KanawatTH

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on August 8th, 2022.

Adams Diversified Equity Fund (NYSE:ADX) is a relatively boring closed-end fund. They don’t offer any sort of unique or special strategy in terms of how they are invested. They are largely invested in a diversified portfolio of large-cap names. It has a positioning similar to the S&P 500. The median market cap in its portfolio is $153.1 billion.

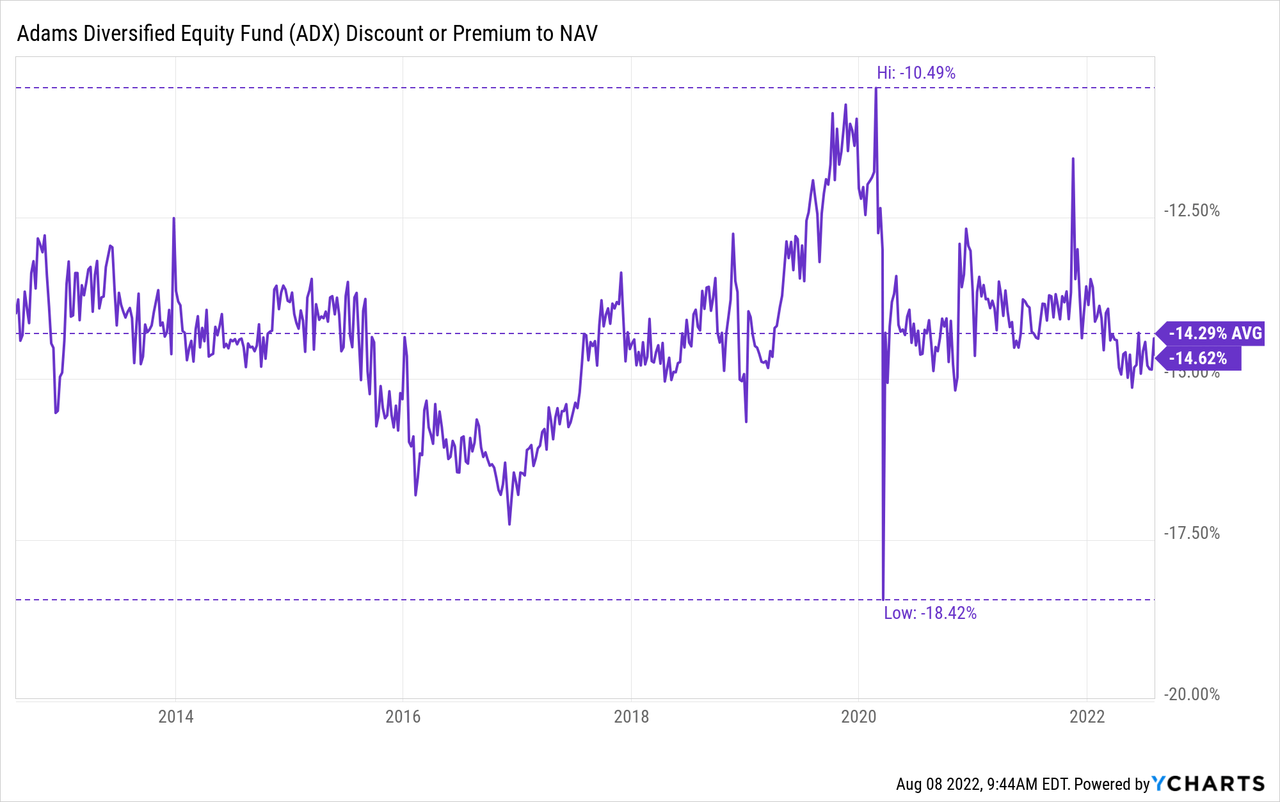

The fund also regularly trades at a deep discount. Although, at this time, it is trading just below its average. That could indicate an attractive time to take up a position or add to one’s position. There have been periods when this discount has contracted, but it has never had less than a 10% discount.

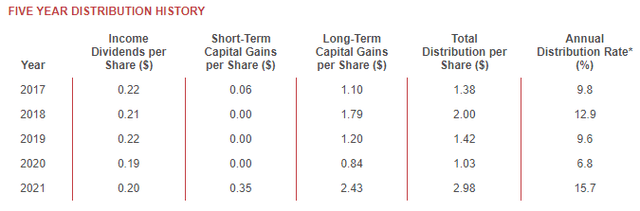

The fund’s distribution schedule is also probably not too appealing to income investors. They pay a small regular quarterly distribution and then a large year-end. They target a minimum of a 6% annual distribution. That’s just the minimum, though. The fund’s distribution yield in 2021 worked out to 15.7%.

