Dr_Microbe/iStock via Getty Images

Thesis

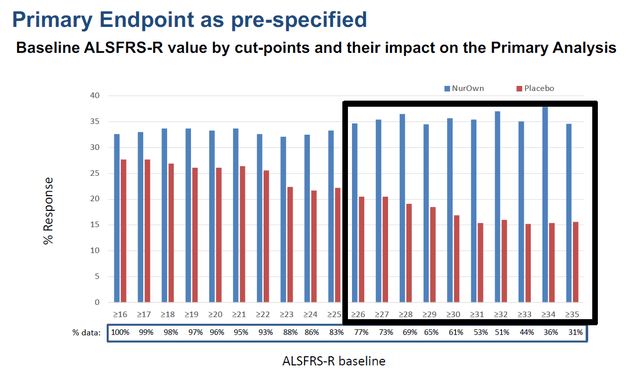

On August 15, 2022, Brainstorm Cell Therapeutics (NASDAQ:BCLI) caught the investment community by surprise, announcing that it would file a BLA for ALS. Brainstorm’s NurOwn failed to reach a primary endpoint in its Phase 3 trial in ALS. Yet, corrections to the initial data were reported and an erratum to the initial publication was published. Those corrections, although minor, did mean that statistical significance was shown in a predefined subgroup that had a baseline ALSFRS-R score of ≥35. Additionally, NurOwn also showed benefit in patients with ALSFRS-R scores of at least 26-35. Higher ALSFRS-R score mean less neurodegeneration, meaning NurOwn shows benefit in patients that have not yet reached the final stages of ALS disease.

In ALS, a complex, heterogeneous and multifactorial disease with a particularly fast neurodegenerative process, these results are remarkable. Yet again, they originate from a treatment candidate focusing on reducing neuroinflammation and modifying glial activity. Only a few companies in the neurodegenerative space have shown promising results of late, and I see this combination returning as a hallmark.

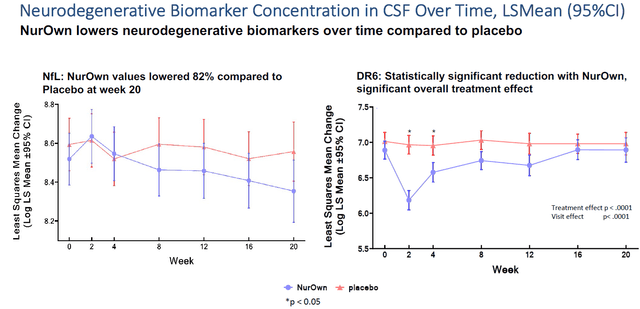

NurOwn was shown to reduce the neurodegenerative biomarker NfL by 82% over the course of five months. Amylyx’s Albriova received a negative advice from the FDA, in part because it did not show change of this biomarker over placebo, indicating no underlying change in the disease was taking place. Biogen’s Tofersen did show a reduction in this biomarker, albeit not as substantial as NurOwn. Despite also missing its primary endpoint in a Phase, Biogen has decided to file a BLA in ALS in part on the basis of Tofersen’s results in this biomarker.

I believe the investment community is not so much aware of the recent FDA’s view on NfL as a biomarker in neurodegenerative diseases. NurOwn’s BLA, when filed, may be eligible for accelerated approval. And it is possibly the best treatment candidate out there so far.

I should add that Brainstorm is also in need of cash at this point but does has an ATM financing facility which it considers it will call upon when the market is right.

