PonyWang

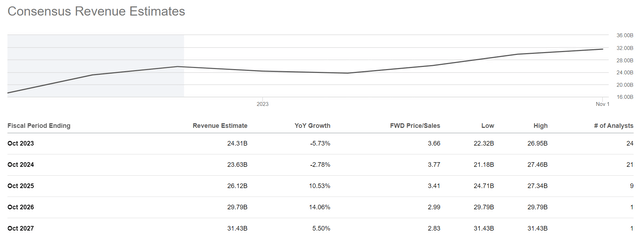

Let us look for a moment, at what’s expected of Applied Materials (NASDAQ:AMAT) in FY2023. Immediately, we see that the revenue consensus is for a mere 5.7% drop in revenues:

Seeking Alpha

We know, from Applied Materials itself (Q4 FY2022 earnings conference call), what the impact from the US sanctions on China buying semiconductor equipment is expected to be:

We estimate that the unmitigated impact to our fiscal 2023 revenues could be up to $2.5 billion. We believe the actual impact can be reduced to $1.5 billion to $2 billion. This will depend in part on how quickly the government provides licenses and approvals as well as how impacted companies refocus their investments.

It would seem that all of the drop (and then some) in revenues from FY2022 to FY2023 is thus expected to be because of the China sanctions. This is so because $1.75 billion (midpoint of the mitigated scenario above) is 6.8% of FY2022’s revenues ($25.79 billion). A 6.8% impact is higher than the expected consensus revenue drop (5.7%).

This article will put forth a very strong reason to argue why this won’t be so. I believe Applied Materials will see a much worse outcome than expected (in FY2023 and FY2024). And the problem won’t be China.

The Problem Will Be The Very Nature Of The Semiconductor Equipment Manufacturing Sector

You see, semiconductor equipment makers sell one thing: capacity. They sell the ability for their customers to add to their semiconductor production capacity.

Typically, a sector which sells capacity to another is much more cyclical than the customer sector (manufacturing semiconductors themselves, in this case). Of course, manufacturing semiconductors is itself cyclical.

Indeed, when selling capacity, sellers are exposed to potentially extreme swings in activity. Let me explain why. Let’s think about a theoretical, very pure, semiconductor manufacturer which sells only capacity to make DRAMs. Let’s then also assume that DRAMs are a static product, so the equipment bought by its customers to make them will continue being used over and over.

Here’s how things look:

- On year 1, the customers need to produce 10 more “DRAM units” than on year 0. They have to buy 10 in additional capacity.

- On year 2, the customers need to produce 20 more “DRAM units” than on year 1. They have to buy 20 in additional capacity (and the capacity seller sees a magnificent 100% increase in demand).

Now, let’s look at 2 scenarios for year 3, which will show the problem clearly:

- First scenario. On year 3, the customers need to produce 10 more “DRAM units” than on year 2. What happens to the capacity seller’s business? Well, he suddenly sees a 50% drop in demand for his equipment! Even though the customers are actually still expanding their production capacity and sales…

- Second scenario. On year 3, the customers need to produce the same as on year 2. What happens to the capacity seller’s business? Well, on this pure scenario, his business goes to zero for one year. And yet, the customers aren’t even seeing a decline in business (volume) activity!

The above is a problem that all capacity sellers in all industries tend to feel to an extent. Of course, in the real-world things aren’t so perfect as in the assumptions. There are many mitigating factors when it comes to semiconductors:

- Process nodes evolve, and to remain competitive (power, performance, cost) some customers have to move to new process nodes, requiring new equipment even if capacity itself isn’t increased.

- There are ongoing projects, which are beyond the ability to stop and have to purchase equipment even if the capacity isn’t needed, for instance due to contractual issues.

- There is new equipment which is so much more productive / cost effective than old equipment, that even on an unchanged process node, some equipment is ordered which isn’t needed to increase production capacity.

- And so on.

But remember, when it comes to the explained dynamics, these are merely mitigating factors. They make things not be so radical in terms of order / sale swings for semiconductor equipment manufacturers. But, even in the presence of these mitigating factors, the swings can be very wild.

For instance, recently there was news that the memory producing sector is cutting equipment orders for 2023 by as much as 50%. Here’s an analyst asking about it in the call:

Vivek Arya

I just wanted to clarify. I thought, Brice, you said somewhere that you provided some look for Q2. I don’t think I caught that. And then several of your memory customers that said that their spending could be down over 50% next year. Recently, Micron said it could be down even more than that. Have you noticed almost 50% cancellation of orders from them? Because I’m just trying to reconcile your commentary that sounds outside of China, of course, more benign and more supportive versus just the very horrific guidance that your memory customers are providing. I understand you’re less exposed to memory versus foundry/logic, but still, it’s a reasonable size exposure. I’m curious, has that 50% cut in CapEx translated to any reduction in your backlog or any change in your thinking about memory for next year?

