Nikolay Evsyukov

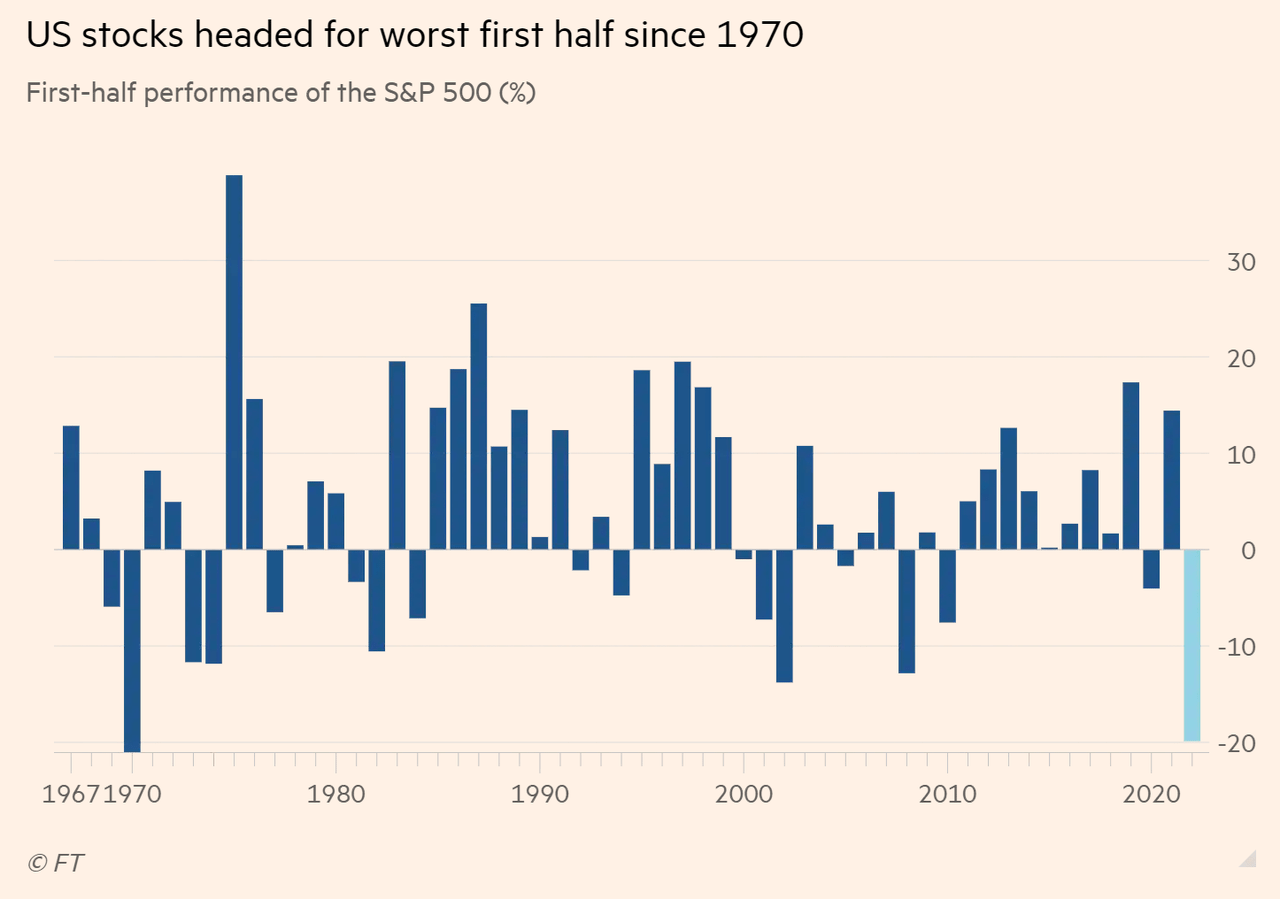

June marked the end of a brutal first half of the year. The S&P 500 finished down -20.6%, its worst start since 1970 and the MSCI World Index return of -20.9% was the worst first-half in its history. Inflation and slowing growth are taking their toll on all risk assets.

