PeopleImages/iStock via Getty Images

Quest Resource Holding Corporation (NASDAQ:QRHC) works with large clients, which will likely require waste services in the future. QRHC’s business model does not require a lot of financing to sustain revenue growth and free cash flow growth. Besides, management appears to have expertise in the M&A markets, and recently signed acquisitions. In my opinion, even considering risks from inflation, failed alliances, or opex increases, Quest Resource appears undervalued.

Quest Operates In Growing Markets

Quest Resource Holding Corporation offers waste and recycling services to clients from across different industry sectors among other services.

The company offers preparation and execution of plans to reduce environmental damage. When hiring Quest, the contracting company has to agree to allow an in-depth investigation of its assets, production models, and documentation to find out the emission levels they are handling.

Quest offers a wide variety of strategies and operations. Some of them are the recycling of plastics and metals along with disposal of automotive waste and food products (along with their packaging and packaging) besides the universal recycling service, general waste from any company, such as lamps, batteries, aerosols, or products with mercury.

Source: Presentation To Investors

In this way, with reliable data added to the experience of more than 10 years in the elaboration of these plans, management of Quest can trace the operation step by step, with the projection of real statistics to know and comply with the emission levels of a company in the future.

Considering the voice of experts, the company is operating in a market that grows at a CAGR of close to 5.4%. With that, Quest Resource usually reports larger sales growth thanks to new markets and corporate combinations.

According to the research report published by Polaris Market Research, the Global Waste Recycling Services Market Size Is Expected To Reach USD 84.8 Billion By 2028, at a CAGR of 5.4% during the forecast period. Source: Waste Recycling Services Market

Companies can also contract Quest to measure their CO2 emissions, which positions the company in a growing and promising market. According to market experts, the global carbon footprint management market is expected to grow at close to 7% from 2022 to 2031.

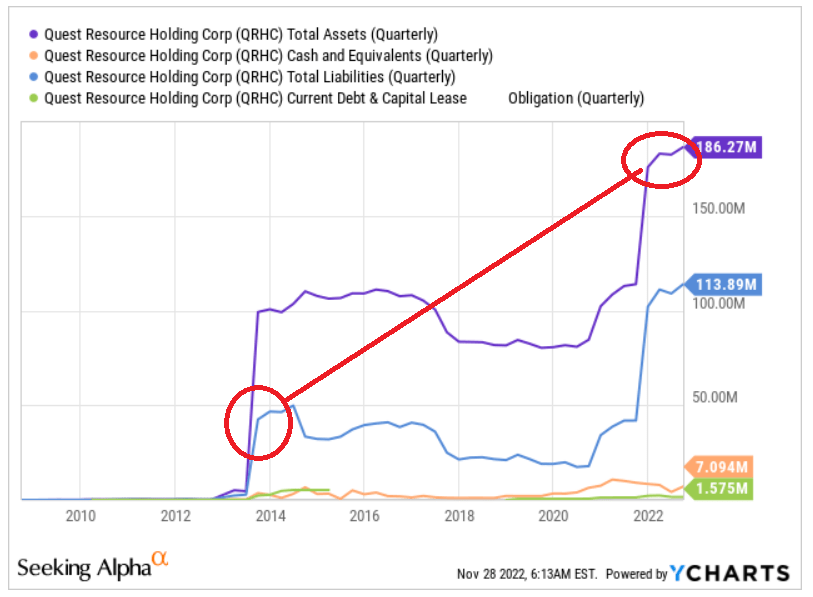

Impressive Increase In The Amount Of Assets And Experience In The M&A Markets

Since its launch in 2009, Quest has been able to expand its environmental pollution reduction advisory services from the United States to Puerto Rico and Canada. According to recent financials, over the last ten years, the company has achieved an increase in the flow of capital, which may be helping Quest become an efficient option for recycling services. The increase in both assets and cash is quite impressive and promising.

Source: YCharts

I am also quite optimistic about the company’s future inorganic growth because of several acquisitions reported recently. In 2021 and 2022, management reported the acquisition of several assets and competitors. Past experience in the M&A markets suggests that management knows how to negotiate deals and incorporate new teams. Currently with a good financial profile, I believe that sales growth could be larger than the target market thanks to new M&A deals.