Brainstorm Cell Therapeutics And NurOwn

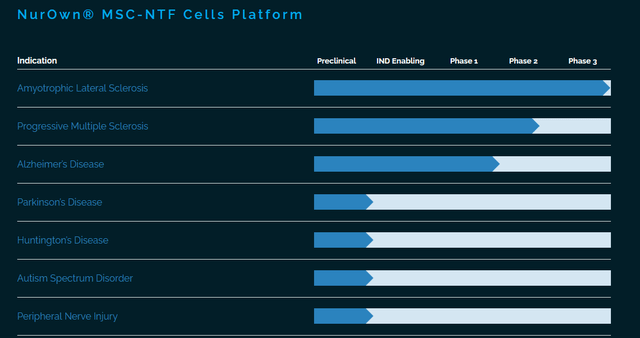

Brainstorm Cell Therapeutics is an Israeli/US-based company developing NurOwn, an autologous stem-cell based treatment candidate for the treatment of several neurodegenerative diseases. This is its current pipeline.

Brainstorm pipeline (Corporate website)

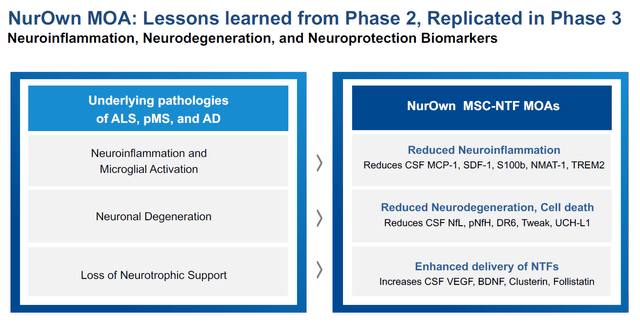

NurOwn works as follows. Mesenchymal stem cells or MSC’s are harvested from the patient’s body and then cryopreserved. Outside of the patient, Brainstorm’s proprietary technology differentiates them to secrete a high amount of neurotrophic factors or NTFs as well as immunomodulatory cytokines, without genetically modifying the MSC’s. The so-called MSC-NTF’s that are created as a result can be cryopreserved for years to deliver ongoing treatment, and are re-injected in the patient through intrathecal injections.

NurOwn’s goal is to reduce neuroinflammation and to modify glial activity in different neurodegenerative diseases. In ALS, microglia as the resident immune cells of the central nervous system (CNS) provoke a chronic heightened inflammatory burden through cytokines, a brain cell cytokine storm so to speak, and astrocytes lose their nerve-cell supporting function. Both microglia and astrocytes are glial cells. Across neurodegenerative diseases, the loss of supporting action by glial cells in the CNS is where most of the field is currently looking at. Articles on neuroinflammation and glial activity in all neurodegenerative diseases are coming out almost every day at this point, though the investing world seems not yet on board with this. NurOwn is reinjected through a spinal cord injection, which apparently is manageable. The goal of NurOwn is to support nerve cells and dampen inflammation. Patients in treatment receive treatment every two months.

The below Vimeo-video as shown on Brainstorm’s website explains this is in more detail.

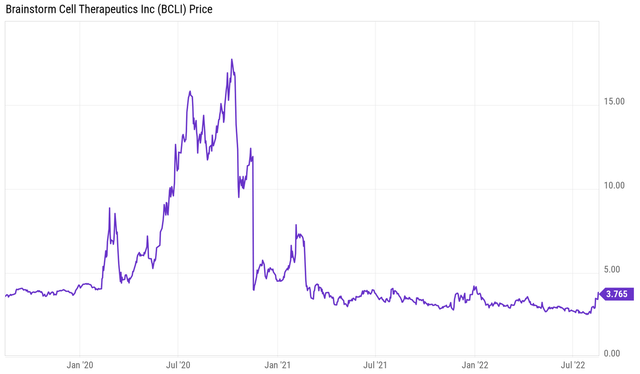

This is the company’s three-year chart, which shows a major sell-off in the course of 2021, which I will cover below as it is related to the phase 3 ALS trial readout.

Brainstorm 3 year stock chart (YCharts)

Brainstorm has a $137 million market cap at the time of writing and a stock price of $3.76.

