magicmine/iStock via Getty Images

Investment Summary

Backdrop – Macro thematic

Portfolio construction in 2022 has become a quest of balancing uncorrelated sources of alpha without incurring heavy downside. With the distribution of macroeconomic probabilities so wide, investors are now positioning to absorb the themes of rate hikes, inflation, central bank tightening and widening credit spreads. The problem is, the asymmetry in risk assets continues to widen, making this difficult. Treasury yields have curled up at the long-end of the curve and have moved in tandem to a sharp correction in equities this year, leaving basically nowhere to turn within long-only, equity focused portfolios.

Stock/Bond correlations YTD – compressing portfolio returns

Image: TradingView

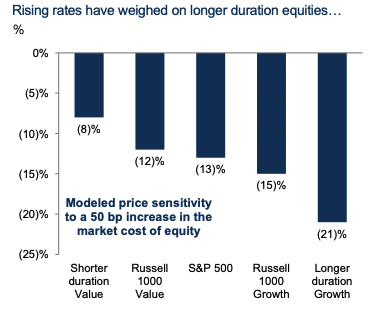

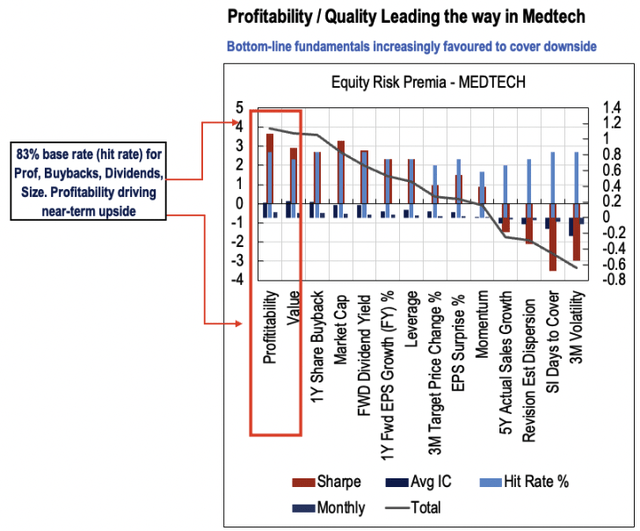

The high beta and growth trade has also exhausted itself in 2022 and equities now offer far less risk premium as an asset class. Instead of rewarding top-line growth, investors have turned to bottom-line fundamentals and profitability as drivers of equity returns. Turning to healthcare, the value spreads traditionally enjoyed in the sector have far less appeal in 2022, as cheapening names within become more and more justified by weakening fundamentals. Quality and low beta strategies are therefore dancing in lockstep with the age-old adage, that well priced stocks, with fundamental momentum and quality earnings/FCF are the real long-term compounders.

Exhibit 1.

Data & Image: Goldman Sachs Investment Research

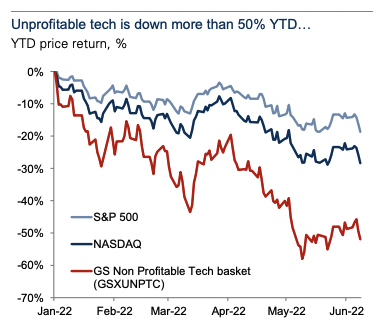

As such, we firmly believe that profitable, fast growing healthcare companies will undergo a substantial re-rating period and run higher in the coming years. We see this in direct view of the current landscape, with several macroeconomic crosscurrents yet to be realised by global markets. Unprofitable names, on the other hand, will continue to suffer in our estimate, not unless they can demonstrate a clear path to profitability. In the regime of near-zero rates, there was plenty of cheap capital around to keep raising equity. However, growth was reliant on additional equity to inject more cash at more lofty valuations.

Evidently, market pundits were happy to participate and kept funnelling the liquidity as valuations set off to Mars. However, investors are now realising that a company can only lose money for so long before the issue of profitability starts to present itself. Recall, if a company is printing losses, in order to keep growing it either has to raise dilutive equity, or, issue debt in the high-yield capital markets (where cost of capital has surged amid the current rates regime). Alas, a company without a robust balance sheet, high FCF conversion, widening margins, high return on capital and forward looking sales momentum will trade south in this current market.

Exhibit 2.

Data & Image: Goldman Sachs Investment Research

Investment Thesis Summary

Which brings us to the investment debate of Quipt Home Medical Corp. (NASDAQ:QIPT), one of the top picks in our healthcare services universe. QIPT is at a turning point in its investment cycle where numerous inflection points look set to amalgamate. QIPT also aligns with several of the risk premia likely to drive equity returns into the coming five years on our estimate. QIPT’s stable and healthy FCF margins, coupled with the prospect of profitability from FY22 are key factors that have us trigger happy on the name.

