JJ Gouin/iStock via Getty Images

Introduction

Agriculture and energy have a lot of similarities, especially because energy prices drive agricultural prices thanks to the importance of energy costs in the total cost picture. In this article, we’ll discuss what I consider to be a fascinating company. Nebraska-based Green Plains Inc. (NASDAQ:GPRE) is in a terrific spot to benefit from high energy prices as it is an efficient ethanol producer with new projects coming online that will allow the company to finally generate (high) free cash flow and exploit the many opportunities the ethanol industry is offering. In this article, I will walk you through my thoughts incorporating ethanol, its by-products, and what looks like a promising turnaround.

So, bear with me!

Long-Term Tailwinds & An Efficient Business Model

Green Plains is one of America’s largest independent ethanol (and by-product) producers. The company operates three business segments including ethanol production where it produced 1.0 billion gallons of ethanol, 2.5 million tons of distillers grains (by-product), and 290 million pounds of industrial grade corn oil from 330 million bushels of corn in its 2021 fiscal year.

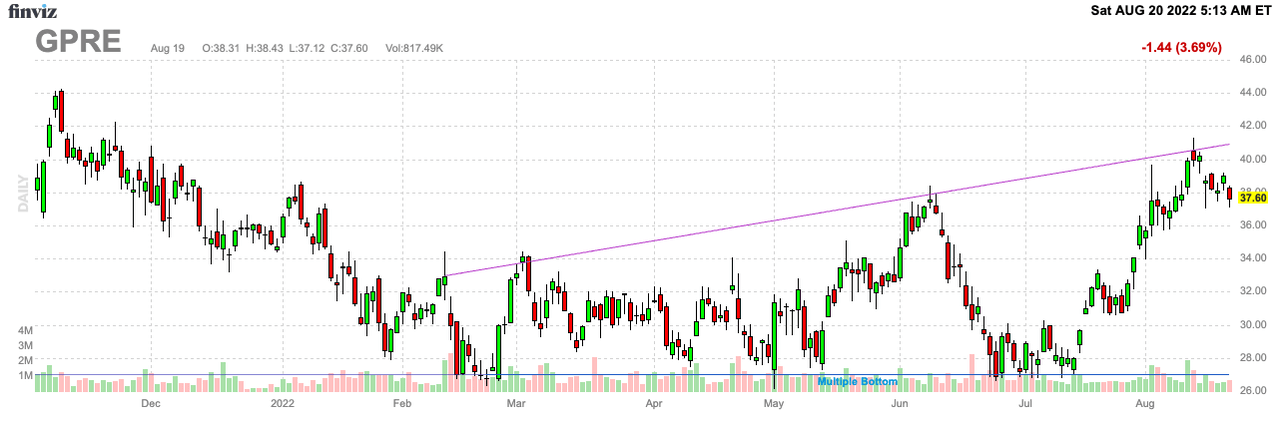

FINVIZ

In its agribusiness and energy services segment, the company covers grain procurement with a capacity of 27 million bushels of grain storage as well as the marketing of ethanol, distillers grains, and ultra-high protein and corn oil.

Its partnership segment covers Green Plains Partners (GPP), which provides fuel storage and transportation services by owning, operating, developing, and acquiring ethanol and fuel storage tanks, terminals, transportation assets, and other related assets and businesses. The partnership’s assets include 29 ethanol storage facilities, four fuel terminal facilities, and approximately 2,300 leased railcars.

There are two things to bear in mind when analyzing Green Plains. First, the company is an ethanol producer, which means it remains dependent on energy prices, demand, and profitability of ethanol production.

According to the USDA, on average, a 56-pound bushel of corn produces approximately 2.9 gallons of ethanol, 15 pounds of distillers grains, and 0.7 pounds of corn oil.