Financial Times

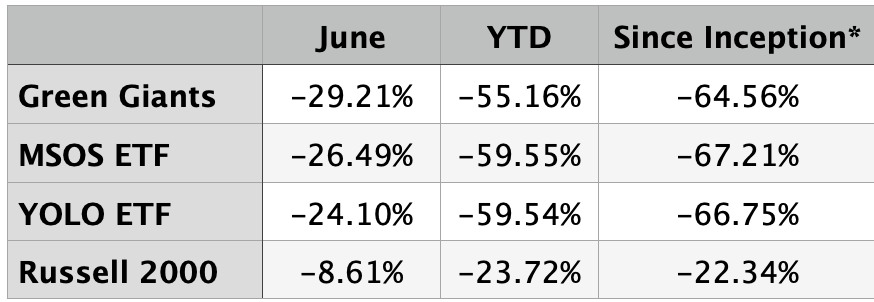

Cannabis stocks once again got clobbered. The MSOS ETF (a proxy for US cannabis) peaked on February 10th, 2021, and is down -82% in the subsequent 500+ days. During June, MSOS fell by 26.49%, which one would hope is a sign of capitulation or maximum pessimism. However, price action and sentiment have been bad enough, for long enough, that it is hard to gauge. Perversely, the fact I am too fatigued to speculate on whether this is–or is near–the bottom might be bullish.

The Green Giants portfolio lagged benchmarks this month. The biggest negative contributors were Green Thumb Industries (OTCQX:GTBIF) and Ascend Wellness Holdings (OTCQX:AAWH). There was not any meaningful news in these names. In these thinly-traded OTC stocks, all it takes is one big seller to pressure the stock. Ascend’s CEO Abner Kurtin mentioned they were aware of a large seller last month. In related news, Abner also purchased more Ascend stock last month and is taking 100% of his 2022 compensation in Ascend stock.

For the year and since its inception, the Green Giants strategy is beating cannabis benchmarks, but absolute returns remain miserable.

*Inception date of Green Giants model portfolio is 10/01/21 (Author)