Exhibit 3. QIPT 12-month price action

Data & Image: Bloomberg

But it is QIPT’s robust M&A pipeline that adds a heavy bullish tilt to the risk/reward calculus. We demonstrate that each of the company’s 17 acquisitions from 2018 through today have been accretive to sales, operating income and earnings. Moreover, revenues are highly synergistic from each of its takeover targets. This strategy continues to lengthen the tail of asset returns for QIPT whilst lowering execution risk, concentration risk in its portfolio, and builds additional sources of value to the top line.

Here we outline why QIPT justifies its inclusion into a number of equity-focused and cross-asset portfolio strategies. We’ve demonstrated how the stock aligns with our viewpoints on the macro-thematic, and how it subscribes to the current risk premia driving equity returns in 2022. We are seeking a return objective of ~40% and priced QIPT at $6.26–$7.70 based on a blend of inputs. Rate buy.

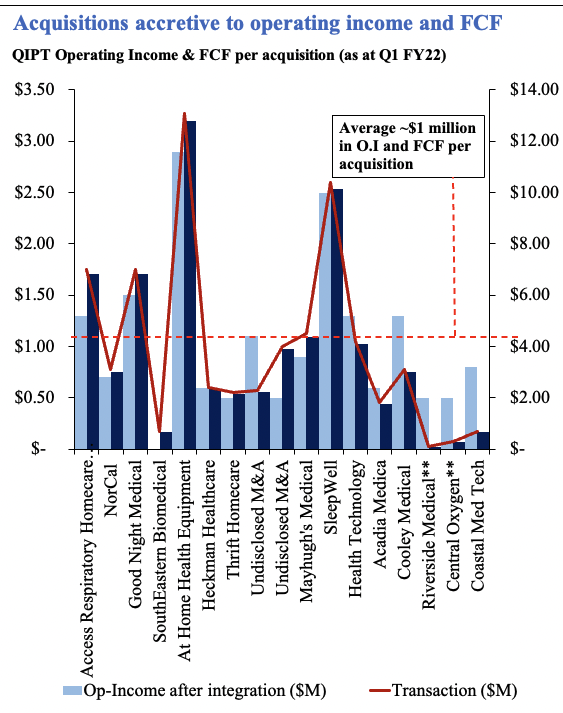

M&A Momentum Clear Differentiator

QIPT’s M&A pipeline has been a key upside driver that looks set to unlock compelling value in the years to come. The strategy has been to acquire either high margin names or product lines that are complementary to its current sales mix. Revenues have been highly synergistic from the 17 acquisitions completed since September 2018 (Exhibit 4). This model gives QIPT strategic control over various idiosyncratic and systematic risks, in our estimation.

For instance, concentration risk is dampened in its portfolio by building in additional sources of value to its top-line. Revenue growth is therefore better hedged against large-sigma events, and sources of revenue are more evenly distributed. Moreover, the execution risk of commercialising new products is effectively quashed. Instead of putting capital at risk in researching, developing and commercialising an untested product line, it simply acquires an already performing, high margin name to do the heavy lifting.

The result has been a lengthy tail of asset returns that continues to feed FCF downstream and winds up torque to QIPT’s revenue flywheel. The company has averaged ~$4 million in revenue per acquisition since it began the trail in 2018. On that turnover, it has averaged ~$1 million in operating income per acquisition and averaged ~$1 million in cumulative FCF using Q2 FY22’s results.

Exhibit 4.

Data: QIPT SEC Filings. Image & Research: HB Insights

Moreover, transactions have been completed on more than respective valuations, demonstrating management’s firm grasp over liquidity and the balance sheet. It continuously puts the balance sheet to effective use in finding a sweet spot of acquisitions of ~1-2x revenue. QIPT averaged paying ~1x revenue per acquisition since 2018, whilst averaging a 4.2x EBITDA per transaction in the same time. For context, the median healthcare deal fetched 20x forward EBITDA in FY21, five turns higher than before Covid-19. Transaction value in healthcare acquisitions of European targets also increased by 224% in 2021 after declining for two years prior. As such, QIPT’s deal flow has been incredibly cheap and efficient, in our estimation. This is a differentiating factor in the investment debate and insulates the company from competitors in providing a very clear path to profitability.

Exhibit 5.