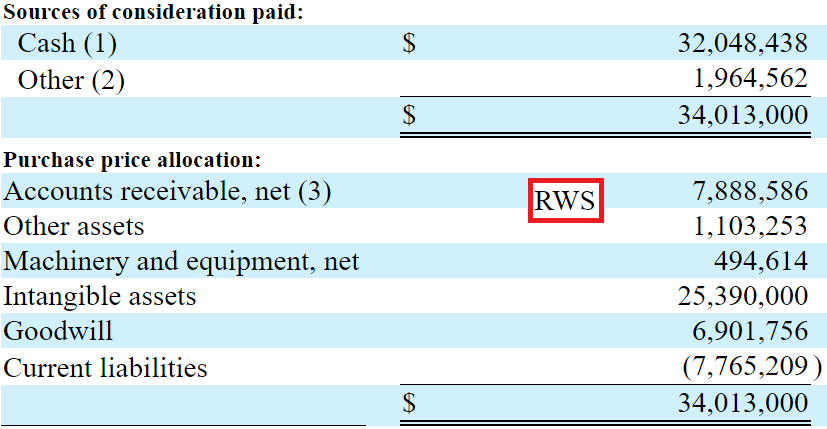

We made significant strategic acquisitions in 2021, including the November 30, 2021 acquisition of the membership interests of RWS, a Chadds Ford, PA-based environmental services company. Source: 10-Q

Source: 10-K

On February 10, 2022, we acquired an independent environmental services company that primarily services customers in the northeast region of the United States. Source: 10-Q