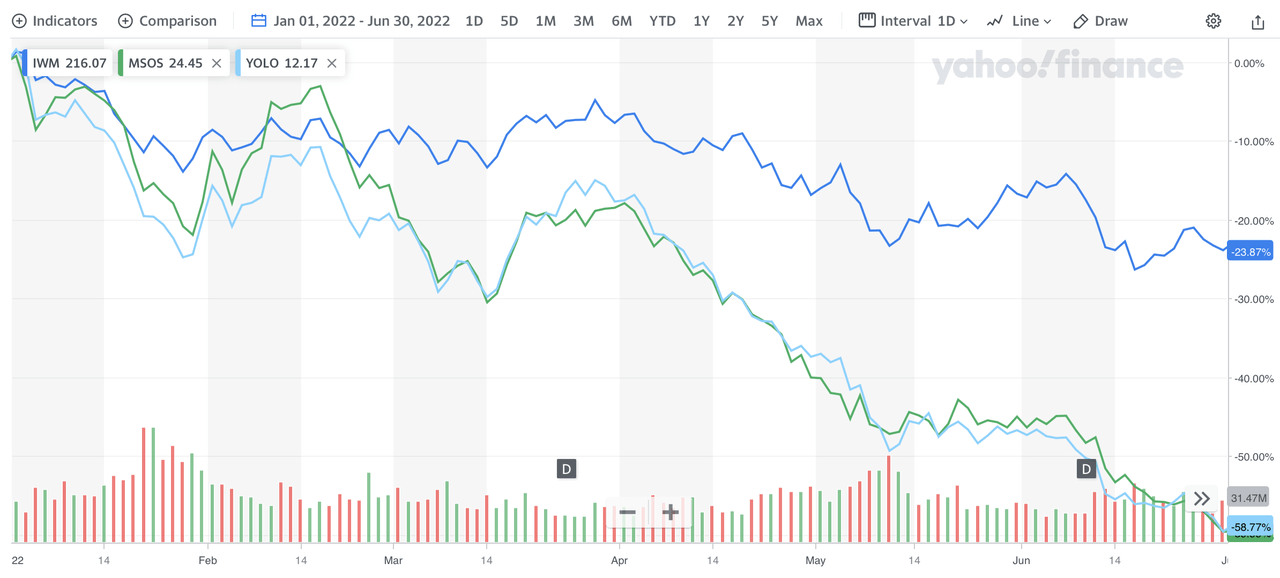

Below is a graphical illustration of how the various benchmarks performed for the first half of 2022.