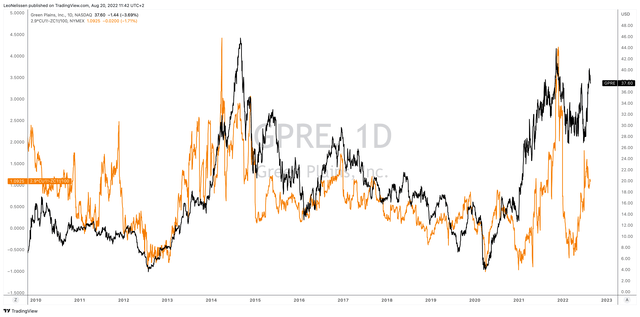

Unfortunately, CME has discontinued its DDG (distillers grains) futures, which makes it harder to calculate the profitability of ethanol production. However, there is a rule of thumb, which is basically to calculate the price difference between 2.9 gallons of ethanol and 1 bushel of corn. It’s not extremely scientific, but it gets the job done. The chart below shows what that looks like (the orange line is the profitability per bushel of corn).

TradingView (Black = GPRE, Orange = Implied Ethanol Margins)

Green Plains and ethanol margins move pretty much in lockstep. However, that’s not the case anymore for one big reason: Green Plains is improving its business.

In other words, while it will remain dependent on ethanol margins, it is soon in a good spot where the company can generate free cash flow to improve its business. That will result in a longer-term uptrend instead of GPRE shares being a proxy for ethanol profitability.

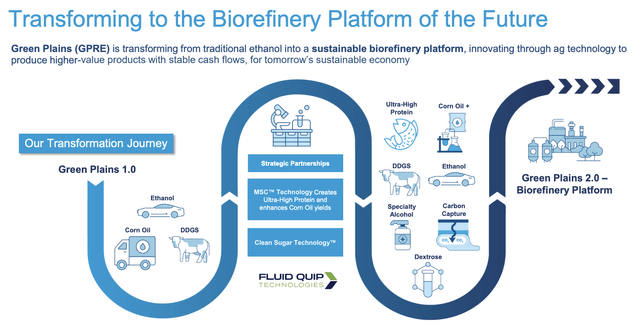

In 2021, GPRE bought a majority stake in Fluid Quip Technologies. This allows the company to go beyond “traditional” ethanol production as it incorporates the MSC technology that improves high-protein and corn oil yields. In other words, it improves the sales potential of every bushel of corn GPRE feeds its plants.

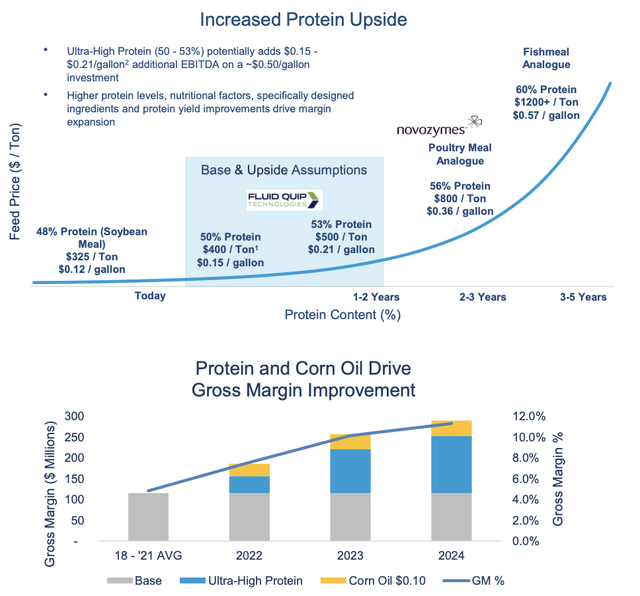

The company estimates that ultra-high protein (50-53%) adds $0.15 to $0.21 per gallon in additional EBITDA on a $0.50 per gallon investment. That’s a terrific deal and could result in even higher returns by adding poultry meal and fishmeal analogue, which is something Green Plains is working on. The company is in an aquafeed partnership with Riverence, the largest trout producer in the Americas, which is anticipated to be operational in 2023.