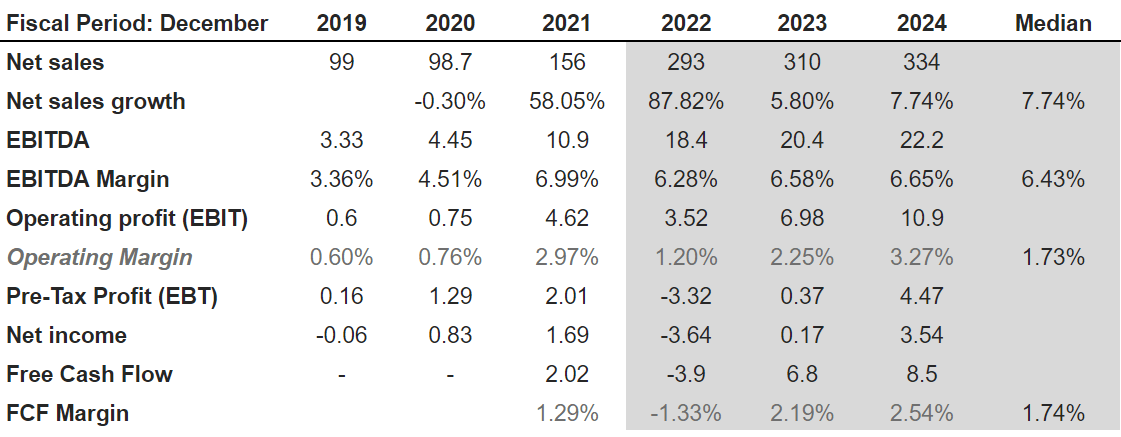

Expectations From Analysts

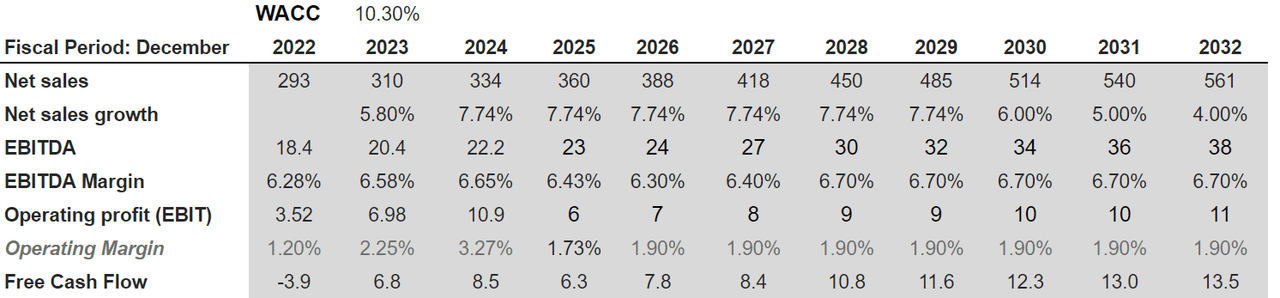

Analysts expect significant sales growth in 2022 thanks to acquisitions. 2024 net sales would stand at close to $334 million together with a net sales growth of 7.74%. In addition to an EBITDA of $10.9 million and an EBITDA margin of 6.99%, the operating profit would stand at $4.62 million, and the operating margin would be 2.97%. 2024 pretax profit would be close to $2.01 million with 2024 net income of $1.69 million. Finally, 2024 free cash flow would be $2.02 million, and the FCF margin would be close to 1.29%. Further numbers from analysts are shown in the image below.

Source: Marketscreener.com

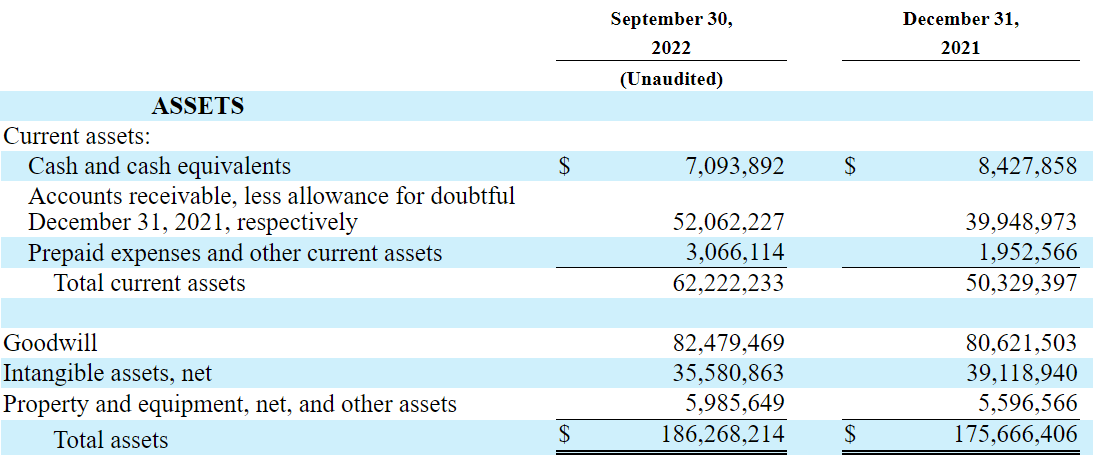

Healthy Balance Sheet

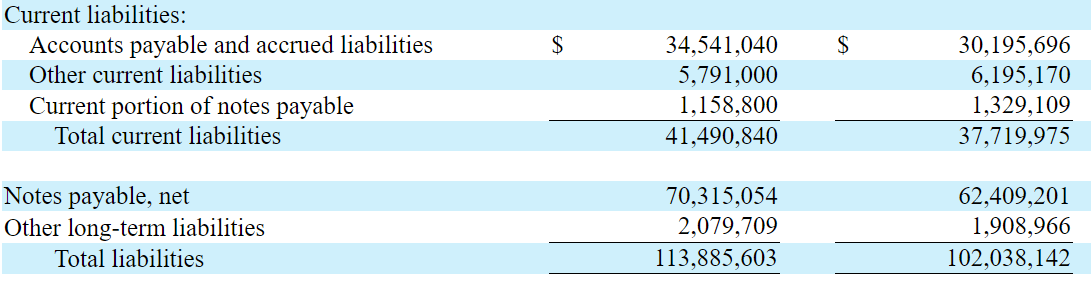

As of September 30, 2022, Quest Resources reported cash and cash equivalents of $7 million, accounts receivable of $52 million, and prepaid expenses of $3 million. Total current assets stand at $62 million, higher than the current amount of liabilities.

