PixelCatchers

Chatham Lodging Trust (NYSE:CLDT) suspended its dividend in the early stages of Covid-19, but given the strong rebound in the travel industry, the trust may reinstate it in the near term.

Even though the lodging-focused real estate investment trust has not provided specific dividend guidance and only stated in 2020 that it would suspend its pay-out to preserve shareholder value in the face of extreme market conditions, I believe the dividend will be reinstated. Furthermore, a dividend reintroduction, even at a lower level, could be a catalyst for CLDT.

Branded Portfolio Ready For A Rebound

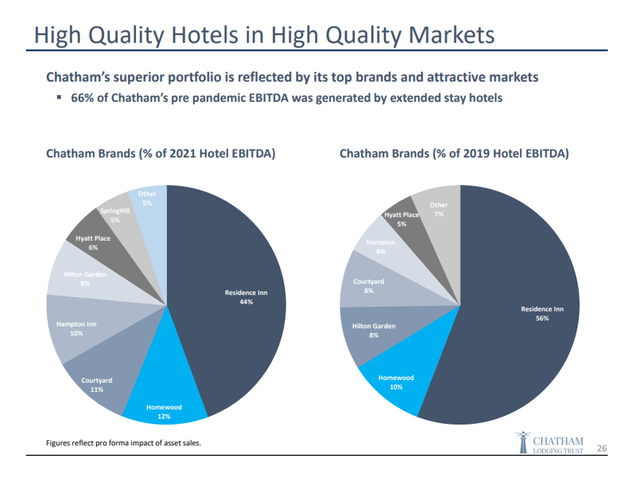

Chatham Lodging Trust is a lodging trust that owns high-quality properties in desirable markets. The trust’s main brand focus is on the branded brands Residence Inn, Homewood, Courtyard, and Hampton Inn, which generate the majority of the trust’s revenue.

Portfolio Overview (Chatham Lodging Trust)

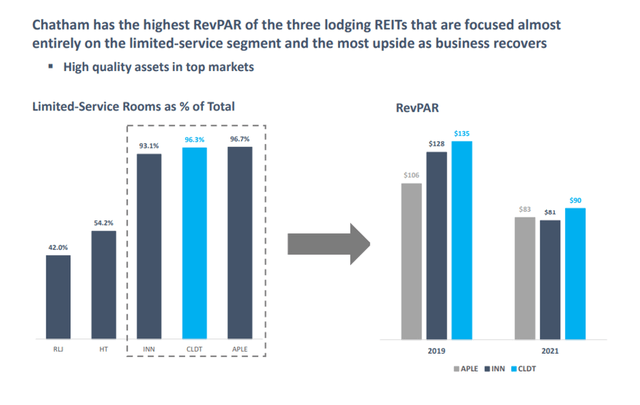

Chatham Lodging Trust outperforms the competition in terms of limited-service rooms and RevPAR, which stands for revenue per available room and is a key performance metric in the hospitality industry. In the recovering hospitality industry, a high RevPAR indicates above-average earnings potential.

RevPAR (Chatham Lodging Trust)

Travel Recovery Sets The Stage For A Dividend Return

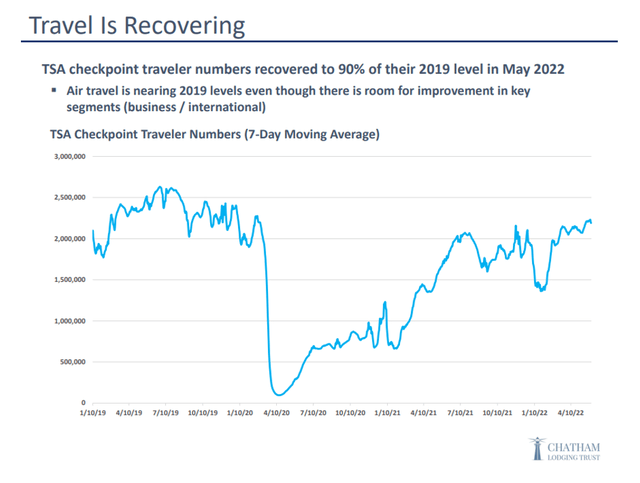

Air travel has returned to pre-pandemic levels, and the CDC recently relaxed Covid-19 guidelines, implying that the pandemic has passed, and the hospitality industry is poised for further recovery.

The travel industry is benefiting greatly from the relaxation of Covid-19 restrictions, and the shift in public health policy may also provide a significant boost to the lodging and hotel industry, which was among the hardest hit by the pandemic.

According to TSA data, the number of air travelers has steadily increased since reaching pandemic lows in 2020, indicating that business travel is on the mend.

