Marcus Lindstrom

Brookfield Asset Management (NYSE:BAM) performed well on all fronts during the most recent quarter. It generated $1.5 billion of net income and $1.2 billion of cash flow. Importantly, it had massive capital inflows amounting to $56 billion, which helped the company reach a record $111 billion of cash and capital available for investment. It will be incredibly interesting to see how the company decides to invest these funds.

During the quarter, the company also completed $21 billion of asset sales, realizing gains totaling $5 billion, and made $20 billion of new investments that look quite promising.

BAM’s assets have, in many cases, benefited from inflation, as some of its revenue streams and cash margins have been widening as the compounding effect of inflation takes hold. This environment is enhancing their cash flows and increasing the replacement cost of many of these assets. In particular, the clean power generation business, mostly represented by Brookfield Renewable (BEP), widened its advantage over other sources of energy, because the input costs of other competitive energy technologies have increased substantially.

Operating results

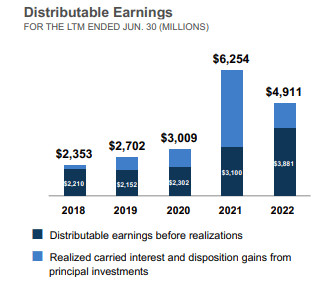

Distributable earnings before realizations were $1.0 billion in the quarter and $3.9 billion over the last 12 months, while total assets under management are now ~$750 billion. Thanks to strong fundraising and capital deployment, the company delivered a 21% increase in fee-related earnings over the last 12 months.

Fundraising momentum has been very strong. BAM recorded inflows of $56 billion since the end of last quarter, and with the company closing in on $75 billion for this round of flagship funds, it is now looking ahead to the next round of fundraising.

One business that is performing really well is the Insurance Solutions business. The American National purchase brought approximately $40 billion of assets. Prior to the closing of the transaction, the company sold 100% of the common equity exposure in the insurance portfolio and converted the bond book last year into cash or short-dated liquid assets. This is now providing it with substantial additional financial resources to deploy into the current investing environment, which is much more interesting than it was at the time the company acquired the portfolio. The current increased yield should be very beneficial to the company.

Financials

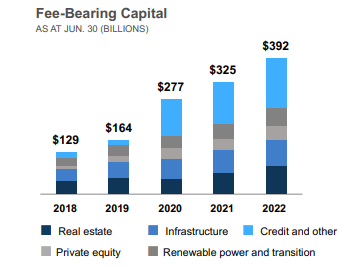

The way we analyze BAM is a little different compared to other companies. Instead of focusing on revenue and profit margins, we look at its fundamental drivers of value. These include fee-bearing capital, which has been growing at a remarkable pace and has now reached $392 billion as of the end of the quarter.

BAM Investor Presentation

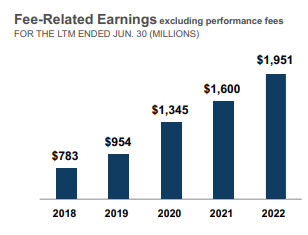

Thanks to the increase in fee-bearing capital, and the fact that the company has been deploying this capital into new investments, fee-related earnings have also increased at an impressive pace, reaching $1.9 billion for the last twelve months ended June 30th.

BAM Investor Presentation

Fee-related earnings might be the most attractive, but not the only source of earnings for the company. BAM provides a very useful figure called ‘Distributable Earnings’, which gives an idea of how much the company could distribute to shareholders if it wanted to distribute all of its earnings, and it includes realized carried interest and disposition gains. In 2021 this figure was abnormally high due to very significant carried interest and disposition gains. We believe the 2022 amount is more reflective of a “normal” year, and think that assigning a multiple to this figure can provide a rough estimate of fair value.

BAM Investor Presentation

New investments

The company reported making several new investments during the quarter at what it believes to be attractive valuations. Some of these new investments include an $8.5 billion software business that serves a large part of the car dealership industry in the US, $3 billion of real estate assets at large discounts to their tangible value, a $6 billion subscription-based residential maintenance business in the UK, and part of a $17.5 billion telecom tower business in Germany.