Goodwill stands at $82 million with intangible assets worth $35 million. Considering that goodwill and intangible assets represent a large part of the total amount of assets, I believe that Quest’s transactions don’t seem small. Total assets stand at $186 million.

Source: 10-Q

Liabilities include accounts payable worth $34 million and other current liabilities of $5.7 million. Debt includes a current portion of notes payable of $1.1 million and long term notes payable worth $70 million. Finally, total liabilities stand at $113 million. The asset/liability ratio stands at close to 2x, so I would say that the balance sheet is healthy.

Source: 10-Q

More Large Customers, More Vendors Inside The Network, And More Data Could Bring The Stock Price To Around $8.3 Per Share

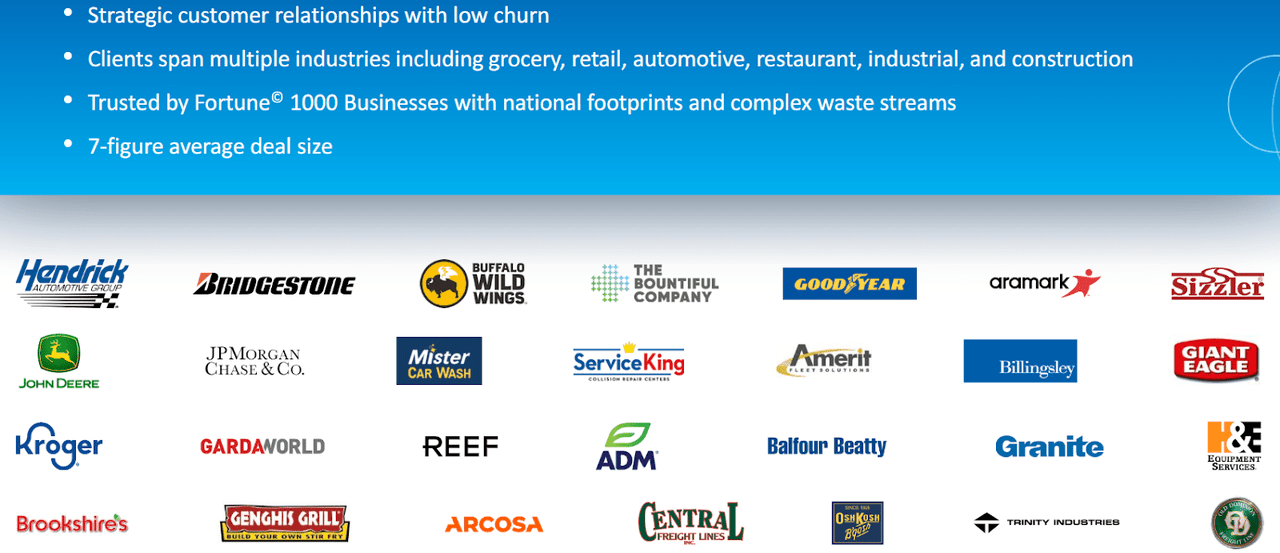

I believe that the company will likely deliver sales growth because clients are large organizations. Even without adding new clients, existing customers will likely grow, and require more waste services. In a recent slide, Quest Resources offered a list of clients. They all come from very different sectors, so the company appears significantly diversified.

