Bet_Noire

In my recent note on the Fidelity Stocks for Inflation ETF (FCPI), I outlined a few reasons why gaining exposure to pro-inflation equities as the market is seemingly adjusting the risk discounts down could turn out to be a painful disappointment.

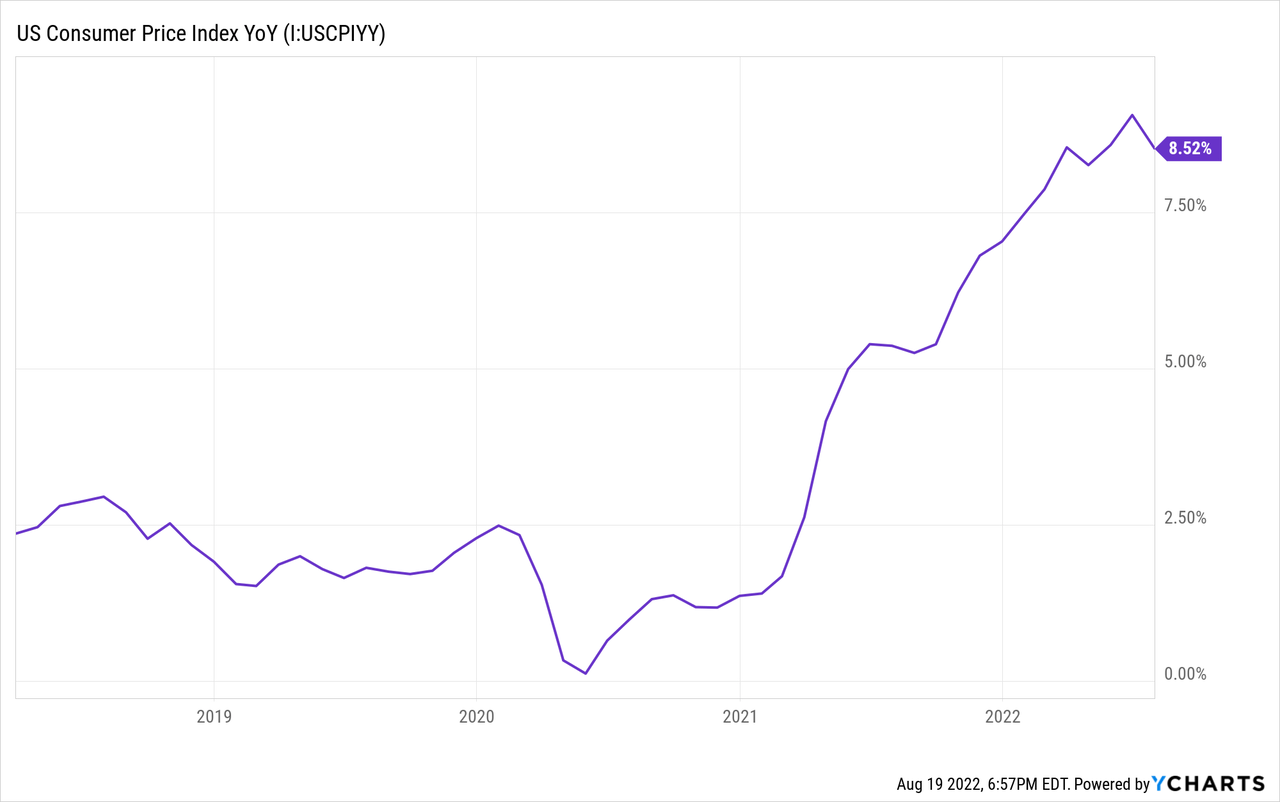

There is no denying that the hawks’ revival has put a lid on markets’ ebullience earlier this year, and inflation that implies higher interest rates, higher cost of capital, and weaker future growth was the main reason for that. But after the July CPI and PPI reports together with the somewhat soft economic data coming from China which could cool down the commodities market, betting on prices across the economy to creep even higher, especially considering that the Fed is clearly not hesitant to proceed with meaningful hikes if necessary, is a precarious move.

VanEck Inflation Allocation ETF (NYSEARCA:RAAX) is yet another inflation-centered investment vehicle I would like to discuss. The reasons why I dislike it principally rely on the premise that inflation is about to or likely has already plateaued. And since the RAAX strategy’s performance during the periods of subdued inflation was merely lackluster, gaining exposure to the fund at this juncture is exceedingly risky. Further, cost-averse investors would note here that a 74 bps expense ratio is a painful detractor from returns, especially over the long term. Thus, it is hard to construct a bullish thesis for this ETF.

How does RAAX calibrate the portfolio to outmaneuver inflation?

As the factsheet tells us, RAAX is focused on boosting real returns (inflation-adjusted) while attempting to minimize the “downside risk during sustained market declines.” That is to say, there is a market-timing ingredient in this strategy.

Please take notice that the fund was renamed in June 2021; before that, it was known as the VanEck Vectors Real Asset Allocation ETF.

RAAX’s investment philosophy relies on the active multi-asset approach. Specifically, it is the fund of funds that combines various ETFs that are supposed to outperform when inflation becomes a concern for the economy. The selection process is proprietary, with few details available.