In other words, the company is set to become a low-carbon producer of energy (ethanol), ultra-high protein feed for cows, pigs, and fish (among others), specialty alcohols for industrial and consumer-focused customers, as well as carbon capture.

This comes with tax benefits. According to the company:

It looks like Congress might be on track to pass the clean energy bill that has potential to be positive for many aspects of what we do at Green Plains. As proposed, the legislation will extend the dollar per gallon biodiesel tax credit for two more years, which impacts positively our low carbon renewable corn oil, create a clean fuel production credit starting in 2025 for all renewable fuels depending on greenhouse gas emission levels, create a new tax credit for sustainable aviation fuel which could include corn, ethanol, alcohol to debt in a positive way, expanding the 45Q tax credit for carbon capture to $85 a ton, which can help decarbonize our company faster and provide $500 million in infrastructure up funding to fuel retailers for E15 for higher blends.

This is what a process like this could look like. Starting with renewable corn, the company has only a few places in the supply chain where carbon is “leaking”. In the end, most carbon is stored and turned into new corn as the very start of its production chain (growing corn) is as “green” as it gets. According to AgWeb:

[…] per acre, every acre of corn absorbs 8 tons of carbon dioxide. In 2012, U.S. farmers grew almost 100 million acres of corn and absorbed 800 million tons of carbon dioxide, and that means corn is very good for the environment.

The Value Of GPRE

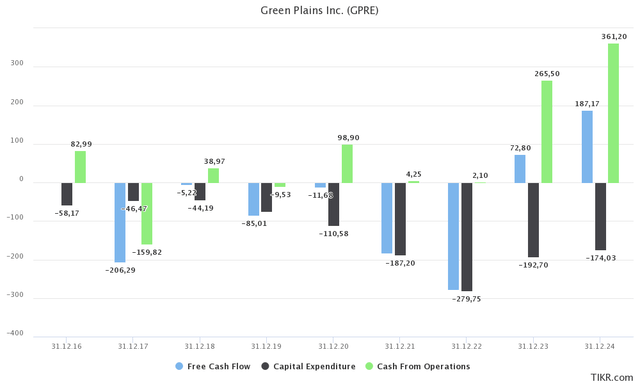

In past articles, readers commented on the company’s free cash flow. So far, the company is not generating free cash flow, meaning its burning cash. That’s bad, but it’s a result of aggressive investments in its capabilities.

For example, in recent years, CapEx has risen to an average of close to $200 million per year. As operating cash flow was not even efficient to cover that in good years, the company had high negative free cash flow. That is not expected to change in 2022. However, after 2022, free cash flow has breathing room as close to 200 thousand tons of ultra-high protein capacity is expected to come online – followed by another 162 thousand tons in 2024. At the same time, CapEx is expected to fall below $200 million again.

If the company is able to do $190 million in free cash flow in 2024 (and beyond) when all of its production is online, it would imply a 9% free cash flow yield using the company’s $2.2 billion market cap.

On top of that, the company is working on new potential joint ventures with both domestic and international (potential) partners, which could increase its customer base and open up new possibilities. While no details have been revealed yet, I am not surprised that these talks are happing. GPRE offers a unique opportunity for a wide range of companies to make their own supply chains more sustainable and getting access to the ultra-high-protein feed from a producer with a strong internal supply chain is a no-brainer in these times.

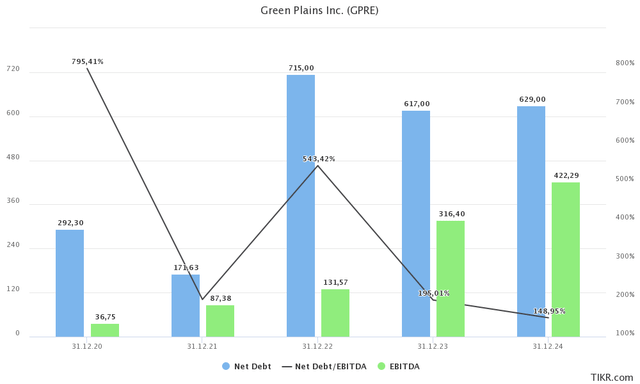

Because of higher free cash flow, net debt is expected to come down from $715 million in 2022E. Also, because EBITDA is expected to accelerate, the net debt ratio is expected to fall below 1.5x in 2024.