This was abnormally large and not likely to be replicated in a down year. The reason is the year-end comes from the capital gains that may or may not be realized in a given year. With a lack of capital gains, the year-end will be smaller.

This is one of my smaller positions, but I view the large year-end as a bit of a “bonus.” This fund has an extremely long history, going back to 1929 as a CEF. Before that, they were an actual business that started in 1840.

The Basics

- 1-Year Z-score: -0.84

- Discount: 14.62%

- Distribution Yield: 1.19% (not counting the regular year-end “special”)

- Expense Ratio: 0.58%

- Leverage: N/A

- Managed Assets: $2.1 billion

- Structure: Perpetual

ADX’s investment objective is simply; “long-term capital appreciation.” The investment policy is quite straightforward as well. They intend to meet this objective by “investing primarily in large U.S. companies.” They also add that they “seek to deliver superior returns over time by investing in a broadly diversified equity portfolio. The Fund invests in a blend of high-quality, large-cap companies.”

Their “distinguishing characteristics,” as they say in their own words, are “internally managed closed-end equity fund with exposure to a broadly-diversified, sector-neutral, large-cap equity portfolio. Committed to an annual distribution rate of at least 6%.”

One of its claims to fame is the expense ratio. For a CEF, this is incredibly low. The industry average of all equity sector mutual funds is 1.13%. The fund isn’t leveraged at all, which can take away one more bit of uncertainty in a volatile and rising rate environment.

Performance – Strong Results, Deep Discount

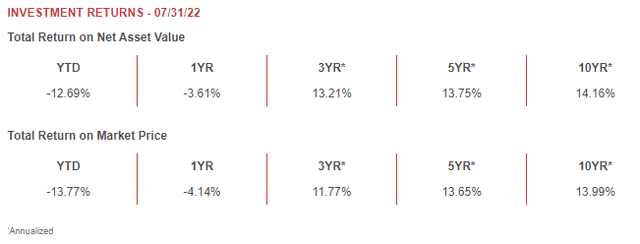

The fund’s total returns have been quite attractive in isolation.

ADX Annualized Returns (Adams Funds)