Travel Recovery (Chatham Lodging Trust)

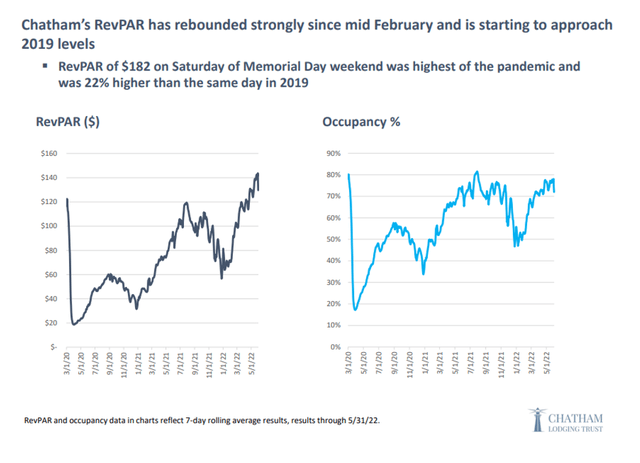

Chatham Lodging Trust’s operating conditions are fundamentally improving as a result of improving trends in the travel industry. The occupancy rate is the most important key metric for real estate investment trusts that indicates strong operating performance. Obviously, the higher the occupancy rate, the better the prospects for revenue and profit generation.

In the case of Chatham Lodging Trust, after falling off a cliff at the start of the Covid-19 pandemic, occupancy rates have improved dramatically in 2022. The trust’s occupancy rate in 2Q-22 was 77%, a 7-percentage point increase YoY.

The RevPAR of Chatham Lodging Trust is also increasing. Growing RevPAR indicates a recovery in demand and better economics for hotel operators. In 2Q-22, the trust’s RevPAR was $138, up 50% from $92 in 2Q-21.

Before the pandemic, the trust’s RevPAR was $146 in the second quarter of 2019, so in one of the most important key metrics, Chatham Lodging Trust has nearly clawed its way back to the 2019 performance level.

RevPAR And Occupancy Data (Chatham Lodging Trust)

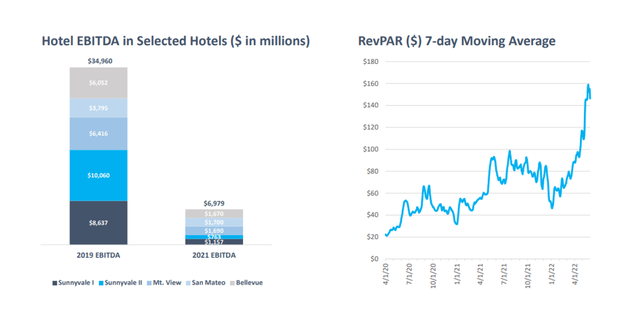

The resumption of business travel, particularly from large companies like Apple and Google, which are ending work-from-home programs and calling their employees back to the office, is a specific growth catalyst for Chatham Lodging Trust. Hotel EBITDA from 5 selected, top Silicon Valley hotels, for example, has significant recovery potential as performance remains suppressed and well below 2019 levels.

Hotel EBITDA (Chatham Lodging Trust)

Dividend Return Could Be A Catalyst For The Stock

Chatham Lodging Trust announced a dividend suspension on May 17, 2020, but the dividend may be reinstated now that business fundamentals are improving and business travel has resumed as a catalyst for continued occupancy improvements and earnings growth.

Before the pandemic, Chatham Lodging Trust paid a monthly dividend of $0.11 per share, and it may reinstate a dividend in the near future, albeit at a lower level.

The AFFO pay-out ratio of Chatham Lodging Trust was 68% in 2018 and 71% in 2019. The trust suspended its dividend in 2020, but the travel industry’s recovery has resulted in a strong rebound in AFFO this year.

The trust’s year-to-date AFFO is $0.48 per share, and if the recovery continues, AFFO could reach more than $1.20 per share in 2022.

I don’t think Chatham Lodging Trust will want to return to a pay-out ratio of 70% because the business is still recovering, but I can see management reintroducing a smaller monthly dividend of $0.04-0.05 per share in 2023, equating to a pay-out ratio of 40-50%.

A smaller reintroduced dividend would be a good compromise for the trust because it would save money for investments while providing investors with confidence in the trust’s improving financial health. A dividend reintroduction, though not officially announced, could reintroduce the stock to dividend seekers.