Amyotrophic Lateral Sclerosis and Multiple Sclerosis

ALS is a fast-progressing neurodegenerative diseases that leads to loss of motor function and nerve cell death. As many remember from the 2014 ice bucket challenge which provoked an unseen interest in this disease, there is also a vibrant community trying to find solutions to this disease. ALS is considered to be highly heterogeneous in nature, with some patients losing function faster than others. The amount of neurodegeneration taking place in ALS patients is generally seen as higher compared to other larger neurodegenerative indications. Patients lose their lives on average in between two and five years after disease onset, although a small percentage of patients (10–20%) live longer than 10 years. Although more common in people over sixty, ALS can also present in younger patients. The FDA approved two drugs, riluzole and edaravone. Both show a minor temporary benefit at best in mortality and function, and come with side-effects. There is an unmet need for better treatments. On June 23, 2022, the FDA unveiled its five-year action plan to find treatments for neurodegenerative diseases, with focus on ALS, including the establishment of a task-force and leveraging regulatory science efforts.

MS is a neurodegenerative disease markedly known for demyelination, meaning the myelin sheath that covers the nerves and neurons is quickly being destroyed. The myelin sheath allows for insulation of nerves and axons and signal transmission. It is created by oligodendrocytes, another immune or glial cell of the CNS. Currently approved therapies manage symptoms and allow for some slowing down of disease progression.

The Initial Phase 3 Results in ALS

Failed Primary Endpoint

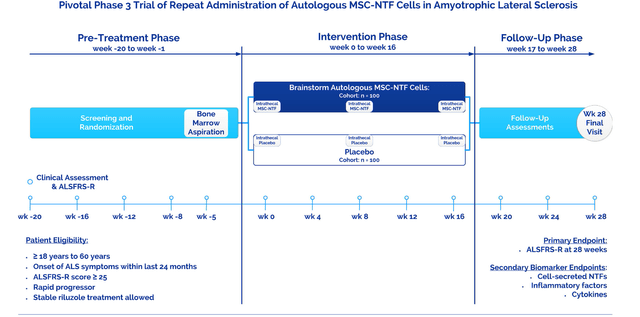

In November 2020, Brainstorm reported that despite being well tolerated, NurOwn’s Phase 3 trial ALS failed to reach its primary endpoint. The trial’s primary endpoint was ALSFRS-R, the well-known and validated rating scale for ALS. The trial was powered to see a 35% response rate for NurOwn versus 15% for placebo. Patients eligible for the trial must have shown a minimum of three-point decline on that rating scale over the 20 weeks leading up to the trial. The trial took place over the course of 16 weeks, then had a follow-up phase up to week 28. Secondary endpoints were mostly biomarker-related, including inflammatory factors and cytokines.

NurOwn Phase 3 trial design in ALS (Corporate website)

The results of the trial did show an improvement in the overall treated patient population compared to placebo, but not one that led to statistical significance in that population. Shares of Brainstorm tanked as a result. NurOwn did demonstrate meaningful improvement compared to placebo in a pre-specified subgroup of patients with early and less advanced disease, but those just missed reaching statistical significance. Additionally, NurOwn showed increase in neurotrophic factor, and decrease in neurodegenerative and inflammatory biomarkers.

What followed was that, after the FDA had initially stated that Brainstorm was collecting relevant data critical to assessment of NurOwn efficacy in its Phase 3 trial, it publicly stated in March 2021 that the NurOwn Phase 3 results in ALS do not show the stem cell therapy helps patients. The FDA did so publicly, I believe, in light of the ongoing stress it is facing from ALS support groups.

At that point, despite the science being interesting, I had discarded Brainstorm Cell Therapeutics from my list of potential investments. Like many, I believe, I also did not pick up the news on the upcoming BLA that’s now just been announced; it was almost hidden in quarterly results, even though the call was pretty much only about it. The recent evolutions in the field of ALS, with Amylyx’s potential approval and Biogen’s BLA for Tofersen coming up, show a field with interesting developments.