Data & Image: QIPT SEC Filings; HB Insights

QIPT’s most recent acquisitions illustrate this well. It announced its expansion to Louisiana via a small tuck-in of Access Respiratory Homecare (“ARH”), for what we estimate, on a $7 million consideration. The deal is expected to add another ~$6.5 million in revenue and ~$1 million in annualised EBITDA after integration. The prevalence of COPD in Louisiana ~305,000 cases, offering a wide addressable market.

The actual settlement price hasn’t been disclosed. However, we’ve prescribed multiples in-line with its historical averages. The deal brings two more locations and 1,000 referring physicians from Lafayette to New Orleans and increases QIPT’s patient count by more than 6,000. This brings Quipt’s total physicians to 20,600 over 92 locations and total patient count to 190,000 as at Q2 FY22. Synergistically, ARH is attractive to QIPT due to its ventilation therapy program that services the Louisiana market.

It also acquired California based NorCal in June, bringing an additional 600 referring physicians. This too brought another 3,400 active patients to QIPT. NorCal’s product mix is basically all respiratory, and so the revenue synergies are on full display once again. California’s COPD base is more than 1.3 million patients, and QIPT’s four locations in the state look set to have a serious stab at stealing market share by our estimate.

QIPT’s turning point

Our QIPT trade is centered on the thesis it is at a turning point in terms of profitability and forward earnings momentum. This is incredibly important, as our research indicates the market is no longer-rewarding top-line growth alone, but is instead shifting focus onto bottom-line fundamentals and profitability. In particular, return on capital, cash earnings, FCF and earnings leverage standout. Essentially, those names with weak balance sheets, slow FCF conversion and poor earnings outlook will continue to flounder in the current macro regime.

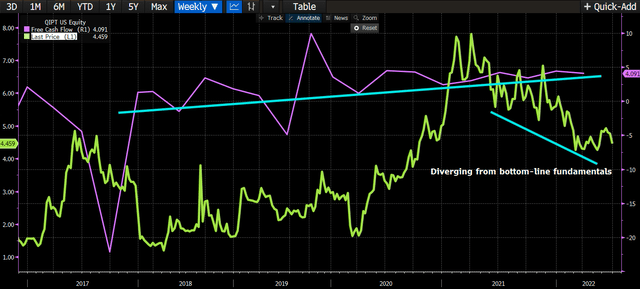

These data points illustrate why the market has overlooked QIPT this year to date, by our estimation. Firstly, the QIPT share price has oscillated southwards since peaking at 52-week closing highs of ~$6.80 in November 2021, in line with broad market trends. It has remained bottom heavy since, despite posting steady FCF, and growing CFFO cumulatively by 74% since FY18. What we feel has overshadowed QIPT’s cash earnings is its negative earnings that make it seem as if the company is ‘unprofitable’. Hence, other metrics based on earnings are skewed too. We see visible evidence of this in the QIPT share price diverging from longer-term growth trends in its bottom-line fundamentals (Exhibit 6).

Exhibit 6. Divergence from bottom-line fundamentals

Data & Image: Bloomberg, HB Insights

For instance, ROA has remained negative for the last five years and came in at -6.8% in the last filing, whilst ROIC has grown substantially to come in at ~0.07%. Gross margins have lifted by ~13 percentage points since FY16 to 78% in Q2 FY22, however, net margins have remained thin and in the red. However, using ROA as a function of FCF yields vastly different results. ROA comes in at ~15% for FY21 when using FY21 FCF instead of net income in the numerator. Moreover, it lands at ~5% for Q1 FY22 using the same method. Similar trends are seen in ROIC and the point is, when looking at cash values for QIPT, it stands out as superior.

Exhibit 7. Market looks to have brushed past QIPT on its past [un]profitability. Looking ahead, the picture is different.

Data & Image Source: Hummingbird Insights LP

And so here’s where the investment debate really heats up for QIPT. From the years FY15–FY21 the company has been unprofitable in terms of net margins, earnings and return on capital/assets. However, sales growth has averaged ~25% YoY in the past three years, and it’s averaged an FCF margin of 15.3% for the same time. It also printed ~$4.1 million FCF last filing and $13.6 million in FY21, and investors enjoy a very attractive 9% FCF yield on this at the time of writing.

We’ve updated modelling to project FCF of ~$6 million in FY22, down 55% YoY from acquisition costs. However, we see QIPT printing $35 million in FCF by FY23, jumping to $40 million the year after. This could change with more acquisitions. Moreover, we’ve baked in EPS assumptions of $0.19 for FY22, expanding to $0.37 and $0.40 in FY23 and FY24 respectively. Recall, we argue that investors are rewarding bottom line fundamentals. With that in mind, the market looks set to pull the trigger on QIPT if and when these numbers come through at its next earnings announcement. Should these underlying trends in investor behaviour continue, then QIPT is a prime candidate for an equity focused portfolio to match this mantra.

