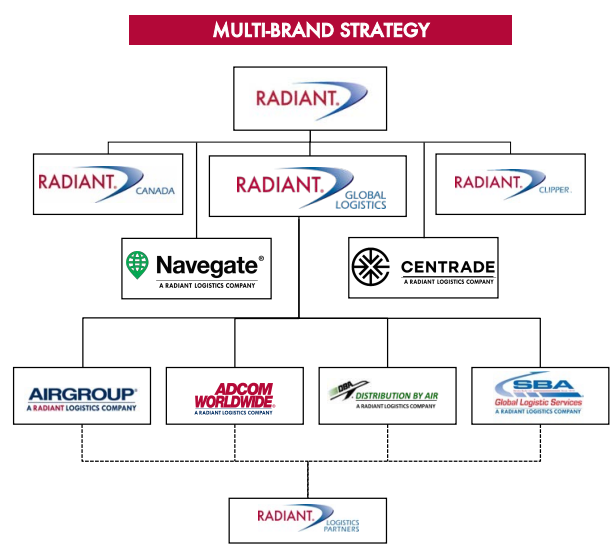

Radiant Logistics focuses on the provision of air and ocean freight forwarding and truckload, less-than-truckload, and intermodal freight brokerage services in the USA and Canada. The company purchases transportation from direct carriers and resells those services to its customers, which are involved in the consumer goods, food and beverage, manufacturing and retail sectors among others. Radiant Logistics also offers materials management and distribution services under contracts generally ranging from a few months to five years. The company has over 100 operating locations and it currently has more than 12,000 clients. Its brand portfolio includes Radiant, Navegate, Centrade, Airgroup, and Adcom Worldwide among others.

Radiant Logistics

Radiant Logistics operates in a fragmented industry and has been relying a lot on inorganic growth over the past 16 years to grow its annual gross revenues from about $25 million to over $1 billion. The EBITDA compound annual growth rate over the past 16 years has been above 35%, which I think is impressive. The M&A focus of Radiant Logistics is on companies with complementary geographical and logistics service offerings and the latest major purchase included global freight management platform Navegate for $35 million in December 2021. I think it was a good purchase considering this company had annual revenues of $88 million and EBITDA of $5.9 million at the time of the acquisition. It also expands the international digital capabilities of Radiant Logistics.

It seems that the integration of Navegate is going well as this company contributed $38.8 million in revenues and $1.7 million in net income in Q1 2022 alone.

Turning our attention to the financial results of Radiant Logistics, you can see from the charts below that revenues and EBITDA have been growing steadily over the past several years but FY22 is shaping up as a record year.

Radiant Logistics

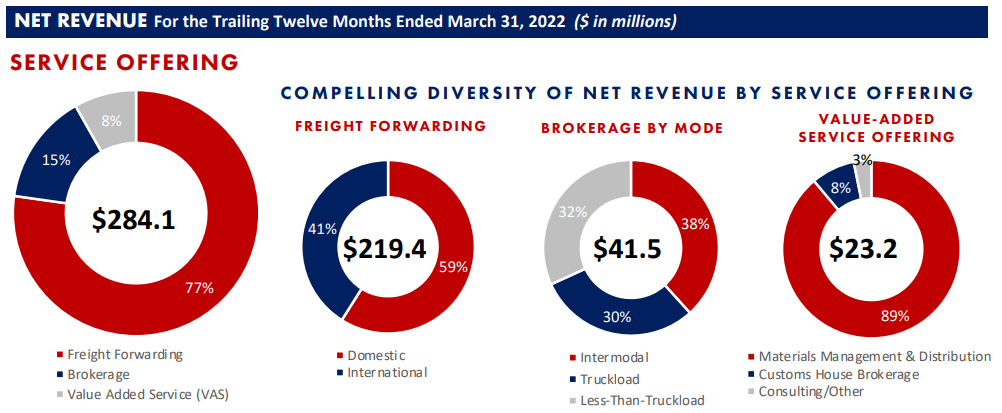

The majority of net revenues come from freight forwarding and they have been particularly strong lately thanks to mark-ups associated with higher transportation costs resulting from tight capacity on ocean, rail and trucking lanes. In addition, Radiant Logistics is getting a strong boost from COVID-19 vaccine deliveries. In Q1 2022 alone, the company was involved the chartering of 24 aircraft flying 85.4 million COVID test kits to the interior of the USA. Revenues from its COVID-related charter business came in at $62.2 million for the period.

Radiant Logistics

So, what can we expect in the future? Well, transportation disruptions and capacity issues should ease eventually, and the COVID-related charter business should dry up but Radiant Logistics said during its latest quarterly earnings call that it still doesn’t see this happening. In view of this, I expect EBITDA to remain above the $20 million mark for a quarter of two more. After that, EBITDA levels could drop to about $10 million per quarter unless there is another acquisition.

