DISCLAIMER: This article is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this article is not an offer to sell or buy any securities. Nothing in it is intended to be investment advice and it should not be relied upon to make investment decisions. Cestrian Capital Research Inc or its employees or the author of this article or related persons may have a position in any investments mentioned in this article. Any opinions or probabilities expressed in this report are those of the author as of the article date of publication and are subject to change without notice.

Background

We’re big fans of Iridium Communications (IRDM) here at Cestrian Capital Research. It’s the gift that keeps on giving. The business is solid as a rock, with consistent fundamental strength. Consistent, predictable revenue growth, big EBITDA margins, very little capex, good working capital management, meaning great cashflow and deleverage. The stock is heading towards being a dividend payor within a year or two in our view. That’s the long-term prize, because it means a whole new class of institutions are likely to buy in, pushing up the stock for existing holders. The short-term prize is that the stock is extremely volatile for such a stable business – and that means it’s a wonderful stock to trade whilst waiting for that dividend catalyst.

Here’s our prior coverage of the stock here on SeekingAlpha.

The Run-Up To Q1 Earnings

IRDM behaves strangely around earnings days, tending to over-react in one direction or another. We flagged to our ‘Marketplace’ members the night before earnings that the stock was in an uneasy position on its chart and we could see it pushing up to $26 or down the low $20s.

Here’s an extract from our subscriber note Monday night before earnings:

Q1 Earnings

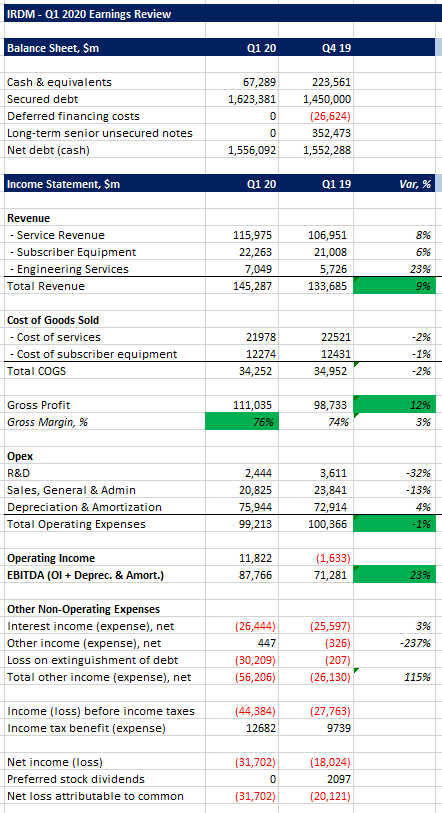

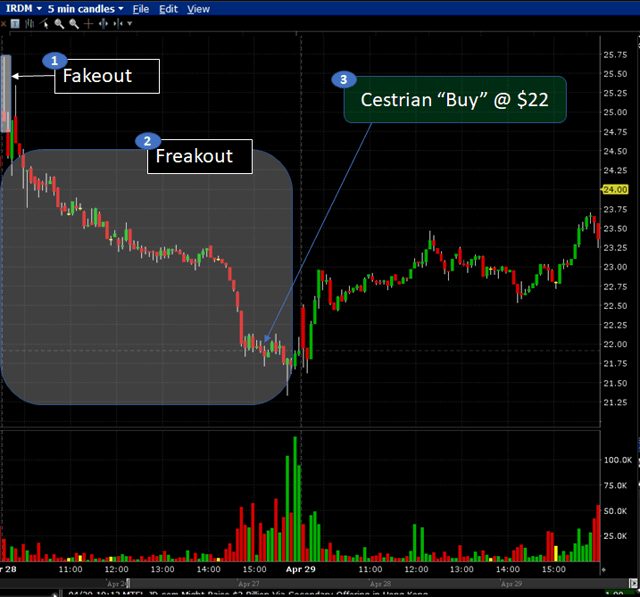

The quarter was excellent in our view. Here’s the numbers. The particularly good parts we’ve highlighted in green.

(Sources: Company SEC filings, YCharts.com, Cestrian Analysis).

The market often gets its head in a mess over IRDM because normally in public markets, earnings per share is the metric to focus on. Even in capex-heavy businesses, because a capex-intensive company is usually always capex-intensive and so the depreciation charge isn’t that different to the capex costs over time. EPS takes account of depreciation and amortization as a proxy for capex. So most analysts just look at EPS, it’s a way to normalize between companies.

IRDM has big negative EPS but big positive cashflows.

Just look at Q1 2020 and Q1 2019 above. Net loss attributable to common shareholders – $32m in Q1 2020 and $20m in 2019. On revenues of $145m and $137m respectively. Horrible, right? Net margins of negative 22% and negative 15% in each case. Margins getting worse as the company grows, even though revenue growth is only 9%, a level at which most companies would be improving margins? Urgh.