A 50% drop in orders is, of course, massive. And that happens because the nature of the semiconductor equipment making sector is as I described. There is no wild 50% lower demand for memory. Indeed, if we count bit growth, 2023 will be another growth year!

Yet, here we are, even what is still an increase in demand / volume, can lead to a massive 50% drop in demand for semiconductor equipment for making memory. Just like the theoretical exercise above showed was possible.

Here, some might say “but Applied Materials doesn’t have huge exposure to memory!” or “but Applied Materials also sells maintenance services”. Both are true, but:

- Memory was 34% of FY2022 semiconductor system sales, and 29% of Q4 FY2022, and “foundry, logic and other” were 66% and 71% respectively. However, here’s the thing, this memory goes into a lot of other products. And there aren’t many instances of products now including less memory than before. And these products which take memory take other semiconductors as well (logic) and are fab’ed as well (foundry). Hence, except partially for memory destocking reasons, we can expect the large declines in semiconductor equipment orders to make memory, to also spread to the other segments. This is typical for the sector as well (memory leads).

- Services are just a “small” part of revenues. They represented 21.5% of sales in FY2022. They can’t possibly isolate Applied Materials from a large downturn in the other 78.5% of its business (displays included).

Sure, one could also talk about how Applied Materials exited Q4 FY2022 sitting on record backlog ($12.7 billion in the semiconductor systems segment, up 90% yoy). But it’s quite obvious that backlog can and will be pushed out, reduced or straight cancelled as needed (some easier than other).

We know this, and even Applied Materials mentioned it, though as of Q4 FY2022 such pushouts and reductions were still being compensated by the rest of the business. As I said above, though, this likely won’t happen for much longer. Memory will just be the canary in the coal mine.

On the memory side, just to kind of click back and think about the overall demand environment, we positioned last quarter that we had a significant amount more demand than we have the ability to supply for ’23. What did happen during the course of this quarter is there is a significant amount of pushouts and reductions in that demand. Now you can see the end result. We still had solid bookings in Q4. We still — we created a record backlog that’s now disclosed. So I would say that some of those pushouts and some of those reductions were definitely in the memory space.

And I wouldn’t — I’m not going to characterize what percentage it was, but I would say that that’s the most affected area in the business in terms of pushouts and reductions for ’23.

Indeed, I will add another detail. Notice that on memory, just 2 quarters ago (6 months), there wasn’t even commentary that reduced equipment demand was in the horizon. Here’s a quote from the Q2 FY2022 earnings conference call:

So I think the way we would think about it is we’re a few quarters behind what raw demand is, and that’s probably what’s happening across the industry. When we think about the sustainability of the demand, we study all the end markets, as you’ve described, all the different ICAPS markets, the edge devices, the leading-edge logic area, et cetera, including the memory components. And we see – we see a consistent growth across the horizon from a demand perspective.

Yet, 6 months later, we’re staring at a huge 50% drop in capex commitments for memory production. I think the same “surprise” is going to happen, only slightly later (and to a smaller, but still large, extent) in “logic, foundry and other”. This is for the obvious reason that memory isn’t some kind of product in itself. It’s just something that’s added (and in the same or greater quantities as before) to nearly every other product out there using semiconductors and logic.

What really matters, is how this sector behaves structurally due to its nature. Applied Materials has many mitigating factors. Backlog, equipment necessary for new process nodes, equipment necessary for new semiconductor inflections, more productive equipment. This all mitigates the magnitude of the downturn somewhat. But the (fundamental) downturn baked into the nature of this sector – selling capacity, to end markets experiencing reduced growth, or even straight shrinkage – means Applied Materials cannot avoid a significant downturn itself.

Yet, when we look at Applied Materials’ revenue growth consensus for FY2023, and even FY2024, all that we see is the (one-off) impact from a ban selling some types of equipment to China. As I explained, that’s the least of Applied Materials’ problems.

Conclusion

I believe Applied Materials is about to suffer a significant downturn in demand for its products. This is baked into the nature of the sector Applied Materials is in – selling capacity, selling capacity to manufacture semiconductors. The extremely large drops in memory making equipment are merely the canary in the coal mine, and soon this will expand to many other customers.

The drop in demand, sales and profits which this implies is not at all in Applied Materials’ consensus estimates. The consensus estimates hardly account for the drop implied by the China ban, never mind what’s coming due to the ultra-cyclical nature of the sector.

Neither does Applied Material’s Price/Earnings, at around 15.4x both for FY2023 and FY2024, in any way reflect Applied Materials’ prospects in an ultra-cyclical sector at a possible cycle top. There’s a reason why cyclical stocks typically drop to very low, single-digit, Price/Earnings before any cycle top — because revenues and profits can be hit extremely hard in a downturn, and the Price/Earnings multiple very rapidly turns into a mirage.

Be the first to comment