These ETFs are selected mostly from the real asset universe with due attention paid to commodities including oil and agriculture, but there are also other classes traditionally deemed capable of benefitting from inflation, like real estate, infrastructure, and MLPs amongst others. Gold is also on the shortlist. Besides, in the past, RAAX invested in bitcoin and clean energy ETFs like VanEck Vectors Low Carbon Energy (SMOG), which is a somewhat unconventional way to defy inflationary pressures assuming these assets have a fairly short history. Regardless, I see neither BTC-focused funds nor clean energy plays in the portfolio as of writing this article.

An important remark is that the fund attempts to time the market, and when managers consider the sentiment as clearly bearish, it can switch to a 100% cash & cash equivalents position.

In the current iteration, RAAX has 20 holdings including a measly cash position accounting for just 16 bps. The fund is markedly concentrated in the Invesco DB Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC), with over 22.6% allocated. The VanEck Merk Gold Shares (OUNZ) is another weighty position accounting for 16.5%. There are also smaller allocations to the iShares Gold Trust (IAU) and SPDR Gold MiniShares Trust (GLDM), as well as iShares Gold Strategy ETF (IAUF), together accounting for around 44 bps. It should be noted that RAAX also has indirect exposure to the gold price as it also favors the VanEck Vectors Gold Miners ETF (GDX) which invests in companies that enjoy cash flow and profit boost when demand for the yellow metal is on the boil.

It has exposure to oil principally via the Energy Select Sector SPDR Fund (XLE) and SPDR S&P Oil & Gas Exploration & Production ETF (XOP); the VanEck Vectors Oil Services ETF (OIH) is an indirect bet on the crude price to stay higher for longer.

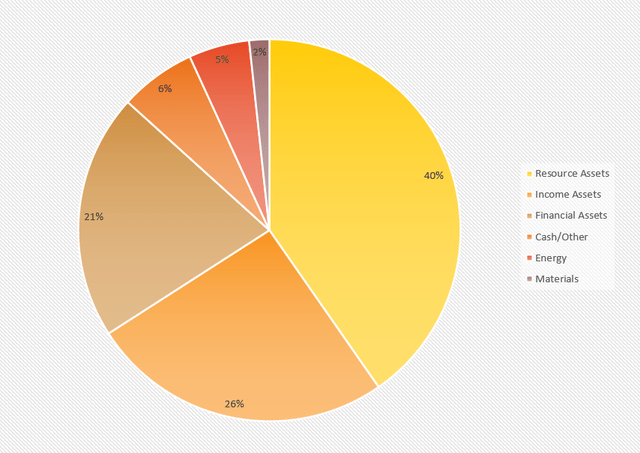

Overall, resource assets dominate in its mix, with the weights of categories as follows:

Created by the author using data from the RAAX website

Lackluster performance before inflation took off is a warning

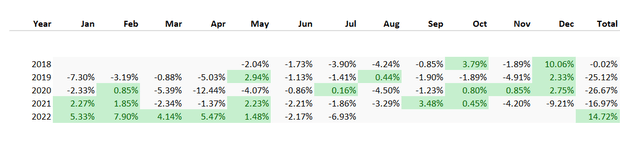

First, let us take a look at RAAX performance vs. the iShares Core S&P 500 ETF (IVV). The table below highlights the periods when the VanEck ETF outperformed the market.

Created by the author using data from Portfolio Visualizer

Incepted on 9 April 2018, RAAX underperformed IVV every year including the eight months of 2018, which resulted in a CAGR of 1.5% (excluding August 2022). It would not be an exaggeration to say that risk-adjusted returns are lackluster too. Specifically, with IVV delivering a Sortino ratio of slightly over 1 (2 is the goal), the fund achieved just 0.15.

Dear readers would likely reply here that for most of that period inflation was something of secondary importance, and the market narrative was first controlled by the trade war, then the coronavirus recession arrived and rendered all the previous economic forecasts irrelevant.

The CPI changes were teetering around the 2% target, and it was in 2021 when the inflation scare started to grab investor attention before evolving into the paramount theme across the globe as even such staid markets like Switzerland or Sweden had to acknowledge price growth could no longer be tolerated. That is certainly true. Uncoincidentally, we see that RAAX outperformed IVV massively five times in 2022, finishing behind the market only in June and July, when the tech and growth cohorts began recuperating.

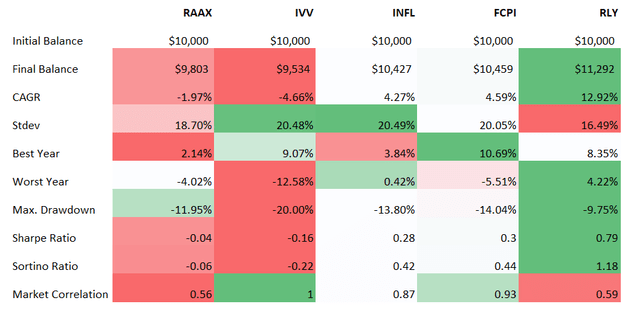

Also, let us compare its one-year performance to IVV as well as the SPDR SSGA Multi-Asset Real Return ETF (RLY) for better context.