The Announcement Of The upcoming Biologics License Application

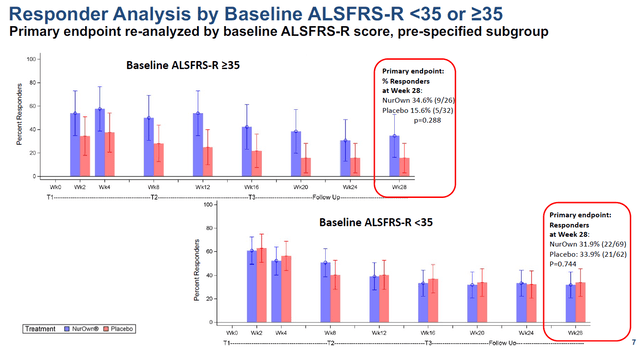

On August 15, 2022, together with its quarterly results, Brainstorm announced that it would file a BLA for NurOwn. How did that come about? Well, the initial publication of its Phase 3 readout had been corrected by an erratum, as the original publication had reported results that unintentionally deviated from the trial’s pre-specified statistical analysis plan. Following this correction, treatment difference of more than 2 points for the average change in ALSFRS-R in the subgroup of patients with a baseline score of at least 35 was found. That subgroup showed 34.6% of responders meeting the primary end point on NurOwn versus and 15.6% of responders on placebo. This subgroup had been prespecified. The correction also demonstrated that all subgroups that had at least 26 to 35 as a baseline ALSFRS-R score showed a statistically significant benefit.

Responder charts (Brainstorm’s slides of 12th Annual California ALS Research Summit) Primary endpoint chart (Brainstorm’s slides of 12th Annual California ALS Research Summit)

The patients showing benefit share the common trait that they are not the furthest-progressed. As seen across neurodegenerative diseases, once diagnosis is made on the basis of rating scales of motor function or cognition, the disease may have been smoldering in the body for a longer time and is generally in late stages of progression. Once the neurons are gone, there is little one can do. The goal of future treatment is to catch the disease in its earlier stages.

NurOwn’s Effects On Biomarkers

The above results are supported by several reported biomarkers going in the same direction.

Biomarker slide (Brainstorm’s slides of 12th Annual California ALS Research Summit)

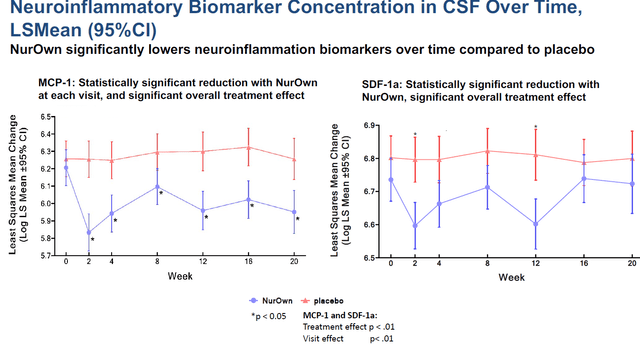

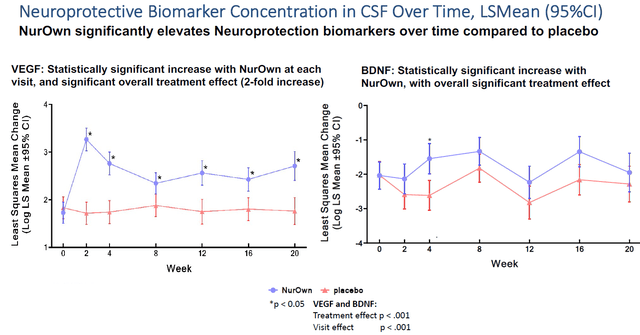

These include biomarkers of neuroinflammation such as MCP-1 and TREM2, or of neurotrophic support such as VEGF.