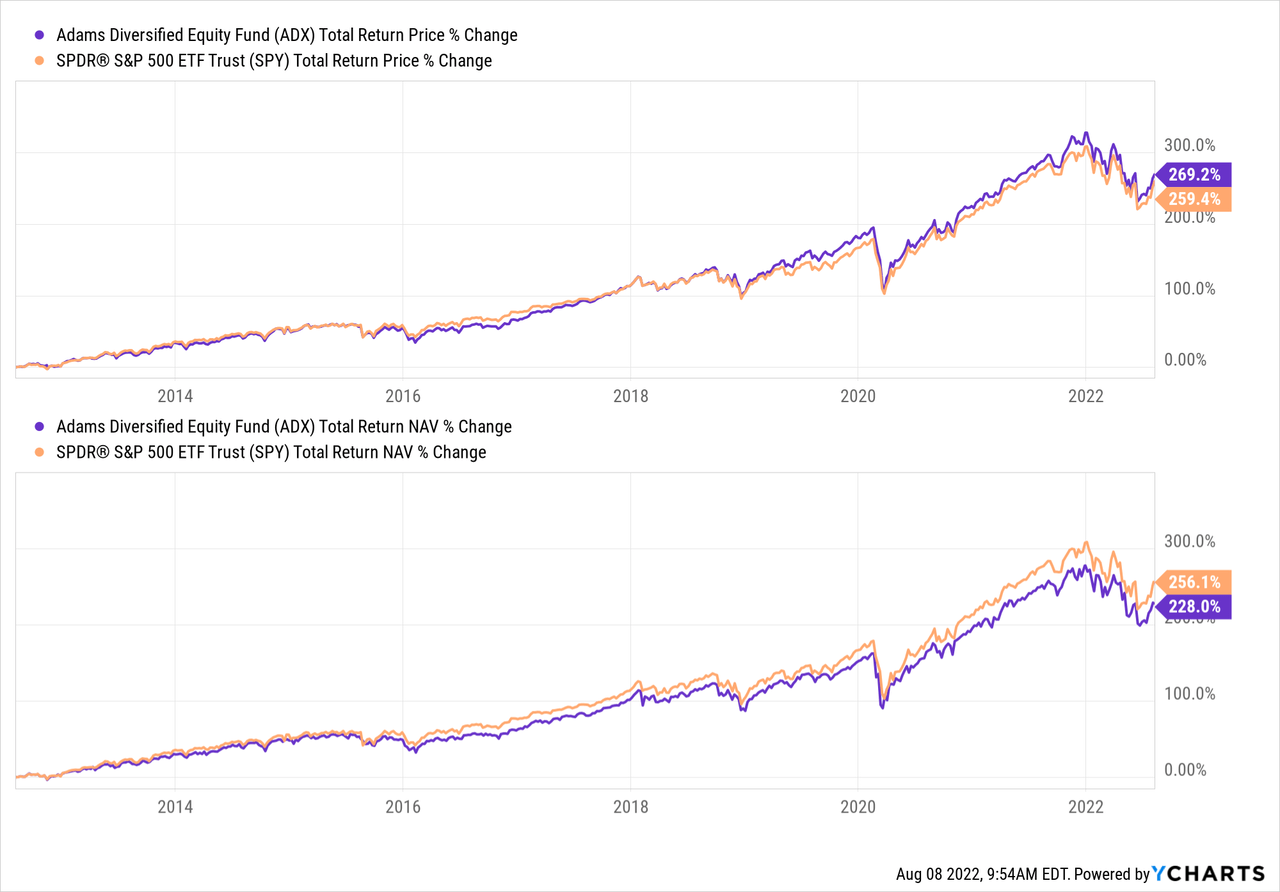

However, you will likely be disappointed if you want to compare to the S&P 500 directly. ADX makes a valiant effort and comes much closer to the “market” returns but still falls short. One of the reasons for this is going to be the higher expense ratio. However, the other is that since they pay out the majority of their gains, they don’t get that compounding effect that SPY enjoys. SPY only pays out income through the years, for the most part.

Ycharts

While they have an unusual distribution payout schedule relative to other funds, they still pay out large year-end gains. That’s capital that would be otherwise retained in the ETF structure and allowed to continue to grow returns off of itself. Even in lean years, ADX will payout 6%. That means potentially selling off assets at depressed prices to fund payouts.