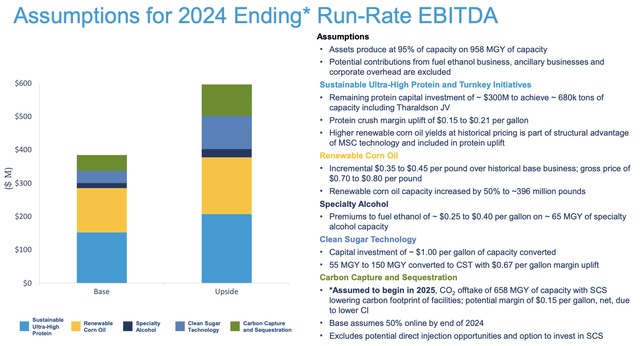

In this case, $400 million in annual EBITDA is expected to be the base case (in 2024 when operations are running). This is based on 95% utilization and roughly 960 million gallons per year of capacity.

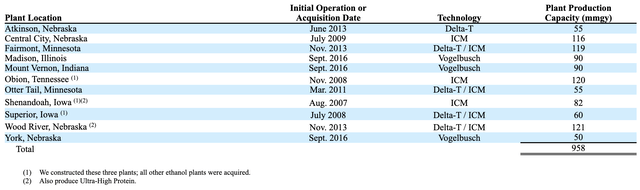

An overview of the company’s available production per plant can be seen below.

With that said, the upside case sees EBITDA of more than $600 million, which I believe will happen, but not without strong pricing power and new joint ventures.

Using these numbers, the company is trading at 7.1x 2024E EBITDA. This is based on its $2.2 billion market cap, $630 million in expected net debt, and $150 million in minority interest. This gives the company an enterprise value of $3.0 billion. That’s 7.1x $422 million in expected EBITDA.

In my last article, I wrote that:

[…] I think GPRE should trade between 7-8x EBITDA […]

Bank of America seems to agree as it downgraded the company to a neutral target of $43. As reported by Seeking Alpha:

The stock now trades at ~8x estimated 2023 EBITDA, which BofA’s Steve Byrne believes is “appropriate given the favorable MSC outlook balanced by uncertain longer-term ethanol margins.”

I agree with that. However, I believe that over the next 3-4 years, the company should trade at a market cap of no less than $3.2 billion, indicating between 40% and 50% upside.

Energy prices are unlikely to fall by a lot (as discussed in this article), providing a fertile ground for higher earnings tied to ethanol and by-products. Hence, I think the company could do (at least) $450 million in 2024 EBITDA. Beyond that, it needs to be seen which joint ventures the company can start and what happens in terms of carbon capture.

Takeaway

Green Plains is a very interesting stock. The company is evolving from a “traditional” ethanol producer to a company that utilizes its by-products to generate new income streams. In less than two years from now, we’re dealing with a company able to do at least $400 million in annual EBITDA with an implied free cash flow yield of more than 8% used to reduce debt and invest in new capabilities.

On top of that, GPRE is able to produce environmentally friendly and become a larger player in carbon capture and related projects, which I believe will result in new joint ventures with companies further down the supply chain – opening up even new selling opportunities.

The valuation is currently highly dependent on ethanol prices as the company is still not free cash flow neutral with a somewhat elevated debt load. However, I am bullish on ethanol given energy fundamentals and believe that industry margins will remain high – despite tough growing conditions for farmers.

So, long story short, GPRE remains one of my favorite investments in the industry, and I’m looking to buy it as soon as I spot weakness.

(Dis)agree? Let me know in the comments!

Be the first to comment