Created by the author using data from Portfolio Visualizer

Clearly, RAAX outshined the market, with the lowest correlation to it in the group, but pure-equity inflation ETFs still did way better. RLY which is more similar to the VanEck fund owning to multi-asset approach, also beat it, with a higher CAGR and lower standard deviation.

To conclude, I would say that the fund is comparatively novel, and extrapolation of its appalling performance during the soft inflation era to construct a multi-year bear thesis would be a mistake. However, these data are a clear warning, and I see no reason for defending the bulls’ side either.

Final thoughts

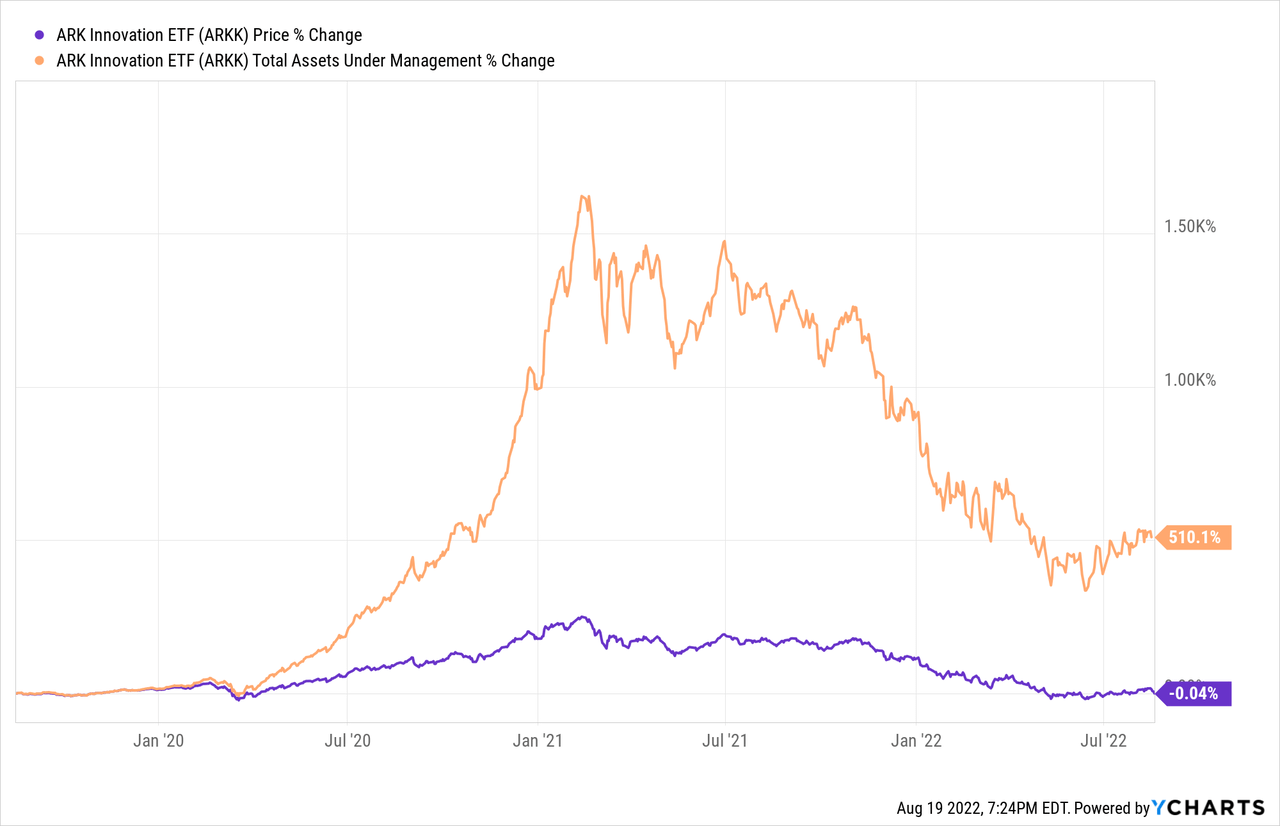

RAAX has seen an astronomic AUM growth, with around a 1,247% increase over the last year and more than 413% over the last six months. Does that mean it is worth chasing it now? The explosive growth in the Ark Innovation ETF’s (ARKK) AUM during the pandemic tech hype is a succinct illustration of how risky it can be to crank up bets on the themes that are in the limelight.

The inflation theme has also become overhyped, which makes beneficiaries most exposed to underperformance when it falls out of favor.

In sum, I am of the opinion that investing in RAAX does not make sense at this juncture.

If past performance is any guide, investors will see returns above the market when the economy reaches an overheat phase marred by high inflation, then these gains will evaporate gradually amid normalization as the RAAX strategy was incapable of delivering meaningful returns during the periods of moderate inflation, like in 2018 and 2019. In the meantime, expenses will also be eating into returns. So, signs of abating price growth are a good reason not to consider topping up allocations to pro-inflation ETFs, be it pure-equity or multi-asset funds. Besides, I see no meaningful reason to short the fund at these levels, too, thus a Hold rating would be an optimal choice.

Be the first to comment