But wait. Let’s look at cashflow. Same quarters. Tables above. $72m of positive unlevered pretax free cashflow in Q1 2020 and $18m of same in Q1 2019. That’s after paying for the capex and after change in net working capital. Oh, and since IRDM has a negligible tax rate – a result of all that historic capex and the current depreciation – then post-tax free cashflow looks an awful lot like pre-tax free cashflow. OK, so, assuming negligible cash tax payments, in Q1 2020 the company made pre- and post-tax FCF margins of around 50%. And in Q1 2019, 13% pre- and post-tax FCF margins.

EPS vs. Cashflow, Again

Now as we’ve said in our coverage of Salesforce.com (CRM), cashflow is what you should really be looking at if you care about fundamentals. You can’t pay the IRS or the bank with earnings, only with cashflow.

Now, EPS is a proxy for cashflow, usually a good one. But sometimes, company business models mean that proxy doesn’t hold up and indeed looking at EPS alone means you can miss a trick. At CRM it’s because of heavy stock-based compensation, which depresses EPS but doesn’t affect cashflow. That means CRM can lever up, buy companies with cash, and pay down the acquisition debt much faster than their earnings suggest they should be able to. And at IRDM it’s because the capex isn’t ongoing, so there’s a heavy depreciation charge even now that capex is low. And that’s because that’s how a satellite business works. You have to pay to buy and loft a satellite fleet every few years. Big money. But then you don’t have to spend much capex. So you spend those fallow capex years depreciating what you just spent. So your earnings look dreadful but your capex is very strong.

Investing in telco isn’t so difficult. The main thing is to make sure someone else pays for the capex. You don’t want to be a shareholder in a telco when it is busy digging holes, building masts or lofting satellites. You want some other shareholder or creditor to be paying for that whilst you play golf. Once the spending is done, then you can safely re-join the party and ride the wave of cashflow that follows. At IRDM, that wave is now building force.

Post-Earnings Stock Reaction

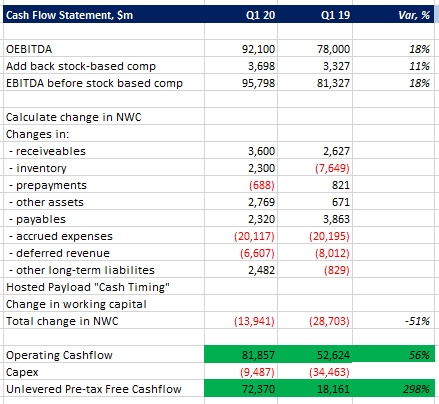

Tuesday was a wild ride for IRDM. Here’s what happened.

First the stock pushed up past 25, showing a +11% gain in Tuesday premarket hours at one point. Then as the market digested the company’s comments, it fell hard. We called Buy at $22 for our subscribers on Tuesday afternoon. The stock dropped a little thereafter, bottoming in the high $21s.

Wednesday the stock recovered, just hitting $24 late in postmarket. So from our Buy call Tuesday afternoon to the peak Wednesday evening, the stock achieved a 10% gain. Not too shabby.

We decided to hold. And we’re re-iterating that Buy here, at the close of Wednesday with the stock at $24.

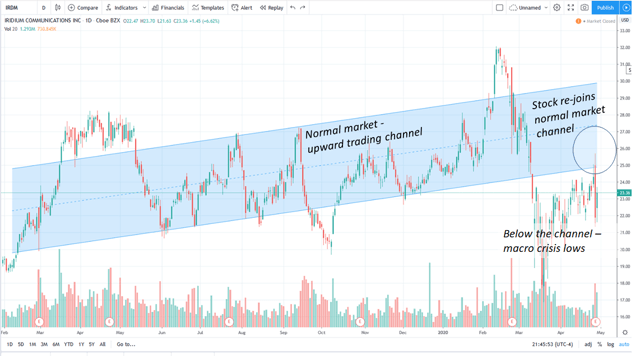

We think IRDM can continue to move up. The market, suitably powered-up by Mr Powell and friends today, can lift boats higher. And if IRDM gets lifted just a little higher, we think it can reach first $25-26 on the chart and then beyond, all the way up to $30.

Here’s the chart.

The stock could fall back down Thursday or Friday – if so we’re confident it will come back, lifted by the market if nothing else. Then, we’re looking for the stock to move up past that $25 resistance, and on upwards to $30.

So, we’re at Buy. We think the stock can reward long-term holding, and it offers short-term trading opportunities too.

Cestrian Capital Research, Inc – 29 April 2020.

Thanks for reading our note. If you enjoyed it, try our SA subscription service, The Fundamentals.

Here’s what you get:

- Deep sector expertise in space, defense, technology and telecom.

- Pro-grade analysis, easy-to-understand presentation.

- 100% independent, clear and direct opinion of stocks’ prospects.

- Long-term investment picks and short-term trading ideas.

- Absolute alignment with our own investing. We run a real-money service and alert you to every move we make in covered stocks. Any such trade we make, you get to trade first.

- Round-the-clock availability in our members’ chatroom.

We speak directly to our companies, from CEO level down.

Disclosure: I am/we are long IRDM. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: We are long IRDM on a personal account basis.

Be the first to comment