Yahoo Finance

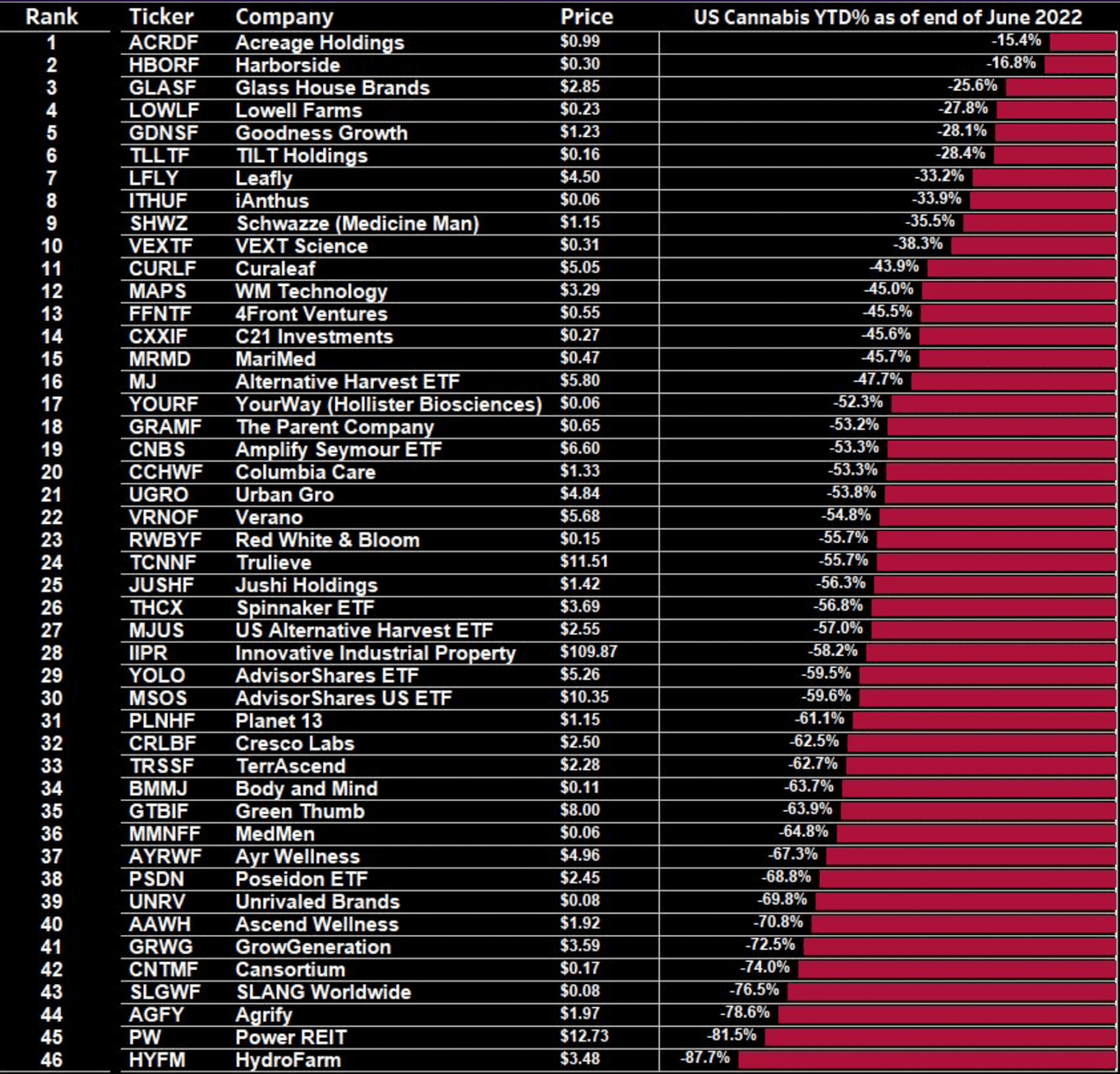

Here is a look at individual cannabis stock performance for the first half of the year. Courtesy of @thecannelorian on Twitter.

@thecannelorian

What Happened?

Despite the punishing price action, there was not much cannabis news last month. It felt like much of the continued decline was cannabis stocks acting high beta, while markets are in a risk-off mode. We are not in earnings season, no mergers or acquisitions took place, and there was minimal stock-specific news.

SAFE Removed From Competes

The biggest drop came when SAFE Banking was once again removed by the senate and not included in the America Competes Act. I noticed on June 21st that MSOs were selling off more than normal, while Canadian LPs were doing fine, and speculated SAFE Banking had been stripped from Competes.

Two days later, we learned that SAFE had been removed and the sell-off accelerated. I wish we would lower our expectations around near-term reform. It may happen, I am far from a political expert, but even the “most informed” parties have trouble accurately predicting what might happen, and when it will occur.

California Cuts Cultivation Tax

On the positive side, California eliminated the $162/pound cultivation tax. This is a flat tax, meaning whether your pound is $1500 or $300, the tax is the same. Therefore, it hits outdoor and greenhouse growers the hardest and is one of the reasons farmers in the outdoor capital of Humboldt County have been so decimated. The tax is eliminated on July 1st and immediately improves the margins of all California cultivators.

One of the biggest beneficiaries is Glass House Brands (OTC:GLASF), a low-cost producer of greenhouse flower. Their current cost to grow one pound is $177, so the cultivation tax was almost doubling their cost of production. Shortly after the news hit, I joined a Twitter Spaces with Graham Farrar of Glass House and Morgan Paxhia of Poseidon to discuss the news.

The biggest takeaway is that things are finally improving in California. The two biggest issues plaguing the state are high taxes and not enough retail stores. The tax issue is being addressed through the elimination of the cultivation tax, however, we still have the 15% excise tax, (at least) 7.25% sales tax, plus each city is able to add an additional cannabis sales tax.

In addition, retail licenses are being issued at the fastest pace ever. The state issued over 90 new dispensary licenses in June, which is almost 10% of the total number issued in the state. More doors are the key to combatting the deeply engrained traditional market and will help support the oversupplied flower market.

I also attended the Glass House Investor Sesh in June. Below are my notes and pictures from the meeting and greenhouse tour.

Portfolio Update

During June we exited TerrAscend (OTCQX:TRSSF) and started a position in Columbia Care. This is largely based on valuations: TerrAscend trades at 15.7 2022 EV/Adj. EBITDA, Columbia Care (OTCQX:CCHWF) is 56% cheaper at 6.7x. This is too simple of a perspective, as there are multiple ways to look at valuations, plus growth rates, debt, and a myriad of other factors go into the equation, but the point remains the same: Columbia Care is too cheap.

Their proposed merger with Cresco (OTCQX:CRLBF) was approved by shareholders on July 8th. When we bought Columbia Care, it was at a 13.7% discount to Cresco. If all goes well, this spread will continue to narrow, and we’ll end up with a position in the combined entity.