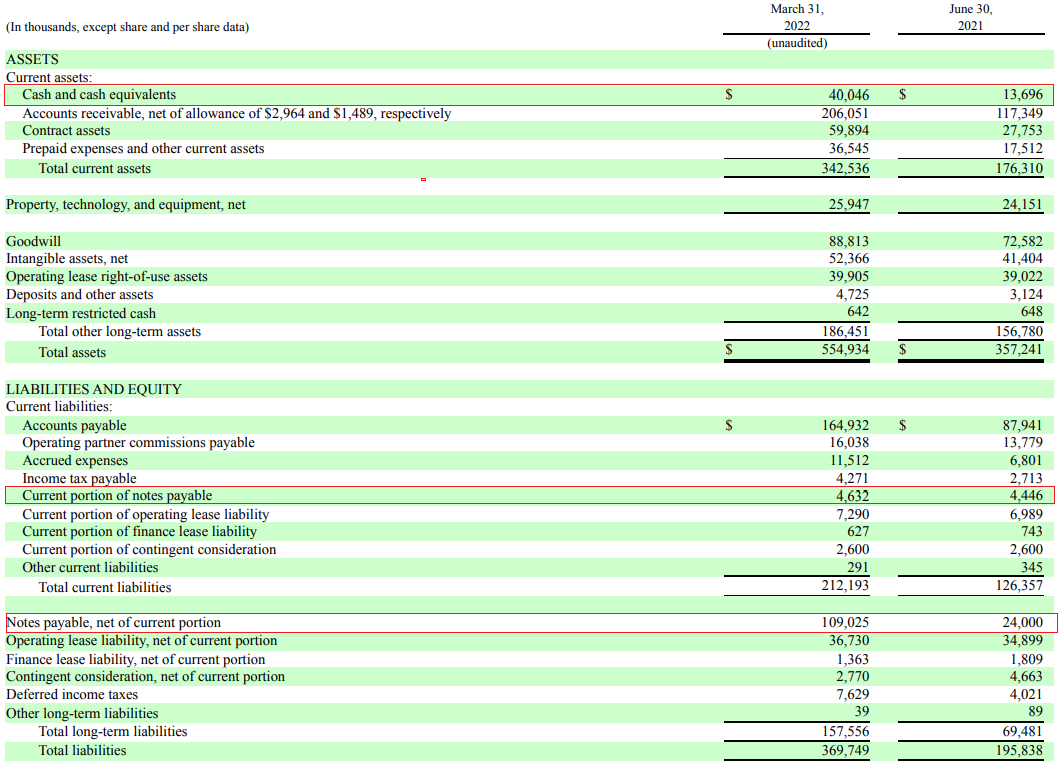

Yet, I think that Radiant Logistics is cheap even if EBITDA returns to about $40 million per year. The company has a diversified customer base with no client accounting for more than 4% of net revenues at the moment. Also, the company has an impressive track record of steady growth through acquisitions and its balance sheet looks strong right now. As of March 2022, net debt was just $73 million.

Radiant Logistics

This means that the enterprise value (EV) is about $410 million as of the time of writing and I think that Radiant Logistics should be valued at over 12x EV/EBITDA based on normalized EBITDA of about $40 million per year. This would put the share price at about $8.20 and I think that the market isn’t giving enough credit to Radiant Logistics for its strong results. After all, the share price is currently below the levels seen in 2015. Radiant Logistics founder and CEO Bohn Crain said twice during the latest quarterly earnings call that there is a disconnect between the underlying value of the company’s stock and the current stock price and it seems that one way Radiant Logistics wants to fix this is through share buybacks. The company purchased a total of 870,733 at an average cost of $7.18 per share during the nine months ended March 31, 2022, and in February it renewed its stock buyback program which allows it to buy back up to 5 million shares through December of 2023.

Turning our attention to the risk for the bull case, I think that there are two major ones. First, it’s impossible to predict when global supply chain issues will end, and this will have a significant impact on the results of Radiant Logistics. If this happens soon, I think the share price could take a hit. Second, a global recession is starting to look more likely with each passing day and this could create a glut in the logistics forwarding market.

Investor takeaway

I think that Radiant Logistics has a good track record of growing through acquisitions and global supply chain disruptions have pushed its quarterly EBITDA above $25 million. However, the EV of the company is still barely above $400 million as of the time of writing and this seems like a good time to open a position.

In my view, Radiant Logistics is a cheap compounder that should be trading at about $8.20 per share and each day of continuing supply chain disruptions strengthens the bull case. I think that the recently renewed stock buyback program could provide a boost for the share price. Yet, keep in mind that a sudden easing of supply chain disruptions could put pressure on the market valuation and this is why I rate Radiant Logistics as a speculative buy.

Be the first to comment