Another compelling point arises from this data. In terms of asset allocation, QIPT needs to warrant its inclusion as an equity holding by demonstrating some kind of forward equity premia. We prefer to define this as QIPT’s forward earnings yield over the current US 10-yr yield. Now more than ever, this figure is of utmost importance. Should QIPT fulfil its earnings prophecy, and continue expanding EPS and FCF into the coming years, its equity risk premium (“ERP”) becomes undeniably more justifiable. Moreover, if Treasury yields were to sharply correct then QIPT’s ERP is certainly warranted.

Exhibit 8. Forward ERP converging to Treasury yields

Data: Bloomberg

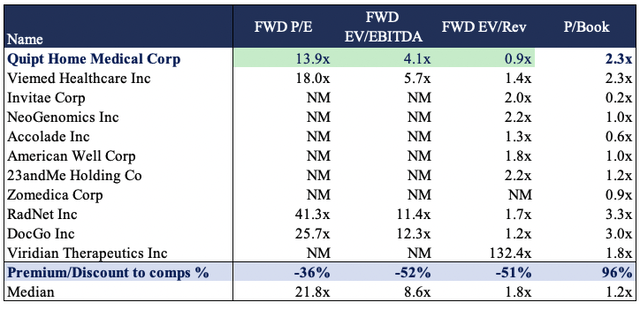

Valuation

Shares are trading at ~14x our FY22 EPS estimates and come in at ~4x our forward EBITDA projections. Shares are also priced at ~8.8x FCF and ~1x forward sales. We’ve chosen to leave the list of unprofitable names in the comps table to demonstrate QIPT’s superiority on a forward-looking basis. We firmly believe the market will begin to reflect this and has overlooked this fact to date in favour of more systematic risks.

Exhibit 9. Multiples & Comps analysis

Data & Image: HB Insights

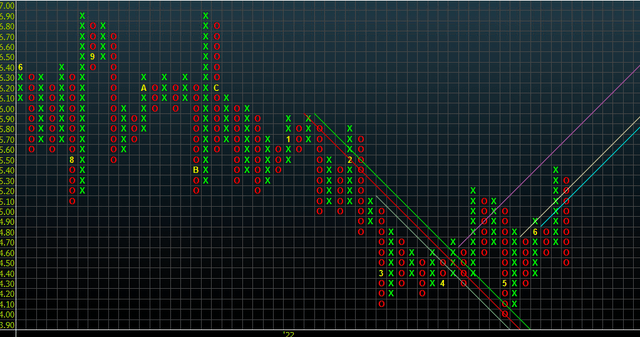

Assigning the 8.8x to our FY23 FCF estimates of $35 million, and discounting this back at 12.5% sets a price objective of $7.70 for QIPT. The company also has $0.50 in FCF per share and looks set to deliver ~$1 in FCF per share by FY23 in our model. In terms of price action, point & figure analysis on a 3-box reversal and 0.1 box size shows the stock has broken through two inner-resistance lines and is showing upside targets at $5.50 and $5.60. Previous downside targets have already been confirmed and taken out, before the latest upswing. P&F charts provide an unambiguous method of distinguishing price action without the noise of time. These price targets are more objective and give indication on where the share could head next.

Blending the three valuation inputs sets a price target of $6.26 having us seek a return objective of 40.5% in this name. This adds to why QIPT is one of our top names within healthcare.

Exhibit 10. Multiple upside targets to $5.50-$5.60

Data & Image: Bloomberg

In short

With these measures in mind, QIPT justifies its inclusion in an equity focused portfolio. We advocate its holding in directional setup as well, but to refrain from long/short plays with this name. We advocate investors to strategically position around 20-30% of their portfolio towards a recession, with the remainder strategically positioned as if the Fed were to deliver a soft landing.

Within that matrix, we’d also suggest to build tactical plays around quality and profitability factors to acknowledge the current premia driving equity returns. A focus on holdings with a 20% margin of safety at minimum is pertinent to provide adequate downside coverage. With that, QIPT easily fits into both molds given its return prospects coupled with defensible balance sheet and P&L. We are seeking a return objective of 40% in this name and will hopefully rebalance or even exit the position at that time pending what the data is telling us. Rate buy.

Be the first to comment