Neuroinflammation slide (Brainstorm’s slides of 12th Annual California ALS Research Summit) Neuroprotective biomarkers slide (Brainstorm’s slides of 12th Annual California ALS Research Summit)

Most importantly, in my eyes, is the readout NurOwn had on NfL, neurofilament light chain, The readout for NfL, which NurOwn lowered by 82% compared to placebo over the course of 5 months of treatment, is shown on the left side. Such percentage reduction is major.

Neurodegenerative biomarkers slide (Brainstorm’s slides of 12th Annual California ALS Research Summit)

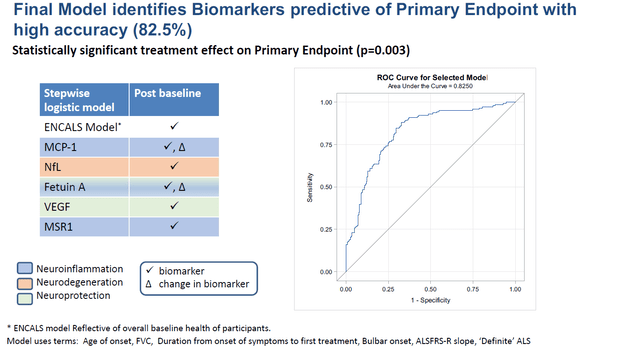

Brainstorm considers that a final model identifies biomarkers that are highly accurate in predicting a statistically significant treatment effect on its primary endpoint.

Final predictive model slide (Brainstorm’s slides of 12th Annual California ALS Research Summit)

Science And FDA’s Focus On Neurofilament Light

I believe the investment community in the field of neurodegenerative diseases is not yet fully on board with NfL as a biomarker of neurodegeneration and neuronal injury. Science and the FDA are, and in the end, that is what matters. There are numerous publications on the matter, across neurodegenerative diseases. The rationale behind that is that measurements of this biomarker, and only this one, is best fit to predict both the rapidity of decline in untreated patients as the rate of success of any disease-modifying treatment, in several neurodegenerative diseases. It seems to be most predictive of decline in ALS and Alzheimer’s disease.

Discussions on a readout of NfL as made by several doctors on the advisory committee pop up on several occasion in the 300+ page transcript of the FDA’s AdCom on Amylyx’s drug Albriova, slated for a PDUFA on September 29, 2022. Amylyx stated, in this transcript:

This is Dr. Timmons from Amylyx. We do have data on neurofilament light. Similar to what we see with neurofilament heavy chain, we do not see a difference between the placebo and AMX0035 groups.

Billy Dunn, the FDA’s Director of the Office of Neuroscience, stated that if Albriova had shown a positive effect on plasma neurofilament heavy chain, it would have provided important contextual and supportive information of an ostensibly beneficial effect on the clinical measure. Amylyx did check for this biomarker in its Phase 3 trials for Albriova, which did not show any change over placebo with regards to NfL as a biomarker. This is the quote from the transcript originating from Billy Dunn (my own highlighting):

I think something very important to keep in mind here — I certainly concur with what Dr. Buracchio said — is neurofilament light we feel is an important aspect of the development program targeted at mitigating neurodegeneration.

It is a marker of neurodegeneration or neuronal injury, and should we have seen an effect on neurofilament, we would have paid attention to that. We asked about it directly, several times, during development with the sponsor.

It is a measure that while not suitable for use as a stand-alone measure, one could certainly envision a situation where an effect in what ostensibly is a beneficial direction here would have provided important contextual and supportive information of, again, an ostensibly beneficial effect on the clinical measure.

Similarly, the lack of an effect here on that measure is something which we found to be part of the overall character of data that we see that does not provide robust support for the primary measurement, so we think it’s appropriate to capture here.

Quite honestly, in the interest of having an effective medication available to ALS patients, I think all of us in this space would have preferred to have seen a directional benefit there that was convincing. We didn’t, and we think that is of some concern in the overall picture that shouldn’t be construed as elevating the use of neurofilament to some kind of independent measure that’s suitable on its own for assessment. But we do think it’s a very important part of the contextual picture, and we do see it used fairly broadly in these types of diseases.