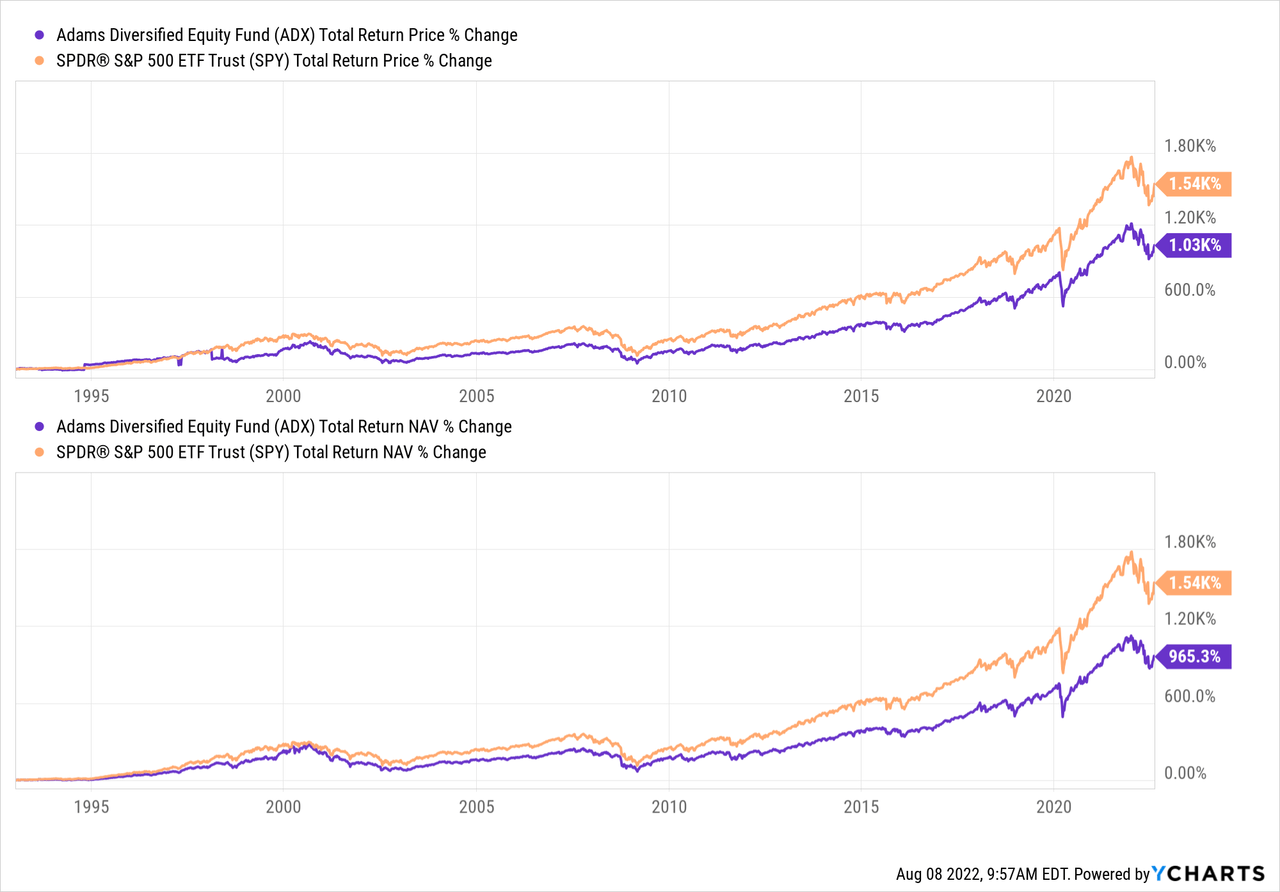

The further back you go, the further the return divergence.

Ycharts

At the same time, over shorter periods of time, ADX could outperform. I believe it would require buying at deeper discounts than current levels. That is, even though the current discount shows that the fund is slightly below its longer-term average.

Ycharts

Distribution – Managed 6% Minimum Target

When looking back over the last five years of distributions, we can see that 15.7% was an abnormally large amount. In 2020, we were much closer to that 6% minimum figure. Given the current market trend, this year could be closer to that 6% once again.

ADX Annual Distributions (Adams Funds)

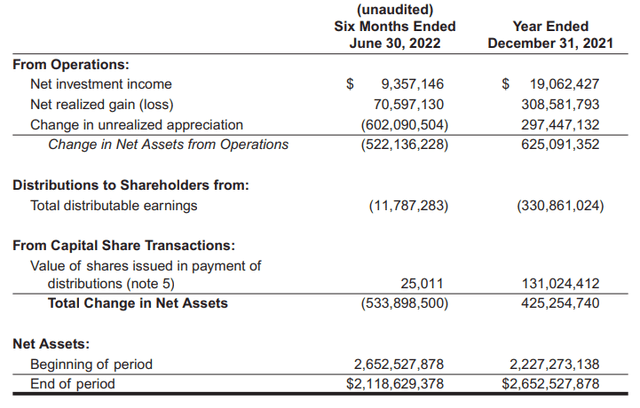

When we look at the first six months of earnings for the fund, we can see that they’ve realized a sizeable amount of gains already. That’s really what will dictate what the distribution for shareholders will be. That’s because, as a regulated investment company, they are required to pay out almost all of their income and realized gains or face an excise tax. In the image below, we can also see why the 2021 distribution was so large. They had realized a massive amount of gains relative to what they had paid out through the regular $0.05 quarterly figure.

ADX Semi-Annual Report (Adams Funds)

They have 117.874 million shares outstanding. This amount increases due to reinvestment creating new shares. When a fund issues new shares at a discount, that is dilutive to shareholders. That’s why this is unusual, and this is one of the few funds that DRIP in this manner.

With 2021’s particularly large year-end special and creation of millions of new shares, it resulted in a $0.17 hit to NAV for the year. They did not do any share repurchase in fiscal 2020 or 2021.

ADX is one of the funds that report a quarterly report, so we don’t need to start estimating the year-end just yet. It’s been a volatile year, so waiting to see the Q3 report would be best before making some guesses. From the previous quarterly report, the realized gains hardly changed at all. They had $69.95 million previously.