Source: Presentation To Investors

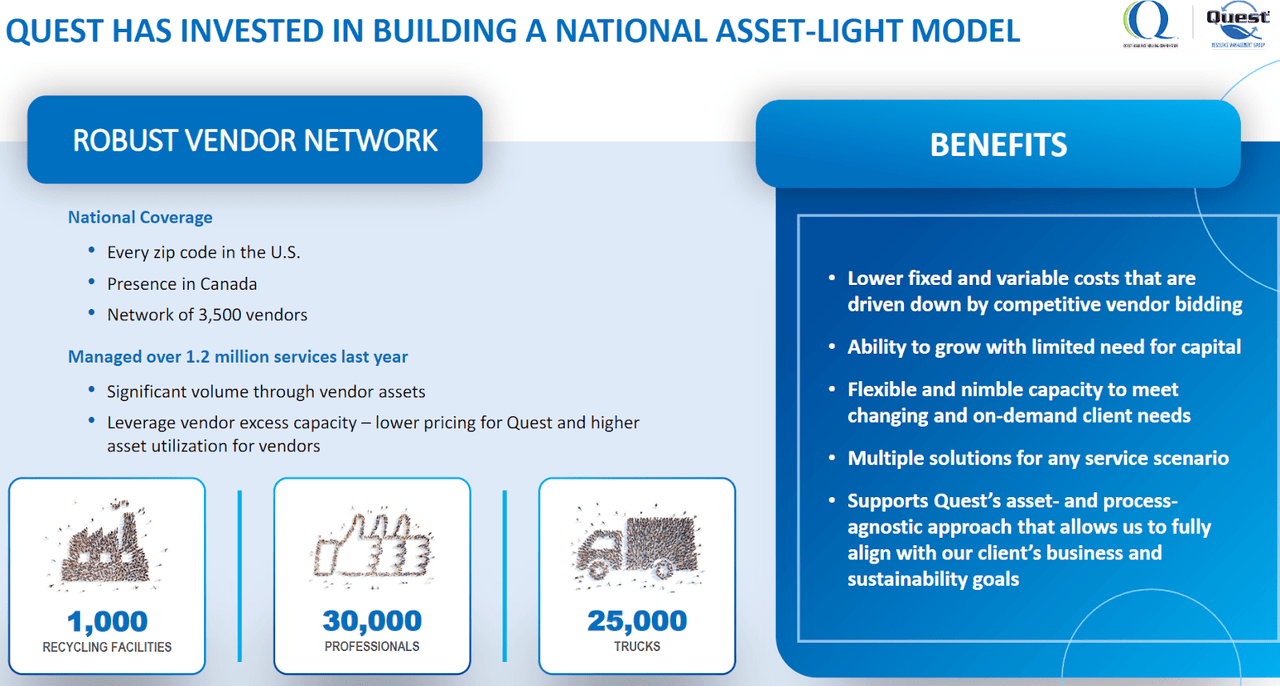

It is also worth noting that Quest does not need a lot of assets to deliver revenue growth and decent margins. Keep in mind that Quest operates as a network building connection between clients and a list of around 3,500 vendors including recycling facilities, trucks, and professionals.