This was in March 2022 and to me, it feels like the FDA is giving guidance to other drug developers here. A month ago, we saw Biogen deciding to seek accelerated approval merely on the basis of its reporting of NfL by Tofersen in patients with ALS. Tofersen initially did not reach its primary endpoint in a Phase 3 trial, despite seeing reduced disease progression across multiple secondary and exploratory endpoints. On June 2022, Biogen additionally reported in SOD1-ALS that, the earlier Tofersen treatment started, the higher slowing of decline was across measures of clinical and respiratory function, strength, and quality of life. What Biogen seems to be doing here, is using the accelerated approval pathway to power its request for approval on biomarkers. This would be a changing approach in neurodegenerative diseases, but from what I have quoted above, I believe the FDA is ready for it. By January 25, 2023 the FDA should have its decision with regards to Tofersen ready.

And not by coincidence I believe, less than a month later, Brainstorm announces to file its BLA, as reported here. Brainstorm’s results are in the lead here. Biogen’s Tofersen reported differences of NfL levels of 67% and 48% compared to baseline respectively in the faster- and slower-progressing populations over the course of 7 months. These results are actually lower in the SOD1-ALS subpopulation as reported in June 2022, but they are still remarkably high in comparison to other reportings I have seen. Brainstorm, however, reported a 82% reduction over the course of five months. Amylyx’s Albriova did not show any effect here. Tofersen also reported much more adverse events than NurOwn.

In Alzheimer’s disease, I can add that INmune Bio has reported an 84% reduction over the course of three months in Alzheimer’s disease, and I have not seen any reporting coming even close to that measure, definitely not over such a short period of time. This is also in part why INmune Bio is my high-conviction play in AD and the field of neurodegenerative diseases as a whole. I would also add that it is a shame that Biogen has not reported data on NfL for Aduhelm.

Brainstorm’s Phase 2 results in primary progressive MS

Though not the topic of this article, I will briefly cover the Phase 2 results in MS, as they underscore the validity of NurOwn as a therapy candidate across neurodegenerative diseases.

In March 2021, Brainstorm reported Phase 2 data, showing that three repeated administrations of NurOwn every two months was safe and showed improvements of neurologic function, cognition, and biomarkers. Improvements by 25% were shown in the timed 25-foot walk test and 9-hole peg test, compared with none in historical controls. The MS walking scale test showed that 38% of patients had at least a 10-point improvement. The letter acuity test and symbol digit modality test reports were that 47% and 67% of patients showed respectively an 8-letter improvement and at least a 3 points improvement in cognitive processing. Increases in neuroprotective molecules VEGF and HGF, and decreases in inflammatory biomarkers MCP-1, SDF-1 and osteopontin were shown.

Overall, these results corroborate results seen in ALS. They also support the science that, by dampening inflammation and modifying glial activity correctly, one can substantially modify the course of neurodegenerative diseases.

Financials

On August 15, 2022, Brainstorm reported 2Q22 a net loss of $7M. It has currently $12.2M in cash on its balance sheet. Brainstorm has 36.5 million common shares outstanding, and fully diluted, has a share count of 39.9 million shares. When asked about Brainstorm’s cash position, this is what its CEO said:

So, you know we have an ATM with Leerink and Raymond and if the market will allow, we’ll tap into it. No pressure for the moment. In the last year, we didn’t tap into it, so we’ll see. But thank you. It’s a very good question.

The at-the-market financing facility is with Raymond James, and Brainstorm can pick up to $100 million tapping into it. In March 2022, Brainstorm mentioned that, as its cash burn is significantly reduced, it has enough cash to go forward at least over a year-and-a-half.

If dilution were to occur in the near future, all will depend on the amount of financing picked up. The financing facility is at-the-market. Seeing Brainstorm is not using a great deal of money at this time, additional dilution and share price pressure may be low, also in light of the current market cap.