Dispositions

Since the last report, the company completed $21 billion in monetizations, realizing gains totaling $5 billion. Some of the businesses and investments the company sold include: A Student Housing Business in the UK, resulting in an internal rate of return of 25%. A Container Port Property in Los Angeles, resulting in an internal rate of return of 19%. A Toll Road Portfolio in India, resulting in an internal rate of return of 14%. Office Properties in the City of London, which generated an annualized internal rate of return of 18%. Electricity Transmission Lines in Brazil that bring desperately needed renewable energy from the north of the country to the industrial heartland of Brazil, where the sale resulted in a 22% internal rate of return.

Valuation

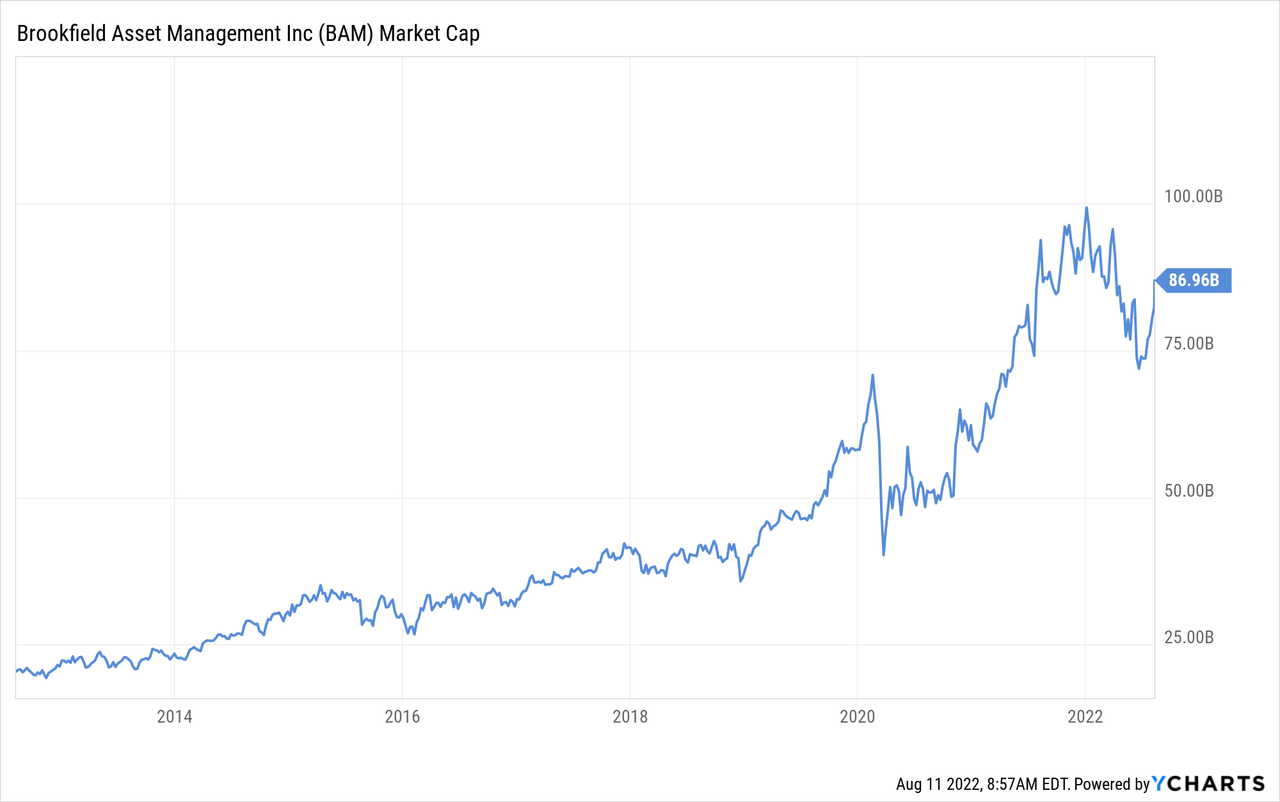

Brookfield Asset Management is trading with a market cap of ~$87 billion. This is ~17x distributable earnings, which we think is a reasonable valuation, but not exactly a bargain. However, given how well the company’s fundraising is going, how fast fee-bearing capital is increasing, and the excellent returns the company is delivering, an argument can be made to still buy the shares at these prices.

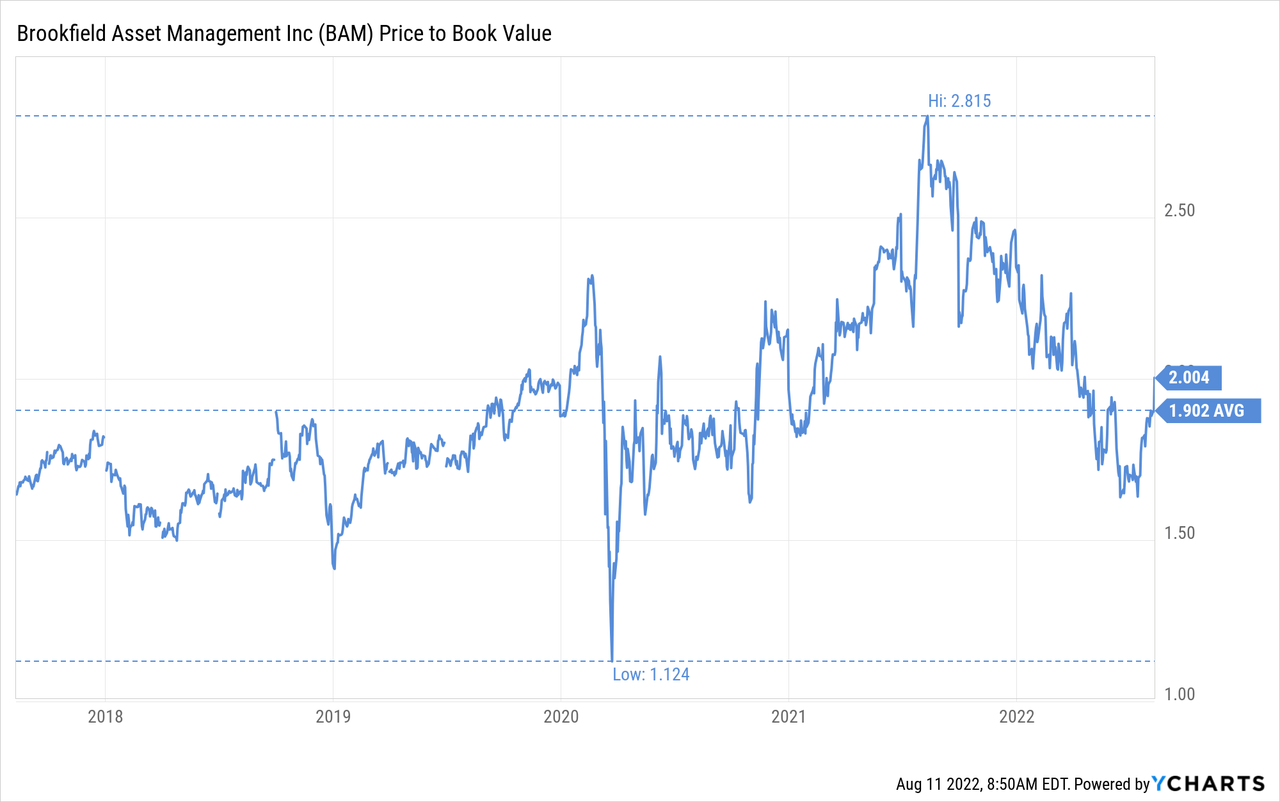

In the last five years, shares have traded at an average price to book value of ~1.9x. And they are very close to that value currently, furthering our belief that shares are currently close to fair value.

Risks

The main risk we see with an investment in BAM is that many of the company’s investments and subsidiaries are highly leveraged. While the company tends to take many measures to mitigate the risk from leverage, including using project-level debt and fixed rate longer duration debt, it is still something to take into consideration.

Conclusion

We are very pleased with the results BAM delivered for the quarter, including the significant increase in fee-bearing capital. Shares are no longer at bargain levels, but it can be argued that they are still close to fairly valued, and as such long-term investors can justify buying the shares. The most impressive data point to come out of the earnings report, at least in our opinion, is the massive $111 billion in cash and capital that the company has available to make investments. It will be really interesting to see how the company decides to deploy these funds.

Be the first to comment