Source: Presentation To Investors

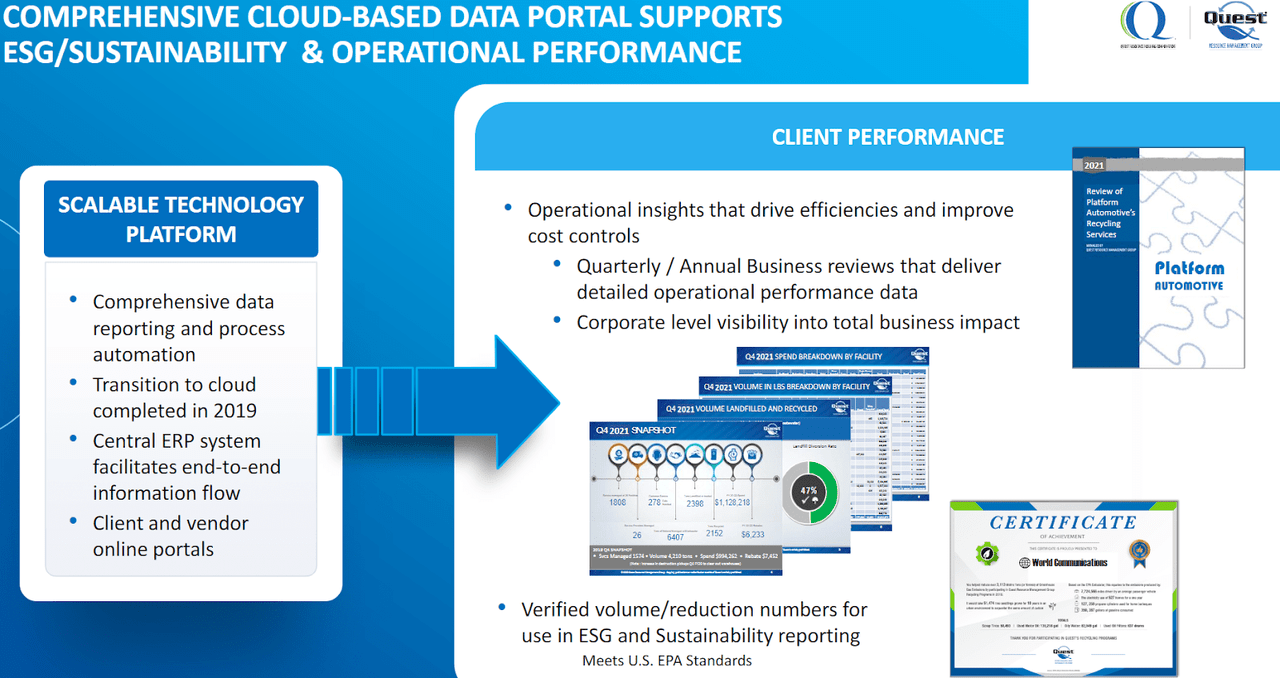

Under this case scenario, I assumed that the company’s cloud based data portal will continue to drive sales growth. Users have access to a lot of information about clients, vendors, and automatization tools.

Source: Presentation To Investors

Finally, I also assumed that we will see further increase in the value of certain recycled materials because of inflation and competition. The company talked about these effects in the last quarterly report.

The changes in gross profit and gross profit margin percentage for the nine months ended September 30, 2022 were primarily due to the net effect of the impact of increased services from certain new and continuing customers, the business operations acquired, change in the mix of services and relative gross profit margins from new and acquired customer base, increased value for certain recycled materials compared to a year ago, and reduced operations at certain other customers. Source: 10-Q

Under my optimistic case scenario, I assumed 2032 net sales of $561 million and net sales growth of 4%. 2032 EBITDA would stand at $38 million together with an EBITDA margin of 6.70%. I also included an operating profit of $11 million accompanied by an operating margin of 1.90%. Finally, free cash flow would be close to $14 million.

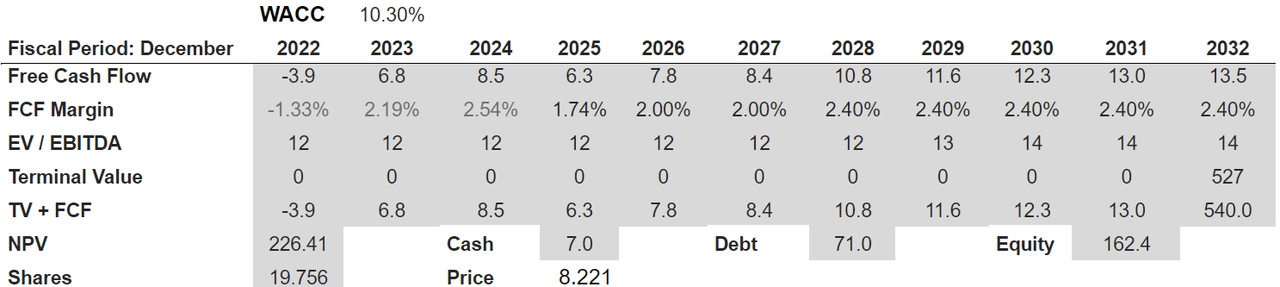

Source: Author’s Work

If we use an EV/EBITDA multiple of 14x and a WACC of 10.3%, the net present value of future FCF would stand at close to $226.41 million. If we also include a share count of 19.756 million, the fair price would stand at close to $8.3.

Source: Author’s Work

Bearish Case Scenario: Failed Acquisitions, Failed Strategic Alliances, And Inflation May Bring The Stock Price Down To $3.29

In my view, the largest risk for Quest Resources would include M&A failures. If management does not obtain the synergies expected from the acquisitions of RW and other environmental services companies, future FCF may be lower than expected. As a result, Quest may lower its goodwill, which may lead to less book value per share. Some investors may decide to sell their shares, which would lead to stock price declines.

Quest Resources noted in a recent annual report that inflation didn’t seem to affect its business model. However, I wouldn’t discard increases in opex due to salary increases or inflationary pressures from truck owners. As a result, Quest Resources could see decreases in its FCF margins, which may drive the company’s fair price down.