If you missed my deep dive on TerrAscend, you can read it here.

Moving Forward

Investors I speak with remain interested in cannabis but are discouraged by the price action. When I talk to the companies in which we invest, I leave feeling confident and excited. When I watch the stocks, I get anxious and discouraged. This is one of the biggest disconnects in my 25 years of investing.

The question I hear most often is, what will turn this around? Below are a few things that stand out.

1. Political progress is the most obvious. The hype around the democratic sweep in 2020 is what shot stocks sky high, and they have been falling every month as the promises and expectations are not met. Most expected SAFE Banking by now and Biden promised us rescheduling (or descheduling) and decriminalization. Being Schedule One or Two makes you subject to 280E, so Schedule Three or below–or descheduling–would remove this crazy tax burden.

There are numerous rumors about potential action prior to year-end. This has boosted stocks for the first week of July. I encourage you to follow Natale Fertig of Politico and Tom Angell of Marijuana Moment to stay up on the latest. Todd Harrison also talks about his optimism for political progress in his latest letter.

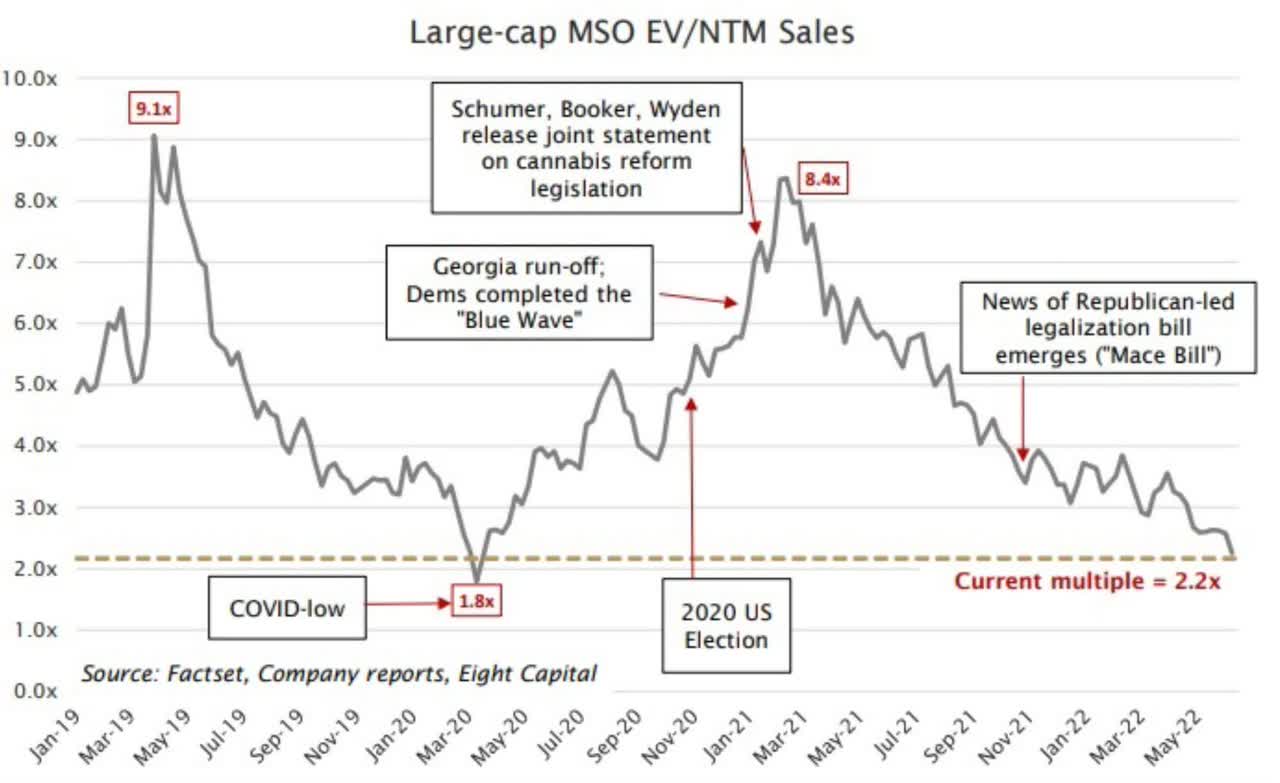

2. Valuations will eventually matter. Cannabis stocks are cheap versus almost every other industry and are approaching the lows established during COVID. Below is a graph showing where we have been, and where we stand today.