No Guidance, Low Valuation

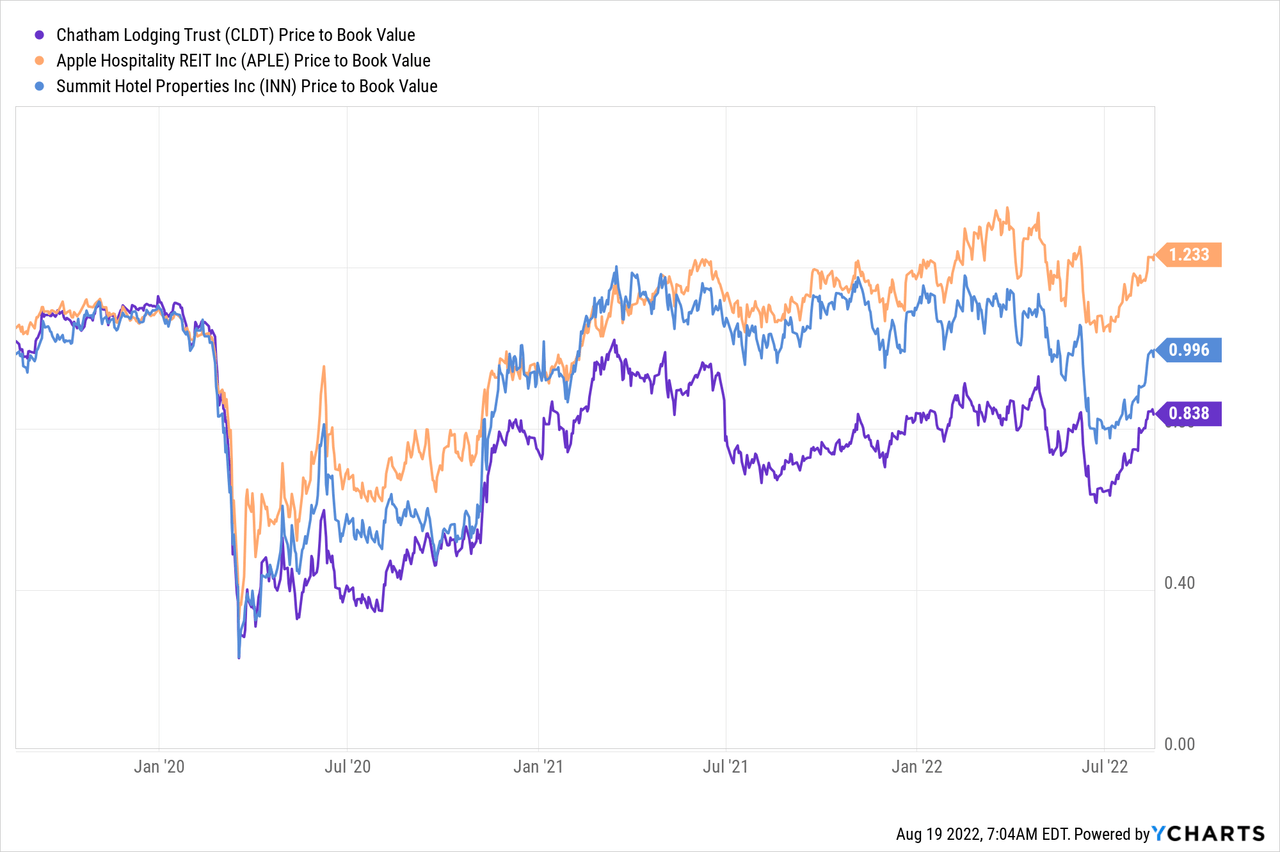

Because Chatham Lodging Trust has not issued any guidance, a reliable FFO figure is not available. Having said that, trusts can also be valued based on their book values because they own a lot of real estate.

Chatham Lodging Trust trades at 0.84x book value, while Summit Hotel Properties Inc. (INN) trades at 0.99x book value and Apple Hospitality REIT Inc. (APLE) trades at 1.23x. The dividend catalyst could assist CLDT in closing the valuation gap between it and its limited-service lodging peers.

Why Chatham Lodging Trust Might See A Lower Valuation

The resumption of business travel and the improving booking situation indicate that the trust’s business will see significant revenue and earnings growth.

Having said that, a recession could derail Chatham Lodging Trust’s recovery efforts, and it couldn’t come at a worse time. A recession would undo some of the significant gains made by the trust in recent quarters, most notably the improvement in occupancy rates and RevPAR.

My Conclusion

A dividend reintroduction would almost certainly be a catalyst for an increase in the market price of Chatham Lodging Trust, as the availability of a dividend would attract new dividend seekers to the trust’s stock.

The hospitality industry is experiencing strong underlying recovery trends such as increased RevPAR and occupancy, and business travel could be a driver of a continuing recovery.

Be the first to comment