Robert Way

Thesis

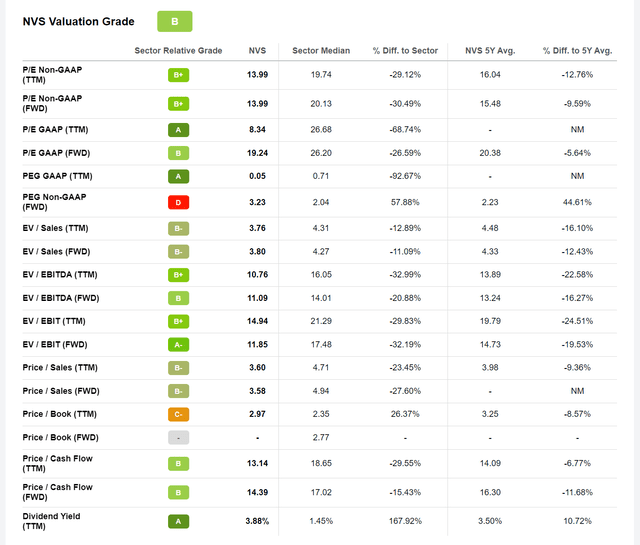

Novartis (NYSE:NVS) trades at a discount to fair value, in my opinion. Valued at a one-year forward P/E of < x14, the company is clearly trading cheap. Investors should consider, however, that the company is a leading pharma conglomerate with strong IP, brand equity and distribution network, which supports a highly competitive moat. Moreover, Novartis’ >3.5% dividend yield should protect the stock from further downside, while a residual earnings valuation framework clearly indicates upside. Anchored on analyst consensus EPS, I calculate a fair implied value per share of $115.02.

About Novartis

Novartis is a global healthcare company with a research-driven focus on pharmaceuticals, both prescription-based and generic. Novartis researches, develops, manufactures, and distributes a broad spectrum of drugs in categories such as respiratory and cardiovascular diseases, immunology, neuroscience, hepatology, and dermatology. The company operates 2 key segments: Innovative Medicine and Sandoz. Novartis’ Innovative Medicines segment is about 80% of sales and focuses on everything related to patented prescription drugs. The Sandoz segment, with about 20% of total sales, is further divided into three franchises: Retail Generics, Anti-Infectives, and Biopharmaceuticals. Notably, Novartis owns and distributes multiple blockbuster medications including the multiple sclerosis drug Gilenya, chronic heart failure drug Entresto, ophthalmology drug Lucentis, and leukemia drug Tasigna. Geographically, Novartis is based in Base, Switzerland, but operates worldwide. The US is the company’s biggest market accounting for about 35% of sales, followed by Europe with about 30% and the rest of world accounting for the remainder.

Valuation Lagging Fundamentals

Novartis stock has performed well this year, being down only about -2.4% versus about -11.8% for the S&P.

Although Novartis stock has outperformed, I argue the market has not fully appreciated the company’s fundamentals and thus still undervalues NVS shares. For reference, Novartis trades at a 2023 forward PE of about x13 and a P/B of < x3. Moreover, Novartis relative valuation implies a material discount to peers with regards to all multiples. This is a very cautious valuation, given Novartis’ strong competitive moat and the company’s history of steady revenue growth and value accumulation.

In 2021, Novartis generated $52.89 billion of revenues and generated $18.3 billion of EBITDA. As compared to the company’s total sales of $46.6 billion, revenues are up at a CAGR of about 4%, which is in line with GDP growth. Novartis balance sheet is strong. As of Q2 2022, Novartis holds $19.76 billion of cash and cash equivalents against total debt of about $31 billion. Given an operating cash-flow for the past 12 month of about $14.2 Billion, I see the company’s $12 billon net-debt position as no issue for Novartis. In fact, I argue that the balance sheet in combination with the strong operating cash-flow confirms the sustainability of Novartis 3.5% dividend pay-out ratio.

Novartis recently reported Q2 2022 results, which highlighted a solid performance. Sales were $12.8 billion for the three months period ending June 30, which was broadly in line with consensus estimates. The company slightly beat on core operating income, which was reported at $4.3 billion, about 3% ahead of consensus.