ADX’s Portfolio

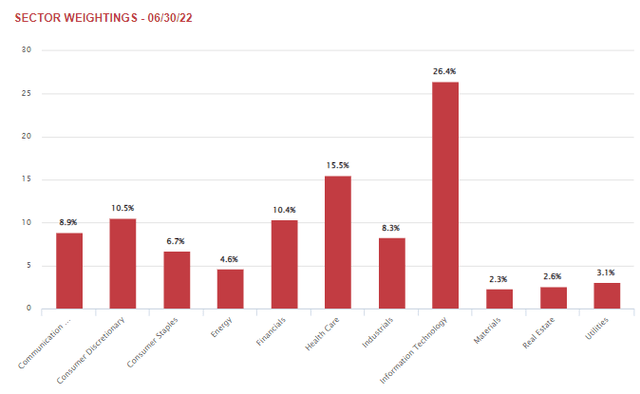

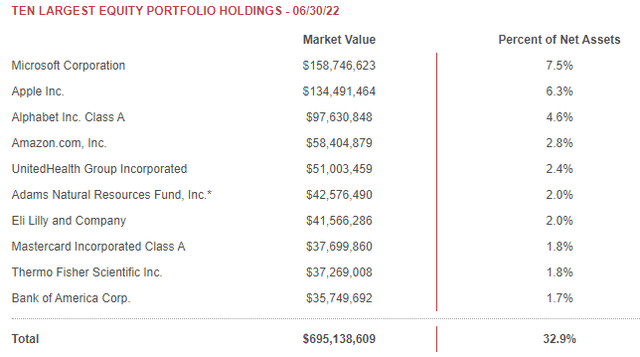

Overall, the portfolio is heavily weighted to large-cap stocks, with a particular focus on the mega-cap tech names making up sizeable positions in the portfolio. Essentially, the fund mirrors the S&P 500 rather closely but does so with only around 92 positions.

The top ten make up a fairly sizeable 33% allocation. Positions such as Microsoft (MSFT), Apple (AAPL), Alphabet (GOOG) and Amazon (AMZN) took the top positions with a weighting of 21.2%. With positions such as that, it really isn’t too much of a surprise that ADX’s sector allocation has tech in the top spot with a 26.4% weighting.

ADX Sector Weighting (Adams Funds)

For the fund’s energy exposure, they carry a position in the Adams Natural Resources Fund (PEO). That’s an affiliated fund offered by Adams Funds.

PEO’s weighting is 2%, meaning there is energy exposure elsewhere in the fund too. That small weighting isn’t anything too meaningful on its own, though it is interesting that they include it. That fund itself also trades at a sizeable discount, with exposure to another 56 holdings. So within that 2%, the exposure is divided even further.

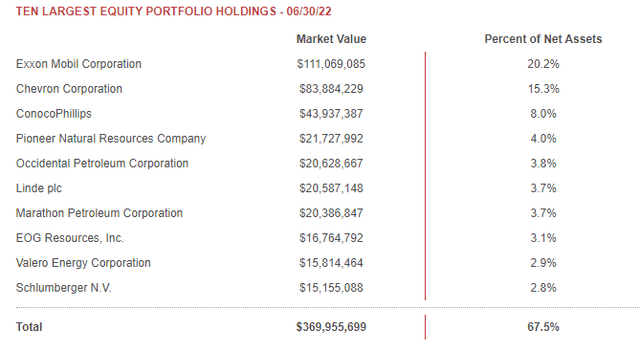

PEO invests mainly in larger energy-related companies. The top ten in that fund make up a 67.5% weighting of the fund. That’s some high concentration, but given they carry Exxon (XOM), Chevron (CVX) and ConocoPhillips (COP), three of the integrated oil majors, I’d argue that their energy exposure isn’t too risky. Those three companies alone make up 43.5% of the fund.

Conclusion

ADX is a relatively unusual closed-end fund. It isn’t likely to be appealing to income investors or total return investors. That leaves it in a bit of an odd position where no one really wants to invest in the fund. At least, not until the year-end is announced. If it is large, it tends to get some attention. I believe that is why the discount stays so persistent. Over the last decade, the narrowest discount the fund touched was around 10.4%. It briefly dropped to around 18.4% in the depths of the pandemic sell-off of 2020.

That isn’t to say that one couldn’t or shouldn’t buy into this fund; I have a position myself. Being that the market more broadly has sold off through 2022, and the discount is relatively attractive, it could be a fair time to pick up a position. I would just go in with the realization that this one isn’t going to knock your socks off.

Be the first to comment