On Valuation

Brainstorm’s market cap is currently $134 million.

About 30,000 patients per year are diagnosed with the disease in the US alone, with 5,000 new cases diagnosed each year. A team of researchers has reported in 2016 that the global disease incidence is expected to increase by 69% from 2015 to 2040. Global ALS market size in 2021 was $681 million. A market revenue forecast for ALS for 2026 of $885 million has been reported. With effective treatments forthcoming, I believe this market size can exceed expectations over time. Lacking substantial competition, I am projecting sales could reach $200 million as of 2026, with peak sales of $300 million or more being realistic by 2028.

The total MS market is currently worth $25.43 billion, and is projected to grow to $33.17 billion by 2029. The primary progressive MS market, which Brainstorm is targeting, is about 10% of the total MS market, which would then total about $3.32 billion. The MS market is more competitive, and I believe 10% in peak sales, or $300 million, as of 2028 is realistic.

In light of both projected peak sales totaling $600 million in revenue per year, Brainstorm would be drastically undervalued in case of success.

At this point, only two analysts are covering the stock. Zack’s small cap research’s David Bauth gives Brainstorm a price target of $22. Maxim’s Jason McCarthy‘s price target is $8.

Risks

As always, investing in biotech companies with one lead asset coming with a risk. One can see from the above price chart of Brainstorm that that risk can be severe. The risk here involves primarily regulatory dependency and efficacy issues. I have explained above how NurOwn for ALS is basically a drug that failed to meet its primary endpoint, but that Brainstorm still believes it has a chance of going for approval in the same indication in light of recent corrected reporting and perhaps more clarity on the FDA’s stance here.

I am going to make this more concrete at this time. The FDA will have to side with Brainstorm to make this happen. After having received several comments from the ALS community, the FDA publicly stated in March 2021 that the NurOwn data did not support approval and decided to provide further clarity. Brainstorm’s goal is now, notwithstanding the FDA’s earlier stances, to have the FDA come back on that decision. This will not be an easy task, but I believe the data are there to support it. And if the FDA grants Biogen’s Tofersen a go-decision, then that would create precedent that may even be helpful for all drug developers in the neurodegenerative space.

Conclusion

Brainstorm has decided on August 15, 2022 that it would soon file a biologics license application for its autologous stem-cell-based treatment candidate NurOwn in ALS. At first sight, that announcement came as a surprise, as the drug had failed to reach a primary endpoint in ALS. At second sight, it may not. Minor corrections to the initial readout, due to the original publication having reported results that unintentionally deviated from the trial’s pre-specified statistical analysis, led the company to report that a prespecified subgroup of patients with a baseline ALSFRS-R score of ≥35 did report statistical benefit. Additionally, this benefit seemingly extends to all patients with scores from 26 to 35.

The FDA’s transcripts on Amylyx’s drug candidate Albriova provide guidance as to the importance of neurofilament light chain as a biomarker. The FDA seems to find this biomarker of significant importance, as it is in part because Amylyx’s Albrovia was unable to demonstrate any change over placebo here, that the FDA’s advisory committee voted against the approval of Albrovia. Biogen decided to go for accelerated approval of its drug candidate Tofersen in ALS based on measurements of the same biomarker. NurOwn has shown a 82% reduction of this biomarker over the course of 5 months, which is significantly better than Biogen’s Tofersen.

I believe exciting times are ahead for the ALS space. Brainstorm Cell Therapeutics is now ready to file for a BLA for NurOwn. Amylyx’s Albriova is up for a PDUFA on September 29, 2022. The FDA’s call on Tofersen is slated for January 25, 2023. My bet is that, if any of these would make it to approval, NurOwn actually stands the best chances. But in light of new data, it would have to move the FDA to revise its earlier decision on NurOwn.

For all the above, I am rating Brainstorm Cell Therapeutics as a buy.

Be the first to comment