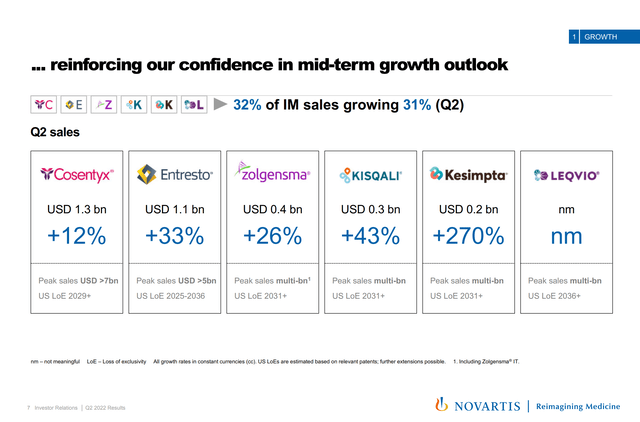

In the June quarter of 2022, Novartis’ Innovative Medicines portfolio performed very well, with revenues growing by about 6% year over year. Notably, the strong performance was driven by a diversity of products as communicated below.

Novartis Q2 2022 Quarter Results

For quite some time now the Sandoz segment has lagged investor and management expectations. Accordingly, the company has announced to ‘evaluate options’ for the segment, including a potential spin-off. But as of August 2022, there is not much visibility in the future direction of Sandoz, which markets obviously don’t like very much. Management commented:

The strategic review of Sandoz is on track; we expect to provide an update, at the latest, by the end of 2022.

But I believe a sale is very likely.

Long-term, Novartis targets 4% annual sales growth and about 35% operating margin—which is achievable and very conservative in my opinion. Note that Novartis has consistently outperformed these operating targets in the past and highlighting again the IM portfolio performance as shared above, Novartis is on track to claim an incremental multi-billion sales run rate until approximately 2030.

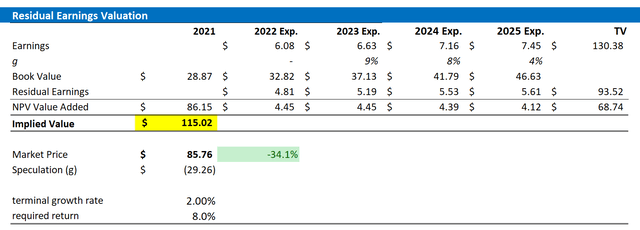

Residual Earnings Valuation

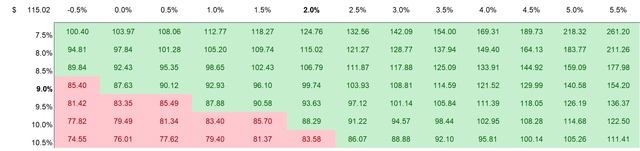

While Novartis’s multiples relative to peers point to a strong undervaluation, let us now look at Novartis’s valuation in more detail. I have constructed a Residual Earnings framework based on the analyst consensus forecast for EPS ’till 2025, a WACC of 8% and a TV growth rate equal to nominal GDP growth. Although the effective cost of capital for Novartis is considerably below 8% (about 8.3% according to the Bloomberg terminal as of 15. August2022), I think an adjustment upwards to 9% is reasonable in order to reflect a conservative valuation.

In addition, the long-term growth assumption equal to zero might definitely be an underestimation, in my opinion, but I prefer to be conservative. If investors might want to consider a different scenario, I have also enclosed a sensitivity analysis based on varying WACC and TV growth combination. For reference, red cells imply an overvaluation, while green cells imply an undervaluation as compared to Novartis’s current valuation.

Based on the above assumptions, my valuation estimates a fair share price of $115.02/share, implying potential upside of almost 35%

Analyst Consensus EPS; Author’s Calculation Analyst Consensus EPS; Author’s Calculation

Risks

Although I think Novartis is significantly de-risked at the current valuation of about x14 P/E for 2023, an investment is not without risk. The primary risk, as for every pharma company, is competitive pressure to innovate successfully and to legally protect and defend intellectual property. Apart from that, investors should consider the general risk sources such as management execution of strategic ambitions, operational efficiency, and currency exposure.

Conclusion

An investment in Novartis is justified, in my opinion. The Swiss pharma giant trades at a discount to the global pharma sector of at least 20%. This is not justified, I argue. Investors should consider that Novartis has a proven history of steady revenue growth and value accumulation, which is amongst others supported by a strong competitive moat. A residual earnings model based on analyst consensus EPS indicates almost 35% upside. Accordingly, I initiate coverage on NVS with a confident Buy recommendation and a $115.02/share target price.

Be the first to comment