Though we believe that the rates of inflation in recent years have not had a significant impact on our operations, a continued increase in inflation, including inflationary pressure on labor and the goods and services we rely upon to deliver service to our customers, could result in increases to our operating costs, and we may be unable to pass these costs on to our customers. Source: 10-K

I believe that agreements with truck owners, recycling facilities, or vendor services may not work. If Quest signs strategic alliances with new parties, the other parties may not offer quality services, or may charge more than expected. As a result, Quest may not only see a decline in its FCF margins, the brand may also get damaged.

Any strategic alliances may not achieve their intended objectives, and parties to our strategic alliances may not perform as contemplated. The failure of these alliances may impede our ability to expand our existing markets or to enter new markets. Source: 10-K

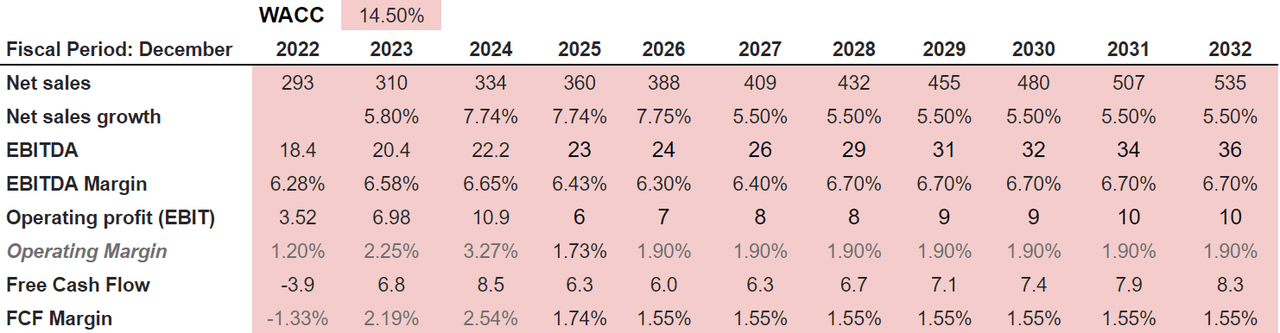

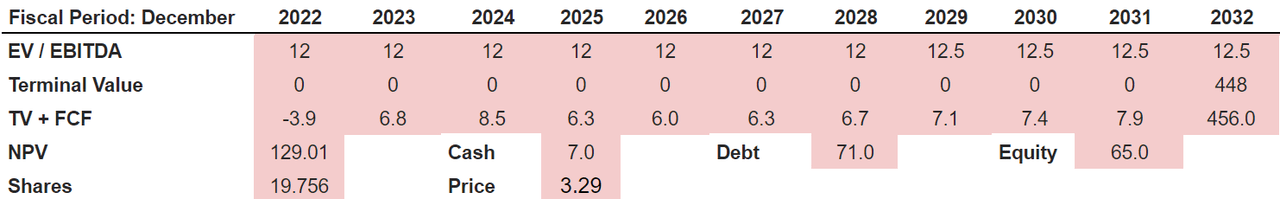

Under the bearish case scenario, I included 2032 net sales of $535 million, in addition to an EBITDA of $36 million and an EBITDA margin of 6.705%. The operating profit would be close to $10 million with an operating margin of 1.90%. Finally, 2032 FCF would be close to $8.35 million with a FCF margin of 1.55%.

Source: Author’s Work

In the bearish case scenario, I assumed an EV/EBITDA of 12.5x, which implied an enterprise value close to $129.01 million. If we also include debt close to $71 million and cash of $7 million, the implied fair price would be $3.29. Equity would stand at $65 million.

Source: Author’s Work

Conclusion

Quest Resources does not require a lot of assets to deliver free cash flow and net revenue growth. The company also appears to sign agreements with large corporations, which will continue to require waste services. Besides, I believe that successful integration of recently acquired targets and new deals could imply a valuation of close to $8.3 per share. I do believe that there are certain risks, like inflation, salaries increases, and opex increases, which may damage the company’s valuation. With that, Quest Resources remains undervalued at the current market price.

Be the first to comment