Eight Capital

The top US MSOs (aka tier ones) trade at 2.2x 2022 sales and 1.8x 2023 numbers. Meanwhile, their revenues are expected to grow by 25% from 2022 to 2023. (FactSet Data as of 07/10/22). Some would call this growth at a reasonable price aka GARP.

Barron’s shared similar sentiments in their recent article, “American Weed Stocks Are Cheap, and About to Get a Sales Bump.”

3. A broad stock market rally. Fundamentally, we are seeing improvements in most of the large operators. This is largely due to new states opening (New Jersey, New York, Connecticut), with the potential for more after the midterm elections. Normally, the market would start discounting these improvements, however, just when this started happening, we entered into a broader bear market, and cannabis stocks were dragged down with everything else.

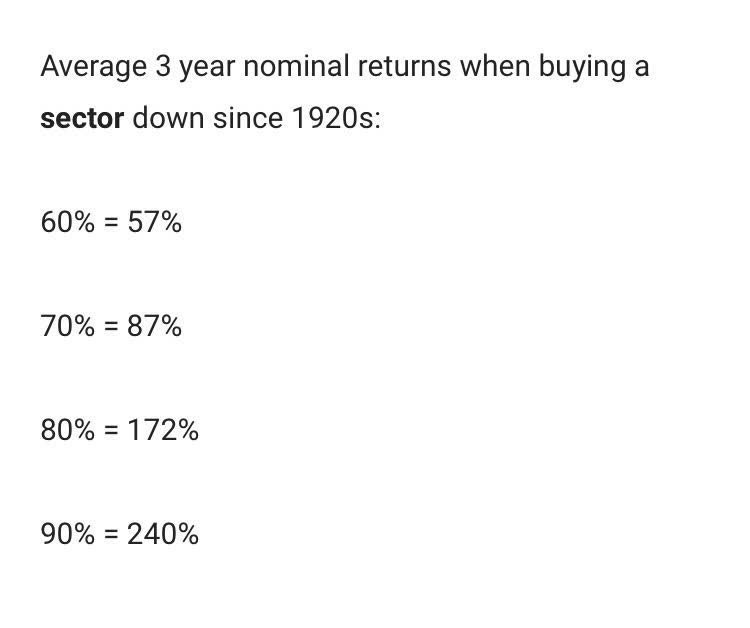

When the market bottoms, small caps usually lead. Furthermore, what has gone down the most, bounces the hardest. Cannabis stocks are down 80% from their peak. Meb Faber wrote an article titled, “What Happens When You Buy Assets Down 80%?”that discusses how beat-up sectors perform on average three years after the bottom. Below is an excerpt.

Meb Faber Research – Stock Market and Investing Blog

I am not calling the bottom. More pain is possible. This is an emerging sector traded on an illiquid exchange. But, cannabis has historically gone in cycles, and from a time and magnitude of drawdown perspective, we are in a similar place as to where we bottomed before. This, coupled with cheap valuations, improving fundamentals, the potential for political progress, and/or a broader stock market rally leads me to believe this is a good time to be building positions. Being short would make me nervous.

Finally, I am going to start writing these letters quarterly, rather than monthly. This will free up more time to write company-specific articles and other more topical pieces. So, look for the next update in October, but there will be other Green Giants content in the meantime. I will continue to publish performance estimates on Twitter.

Thank you for your continued interest and subscription. It is appreciated.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment