Justin Sullivan/Getty Images News

Those wing doors will not get that Tesla off the ground, and new action against Elon Musk’s autopilot claims might even stop them being driven manually by man – including Musk – in some places. An earlier action against Musk by the SEC resulted in him giving up his driving position as both Chairman and CEO.

In my first article on Tesla, Inc. (NASDAQ:TSLA) on 16 November, 2021, titled Tesla’s Ticking Time Bomb, I strongly advised selling Tesla. The price then was $1,054.73, so it is down 18%, somewhat more than the S&P500’s 12% decline. On the first of that same month, the price was $1,209.

TSLA hit a low of $626 on 24 May, 2022, suggesting many are having doubts, with the recent bounce perhaps being caused by believers in that sky-high $1580 forecast. To those I would recommend they check the past and see that the price had never gone above $100 until the beginning of last year, the price level I believe it will return to. It is down 27% YTD en route to that price.

This shall probably be my last article on Tesla, as I prefer to write on companies that will gain from world developments, and those do not benefit Tesla in the way they did in the past. That should have a significant negative effect on Tesla’s future performance in both the car and stock markets, and I hope this article will be of value to those holding or considering buying into Tesla now. I would emphasize here that I am not a short seller or a trader. Tesla may well suit those that are, but it does not suit me. I am an investor and I write with only that in mind.

I will first touch on Tesla the car (and solar panel) maker and expand on the challenges it faces later.

Tesla The Car Maker

Tesla was founded by a visionary named Elon Musk. He saw an opportunity in electric cars, EVs, when other carmakers – and especially the U.S. and German manufacturers – were mostly focused on traditional internal combustion engines, ICEs.

He gained an almost cult-like following among retail investors and used the resultant share price explosion to raise over $13 billion in four stock offerings. Car-making is a capital-intensive industry, and such low capital costs gave it an advantage to get off the ground and into the big league.

Tesla also had good profit margins. Being a newcomer to car manufacturing, Tesla did not have legacy car maker problems such as restrictive unions and large company bureaucracies to add cost, plus EVs require many fewer components than ICEs. That makes Tesla’s profit margins better – gross margins were 23% in fiscal 2020, compared with Ford’s (F) 10%. That gap is closing. Tesla’s superior margins over other carmakers are used by many believers to justify its high valuation, but – while they are good compared with many – they are not sufficiently better than the world’s largest carmaker Toyota (TM, OTCPK:TOYOF) to do make the difference so extreme.

Toyota’s P/E is 10.9. Tesla’s P/E is 103.77 – nearly 10 times Toyota’s!

Toyota’s market cap $260bn. Tesla’s $967bn – nearly 4 times Toyota’s!

The latest gross margin (“GM”) figures show this:

Tesla’s GM: 28%. Net: 10.5%. Ops: 14.6%

Toyota’s GM: 18%. Net: 8.5%. Ops: 8%

That GM gap will close when Toyota (and other ICE makers) build more EVs because of the hugely lower amount of materials needed to build EV motors than ICEs, so either TM’s P/E should shoot up or TSLA’s crash down.

The latest results from Tesla’s website were good, but the Gross Margin is declining.

F I N A N C I A L S U M MA R Y (Unaudited)

|

($ in millions, except percentages and per share data) |

Q2-2021 |

Q3-2021 |

Q4-2021 |

Q1-2022 |

Q2-2022 |

YoY |

|

Automotive revenues |

10,206 |

12,057 |

15,967 |

16,861 |

14,602 |

43% |

|

of which regulatory credits |

354 |

279 |

314 |

679 |

344 |

-3% |

|

Automotive gross profit |

2,899 |

3,673 |

4,882 |

5,539 |

4,081 |

41% |

|

Automotive gross margin |

28.4% |

30.5% |

30.6% |

32.9% |

27.9% |

-46 bp |

|

Total revenues |

11,958 |

13,757 |

17,719 |

18,756 |

16,934 |

42% |

|

Total gross profit |

2,884 |

3,660 |

4,847 |

5,460 |

4,234 |

47% |

|

Total GAAP gross margin |

24.1% |

26.6% |

27.4% |

29.1% |

25.0% |

89 bp |

|

Operating expenses |

1,572 |

1,656 |

2,234 |

1,857 |

1,770 |

13% |

|

Income from operations |

1,312 |

2,004 |

2,613 |

3,603 |

2,464 |

88% |

|

Operating margin |

11.0% |

14.6% |

14.7% |

19.2% |

14.6% |

358 bp |

|

Adjusted EBITDA |

2,487 |

3,203 |

4,090 |

5,023 |

3,791 |

52% |

|

Adjusted EBITDA margin |

20.8% |

23.3% |

23.1% |

26.8% |

22.4% |

159 bp |

|

Net income attributable to common stockholders (GAAP) |

1,142 |

1,618 |

2,321 |

3,318 |

2,259 |

98% |

|

Net income attributable to common stockholders (non-GAAP) |

1,616 |

2,093 |

2,879 |

3,736 |

2,620 |

62% |

|

EPS attributable to common stockholders, diluted (GAAP)(1) |

1.02 |

1.44 |

2.05 |

2.86 |

1.95 |

91% |

|

EPS attributable to common stockholders, diluted (non-GAAP)(1) |

1.45 |

1.86 |

2.54 |

3.22 |

2.27 |

57% |

|

Net cash provided by operating activities |

2,124 |

3,147 |

4,585 |

3,995 |

2,351 |

11% |

|

Capital expenditures |

(1,505) |

(1,819) |

(1,810) |

(1,767) |

(1,730) |

15% |

|

Free cash flow |

619 |

1,328 |

2,775 |

2,228 |

621 |

0% |

|

Cash and cash equivalents |

16,229 |

16,065 |

17,576 |

17,505 |

18,324 |

13% |

Source: Tesla.

If more financial information is required, it can be found here on Tesla’s website.

Cash and cash equivalents are good, but billions will be needed to build the additional giant factories required, as might the many existing problems that remain unresolved with new ones still emerging.

I will now move on to those…

Problems – Internal

Self-Inflicted

There are many self-inflicted problems, and many have yet to be resolved. The latest are claims by California’s DMV that Tesla overstated its autopilot capabilities. This Reuters article tells more about that. California is Tesla’s largest U.S. market. The company sold 121,000 vehicles there in 2021, out of an estimated 352,000 sold nationwide. The DMV is seeking remedies that could include suspending Tesla’s license to sell vehicles in California and requiring the company to make restitution to drivers.

Wikipedia has this list of lawsuits against Tesla. I know of no other reputable company that has stirred up so much controversy. The “autopilot” – the word used by Elon Musk to describe Tesla’s driver assistance technology – fatality case could prove to be fatal or near-fatal for the whole company. Autoblog tells us more on that.

Currently, in a car accident in the U.S., the driver of one car sues the driver of the other car. It is only very seldom the car manufacturer is sued. For self-driving cars, however, things are likely to be different. There aren’t other drivers to sue. There is just the car – and the company that made it. It won’t take long for plaintiffs’ lawyers to start filing big lawsuits, even class actions, against the car and technology companies that made the cars and designed the self-driving technology. And, as we have seen in other such situations, there could soon be billion-dollar judgments against Tesla.

Recall and Warranty costs. In 2021, Tesla recalled 475,000 vehicles for safety issues in the U.S. alone. Barron’s recently reported that, since January, 2022, Tesla has issued four recalls for almost 1.5 million vehicles worldwide, according to the National Highway Traffic Safety Administration. That’s roughly four times the 360,000 cars that Tesla delivered in the U.S. in 2021, and a half-million more, at least, than the 936,000 delivered worldwide. Global deliveries rose about 87%, compared with 2020. Those problems have to be fixed free of charge, plus many other problems require fixing under warranty.

They all require the vehicle to be returned to a dealer to be fixed. They are a nuisance for the owners and costly for Tesla shareholders.

Musk’s Antics. I borrowed the word antic from Al Jazeera’s report headed “Musk’s antics turn Tesla owners, new buyers against it.”

Another antic was buying into solar panels. This is a U.S.-only market for Tesla. He got into solar by buying a troubled company founded by his cousins and on whose board he sat. That was paid for with Tesla shareholders’ money and led to a failed lawsuit by them, according to this Business Insider report. Its policy has been to offer lowest price guarantees, which is suicidal in such a commodity product market sector and – to reduce costs in the U.S. further – President Biden has waived tariffs on solar panels imported from Cambodia, Malaysia, Thailand, and Vietnam. A CNET report also claims that “Tesla is skimping on customer service.” This activity will be a constant drain on Tesla profits until closed!

Share sales. Musk’s latest antic is to sell more Tesla shares purportedly to prepare any payment he may have to pay for his Twitter bid. One has to question why did he sell now if he has confidence the stock price will be higher when the outcome of that case against him is known?! This SA News report headed “Elon Musk backtracks on stock pledge” tells more, including “he now owns just under 15% of Tesla.” One day he may be a total high-price dropout!

Musk’s Aims. As a visionary, he has achieved near miracles to get Tesla where it is today. However, it will need another miracle in the near future if 20 million cars are to be made, and even aiming for them could put Tesla into reverse gear financially. At Tesla’s recent Cyber Round Up in Austin, Texas, Musk said the company would “end up building at least 10 or 12 Gigafactories.” Those Gigafactories cost Gigabucks to build. They also require years to build, and he needs them soon if he is to make 20 million cars per year by 2030. That means completion before the end of 2029 – just over 7 years away. None have been started, nor even have locations been announced!

In the unlikely event Tesla achieved that number, it would require another miracle to sell that many cars, because gaining 16.4% of the entire world car market – including ICEs – is probably impossible for any car maker. GlobeNewswire made the 2030 estimate of total car market size in 2030 of 122.83 million units that I used to calculate that market share percentage. It makes worthwhile reading.

It also looks rather stupid if S&P Global’s estimate of 26.8 million EV sales by 2030 proves correct. That would mean Tesla has to achieve 75% EV market share!

Toyota is the world’s largest carmaker and manufactures around 10 million cars per year. It has around 10% of the world market. It makes ICEs, hybrids, plug-in hybrids, battery EVs, and hydrogen cars. Tesla only makes battery EVs.

It therefore takes a bit of a stretch of the imagination to see Tesla selling 20 million cars per year by 2030… if it can make them!

Problems – External

Lithium supplies. The Financial Times recently published this article headed “Electric-car makers warned lithium supply crunch is set to last until 2030.”

Political and economic. The new Inflation Reduction Act could have a perverse and unintended negative result for Tesla. The $7,500 electric vehicle tax credit will be renewed in January of 2023 and last until the end of 2032. A striking new requirement is that qualifying cars must be assembled in North America and that materials and critical minerals in the battery must come from the U.S. or a country with a free trade agreement with the U.S. That means some electric vehicles sold in the U.S. will be ineligible as soon as the bill takes effect. Chinese battery maker Contemporary Amperex Technology Co., Limited (“CATL”), who make some batteries for Tesla, has dropped plans to make them in the U.S. following House Speaker Nancy Pelosi’s visit to Taiwan. The U.S. does not have a free trade agreement with China, so Tesla will not qualify for this credit if it buys batteries from there.

Political backlashes. Elon Musk has probably made some enemies at the political top in California due to his personal move, and Tesla’s HQ, from there to Texas. They may encourage a harsh judgement in DMV’s autopilot case against Tesla that I mentioned above.

Tesla may yet face other challenges due to his behavior in Germany. That country is full of bureaucracies, some of which wanted to prevent the car and battery factory near Berlin from being built in the first place. Also, local residents and environmentalists – including Green party politicians – did not want their environmentally and visually valuable forest torn down, as this report shows. Elon Musk apparently barged through those bureaucratic regulations and local and environmental objections and started building without proper approvals. The battery factory has still not been started. Their unanswered environmental problems remain. This CNBC article tells more.

The China/US political confrontation maybe the biggest threat to Tesla. This recent SA article by Anton Wahlman titled “Tesla’s China Exposure Faces New Risks” covers some of those risks well.

Even prior to Pelosi’s recent visit to Taiwan, politics in China were not in Tesla’s favour because Elon Musk’s SpaceX company may also compound Tesla’s potential problems there. The South China Morning Post published this article, titled “China military must be able to destroy Elon Musk’s Starlink satellites if they threaten national security.”

There are also many reports that the Chinese government sees Tesla’s cars as a spying threat, having banned them in places requiring tight security and stopped government departments from buying them for official use. This getjerry report tells some of that story.

Given the influence the Chinese government has over its people, it could easily encourage them to buy Chinese brands in preference to Tesla.

China’s economic situation is not good, either. With its imploding property lending bubble and ageing population China’s economy is looking precarious, and many U.S. political leaders would not be averse to helping that worsen.

That will affect many foreign companies, but Tesla is more exposed to China than many given its vast factory there and the fact China is the world’s largest car market, including EVs. China’s automobile industry association has just raised its forecast for Chinese EV purchases in 2022 from 5.5MM to 6.0MM, more than double 2021 levels. Tesla sold 28,217 China-made vehicles in July, down 14.41% Y/Y and 64.24% M/M from 78,906 units in June.

The UK is in or near recession, as are several EU continues. They include important German, UK, French, and Italian car makers, all of which have poured billions into making EVs.

That brings me to another major problem for Tesla…

Competition

– Loss of a previously exclusive big Tesla buyer. EV subscription company Autonomy has placed an order for 23,000 EVs with 17 global automakers to expand and diversify its subscription fleet beyond just Tesla vehicles. Autonomy currently has 1,000 cars, all of which are Tesla models. The fleet order valued at $1.2B includes EVs from BMW (OTCPK:BMWYY), Canoo (GOEV), Fisker (FSR), Ford (F), General Motors (GM), Hyundai (OTCPK:HYMTF), Lucid Group (LCID), Mercedes-Benz (OTCPK:DDAIF), Polestar (PSNY), Rivian (RIVN), Stellantis (STLA), Subaru (OTCPK:FUJHY), Tesla (TSLA), Toyota Motor, VinFast, Volvo Car (OTCPK:VLVOF), and Volkswagen (OTCPK:VLKAF).

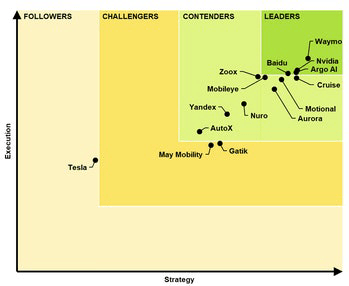

– Others lead the autopilot race. Tesla’s autopilot faces costly attacks and is anyway losing the race to others, as this chart shows

inverse.com

Waymo leads with Baidu not far behind…

– Chinese tech giant, Baidu (BIDU) has secured the first permits in China to offer commercial fully driverless robotaxi services to the public on open roads.

Baidu’s Apollo RT6 FAV unveiled last month in Beijing (Baidu)

Wei Dong, vice president and chief safety operation officer of Baidu’s Intelligent Driving Group, said in a statement:

“We believe these permits are a key milestone on the path to the inflection point when the industry can finally roll out fully autonomous driving services at scale.”

Baidu will sell its technology to other car makers helping those leapfrog over Tesla.

It will also make cars having unveiled the Apollo RT6 – photo above – an EV ready for production with an initial starting price of $37,000. Jidu Auto, which is a joint venture between Baidu and Geely Automobile Holdings (OTCPK:GELYY) is looking at raising between $300M and $400M as it seeks to launch its first commercial vehicle in 2023.

– Apple (AAPL) may have this fully autonomous EV on the road by 2025. Rumors suggest it will be made by Hyundai. If so, maybe their worldwide dealer network will sell and service it.

Vanorama

Apple reportedly poached a top executive from Italian luxury carmaker Lamborghini for its car project.

– China’s BYD (OTCPK:BYDDF, OTCPK:BYDDY) sold 641,350 EVs in the first six months of 2022, representing a 315% increase from the same period last year. Tesla, on the other hand, delivered a total of 564,743 vehicles in H1.

– Century-old car makers are determined to be around for another century! Every major maker is spending billions on EVs. A JV between Stellantis (STLA) and Samsung (OTCPK:SSNLF) is building a $2.5 billion battery factory in Indiana. General Motors is spending $7bn to convert an existing factory to make EVs. That shows another advantage traditional car makers have over Tesla. It costs less to convert an existing plant to make EVs than to build a new one from scratch, plus they have an established workforce and customer base.

A report on SA tells us that GM’s all-electric Hummer draws rave review from Barron’s.

Ford is spending $11 billion on plants in Tennessee and Kentucky, and plans to build 600,000 EVs by the end of next year.

European companies are likewise spending huge sums at home and in the U.S. to build EVs and battery factories.

Putting all those above points into one big picture and I conclude that…

Tesla Is Beyond Its Sell-By Date

I mentioned Elon Musk’s sales above. He is not the only insider to have been selling; Robyn Denholm – Chairman of the Board – was a huge seller in May and June this year. From the Financial Times, the last time I could find news of insiders buying – including a tiny buy by Elon Musk – was in February 2020:

| Dealing date | Name / Title | Shares | Per share(USD) | Deal size(USD) |

|---|---|---|---|---|

| Sale30 JUL 2020 | Robyn M. Denholm CHAIRMAN OF THE BOARD | 1,400 | 1501.82 | 2.10 m |

| Sale30 JUL 2020 | Robyn M. Denholm CHAIRMAN OF THE BOARD | 700 | 1503.49 | 1.05 m |

| Sale1 JUN 2020 | Kimbal Musk INDEPENDENT DIRECTOR | 7,275 | 895.00 | 6.51 m |

| Purchase14 FEB 2020 | Lawrence J. Ellison INDEPENDENT DIRECTOR | 1,250 | 767.00 | 958.75 k |

| Purchase14 FEB 2020 | Elon Musk TECHNOKING OF TESLA, CHIEF EXECUTIVE OFFICER AND DIRECTOR | 13,037 | 767.00 | 10.00 m |

Source: Financial Times

If Insiders are big sellers – and none buy – why should outsiders do otherwise?!

Be the first to comment